Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

WTI crude fell below its 200-day MA as IEA raised supply forecasts and cut demand outlook. Technicals turned bearish, with resistance at $62.69 and risk toward sub-$60 if $65.60 isn’t reclaimed.

Daily Light Crude Oil Futures

Daily Light Crude Oil FuturesKey Points:

Vietnam will pilot a digital asset exchange in an international financial center, finalized by the Ministry of Finance, and awaiting government approval in August 2025.This move signals Vietnam's commitment to digital finance, potentially increasing regional liquidity and paving the way for modernized economic infrastructure.

Vietnam's move to pilot a digital asset exchange stems from legislative developments that include the National Assembly's resolution and the Ministry of Finance's comprehensive proposal. The planned pilot policy, awaiting August submission, will encompass trading, issuance, and management of digital assets, with a focus on blockchain and cybersecurity. The policy is designed to offer service providers the autonomy to select listed assets.The pilot exchange aims to boost liquidity and demand for leading digital assets, serving both Vietnamese and foreign markets. Vietnam's central bank's ongoing research into a national digital currency underlines the government's long-term strategy for a digital economy. Service providers will play a key role in asset selection, potentially elevating trading volumes.

Market observers note the announcement's potential to catalyze investment flows into Vietnam's digital asset market. Blockchain proponents herald this as an opportunity for expansion and innovation. The exchange pilot suggests broad support for blockchain technology, attracting notable attention within the regional and global financial community.

Did you know? Vietnam's policy fosters transparency and growth, potentially setting a regulatory standard in the region.

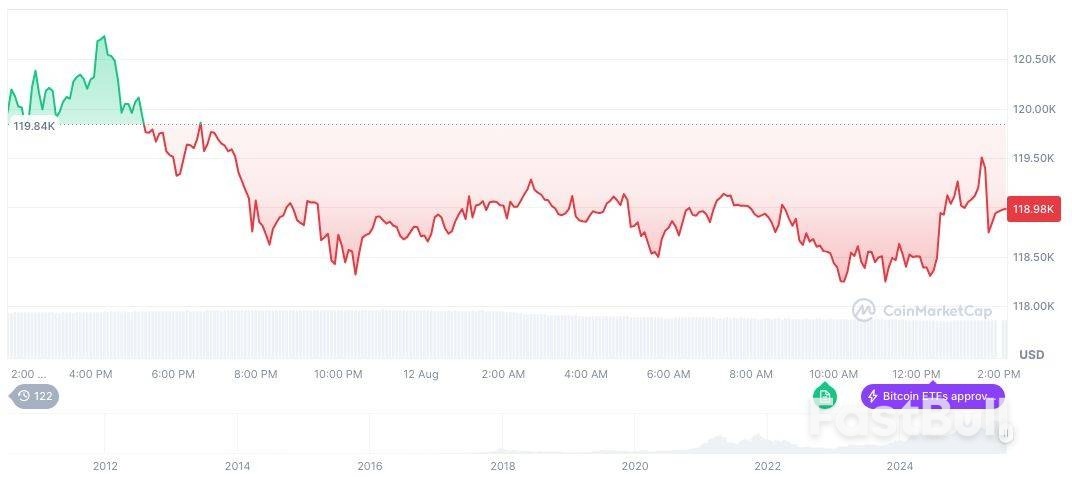

As of the latest data from CoinMarketCap, Bitcoin (BTC) holds a price of $119,220.74, with a market capitalization of $2.37 trillion and a dominance of 58.81%. However, its 24-hour trading volume decreased by 10.61% to $73.77 billion. Over 90 days, BTC's price increased by 15.74%.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 02:29 UTC on August 13, 2025.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 02:29 UTC on August 13, 2025.The Coincu research team highlights that Vietnam's policy fosters transparency and growth, potentially setting a regulatory standard in the region. "The pilot policy for digital asset trading finalized for government review by August," states the Vietnam Ministry of Finance. By integrating blockchain tech into the infrastructure, the exchange is positioned as a model of innovation in Southeast Asia's financial landscape. The pilot policy is anticipated to accelerate Vietnam's standing in an evolving financial climate.

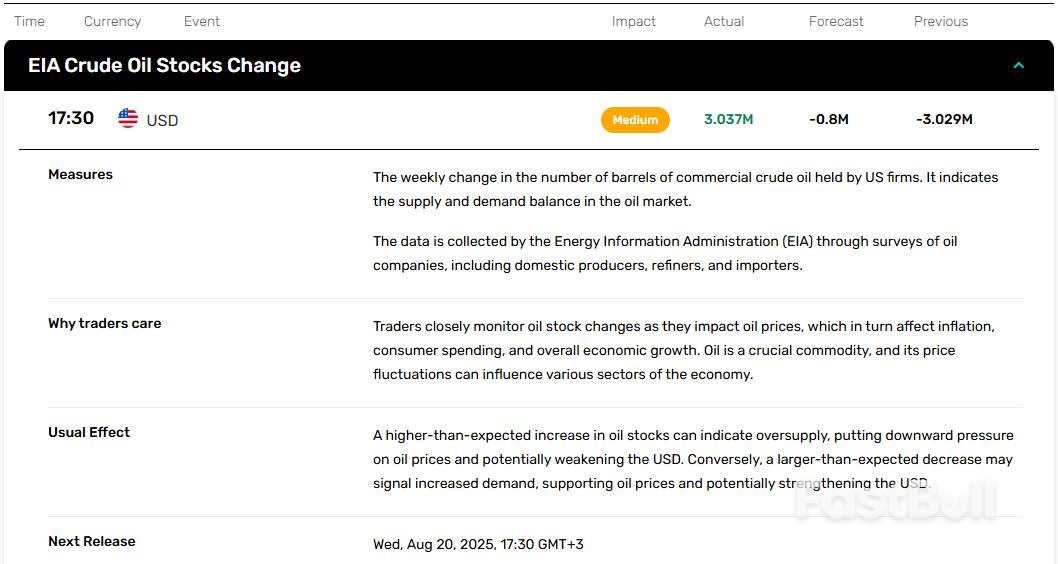

Strategic Petroleum Reserve increased from 403.0 million barrels to 403.2 million barrels.Domestic oil production grew from 13.284 million bpd to 13.327 million bpd.Oil prices moved lower as traders reacted to the EIA report.

On August 13, 2025, EIA released its Weekly Petroleum Status Report. The report indicated that crude inventories increased by +3 million barrels from the previous week, compared to analyst consensus of -0.8 million barrels. At current levels, inventories are about 6% below the five-year average for this time of the year.

Total motor gasoline inventories declined by -0.8 million barrels, compared to analyst forecast of -1 million barrels. Distillate fuel inventories increased by +0.7 million barrels from the previous week.

Crude oil imports increased by +958,000 bpd, averaging 6.9 million bpd. Over the past four weeks, crude oil imports averaged 6.2 million bpd. Rising crude oil imports were the key driver behind the increase in crude inventories.

Strategic Petroleum Reserve increased from 403.0 million barrels to 403.2 million barrels. From a big picture point of view, Strategic Petroleum Reserve has remained mostly unchanged in recent weeks.

Domestic oil production increased from 13.284 million bpd to 13.327 million bpd. A move above the 13.4 million bpd level will signal that domestic oil production is ready to increase at current oil price levels.

WTI oil remained under pressure as traders reacted to the EIA report. Currently, WTI oil is trying to settle below the $62.50 level.

Brent oil pulled back towards the $65.50 level after the release of the report.

The likelihood of a Federal Reserve rate cut in September is now seen near 100% after new data showed U.S. inflation increasing at a moderate pace in July and Treasury Secretary Scott Bessent said he thought an aggressive half-point cut was possible given recent weak employment numbers.

Traders in contracts tied to the benchmark federal funds rate on Wednesday put the odds of a quarter-percentage point cut at the Fed's September 16-17 meeting at 99.9%, according to estimates calculated by the CME Group's FedWatch tool that followed the release of July Consumer Price Index data on Tuesday and later comments by Bessent noting that the Fed used fears of a weakening job market as justification for a larger cut last September.

Trump has slammed that cut as politically motivated given the proximity to the November presidential election.

Bessent rooted his argument in recent Bureau of Labor Statistics revisions showing job growth had slowed to a crawl in May, June and July, though initial estimates for May and June showed stronger employment growth that Fed officials used to argue that the labor market remained in good shape.

"If we'd seen those numbers in May, in June, I suspect we could have had rate cuts in June and July. So that tells me that there's a very good chance of a 50 basis-point rate cut," in September, Bessent said in an interview on Bloomberg television.

US President Donald Trump said he would be speaking to European leaders shortly as he prepares for his summit later this week with Russian counterpart Vladimir Putin.

“Will be speaking to European Leaders in a short while. They are great people who want to see a deal done,” Trump wrote on social media Wednesday.

The call comes as Trump ramps up diplomatic efforts to end Russia’s war in Ukraine — now well into its fourth year — with a face—to-face meeting with Putin on American soil.

The sitdown slated for Friday in Alaska has raised worries among Kyiv’s allies that the US and Russian presidents may negotiate a deal that swaps land for peace without Ukraine’s input or leaves Ukrainian President Volodymyr Zelenskiy sidelined or without the security assurances needed to deter further aggression.

Earlier: European Leaders Want to Speak to Trump Before He Meets Putin

Trump has said that there may be “some changes” in land, but has also sought to downplay expectations for the summit, casting it as a “feel-out meeting” and saying that he would confer with Ukrainian and European leaders after his gathering with Putin.

“I’m going to be telling him, ‘You got to end this war. You got to end it,’” Trump said Monday at a White House press conference. “I may leave and say, ‘Good luck,’ and that’ll be the end. I may say this is not going to be settled.”

Trump lashed out at what he said was “very unfair media” ahead of the Putin summit in a subsequent social media post on Wednesday.

“If I got Moscow and Leningrad free, as part of the deal with Russia, the Fake News would say that I made a bad deal!,” Trump wrote.

Zelenskiy has ruled out Putin’s demand for territory that Moscow does not control as a pre-condition for a ceasefire, saying that he would need to seek constitutional approval for such a move. That explanation appeared to rankle Trump earlier this week.

Trump has indicated that he did not plan to invite Zelenskiy to the summit, saying the next step after the bilateral meeting would be for Putin and the Ukrainian president to meet directly. Trump offered to mediate that conversation, if necessary.

The call with European leaders follows a weekend of diplomacy between US, Ukrainian and European officials. European leaders have said that any peace agreement must “respect international law, including the principles of independence, sovereignty, territorial integrity.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up