Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)A:--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)A:--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)A:--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)A:--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)A:--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)A:--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)A:--

F: --

P: --

Japan PPI MoM (Nov)

Japan PPI MoM (Nov)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)A:--

F: --

P: --

China, Mainland CPI YoY (Nov)

China, Mainland CPI YoY (Nov)A:--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)A:--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)A:--

F: --

P: --

Indonesia Retail Sales YoY (Oct)

Indonesia Retail Sales YoY (Oct)A:--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. Yield--

F: --

P: --

BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks South Africa Retail Sales YoY (Oct)

South Africa Retail Sales YoY (Oct)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Nov)

Brazil IPCA Inflation Index YoY (Nov)--

F: --

P: --

Brazil CPI YoY (Nov)

Brazil CPI YoY (Nov)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

U.S. Labor Cost Index QoQ (Q3)

U.S. Labor Cost Index QoQ (Q3)--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. Federal Funds Rate Projections-Longer Run (Q4)

U.S. Federal Funds Rate Projections-Longer Run (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-1st Year (Q4)

U.S. Federal Funds Rate Projections-1st Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Projections-Current (Q4)

U.S. Federal Funds Rate Projections-Current (Q4)--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Federal Funds Rate Projections-3rd Year (Q4)

U.S. Federal Funds Rate Projections-3rd Year (Q4)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Refined products had been one of few tailwinds for crude this year, and the recent demand-driven weakness is exacerbating a sense of bearish gloom ahead of a widely telegraphed glut.

U.S. job openings increased marginally in October after surging in September, but subdued hiring and the lowest level of resignations in five years underscored the economic uncertainty that economists have largely blamed on tariffs.

The Labor Department's monthly Job Openings and Labor Turnover Survey, or JOLTS report, was released on Tuesday as Federal Reserve officials started a two-day policy meeting. Financial markets expect the U.S. central bank will cut its benchmark overnight interest rate by another 25 basis points to the 3.50%-3.75% range on Wednesday out of concern for the labor market. The Fed has lowered borrowing costs twice this year.

"The job market isn't collapsing but it is certainly losing steam," said Oren Klachkin, financial markets economist at Nationwide. "We anticipate Fed officials will try to get ahead of labor market weakness with another 25 basis points rate cut tomorrow even as inflation remains above the 2% goal."

Job openings, a measure of labor demand, were up 12,000 to 7.670 million by the last day of October, the Labor Department's Bureau of Labor Statistics said. Economists polled by Reuters had forecast 7.150 million unfilled jobs. The report incorporated data for September, whose release was canceled because of the 43-day federal government shutdown.

Vacancies soared 431,000, the most in nearly a year, to 7.658 million in September. The BLS said it had "temporarily suspended use of the monthly alignment methodology for October preliminary estimates," adding that "use of this methodology will resume with the publication of October final estimates."

The bulk of the job openings in October were in the trade, transportation and utilities sector, with 239,000 vacancies, mostly at retailers. There were 114,000 fewer open positions in the professional and business services industry. Job openings in the accommodation and food services sector fell 33,000. The federal government had 25,000 fewer vacancies.

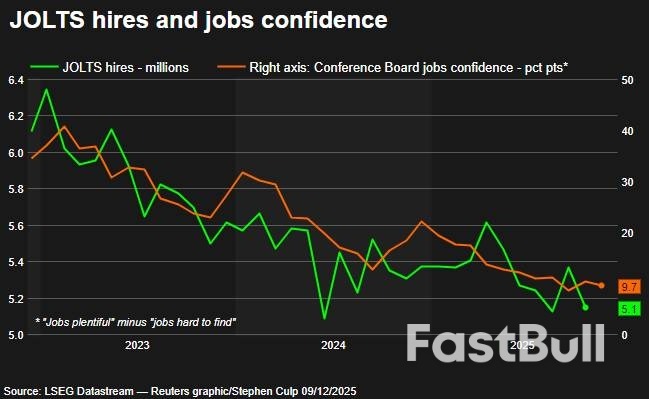

The job vacancies rate was unchanged at 4.6%. Hiring dropped by 218,000 to 5.149 million in October, with most of the declines in construction, professional and business services, healthcare and social assistance as well as accommodation and food services industries. The hires rate slipped to 3.2% from 3.4% in September. There were 5.367 million hires in September.

Layoffs crept up 73,000 to a still-low 1.854 million, concentrated in the accommodation and food services sector. The layoffs rate rose to 1.2% from 1.1% in September.

Stocks on Wall Street were mixed. The dollar gained versus a basket of currencies. U.S. Treasury yields were mostly higher.

JOLTS hires and jobs confidence

JOLTS hires and jobs confidenceThe combined September and October reports suggested the labor market remained in what economists and policymakers call a "no-hire, no-fire" state.

Labor market stagnation has been blamed on reduced labor supply amid a reduction in immigration that started during the final year of former President Joe Biden's term and accelerated under President Donald Trump's second administration. The adoption of artificial intelligence for some job roles is also reducing labor demand, especially for entry-level positions.

The unemployment rate rose to a four-year high of 4.4% in September. The BLS canceled October's employment report and will not be publishing the unemployment rate for that month as the longest shutdown on record prevented the collection of data for the household survey from which the jobless rate is calculated.

November's delayed employment report, now due next Tuesday, will include October's nonfarm payrolls data.

With the labor market wobbly, fewer workers are job hopping in search of greener pastures, pointing to benign wage inflation. The number of people quitting their jobs dropped 187,000, the largest decline since June 2023, to 2.941 million. That was the lowest level since August 2020 when the labor market was recovering from the first wave of the pandemic.

The quits rate, viewed by policymakers as a gauge of labor market confidence, slipped to 1.8%. That was the lowest reading since May 2020, and was down from 2.0% in September. Lower wages because fewer workers are changing jobs could, however, hurt consumer spending.

"This (quits rate) is a pretty 'cold' reading that has historically been consistent with wage growth of just 2.5% year-on-year," said James Knightley, chief international economist at ING. "That's not good news for consumption, but given in a service-sector economy, such as the U.S., the biggest cost input is the cost of your workforce, this suggests medium- to longer-term inflation will be on a downward trajectory."

White House economic adviser Kevin Hassett said Tuesday there is "plenty of room" to cut interest rates further, though he noted that rising inflation could alter this outlook.

Speaking at the WSJ CEO Council, Hassett, who is widely considered a front-runner to become the next Federal Reserve chair, compared the current economic environment to the 1990s, describing it as a "potentially extremely transformative time."

When asked how he would respond if President Donald Trump requested interest rate cuts that he personally disagreed with, Hassett provided a specific example of when rate cuts would be inappropriate. "If inflation has gone from 2.5% to 4%, you can't cut rates then," he said, according to a tweet from Wall Street Journal Fed reporter Nick Timiraos.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up