Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Political leaders in the Netherlands and Hungary are backing proposals to designate Antifa as a terrorist group after U.S. President Donald Trump suggested he would take such an action in the United States.

Political leaders in the Netherlands and Hungary are backing proposals to designate Antifa as a terrorist group after U.S. President Donald Trump suggested he would take such an action in the United States.

Hungarian Prime Minister Viktor Orban looks on, before the voting of the ratification of Sweden's NATO membership in Budapest, Hungary, on Feb. 26, 2024. Bernadett Szabo /Reuters

Hungarian Prime Minister Viktor Orban looks on, before the voting of the ratification of Sweden's NATO membership in Budapest, Hungary, on Feb. 26, 2024. Bernadett Szabo /Reuters“Dutch Parliament votes in favour of my party’s proposition to declare Antifa a terrorist organization,” Thierry Baudet, founder of the Forum voor Democratie (FvD) party, said in a Sept. 19 X post.“Enough is enough! The violent and criminal terrorist organisation that is Antifa, with chapters all over the world, will finally be OUTLAWED in the Netherlands. This is just the beginning.”In a Sept. 19 X post, Member of the House of Representatives of the Netherlands, Geert Wilders, posted a request that was filed at the Netherlands’ House of Representatives to designate Antifa as a terror outfit in the country.

The request said the United States has already decided on such a designation and warned the group’s cells “are also active in our country, which regularly engage in bad language, make threats, intimidate city dwellers and journalists, and do not shy away from using violence.”Zoltan Kovacs, Hungary’s State Secretary for International Communication and Relations, on Sept. 19 posted a video clip on X featuring the country’s Prime Minister Viktor Orban saying he wants Antifa to be designated as a terror group.

“I was pleased with the U.S. president’s decision and I will take the initiative to do the same here in Hungary,” Orban said. “Antifa is a terrorist organization. They have come to Hungary, beaten peaceful people in the streets, beaten some half to death, and then gone to become MEPs, and from there they lecture Hungary on the rule of law.” MEP refers to a Member of the European Parliament. He did not explicitly identify any MEP’s Antifa affiliation in the video.“The time has also come in Hungary for organizations like Antifa to be classified as terrorist organizations, following the American example,” Orban said.

During a White House news conference on Sept. 15, Trump was asked about U.S. conservative commentator Charlie Kirk’s assassination and whether he would designate Antifa as a terror outfit.“It’s something I would do, yeah, if I have support from the people back here,” Trump said, referring to officials standing behind him, including Attorney General Pam Bondi. “I would do that 100 percent,” he said, adding that “Antifa is terrible.”

FVD (Forum for Democracy) faction leader Thierry Baudet attends a debate at the Dutch House of Representatives in The Hague, Netherlands, on June 4, 2025. Pierre Crom/Getty Images

FVD (Forum for Democracy) faction leader Thierry Baudet attends a debate at the Dutch House of Representatives in The Hague, Netherlands, on June 4, 2025. Pierre Crom/Getty ImagesTyler Robinson, the suspect in the assassination, is said to have followed leftist ideologies during recent years, according to Utah Gov. Spencer Cox and FBI Director Kash Patel.

In a Sept. 18 Truth Social post, Trump doubled down on his stance.

“I am pleased to inform our many U.S.A. Patriots that I am designating Antifa, a sick, dangerous, radical left disaster, as a major terrorist organization. I will also be strongly recommending that those funding Antifa be thoroughly investigated in accordance with the highest legal standards and practices,” the president wrote, partially in capital letters.When Trump met with Britain’s royal family at Windsor Castle on Sept. 17, Antifa members gathered outside the castle, chanting “Charlie’s in a box.”

Meanwhile, Democratic lawmakers announced plans to introduce the No Political Enemies (NOPE) Act to counter what they alleged was the administration’s attack on free speech, according to a Sept. 18 statement from Rep. Chrissy Houlahan’s (D-Pa.) office.“The announcement follows threats from President Trump, Vice President JD Vance, Attorney General Pam Bondi, and White House Senior Deputy Chief of Staff Stephen Miller to use the tragic shooting of Charlie Kirk as justification to weaponize the federal government to go after left-leaning individuals and organizations that don’t align with Trump’s political agenda,” said the statement.

“This bill would reaffirm the constitutionally protected right to free speech and establish clear and enforceable protections to deter abuse, empower individuals and organizations to defend themselves, and create meaningful accountability.”In January, Rep. Marjorie Taylor Greene (R-Ga.) introduced a House Resolution aiming to designate Antifa as a domestic terrorist organization.The bill calls on the Department of Justice to “use all available tools and resources” to combat the spread of domestic terrorism committed by Antifa. The measure has been referred to the House Committee on the Judiciary.

Trump had previously raised the idea of categorizing Antifa as a terror outfit back in 2020. According to former Attorney General William Barr, Antifa was present in some of the violent protests that followed the death of George Floyd.Historically, Antifa began as a part of the Soviet Union’s front operations to bring about communist dictatorship in Germany.One of the distinctive operational modes of the organization, then, as now, has been to label all rival parties as “fascist.”The group works in a decentralized and covert format, often advocating extreme violence and anarchy.

Following President Javier Milei's comments on Friday that the market was in "panic mode", US Treasury Secretary Scott Bessent has said “all options” are on the table for the Trump administration to support Argentina through this bout of severe market volatility.

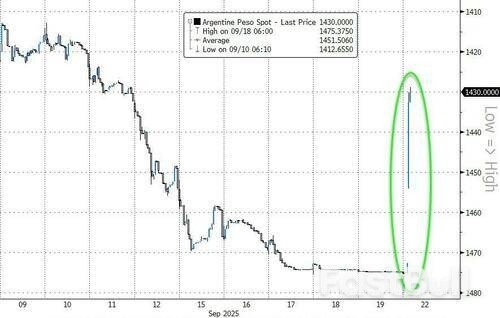

The country has already spent more than $1 billion to defend the peso out of its scarce international reserves.

The two countries are in talks this week - Milei and US President Donald Trump will meet Tuesday - and Treasury Secretary Scott Bessent posted on social media earlier that the US is ready to do whatever it takes to support Argentina.

That includes direct currency purchases as well as swap lines and purchases of dollar-denominated government debt.

Bessent called the South American country “a systemically important US ally in Latin America,” adding that the US Treasury “stands ready to do what is needed within its mandate to support Argentina. All options for stabilization are on the table.”

He said that options for a support package “may include, but are not limited to, swap lines, direct currency purchases, and purchases of US dollar-denominated government debt from Treasury’s Exchange Stabilization Fund”.

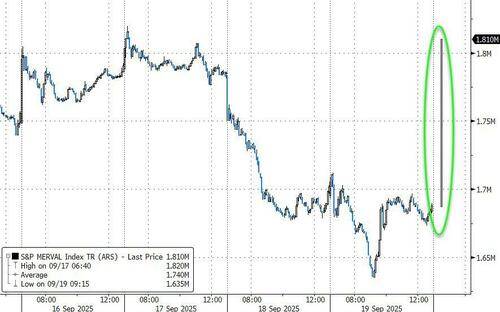

The comments sent Argentine stocks soaring...

...and the peso ripped...

Argentina’s dollar bonds due in 2029 and 2035 rallied by 5 to 6 cents in the dollar to 70 and 53 cents respectively after Bessent’s comments.

As Bloomberg reports, it’s not impossible he can recover from here, especially with the support of the US and International Monetary Fund, but the key test will be next month’s midterm elections.

The possibility of a defeat for his cost-cutting government in October is what has spooked the market. Argentina’s friends can help it prop up the currency, but they can’t help Milei keep the support of voters.

Gold prices hit a record US$3,728 (RM15,666.91) per troy ounce on Monday, extending a rally that has boosted them twofold since late 2022. Demand is expected to remain robust for some time due to a mix of factors.

Central bank purchases and strong investment demand, visible in inflows into physically backed gold exchange-traded funds (ETFs), are the main drivers, fuelled by US President Donald Trump's upending of Western security policy, his trade wars with other countries and concerns about the independence of the US Federal Reserve (Fed).

Annual net purchases of gold by central banks have exceeded 1,000 metric tons each year since 2022, according to consultancy Metals Focus, which expects them to buy 900 tons this year, twice the annual average of 457 tons in 2016-2021.

Developing countries are seeking to diversify from the dollar after Western sanctions froze roughly half of Russia's official foreign currency reserves in 2022.

Official numbers reported to the International Monetary Fund reflect only 34% of the 2024 total central bank gold demand estimate, according to the World Gold Council (WGC), an industry body.

They have contributed 23% to total annual gold demand in 2022-2025, double the average share recorded during the 2010s.

Demand for gold for jewellery, the main source of physical demand, fell 14% to 341 tons in the second quarter of 2025, the lowest since the pandemic-swept third quarter of 2020, as high prices deterred buyers, according to the WGC.

High prices spurred the decline, the bulk of which came from the largest markets, China and India, whose combined market share fell below 50% for only the third time in the last five years, the WGC estimated.

Metals Focus estimated that gold jewellery fabrication fell 9% to 2,011 tons in 2024 and will deliver a 16% slump this year.

There has been a major shift in appetite for different products in the retail investment market but total purchases in this sector remain robust.

Investment demand for gold bars rose 10% in 2024, while coin buying fell 31%, according to the WGC, which said the trend had extended to this year.

Metals Focus expects net physical investment to rise 2% this year to 1,218 tons as demand in Asia remains high amid positive price expectations.

Gold ETFs have become a more important source of demand for gold this year, recording inflows of 397 tons in the period from January to June, their largest first half inflow since 2020, according to the WGC.

Gold ETFs total holdings stood at 3,615.9 tons at the end of June, the largest since August 2022. Their record was 3,915 tons five years ago.

Metals Focus expects net investment in exchange-traded products in 2025 at 500 tons after seven tons of outflows in 2024.

Acceleration through key $3700 resistance zone pushed gold price to new record high on Monday (price was up 1.1% since opening).

Shallow pullback from previous peak did not harm larger bulls and was just positioning for fresh push higher, as it reversed well above $3600 lower breakpoint.

Revived optimism of more Fed rate cuts (despite less dovish than expected post-FOMC comments from chief Powell) brightened the sentiment, along with complicating geopolitical situation after a few countries recognized the State of Palestine, that resulted in fresh rise in safe haven demand.

In addition, sustained physical buying by central banks continues to underpin yellow metal’s price.

Daily studies remain firmly bullish and supportive for further advance, with immediate targets at $3734 and $3750, guarding $3789/$3800 zone.

Daily close above $3700 is needed to validate positive signal, generated on completion of bullish continuation pattern on daily chart.

Meanwhile, bulls may face headwinds from overbought conditions on hourly and 4-hr charts, with limited dips expected to find firm ground at $3700 zone (reverted to solid support).

Res: 3734; 3750; 3789; 3800.Sup: 3707; 3700; 3663; 3627.

Oil and gas production is like running uphill on a treadmill with a merciless trainer who keeps cranking up the speed. It demands continuous investment just to maintain production and to meet even flat, let alone growing, demand. A new study highlights accelerating decline rates – and what they mean for oil companies, geopolitics and the climate.The International Energy Agency (IEA)’s report indicates that, in the absence of new investment, oil production would fall by about 8 per cent per year and natural gas by about 9 per cent. This is up substantially from the 2010 levels, because of a much higher share of shale production – mostly from the US – and deepwater output. These decline more quickly than the onshore super-giant fields typical of the Middle East.

Even with new investment, natural decline rates are 5.6 per cent for conventional oilfields and 6.8 per cent for conventional gas. Effectively, each year, Iraq plus Oman disappears from global oil supply and Qatar plus Algeria disappear from global gas. This is despite strenuous efforts to sustain output from existing fields, including drilling new wells and injecting water, gas and other substances. These losses have to be replaced through developing new fields.

This does not mean that demand will necessarily increase. Oil consumption, in particular, may be close to a peak as electric vehicles become ever more capable and popular. But it is unlikely that global oil needs will decline by anything close to 5.6 per cent annually. Even a fairly rapid reduction of 1 or 2 per cent annually would require significant continuing upstream investment.

Yet in 2021, the IEA’s net-zero report seemed to say the opposite: that no investment was required in new oil and gasfields. Not surprisingly, environmentalists seized on this, and it has been used as a justification for demanding that oil companies wind down production and for governments not to approve new field developments.The puzzlement over the IEA’s apparently conflicting messages stems from confusing what should be, for the sake of the climate, with what is.If we were really on track for a net-zero carbon world, or even a sustained decrease in hydrocarbon demand, there would be no need for bans on new fields. Oil and gas prices would be plummeting, and investment would be drying up.

Instead, oil prices today are modestly below the historic average while gas prices are still well above it. Upstream investment has been relatively low after the oil price crash of late 2014, but has still remained fairly steady at about $600 billion annually, excluding the Covid-hit years of 2020 and 2021. Nine-tenths of this spending goes to replace declines, while only a tenth increases supply.

Oil companies are very active in deepwater hotspots such as the US Gulf of Mexico, Brazil, Guyana and West Africa. Opec members Iraq and Libya are attracting major new spending after periods of political turmoil.Environmental groups will doggedly fight new hydrocarbon production projects such as drilling in Alaska, developing the Rosebank and Jackdaw fields off the UK coast, or building a pipeline for oil from landlocked Uganda.

For a start, the distinction between new and existing fields is largely meaningless. Production can be boosted from existing fields by “enhanced recovery” methods or by exploiting additional reservoir layers or field extensions. From both climate and economic perspectives, new fields may be cheaper to produce from and lower in emissions than wringing the last drops from older fields, or extracting carbon-intensive resources such as Canada’s gigantic oil-sands.If new fields in developed countries are blocked off, oil and gas will be imported from Russia or the Middle East or an overtly anti-climate US. With no new investment, Opec and Russia would collectively produce more than 65 per cent of global oil by 2050. That would be a politically unacceptable level of dependence for their key customers.

Far-right parties across Europe, such as the UK’s Reform, are using worries about high energy bills and opposition to “net-zero” carbon policies and bans on North Sea fields to boost support. They do not have to present any positive or practical energy or climate vision of their own.Alternatively, investment in new producing countries could be banned. Financing for new fields from western banks or international financial institutions has been very hard to obtain for years. That policy bars new entrants, mostly lower-income countries such as Uganda, Mauritania and Guyana, while ensuring continuing hydrocarbon revenue flows to wealthy countries such as the GCC states, Australia, Norway and Canada.

If oil-producing countries themselves decided voluntarily to cease investment, the rapid loss of oil production would send prices through the roof. Something similar occurred in 2022, when Russia restricted gas supplies to Europe during its invasion of Ukraine. In the face of economic crisis, European politicians seized the chance to strengthen support for low-carbon energy and improve efficiency. But they also introduced price caps, restarted coal power stations, and flew to the Gulf and North Africa to beg for additional oil and gas.

The major producers in the Middle East have to invest steadily to meet their assessment of demand, not overproducing to crash prices, nor underspending and damaging the global economy. They learnt the bitter lesson of restricting supply too much in the 1970s, which was followed by a surge of competition elsewhere and a collapse in demand for their oil, leading to a decade and a half of slump. They should probably err – but only a little – on the side of over-investing.

Their giant, low-cost, low-carbon footprint resources mean they will inevitably gain market share both for oil and gas as long as they maintain consistent investment plans. Qatar and Saudi Arabia in gas, Iraq in oil, and the UAE in both, all have such programmes. The tyranny of the treadmill applies to them as much as to any hydrocarbon producer, but their superior fitness should make them the winners.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up