Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil drifted as traders waited for fresh catalysts to move prices out of what’s been a relatively narrow band, with attention on an upcoming OPEC+ meeting and US moves on Russian supplies.

Oil drifted as traders waited for fresh catalysts to move prices out of what’s been a relatively narrow band, with attention on an upcoming OPEC+ meeting and US moves on Russian supplies.

Brent traded above $68 a barrel after the November contract gained 1% in the previous session, while West Texas Intermediate was near $65. OPEC+ will hold a meeting this weekend to decide on output for October, and market watchers are divided over the likely outcome between no change and a modest rise.

Supplies are also in focus amid US efforts to pressure Moscow to make peace in Ukraine by targeting India, a top importer of its crude. New Delhi has rejected that initiative, with a cordial meeting between Prime Minister Narendra Modi and President Vladimir Putin on Monday. Separately, Treasury Secretary Scott Bessent said Washington would look at Russian sanctions this week.

Global crude benchmark Brent has largely been confined between $65 and $70 a barrel in recent weeks, with prices about 8% lower this year. Among traders, there are widespread concerns about a looming surplus after OPEC+ opted at earlier meetings to relax supply curbs in a bid to reclaim market share, and as the US-led trade war risks crimping energy demand.

“Crude is likely to remain rangebound,” said Vandana Hari, founder of market analysis firm Vanda Insights, adding that Ukranian attacks on Russian oil facilities were providing a floor for prices, while chances of tighter US sanctions had receded. “Expectations of a looming glut are capping gains,” she said.

On the Indian standoff, President Donald Trump said New Delhi had offered to cut its tariff rates to zero following the US imposition last week of 50% levies as punishment for the purchases of Moscow’s oil. Still, it wasn’t clear when the offer was made, or whether the White House plans to reopen talks.

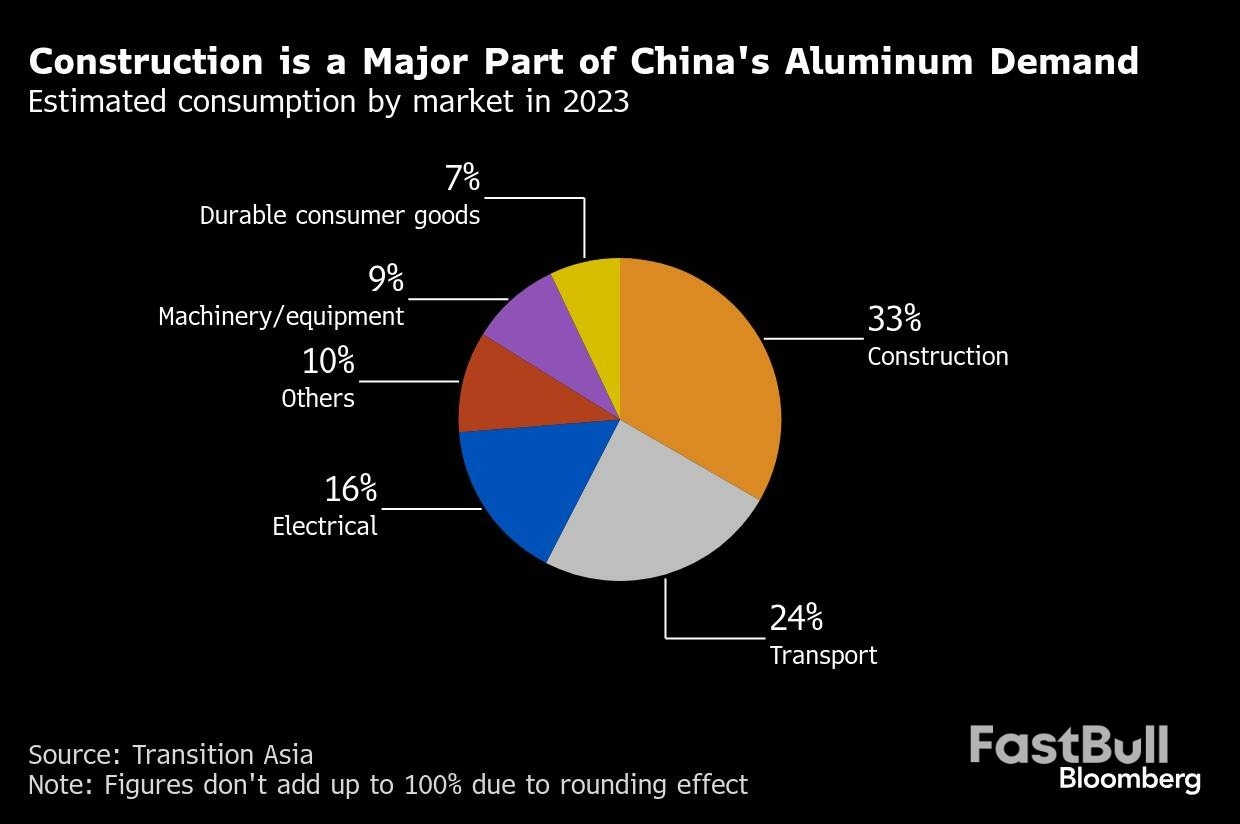

For Liang Zhu, who runs an aluminum factory about 100 kilometers north of Hong Kong, there is only one way out of China’s vicious spiral of excessive competition: shift away from inexpensive metal for window frames and door handles, and toward the specialized alternatives needed for iPads and airplanes.Guangdong province has long been a powerhouse of light manufacturing. Today, though, many companies like Liang’s are battling to survive in the era of “involution”, a term commonly used to describe the country’s intense, self-harming industrial race. China’s property boom is over, and has left behind small to medium-sized manufacturers saddled with overcapacity, evaporating margins and a relentless struggle for customers.

“Without sufficient profits, there will be no funds to invest in innovation, research or in finding solutions for society,” said Liang, general manager at Guangdong Mingzhu Metal Material Technology Co., a company he founded after returning from a spell working in Australia. “That’s a dilemma for us, so we look for ways to get out of this so-called involution.”Producers of aluminum to be used in railings or furniture thrived in Guangdong from the early reform years of the 1980s up until the country’s real estate crisis began in earnest five years ago. Since then, the region has seen a wave of consolidation.

In July, Mingzhu Metal started up its first production line making items with “7-series” aluminum, a more complex product that’s harder to rework and weld, more resistant to heat and easier to crack when cooling. Most importantly, it has lucrative buyers in China’s emerging higher-value industries — from aerospace to electric vehicles and consumer goods.

Aluminum is arguably the world’s most versatile metal because it’s lightweight, durable and doesn’t rust. Extruders, as companies like Liang’s outfit are known, take thick bars of semi-finished metal and work it through several phases to form different shapes and profiles, from car frames to supports for solar panels.

This corner of the sector has long relied on real estate and infrastructure, so the collapse of construction activity since the start of the pandemic has been devastating. Operating rates for aluminum processors are at about 60% to 70% for the best-performing companies, and at only 40% to 50% for the weaker ones, according to researcher Shanghai Metals Market, or SMM. Both are below the 80% level deemed a healthy minimum.

President Donald Trump's administration plans new measures to tackle the high cost of housing in the coming weeks, U.S. Treasury Secretary Scott Bessent told Reuters in an interview on Monday.

Emphasizing the urgency of the situation, Bessent described it as an "all hands on deck" challenge.

Bessent told the Washington Examiner in a separate interview that Trump may declare a national housing emergency this fall to address rising prices and dwindling supply.

The housing market has been hardest hit by the U.S. central bank's tight monetary policy stance and high housing costs are a top concern for many Americans.

The Treasury secretary told Reuters rents were now dropping, which was important for Americans who do not own their homes.

He said he was expecting an increase in real estate transactions and home sales once interest rates began falling, which could encourage people who were locked into low mortgages to put their existing homes on the market.

Bessent said the Trump administration was also exploring ways to simplify permitting and encourage standardization to boost construction, which would boost housing supply and help to bring high costs down.

Affordability would be a big focus for the administration, Bessent said, noting Trump's push to drive down prescription prices.

On Friday, Aug. 22, the Trump administration announced that the U.S. government would be converting $8.87 billion in CHIPS Act grant money that had been awarded to Intel into equity in the company. The government will receive just over 433 million shares at $20.47, good for about 8.85% of Intel when factoring in another recent investment by Japanese tech giant Softbank. Needless to say, it's unusual for the U.S. government to take a stake in a major company; it's the type of thing one may find common in other countries, but typically not in the USA, the center of "free market capitalism."Leaving out the philosophical issue of how much government should be involved in the private sector, is the deal a good one for Intel shareholders?

"Free" money turned out not to be so free

While some have posited the government is throwing Intel a "lifeline," Intel was already supposed to receive this money without having to offer any shares in return. CHIPS Act grants were essentially subsidies to be paid out upon the completion of certain construction milestones for U.S.-based manufacturing fabs.While Intel had only completed part of that buildout and other parts were still up in the air, the fact remains that CHIPS Act grants were supposed to be subsidies for projects Intel was likely to execute at some point. However, language in Intel's recent quarterly report suggested the Trump administration might not pay the funds out as prescribed by law, even as Intel is currently struggling with cash flow.

While we don't really know the dynamics behind the negotiations, we do know that at the end, money Intel was supposed to receive in return for its chip buildout had been converted to equity after the fact, flouting the CHIPS Act as it was intended. That legally dubious maneuver diluted shareholders who weren't expecting it, which really isn't a great precedent.

In the "risks" section to the filing, Intel noted that the government's stake could put some of Intel's overseas sales at risk. That could be significant, as 76% of all Intel sales were in international markets, according to the filing.

While it may seem a long shot that a customer may choose another chip over Intel solely because of the government's involvement, it's not inconceivable. After all, China just told local businesses to stop buying the Nvidia (NVDA -3.38%) H20 chip, shortly after the Trump administration said the government would take 15% of all H20 sales to China, and administration official Howard Lutnick said the goal was to get Chinese developers "addicted to the American technology stack."

Some free market purists may have taken comfort in the fact that the government pledged not to get involved in shareholder votes and therefore won't be dictating strategy to the company. However, that doesn't mean the government's stake won't have an impact.In the agreement, the government agreed to vote along with the board of directors when it comes to all proposals and nominees. That means the government won't come in and impose its own agenda, but it will add to the power of the board.

History has shown that boards of directors are notoriously bad at policing themselves. Should Intel's board engage in any bad practices that outside shareholders disagree with, those shareholders will have a harder time making changes or decisions against the board's preferences.Some have criticized Intel's board in recent years, with some shareholders noting that many members were on the board during Intel's fall from grace during the 2010s. Others have complained about the board's lack of semiconductor business experience, while others questioned last year's firing of CEO Pat Gelsinger.

Intel gets the money now, without conditions

Intel received the first $5.7 billion of the money last week, with the remaining $3.2 billion to come as Intel fulfills commitments under the Secure Enclave program, whereby it will produce chips for the U.S. military. So Intel gets help with its balance sheet now, instead of having to build and complete projects in the future on an uncertain timeline. That could certainly put potential customers' minds at ease when deciding whether to use Intel as their foundry.In addition, Intel is free of other burdens, such as certain workforce requirements spelled out in the CHIPS Act. And Intel is also now freed from an "excess profits" clause, whereby it would have to pay cash flow above a certain threshold for each funded project back to the government.

So while shareholders are diluted, if Intel does become wildly successful in foundry, there may now be more upside than there was before.

While it's unlikely the government will directly force chip customers to use Intel, it's possible the government's stake could spur customers to choose Intel over Taiwan Semiconductor Manufacturing if customers are on the fence and having to make a close choice.After all, major tech companies such as Apple have announced large U.S. investments to get on the administration's good side, so one could easily see a scenario whereby a customer shifts at least some production to Intel's foundry, IFS, as a gesture of goodwill.

Moreover, the Trump administration has been open to using "sticks" as motivators to get companies to build more in the United States. Using Intel's foundry may be a way to get around restrictions, tariffs, or unique taxes the government might otherwise impose in the future.

It was interesting that just before the announcement of the government's investment, Intel announced a $2 billion equity investment from Japanese tech conglomerate Softbank just a few days prior.Like the government's stake, Softbank's investment is for Intel equity, not just the foundry. And also like the government's investment, there were no apparent "strings" attached. However, it seems likely Softbank will steer one or more of its portfolio companies to use Intel foundry in the future.

Most notably, Softbank owns 90% of Arm Holdings (ARM -2.97%), whose chip architecture is used in a variety of low-power applications, such as smartphones and certain data center chips. Arm has reportedly been contemplating building its own AI chips. If that homegrown chip plan comes to fruition, it's possible Arm could use Intel foundry to build them.

Softbank has also made other big AI-related announcements this year. In May, it announced the acquisition of private AI chip company Ampere for $6.5 billion. Interestingly, Ampere's founder and CEO is an ex-Intel executive. Softbank is also collaborating with OpenAI on several AI ventures, including Stargate, the massive $500 billion AI data center infrastructure project based in the United States. Another is Cristal Intelligence, an enterprise-focused AI solution co-developed by both Softbank and OpenAI.

At last week's Deutsche Bank technology conference, CFO David Zinsner said it was a "coincidence" that Softbank had invested in the same week as the U.S. government. However, the timing does raise questions as to whether Softbank would have directly invested had the government not been in talks already. And if Intel needs to raise more money in the future for its 14A buildout, the government's involvement may also give confidence to future investors.

Finally, the government's investment could show confidence in Intel's technology. While it's true that Intel was owed this money anyway, the government also could have continued withholding the money if it didn't think Intel had any hope for a turnaround.

While we can't know what Lip-Bu Tan and other Intel executives discussed with the administration, it's clear that the administration gained more confidence in Intel over the past few weeks, with President Trump at first insisting on Tan's firing, only to then invest billions of dollars alongside him after their meeting.

Could Intel be on the brink if better things? Remember, Intel's 18A node was supposed to achieve technological equality with TSMC after a decade of underperformance, and 18A is set for its first production later this year, with Intel's Panther Lake CPU. 18A sports new innovations such as backside power, which TSMC won't introduce until later this decade, as well as gate-all-around transistors. There is also the possibility that Intel is going to use high-NA EUV technology on 18A, even though Intel originally slated high-NA use for its future node, 14A. After all, Intel has already purchased several high-NA machines and was the first company do so.

In any case, with Intel's first 18A chip due out later this year, it's possible the government saw improvement on the horizon.

While the government's investment is certainly a strange turn of events, it seems the potential "goods" outweigh the "bads" at this point.That's because the most important element here is Intel's ability to land customers for its foundry. If more customers sign up for IFS than they otherwise would have based on the government's stake, then the deal was likely to be worth it.That's probably why, despite the shareholder dilution, Intel's stock went up on the news.

Russia and China strongly condemned the deployment of the Typhon, which would have been banned by the now-defunct INF Treaty...

The US Army announced on Friday that it will be deploying the controversial Typhon missile system to Japan for drills in September, a move strongly condemned by Russia and China.The Typhon, also known as Mid-Range Capability, is a land-based missile launcher that can fire nuclear-capable Tomahawk missiles, which have a range exceeding 1,000 miles, and SM-6 missiles, which can hit targets up to 290 miles away. The missile system would have been banned under the Intermediate Nuclear Forces (INF) Treaty, a treaty with Russia that the US withdrew from in 2019.

According to Stars and Stripes, the Typhon is being deployed to a US Intermediate Nuclear Forces (INF) Marine Corps Air Station Iwakuni, about 25 miles southeast of Hiroshima, which puts mainland China and parts of eastern Russia in range if the system is armed with Typhons.

The drills for which the Typhon is being deployed will be held from September 11 to September 25, but that doesn’t mean the missile system will return to the US at the conclusion of the exercises. A Typhon that the US deployed to the Philippines for drills in April 2024 remains in the country to this day, and there is talk of the US potentially sending another one.“China always opposes the United States deploying the Typhon Mid-Range Capability missile system in Asian countries,” Chinese Foreign Ministry spokesman Guo Jiakun said on Friday in response to the news about the Typhon deployment to Japan.

“We urge Japan to take a hard look at its history of aggression, follow the path of peaceful development, act prudently in military and security areas, and refrain from further losing the trust of its Asian neighbours and the international community,” Guo added.Russian Foreign Ministry spokeswoman Maria Zakharova said Moscow viewed the deployment as “another destabilising step as part of Washington’s course toward ramping up the potential of ground-based shorter and intermediate-range missiles.”

She added that deploying Typhons “in regions near Russia poses a direct strategic threat to Russia” and noted Japan’s “accelerated militarization” in cooperation with the US.Russia recently announced that it is no longer bound by a self-imposed moratorium on the deployment of missile systems that were previously banned by the INF Treaty.The US has previously deployed a Typhon system to Denmark for drills and plans a long-term deployment of a Typhon or another system with a similar range in Germany by 2026

Japan’s ruling party on Tuesday will disclose its findings on why it lost so many seats in a July upper house election, in a report that’s likely to indicate how much longer Prime Minister Shigeru Ishiba can expect to stay in office.

The review comes as the Liberal Democratic Party prepares to hold a vote next week on whether to move forward a party leadership contest originally set for 2027 as Ishiba clings to power despite calls for his resignation.

A key finding will be how much blame is assigned to Ishiba and other senior officials for the election setback that left the LDP without a majority in either chamber of parliament. Some media polls have indicated that ordinary voters blamed the debacle on the party itself, rather than Ishiba. If the review apportions the responsibility to Ishiba, it will provide fuel to critics within the party seeking to topple the premier.

Even if Ishiba manages to avoid being squarely blamed for the dismal election results, the resignation of LDP Secretary-General Hiroshi Moriyama or other senior members of the party would deal a blow to Ishiba’s standing. Moriyama has played a vital role in keeping the party in line for Ishiba, who is widely seen as lacking a strong support base among LDP lawmakers.

The report will be an important factor for lawmakers mulling whether to call next week for an early leadership contest. If over half of LDP lawmakers and regional branch representatives submit a written request, the party is obliged to move up the leadership race, according to party protocol. That decision is likely to come as early as Monday, according to local media reports.

A poll of LDP members conducted by the Yomiuri newspaper and released on Sunday showed that 128 out of 342 would call for an early contest, compared with 33 who said they would not. About half of respondents were undecided on what choice they’d make in the vote.

On Monday, agriculture minister Shinjiro Koizumi, whose name has been floated as a potential future prime minister, said on a live TV broadcast that he will “consider what to do after taking a proper look at the review.”

Some politicians have already broken rank without waiting for the election review to explicitly call for an early contest.

“If I am asked to resign from my post as state minister because of my support for moving up the leadership race, then I will do so,” Hiroaki Saito, an LDP lawmaker who currently serves as State Minister of Finance, wrote Sunday in a post on social media platform X.

Although some within the LDP are disgruntled with Ishiba, the prime minister still has some support from the broader public, with recent polls showing an increase in his approval ratings.

In late August, Ishiba’s popularity rose 12.5 points compared with the previous month to 35.4% in a Kyodo poll, while a Yomiuri survey showed a jump of 17 points to 39%. A separate poll by the Mainichi newspaper saw a 4-point increase to 33%.

The Kyodo poll also showed a 11.6-point decrease in respondents who thought Ishiba should quit, putting the percentage of people who thought he should continue at 57.5% as opposed to 40% who believed he should stand down.

Despite those relatively positive poll results, Ishiba is still in a bind when it comes to the electoral review.

A report that does not put some responsibility on Ishiba and the current party leadership could be seen as a sign that the LDP is skirting its responsibility for its bruising electoral setback.

Ultimately, Ishiba’s fate is likely to depend on how lawmakers and regional representatives interpret the LDP election review and how they will decide to vote over the next week on whether to pursue an early leadership race.

The LDP will hold a meeting Tuesday to finalize the election report before disclosing the results at a plenary meeting scheduled for later in the day.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up