Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

ECB Monetary Policy Statement

ECB Monetary Policy Statement Canada Average Weekly Earnings YoY (Oct)

Canada Average Weekly Earnings YoY (Oct)A:--

F: --

U.S. Core CPI YoY (Not SA) (Nov)

U.S. Core CPI YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. CPI YoY (Not SA) (Nov)

U.S. CPI YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Philadelphia Fed Business Activity Index (SA) (Dec)

U.S. Philadelphia Fed Business Activity Index (SA) (Dec)A:--

F: --

P: --

U.S. Philadelphia Fed Manufacturing Employment Index (Dec)

U.S. Philadelphia Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. Core CPI (SA) (Nov)

U.S. Core CPI (SA) (Nov)A:--

F: --

P: --

ECB Press Conference

ECB Press Conference U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. Kansas Fed Manufacturing Production Index (Dec)

U.S. Kansas Fed Manufacturing Production Index (Dec)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (Nov)

U.S. Cleveland Fed CPI MoM (Nov)A:--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Nov)

U.S. Cleveland Fed CPI MoM (SA) (Nov)A:--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Dec)

U.S. Kansas Fed Manufacturing Composite Index (Dec)A:--

F: --

P: --

Mexico Policy Interest Rate

Mexico Policy Interest RateA:--

F: --

P: --

Argentina Trade Balance (Nov)

Argentina Trade Balance (Nov)A:--

F: --

P: --

Argentina Unemployment Rate (Q3)

Argentina Unemployment Rate (Q3)A:--

F: --

P: --

South Korea PPI MoM (Nov)

South Korea PPI MoM (Nov)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan National CPI MoM (Not SA) (Nov)

Japan National CPI MoM (Not SA) (Nov)A:--

F: --

P: --

Japan CPI MoM (Nov)

Japan CPI MoM (Nov)A:--

F: --

P: --

Japan National Core CPI YoY (Nov)

Japan National Core CPI YoY (Nov)A:--

F: --

P: --

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI MoM (Excl. Food & Energy) (Nov)

Japan National CPI MoM (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Excl. Food & Energy) (Nov)

Japan National CPI YoY (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Nov)

Japan National CPI YoY (Nov)A:--

F: --

P: --

Japan National CPI MoM (Nov)

Japan National CPI MoM (Nov)A:--

F: --

P: --

U.K. GfK Consumer Confidence Index (Dec)

U.K. GfK Consumer Confidence Index (Dec)A:--

F: --

P: --

Japan Benchmark Interest Rate

Japan Benchmark Interest Rate--

F: --

P: --

BOJ Monetary Policy Statement

BOJ Monetary Policy Statement Australia Commodity Price YoY

Australia Commodity Price YoY--

F: --

P: --

BOJ Press Conference

BOJ Press Conference Turkey Consumer Confidence Index (Dec)

Turkey Consumer Confidence Index (Dec)--

F: --

P: --

U.K. Retail Sales YoY (SA) (Nov)

U.K. Retail Sales YoY (SA) (Nov)--

F: --

P: --

U.K. Core Retail Sales YoY (SA) (Nov)

U.K. Core Retail Sales YoY (SA) (Nov)--

F: --

P: --

Germany PPI YoY (Nov)

Germany PPI YoY (Nov)--

F: --

P: --

Germany PPI MoM (Nov)

Germany PPI MoM (Nov)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Jan)

Germany GfK Consumer Confidence Index (SA) (Jan)--

F: --

P: --

U.K. Retail Sales MoM (SA) (Nov)

U.K. Retail Sales MoM (SA) (Nov)--

F: --

P: --

France PPI MoM (Nov)

France PPI MoM (Nov)--

F: --

P: --

Euro Zone Current Account (Not SA) (Oct)

Euro Zone Current Account (Not SA) (Oct)--

F: --

P: --

Euro Zone Current Account (SA) (Oct)

Euro Zone Current Account (SA) (Oct)--

F: --

P: --

Russia Key Rate

Russia Key Rate--

F: --

P: --

U.K. CBI Distributive Trades (Dec)

U.K. CBI Distributive Trades (Dec)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Dec)

U.K. CBI Retail Sales Expectations Index (Dec)--

F: --

P: --

Brazil Current Account (Nov)

Brazil Current Account (Nov)--

F: --

P: --

Canada Retail Sales MoM (SA) (Oct)

Canada Retail Sales MoM (SA) (Oct)--

F: --

P: --

Canada New Housing Price Index MoM (Nov)

Canada New Housing Price Index MoM (Nov)--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Oct)

Canada Core Retail Sales MoM (SA) (Oct)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Nov)

U.S. Existing Home Sales Annualized MoM (Nov)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Dec)

U.S. UMich Consumer Sentiment Index Final (Dec)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Oct)

U.S. Dallas Fed PCE Price Index YoY (Oct)--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Nov)

U.S. Conference Board Employment Trends Index (SA) (Nov)--

F: --

P: --

Euro Zone Consumer Confidence Index Prelim (Dec)

Euro Zone Consumer Confidence Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Dec)

U.S. UMich Consumer Expectations Index Final (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Dec)

U.S. UMich Current Economic Conditions Index Final (Dec)--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Nov)

U.S. Existing Home Sales Annualized Total (Nov)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Another reduction expected next year but monetary policy committee is deeply divided over inflation prospects

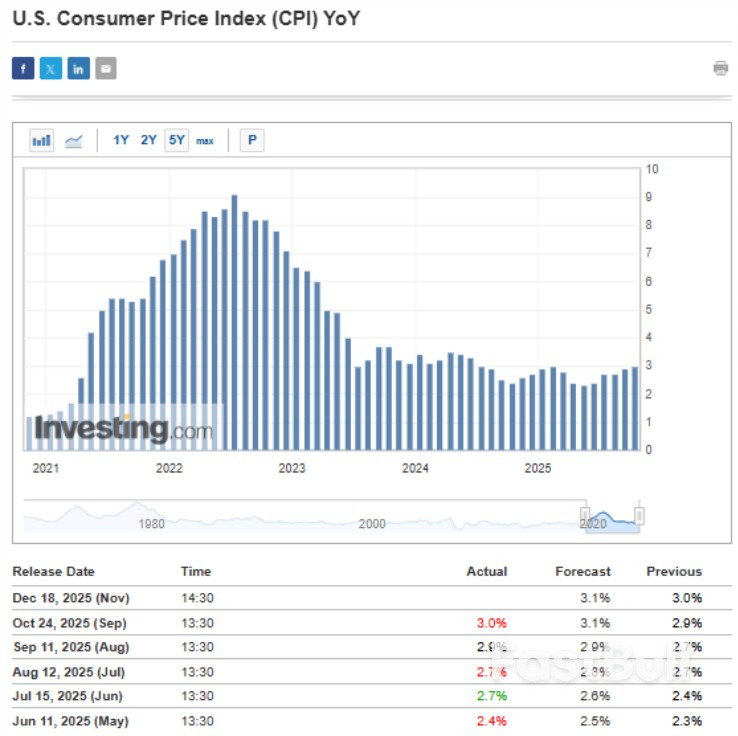

Stocks rallied at the open, bouncing after a sharp selloff Wednesday, as a cooler-than-expected inflation report lifted hopes that the Federal Reserve would cut interest rates further. An optimistic outlook in the tech sector also lifted sentiment.

The S&P 500 Index opened 1% higher Thursday morning and looks to snap a four-day losing streak. Micron Technology Inc. was the top-performing stock in the benchmark after providing an upbeat forecast, citing the ability to charge more for products given rising demand and supply shortages.

The tech-heavy Nasdaq 100 Index advanced 1.3%, rebounding after its biggest daily drop in a month, while the blue chip Dow Jones Industrial Average rose 0.5%.

"The earnings engine in the United States is on," Emily Roland, co-chief investment strategist at Manulife John Hancock Investments, in a Bloomberg TV interview. She's looking for earnings growth outside of the tech for 2026, after being overweight the sector for much of 2025.

"We still like tech, but there's no doubt about it, it's expensive," she added.

The lofty valuations of AI stocks continue to concern investors. About 57% of participants in a Deutsche Bank survey said a potential plunge in AI valuations is the biggest risk to market stability in 2026. Separately, JPMorgan Chase & Co. warned of "extreme crowding" in speculative stocks, including a handful of AI-linked names.

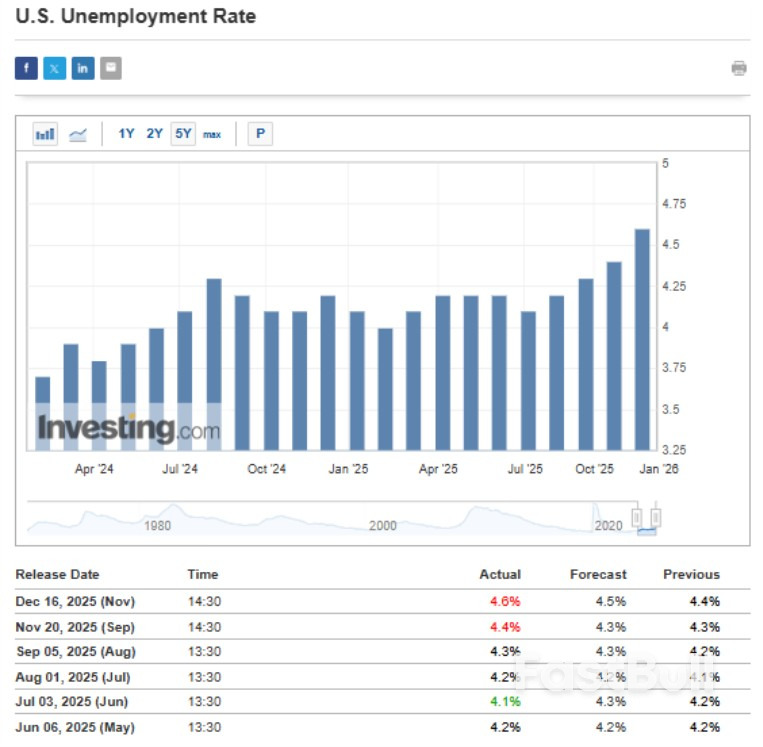

Thursday's market move follows a cooler-than-expected inflation report. The core consumer price index rose 2.6% in November, according to the Bureau of Labor Statistics — well below expectations for a 3.1% gain. Traders also focused on jobless claims data, which showed continuing claims rising to 1.9 million.

"The Fed could look at the increase in the unemployment rate and the tame inflation reading as a reason to cut again," said Brian Jacobsen, chief economic strategist at Annex Wealth Management.

US President Donald Trump said in a televised address Wednesday night that he would soon pick a new Fed chair that would bring rates down significantly further as he sought to calm concerns about the high cost of living.

"A Santa Rally could still be in the cards," said David Russell, global head of market strategy at TradeStation,

Still ahead, FedEx Corp. and Nike Inc. are set to report earnings after the closing bell Thursday. Traders will also parse existing home sales data and a University of Michigan survey of inflation expectations, which are expected Friday morning, for additional clues on the central bank's rate path.

The US government acknowledged in a federal court filing that it was liable for damages resulting from a deadly collision between an Army helicopter and a regional American Airlines Group Inc. jetliner earlier this year near Washington, one of the deadliest crashes in decades.

"The United States admits that it owed a duty of care to plaintiffs, which it breached, thereby proximately causing the tragic accident" on Jan. 29 that killed 67 people, Justice Department lawyers wrote in a court document Wednesday in one of about two dozen lawsuits filed over the crash.

The American CRJ-700 jet and the Sikorsky UH-60 Black Hawk helicopter collided as the plane approached Ronald Reagan Washington National Airport in Virginia, with both aircraft falling into the Potomac River. The jet was carrying 60 passengers and four crew members on Flight 5342 from Wichita, Kansas. The helicopter was carrying three people participating in a regular training mission. Family members of the victims have sued the government and American, along with one of its subsidiaries, PSA Airlines.

CNN reported earlier on the Justice Department filing.

Robert Clifford, an attorney representing the wife one of the passengers killed in the crash, said in a statement that the US Army had admitted its "responsibility for the needless loss of life," as well as the Federal Aviation Administration's "failure to follow air traffic control procedure." However, the government was just "one of several causes," Clifford said, pointing out that American and PSA have sought to dismiss the complaints.

American declined to comment on the recent filing but referred Bloomberg to its previous motion to dismiss the case against it. In that motion, the airline said it's "sympathetic to plaintiffs' desire to obtain redress for this tragedy" but "plaintiffs' proper legal recourse is not against American. It is against the United States government."

The FAA referred questions to the Justice Department. The US Army didn't immediately respond to messages seeking comment after normal business hours.

The collision was followed by several other aviation mishaps, including crashes and near misses, that resulted in widespread concern among the flying public. Since then, the Federal Aviation Administration has stepped up safety measures at the busy Reagan airport and restricted non-essential helicopter operations.

The case is Crafton vs. American Airlines, 25-cv-03382, US District Court, District of Columbia (Washington).

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up