Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. NY Fed Manufacturing New Orders Index (Jan)

U.S. NY Fed Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Jan)

U.S. NY Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. Export Price Index YoY (Nov)

U.S. Export Price Index YoY (Nov)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Jan)

U.S. NY Fed Manufacturing Index (Jan)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Export Price Index MoM (Nov)

U.S. Export Price Index MoM (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Nov)

Canada Manufacturing Unfilled Orders MoM (Nov)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Nov)

Canada Manufacturing New Orders MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)

U.S. Philadelphia Fed Manufacturing Employment Index (Jan)A:--

F: --

P: --

Canada Wholesale Sales YoY (Nov)

Canada Wholesale Sales YoY (Nov)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Nov)

Canada Wholesale Inventory MoM (Nov)A:--

F: --

P: --

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)

U.S. Philadelphia Fed Business Activity Index (SA) (Jan)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Germany CPI Final MoM (Dec)

Germany CPI Final MoM (Dec)A:--

F: --

P: --

Germany CPI Final YoY (Dec)

Germany CPI Final YoY (Dec)A:--

F: --

P: --

Germany HICP Final MoM (Dec)

Germany HICP Final MoM (Dec)A:--

F: --

P: --

Germany HICP Final YoY (Dec)

Germany HICP Final YoY (Dec)A:--

F: --

P: --

Brazil PPI MoM (Nov)

Brazil PPI MoM (Nov)A:--

F: --

P: --

Canada New Housing Starts (Dec)

Canada New Housing Starts (Dec)A:--

F: --

U.S. Capacity Utilization MoM (SA) (Dec)

U.S. Capacity Utilization MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output YoY (Dec)

U.S. Industrial Output YoY (Dec)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Dec)

U.S. Manufacturing Capacity Utilization (Dec)A:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Dec)

U.S. Manufacturing Output MoM (SA) (Dec)A:--

F: --

U.S. Industrial Output MoM (SA) (Dec)

U.S. Industrial Output MoM (SA) (Dec)A:--

F: --

U.S. NAHB Housing Market Index (Jan)

U.S. NAHB Housing Market Index (Jan)A:--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Core Machinery Orders YoY (Nov)

Japan Core Machinery Orders YoY (Nov)--

F: --

P: --

Japan Core Machinery Orders MoM (Nov)

Japan Core Machinery Orders MoM (Nov)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Jan)

U.K. Rightmove House Price Index YoY (Jan)--

F: --

P: --

China, Mainland GDP YoY (YTD) (Q4)

China, Mainland GDP YoY (YTD) (Q4)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Dec)

China, Mainland Industrial Output YoY (YTD) (Dec)--

F: --

P: --

Japan Industrial Output Final MoM (Nov)

Japan Industrial Output Final MoM (Nov)--

F: --

P: --

Japan Industrial Output Final YoY (Nov)

Japan Industrial Output Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Dec)

Euro Zone Core HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final MoM (Dec)

Euro Zone HICP Final MoM (Dec)--

F: --

P: --

Euro Zone HICP Final YoY (Dec)

Euro Zone HICP Final YoY (Dec)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)

Euro Zone HICP MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Euro Zone Core CPI Final YoY (Dec)

Euro Zone Core CPI Final YoY (Dec)--

F: --

P: --

Euro Zone Core HICP Final YoY (Dec)

Euro Zone Core HICP Final YoY (Dec)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Dec)

Euro Zone CPI YoY (Excl. Tobacco) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Dec)

Euro Zone Core CPI Final MoM (Dec)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada CPI MoM (SA) (Dec)

Canada CPI MoM (SA) (Dec)--

F: --

P: --

Canada Core CPI MoM (SA) (Dec)

Canada Core CPI MoM (SA) (Dec)--

F: --

P: --

Canada CPI YoY (SA) (Dec)

Canada CPI YoY (SA) (Dec)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Dec)

Canada Trimmed CPI YoY (SA) (Dec)--

F: --

P: --

Canada CPI YoY (Dec)

Canada CPI YoY (Dec)--

F: --

P: --

Canada CPI MoM (Dec)

Canada CPI MoM (Dec)--

F: --

P: --

Canada Core CPI YoY (Dec)

Canada Core CPI YoY (Dec)--

F: --

P: --

Canada Core CPI MoM (Dec)

Canada Core CPI MoM (Dec)--

F: --

P: --

South Korea PPI MoM (Dec)

South Korea PPI MoM (Dec)--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

Germany PPI YoY (Dec)

Germany PPI YoY (Dec)--

F: --

P: --

Germany PPI MoM (Dec)

Germany PPI MoM (Dec)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Nov)

U.K. 3-Month ILO Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

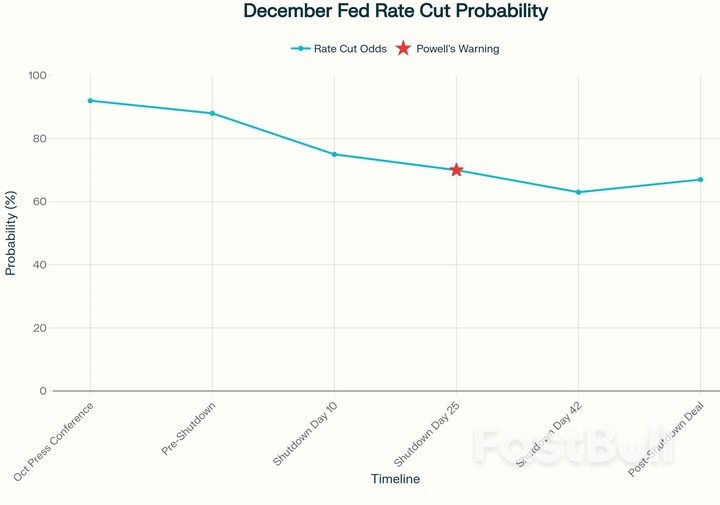

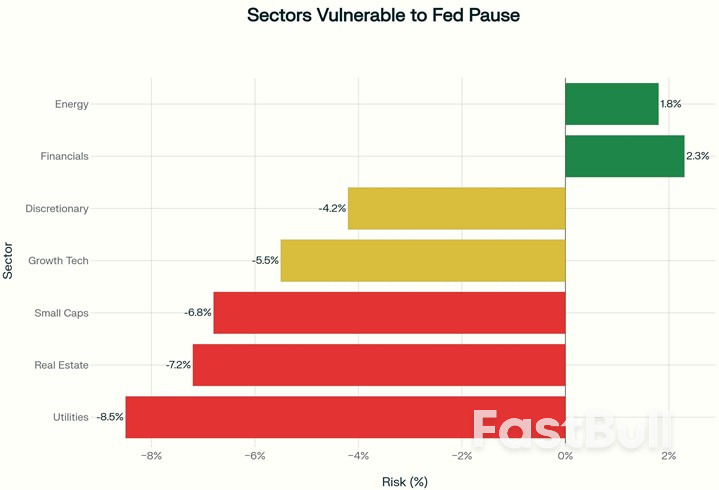

Traders continue to pare bets that the Federal Reserve will cut rates at its next meeting, with the odds now below 50%. The probability of a rate cut at the Fed's December 10th meeting is now 47.4%, down from 62.8% last week and 96% last month.

Traders continue to pare bets that the Federal Reserve will cut rates at its next meeting, with the odds now below 50%. The probability of a rate cut at the Fed's December 10th meeting is now 47.4%, down from 62.8% last week and 96% last month.

This sharp decline is partly due to the recent U.S. government shutdown, which has limited the availability of economic data. As a result, Federal Reserve officials feel they are "flying blind." Additionally, inflation remains somewhat elevated.

Susan Collins, a voting member of the Federal Open Market Committee (FOMC) and considered a centrist, expressed caution about further rate cuts given the lack of data. "Absent evidence of a notable labor market deterioration, I would be hesitant to ease policy further, especially given the limited information on inflation due to the government shutdown," Collins said in prepared remarks on Wednesday.

The Fed has cut rates at its last two meetings, bringing the federal funds rate down to 3.75–4%. However, Fed Chair Jerome Powell emphasized that a rate cut in December is "not a foregone conclusion, far from it."

With about four weeks remaining until the next FOMC meeting and a series of key economic reports now scheduled for release, market expectations could shift quickly. For now, however, traders are taking a more cautious approach about the possibility of a year-end rate cut.

S&P 500 daily

S&P 500 daily S&P 500 4 hour

S&P 500 4 hour S&P 500 1 hour

S&P 500 1 hourA panel of U.S. appeals court judges on Wednesday voiced concerns that the National Labor Relations Board has gone too far in policing employers' restrictions on workers wearing union apparel, grappling with the issue in a case involving Starbucks.

Starbucks is challenging an NLRB ruling that said the company violated federal labor law by barring workers at a flagship New York City store from wearing t-shirts or more than one pin supporting a union campaign.

The case at the 2nd Circuit U.S. Court of Appeals in New York is the latest to ask a federal appeals court to rein in the NLRB's test for determining when workplace dress codes unlawfully interfere with employees' rights to advocate for better working conditions and join unions.

The 8th Circuit in St. Louis last week said Home Depot had the right to bar employees from writing "Black Lives Matter" on their work aprons, and the New Orleans-based 5th Circuit in 2023 said Tesla could bar factory workers from wearing union t-shirts. Both courts reversed NLRB decisions.

In the Starbucks case, a lawyer for the NLRB, Jared Cantor, told a three-judge 2nd Circuit panel on Wednesday that the board deemed any policy prohibiting union paraphernalia to be unlawful unless an employer can prove that "special circumstances" exist to justify restrictions.

Circuit Judges William Nardini and Susan Carney were skeptical of that standard, saying it rendered many common workplace dress codes illegal and failed to properly balance employers' legitimate interests, such as safety or their public image, with workers' rights.

Starbucks imposed its dress code "in accordance with a general desire to create a vibe for this retail establishment," said Carney, an appointee of Democratic former President Barack Obama. "Seems to me a reasonable position."

The 23,000-square-foot Starbucks store in Manhattan's Meatpacking District includes an on-site roastery, coffee and cocktail bars, a bakery and retail space.

Instead of Starbucks' standard green aprons and black tops, workers there don brown aprons and collared shirts or turtlenecks in muted colors and can opt to wear a handful of pre-approved shirts and pins. Those support various causes such as military veterans, Black Lives Matter, Hispanic Heritage Month and World AIDS Day, according to court filings.

The store in 2022 became one of the first Starbucks locations to unionize; workers at 650 other U.S. stores have voted to join unions since then, and in the process have filed hundreds of complaints with the NLRB accusing the company of illegal labor practices.

The board last year ruled that before the Manhattan store unionized, Starbucks interfered with workers' rights there by prohibiting union shirts and multiple pins, and that the company failed to show any legitimate justification. The company appealed to the 2nd Circuit.

Starbucks' lawyer, Amy Saharia, told the court on Wednesday that the board had made it so difficult for an employer to prove a special circumstance that even a policy allowing workers to wear a union pin was deemed illegal. But even under that test, Starbucks' policy was justified by its need to curate its public image and was evenly applied, she said.

Nardini seemed to agree with Saharia about the scope of the board's standard, questioning Cantor about its limits.

"Do [workers] have a right to wear union hats? And giant blinking signs, sandwich boards that say 'hooray for the union?'" asked Nardini, an appointee of Republican President Donald Trump.

"In a workplace where employees are wearing lots of sandwich boards, it's possible an employee could [have the right to] wear that one," Cantor replied.

The panel includes Circuit Judge John Walker, who was appointed by Republican former President George H.W. Bush.

The 2nd Circuit in 2012 upheld a Starbucks policy allowing baristas at smaller Starbucks stores to wear only one union pin, reversing a different NLRB decision. The court at the time said multiple buttons or pins could be distracting and interfere with the public image Starbucks intended to display.

U.S. 10-year Treasury yields, assuming no upside inflation surprises, are likely to rise modestly in coming months, according to a Reuters poll of market experts, while short-dated yields are forecast to decline on rate cut bets.

The survey results suggest inertia in the world's largest debt market despite a long list of potential risks, not least of which is a mountain of upcoming supply.U.S. President Donald Trump's recently passed budget will require an estimated $3 trillion of additional borrowing over the coming decade but that flood of expected issuance has yet to make any significant impact on current pricing.

The benchmark 10-year Treasury yield, currently 4.09%, was forecast to trade at 4.10% in the coming three and six months, before rising to 4.21% in a year, according to median forecasts from over 50 bond strategists surveyed from November 6 to 13. Medians were broadly unchanged from last month's survey.

Other market pricing, including multiple breakeven rates embedded in inflation-protected Treasury securities, points to lower market-based inflation expectations compared with earlier in the year.

That has coincided with the absence of official government data during the longest shutdown in history that just ended on Wednesday and still no serious official inflation evidence from U.S. tariffs on imported goods put in place this year.

Jean Boivin, head of the BlackRock Investment Institute, said this reflects a familiar pattern: bond markets are often excessively responsive to near-term developments.

"The implication is it's very likely the market is over-indexing on the recent track of inflation. And I don't think you make a good return by positioning in the near-term for what the market will only eventually price in properly. But I do think eventually the market will start to reflect more inflation expectations."

Indeed, the Federal Reserve's preferred inflation gauge is running at nearly 3% and has been above the 2% target for over four years. U.S. consumer inflation expectations have also remained elevated through most of the year.

Boston Fed President Susan Collins said on Wednesday persistent inflation warrants greater caution about the path of future easing, particularly for the upcoming December 17-18 Fed meeting.

According to the poll, the rate-sensitive two-year Treasury yield, currently 3.58%, was forecast to fall to 3.50% in three months and 3.40% in six months.Interest rate futures remain priced for three-to-four rate reductions by end-2026 despite stark divisions on the Federal Open Market Committee on how soon rates need to fall again.

Over three-quarters of respondents to an additional question, 26 of 34, said the yield curve would modestly steepen by end-January.

That included Michael Chang, head of rates derivatives strategy at Citi, who said the market was still bracing for higher "term premium" - compensation demanded for holding debt over time - as Treasury issuance continues to rise.

"We're expecting most of the coupon issuance increase to be announced in next year's November refunding meeting...And regardless of where the increase happens on the curve, that's going to translate to repricing for a higher term premium overall."

"That means the curve is probably going to be steeper, with the long end underperforming the front and the belly of the curve," Chang added.

December Fed Rate Cut Probability Has Collapsed: From 92% Certainty to 67% Uncertainty

December Fed Rate Cut Probability Has Collapsed: From 92% Certainty to 67% Uncertainty

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up