Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil prices saw a slight dip as traders shifted their focus to the easing of tensions in the Middle East and the growing stockpiles in the United States. Brent crude dropped below $66 per barrel after a previous rise of over 1%, while West Texas Intermediate hovered around $62. ...

Key takeaways:

● Solana ETFs and ETPs recorded $706 million in weekly inflows, outpacing XRP’s $219 million, per CoinShares.

● SOL funding rates stayed below the 6% neutral level, signaling reduced appetite for leveraged bullish positions among traders.

Solana’s native token, SOL, climbed back to $229 on Tuesday after briefly dipping to $218. The move came as investors responded positively to the US Federal Reserve’s release of minutes from its Sept. 17 meeting, which reaffirmed expectations of additional interest rate cuts in 2025.Traders remain optimistic that SOL could advance toward the $300 mark, a target that appears realistic given the strong bullish sentiment reflected in derivatives metrics and onchain data.

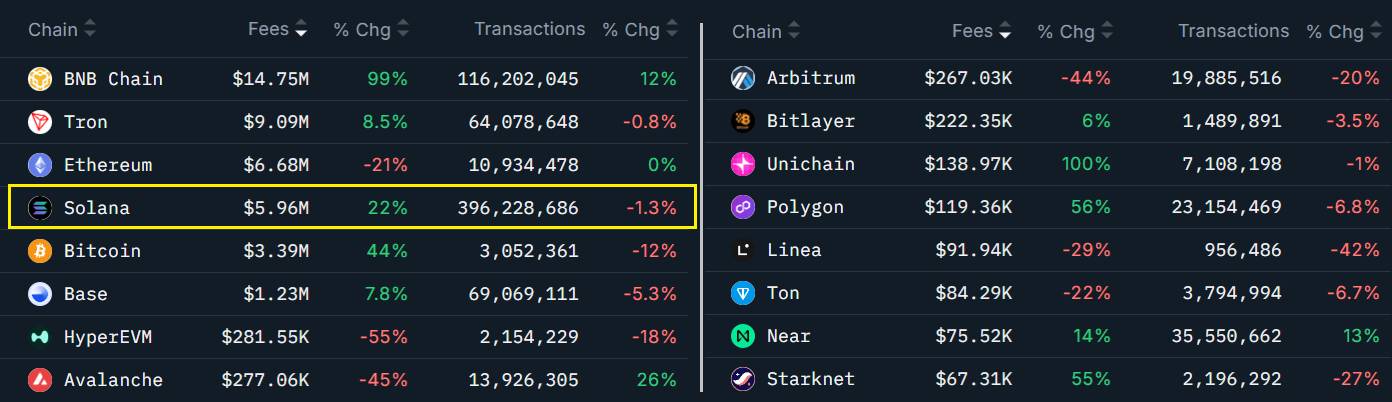

Blockchains ranked by 7-day fees. Source: Nansen

Blockchains ranked by 7-day fees. Source: NansenSolana recorded a 22% increase in seven-day network fees, driven by rising activity across decentralized exchanges (DEXs). Meanwhile, its main rival by deposits, Ethereum, saw the opposite trend, with network revenue falling 21% during the same period. Solana continues to dominate in transaction count, surpassing the combined total of Ethereum and its layer-2 ecosystem.

Weekly Solana DEX (left) and perpetual (right) volumes, USD. Source: DefiLlama

Weekly Solana DEX (left) and perpetual (right) volumes, USD. Source: DefiLlamaDEX volumes on Pump rose 78% over the past seven days, followed by a 73% increase on Meteora and a 46% rise on Raydium. Solana regained its leading position in decentralized exchange activity, posting $129 billion in 30-day volume and surpassing Ethereum’s $114 billion, according to DefiLlama data. Notably, the fastest-growing rival, Hyperliquid, has stalled at around $31 billion.

Network fees remain a key element for any blockchain focused on decentralized applications, particularly when the revenue helps offset inflationary pressures. Unless the system is centralized, maintaining validators incurs costs, and staking participants expect a reasonable return. In short, weak network activity discourages holding the native token and can trigger sell pressure.

Solana’s total value locked (TVL) rose 8% in 30 days, supporting further growth in network fees. Standout performers included a 20% rise in Kamino deposits, 12% in Drift, and 12% in Orca. By comparison, Ethereum’s TVL increased 3% over the same period, while Tron deposits grew 6%. As a result, Solana has solidified its position as the second-largest network, with $14.2 billion in TVL, representing an 8% market share.

The rapid surge in activity on the perpetual futures trading platform Aster has redirected traders’ focus toward BNB Chain, following a wave of memecoins that soared 150% or more within seven days. As a result, even though SOL’s price rose 3% during the same period, BNB’s remarkable 28% rally weighed on sentiment among Solana ecosystem investors.

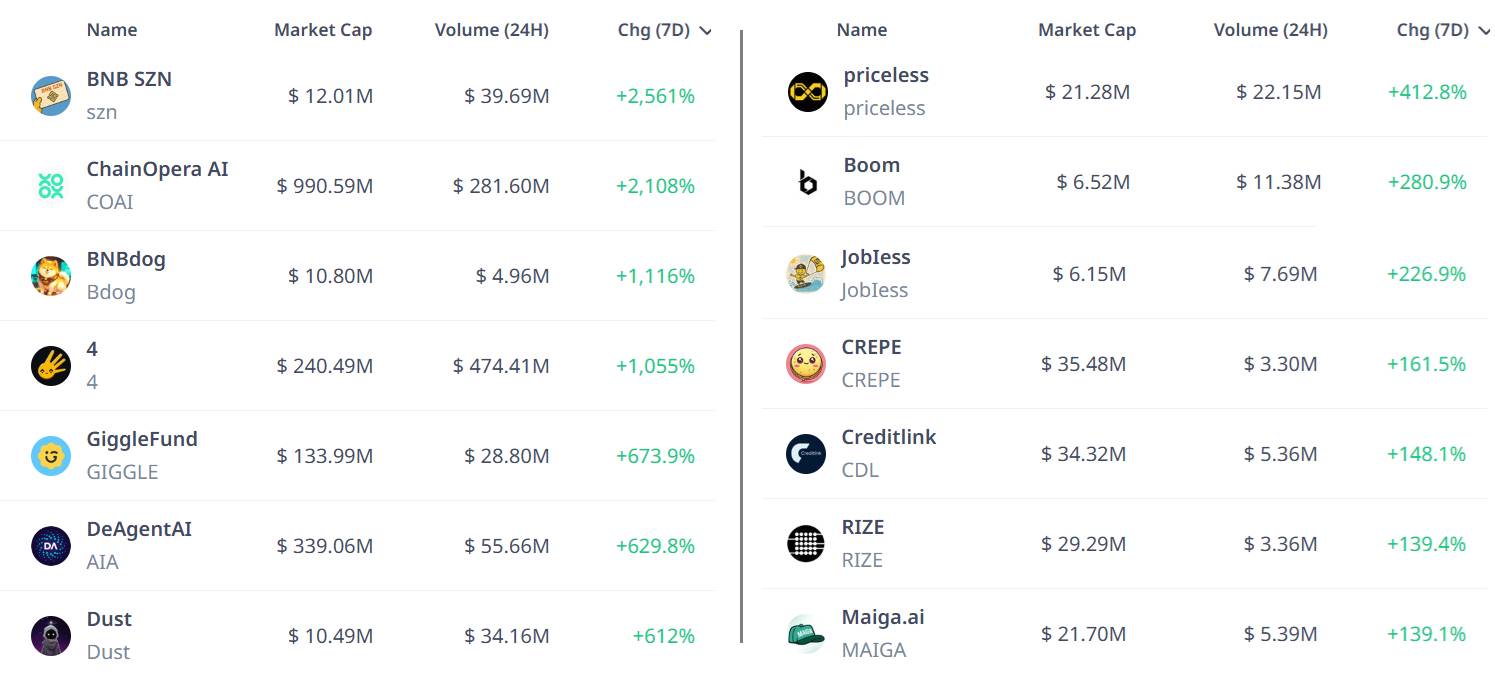

Top 7-day performances of BNB Chain tokens, USD. Source: Cryptorank.io

Top 7-day performances of BNB Chain tokens, USD. Source: Cryptorank.ioData from SOL perpetual futures provides insight into whether traders have lost confidence after the failed attempt to break above $250 on Sept. 18. Many SOL holders are likely frustrated, especially as some rival tokens have recently reached new all-time highs, including BNB at $1,357 on Tuesday and Mantle at $2.81 on Wednesday.

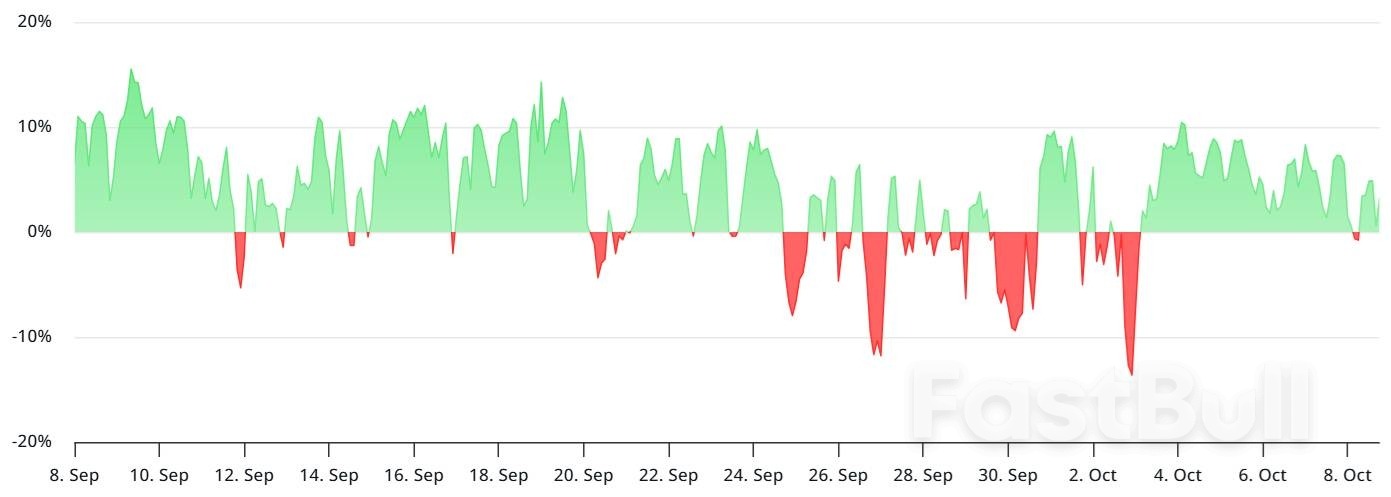

SOL perpetual futures funding rate, annualized. Source: laevitas.ch

SOL perpetual futures funding rate, annualized. Source: laevitas.chThe funding rate on SOL perpetual futures has remained below the 6% neutral threshold, signaling weak demand for bullish leveraged positions. This cautious stance among traders may be partly attributed to the growing traction of competing blockchains, which have drawn attention away from Solana despite record weekly inflows into its exchange-traded products.

CoinShares reported that Solana ETFs and ETPs attracted $706 million in inflows during the seven days ending Sept. 5, far surpassing the $219 million recorded by XRP instruments. Investors now anticipate that the US Securities and Exchange Commission will approve multiple spot Solana ETFs on Friday, a development that could drive additional institutional inflows and potentially push SOL’s price beyond $300.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up