Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

New Zealand's central bank cut its benchmark official cash rate by 25 basis points to 2.25% on Wednesday, its lowest level since mid-2022, as policymakers extended their efforts to revive a struggling economy and mitigate global headwinds.

New Zealand's central bank cut its benchmark official cash rate by 25 basis points to 2.25% on Wednesday, its lowest level since mid-2022, as policymakers extended their efforts to revive a struggling economy and mitigate global headwinds.

The decision matched a Reuters poll in which all but four of the 36 economists surveyed forecast the Reserve Bank of New Zealand would cut the cash rate by a quarter point.

The central bank, which surprised markets by slashing rates by a bigger-than-expected 50 basis points in October, has delivered 325 basis points worth of easing since August 2024 to shore up an economy that has contracted in three of the last five quarters.

Key Points:

USD/JPY traders brace for a crucial mid-week session on Wednesday, November 26, as markets adjust bets on BoJ and Fed monetary policy stances.

Early updates from Japan's annual wage negotiations for 2026 suggest another substantial pay hike, supporting a December BoJ rate hike. BoJ Governor Kazuo Ueda recently underscored the importance of annual wage negotiations, commonly known as Shunto. He stated that more data would be needed from wage discussions to assess whether US tariffs would force firms to limit wage hikes.

Meanwhile, US economic data and FOMC members have fueled speculation of a December Fed rate cut, signaling a potential narrowing of US-Japan rate differentials, and favoring the yen. Monetary policy divergence could materially alter USD/JPY's recently bullish trajectory, placing a greater emphasis on incoming data.

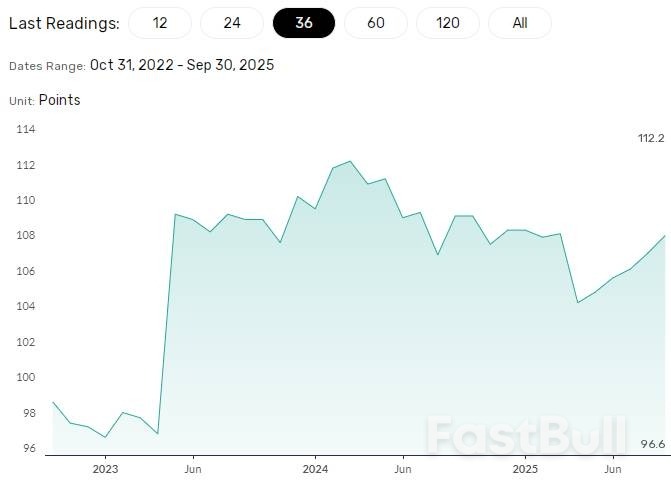

On Wednesday, November 26, Japan's Leading Economic Index (LEI) will provide insights into business and consumer sentiment at the end of the third quarter. Economists expect the LEI to rise from 107.0 in August to 108.0 in September.

A higher LEI reading could point to increased business investment and higher wages, aligning with updates from wage negotiations. Crucially, higher wages could boost households' purchasing power, leading to higher spending and rising demand-driven inflation. Furthermore, improving consumer sentiment may also translate into an upswing in private consumption.

For context, the LEI dropped to 104.2 in April, its lowest level in two years before edging higher. LEI trends reflected trade developments. These trends suggest a September pickup, given that the US lowered tariffs on Japanese goods to 15% in September. The softer yen could also lift sentiment, given that USD/JPY strength would offset the effect of tariffs on company profit margins.

FX Empire – Japan Leading Economic Index

FX Empire – Japan Leading Economic IndexWith the BoJ's focus on wages and inflation, improving sentiment would support a more hawkish BoJ rate path and a stronger yen. Notably, USD/JPY briefly dropped below 156 this week. Traders reacted to updates from Japan's wage negotiations and softer US economic data.

USDJPY – Daily Chart – 261125 – Fiscal Stimulus and Dovish Fed

USDJPY – Daily Chart – 261125 – Fiscal Stimulus and Dovish FedAmid rising bets on a December BoJ rate hike, US jobs data could boost bets on a December Fed rate cut, potentially sending USD/JPY sharply lower.

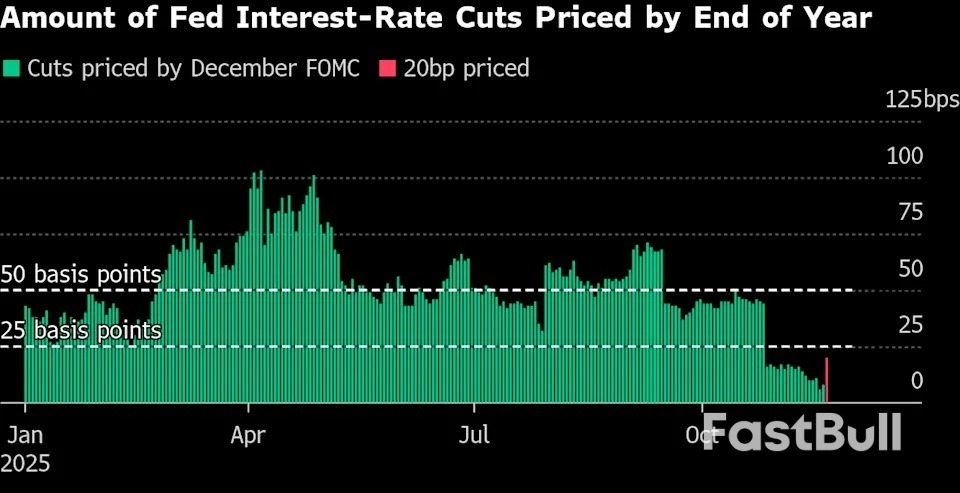

Economists forecast initial jobless claims to rise from 220k (week ending November 15) to 227k (week ending November 22). A larger-than-expected increase could bolster bets on a December rate cut, weighing on demand for the US dollar. A potential narrowing in US-Japan interest rate differentials could push USD/JPY toward 155.

For context, the ADP reported a 13.5k 4-week average drop in employment, signaling a cooling labor market. A third consecutive decline in the 4-week average sent USD/JPY lower, highlighting the pair's likely response to higher jobless claims.

Beyond the data, traders should monitor FOMC members' speeches. Reaction to US economic data and views on the timeline for cutting rates will influence USD/JPY trends. Growing calls for a December cut could accelerate the pair's fall toward 150.

USDJPY – Daily Chart – 261125

USDJPY – Daily Chart – 261125Key Market Drivers to Watch Today:

Australia's core inflation came in stronger than anticipated in October, suggesting the Reserve Bank will remain on the sidelines as it tries to assess whether the economy is running beyond its speed limit.

The currency gained as the closely-watched trimmed mean gauge of consumer prices, which shaves off volatile items, advanced 3.3% from a year ago, data from the Australian Bureau of Statistics showed Wednesday. That's above the top of the RBA's target band and compared with a forecast 3% increase.

The headline number came in at 3.8%, also exceeding a forecast 3.6% increase.

The Australian dollar advanced 0.2% and the yield on policy sensitive three-year government notes climbed 6 basis points. Money markets see a slim chance the RBA will cut next year while economists generally expect a reduction around mid-2026. Goldman Sachs Group Inc. and Commonwealth Bank of Australia are among a handful that reckon the easing cycle has ended.

The data supports the RBA's assessment that its efforts to rein in core inflation have hit an airpocket at a time when the economy is showing signs of gaining momentum. The central bank aims to keep inflation around the midpoint of its 2–3% range.

This is the inaugural release of monthly inflation data, replacing a previous partial monthly CPI indicator. Still, the quarterly inflation report is set to remain the key reading for policymakers until they're confident that any bugs in the new monthly release have been ironed out.

U.S. President Donald Trump said on Tuesday that a deal to end the war in Ukraine is "getting very close," though he did not provide specific details about the potential agreement.

"We're going to get there," Trump told attendees at a White House event.

His comments came after a Ukrainian official earlier expressed support for the framework of a peace agreement with Russia, while noting that some sensitive issues still need to be resolved.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up