Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

In recent months, Federal Reserve officials have repeatedly referred to monetary policy as restrictive.

In recent months, Federal Reserve officials have repeatedly referred to monetary policy as restrictive. In September, Jerome Powell said policy was "clearly restrictive," and in November, New York Fed President John Williams stated "I still view the current monetary policy level as moderately tight..."

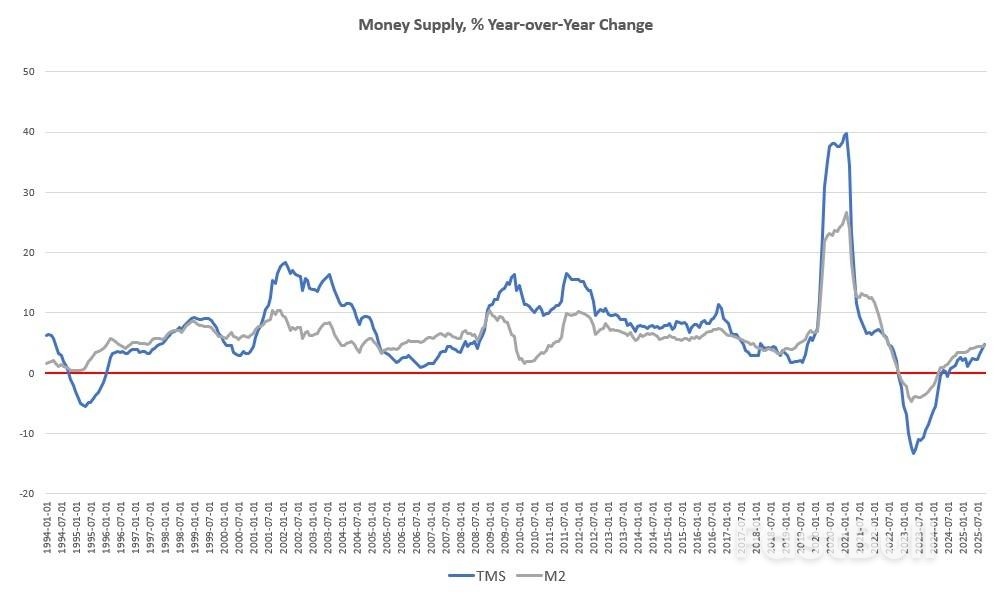

Well, it may be that current policy is "restrictive" compared to, say, the policies of Bernanke and Yellen. But recent data on the money supply suggests that the money supply in recent months is finding plenty of room to increase rapidly, in spite of what Fed officials say.

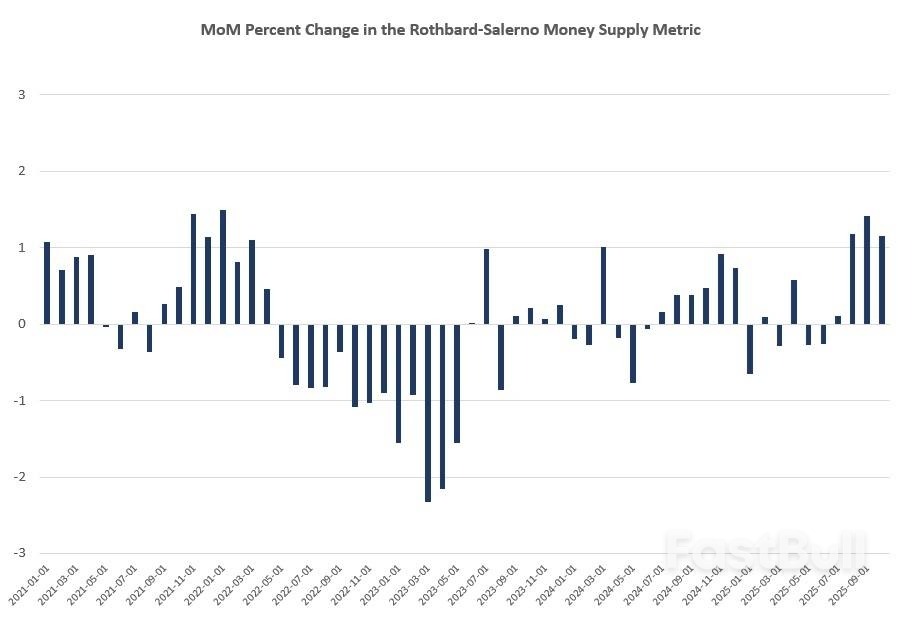

For example, the money supply has increased every month for the past four months, and as some of the highest rates we've seen in years. Moreover, when measured year-over-year, the money supply has accelerated over the past three months and is now at the highest rate of growth seen in 40 months—or since July of 2022.

While the money supply largely flatlined through much of the mid-2025, growth has clearly accelerated since August of this year.

During October, year-over-year growth in the money supply was at 4.76 percent. That's up from September year-over-year increase of 4.06 percent. Money supply growth is also up sizably compared to October of last year when year-over-year growth was 1.27 percent.

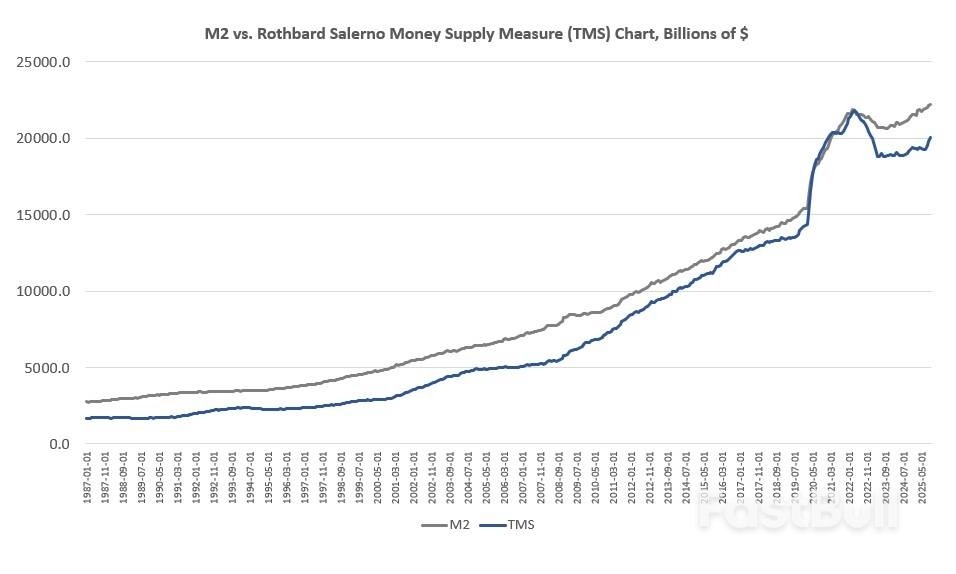

In October, the total money supply again rose above $20 trillion for the first time since January of 2023, and grew by half a trillion dollars from August to October.

In month-to-month growth, August, September, and October all posted some of the largest growth rates we've seen since 2022, rising 1.18 percent, 1.4 percent, and 1.14 percent, respectively. topping off four months of growth.

The money supply metric used here—the "true," or Rothbard-Salerno, money supply measure (TMS)—is the metric developed by Murray Rothbard and Joseph Salerno, and is designed to provide a better measure of money supply fluctuations than M2. (The Mises Institute now offers regular updates on this metric and its growth.)

Historically, M2 growth rates have often followed a similar course to TMS growth rates, but M2 has even outpaced TMS growth in eleven of the last twelve months. In October, the M2 growth rate, year over year, was 4.63 percent. That's up from September's growth rate of 4.47 percent. October's growth rate was also up from October 2024's rate of 2.97 percent.

Although year-over-year and month-to-month growth rates moderated during the summer—and even fell substantially during 2023 and early 2024, money-supply totals are again rapidly heading upward. M2 is now at the highest level it's ever been, topping $22.2 trillion. TMS has not yet returned to its 2022 peak, but is now at a 34-month high.

Since 2009, the TMS money supply is now up by more than 200 percent. (M2 has grown by nearly 160 percent in that period.) Out of the current money supply of $20 trillion, nearly 29 percent of that has been created since January 2020. Since 2009, in the wake of the global financial crisis, more than $13 trillion of the current money supply has been created. In other words, more than two-thirds of the total existing money supply have been created since the Great Recession.

Given current economic conditions, it is surprising to see such robust growth in the money supply.

Given current stagnating economic conditions, it is surprising to see such robust growth in the money supply. Private commercial banks play a large role in growing the money supply in response to loose Fed policy. When economic conditions are expansive, and as employment grows, lending also grows, further loosening monetary conditions.

In recent months, however, economic indicators continue to point to both worsening employment conditions and rising delinquencies. For example, US layoffs in October surged to a two-month high. Meanwhile, Bloomberg reports that " Mom-and-Pop Business Bankruptcies Hit a Record as Debts Rise." The latest price-sector jobs numbers show more job losses.

This all applies downward pressure on money supply growth. However, in an effort to further pump asset prices and somehow counter our growing economic stagnation, the Fed lowered the target federal funds rate in September and throughout much of this year has slowed its efforts to reduce the Fed's balance sheet—also known as "quantitative tightening."

This return to accommodative monetary policy—which belies Fed claims of "restrictive" policy—has surely done its part in returning the money supply to growth levels we haven't seen in years.

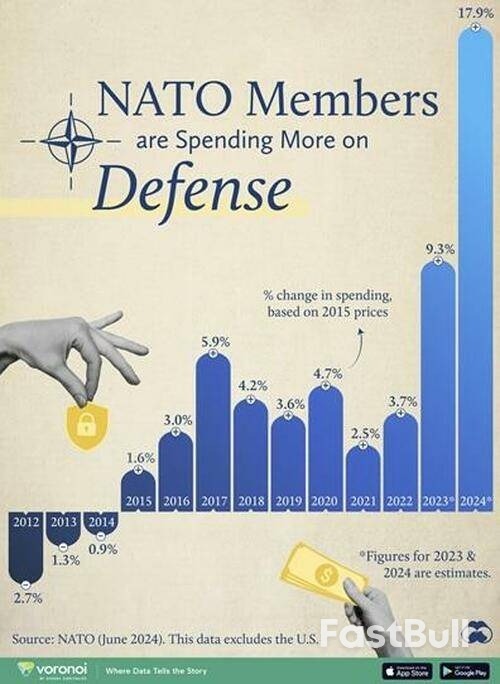

European members of NATO have been warned by Washington that they must assume greater responsibility for the alliance's intelligence operations and missile production - which will require significantly more defense spending by 2027, Reuters has reported.

Reuters in its exclusive Friday report said that the United States "wants Europe to take over the majority of NATO's conventional defense capabilities, from intelligence to missiles, by 2027, Pentagon officials told diplomats in Washington this week, a tight deadline that struck some European officials as unrealistic."

"The message, recounted by five sources familiar with the discussion, including a U.S. official, was conveyed at a meeting in Washington this week of Pentagon staff overseeing NATO policy and several European delegations," the report continued.

The directive was coupled with a warning behind the scenes, reportedly involving Pentagon officials cautioning representatives from several European nations that the US may scale back its role in certain NATO defense efforts if this target and deadline is not met.

US Army/NATO file image

US Army/NATO file imageIt was noted in the report that some European officials consider the 2027 goal unrealistic, saying that rapidly substituting American military support would demand far greater investment than current plans and NATO member approved defense budgets allow.

This generally reflects the Trump administration's long verbalized dissatisfaction with with Europe's progress on shouldering more of NATO's collective defense burden.

But the Reuters report also underscored that European officials were not offered tangible metrics whereby failure or success would be assessed:

Conventional defense capabilities include non-nuclear assets from troops to weapons and the officials did not explain how the U.S. would measure Europe's progress toward shouldering most of the burden.

It was also not clear if the 2027 deadline represented the Trump administration position or only the views of some Pentagon officials. There are significant disagreements in Washington over the military role the U.S. should play in Europe.

One NATO official was cited as saying "Allies have recognized the need to invest more in defense and shift the burden on conventional defense" from the US to Europe.

As we described previously the Trump administration's new National Security Strategy really hits out hard at Europe, stating saying "it is far from obvious whether certain European countries will have economies and militaries strong enough to remain reliable allies" to the United States.

The document further highlights that this current reality of European weakness could have certain negative implications for potential for heightened Western escalation with Russia:

"Managing European relations with Russia will require significant U.S. diplomatic engagement, both to reestablish conditions of strategic stability across the Eurasian landmass, and to mitigate the risk of conflict between Russia and European states," the document reads.

Most analysts see the language in the document as opening the door for greater Washington meddling in European affairs.

Source: Visual Capitalist

Source: Visual Capitalist"Washington is no longer pretending it won't meddle in Europe's internal affairs" Pawel Zerka, a senior policy fellow at the European Council on Foreign Relations, observed.

"It now frames such interference as an act of benevolence ('we want Europe to remain European') and a matter of US strategic necessity. The priority? 'Cultivating resistance to Europe's current trajectory within European nations'," he concludes.

The dollar eased on Monday, ahead of a week packed with central bank meetings and headlined by the U.S. Federal Reserve, where an interest rate cut is all but priced in, although a highly divided committee makes for a wild card.

Besides the Fed decision on Wednesday, the central banks of Australia, Brazil, Canada and Switzerland also hold rate-setting meetings, although none of these are expected to make any changes to monetary policy.

Analysts expect the Fed to make a "hawkish cut", where the language of the statement, median forecasts and Chair Jerome Powell's press conference point to a higher bar on further rate reduction.

That could support the dollar if it pushes investors to dial back expectations for two or three rate cuts next year, though messaging could be complicated by policymakers' division as several have already all but indicated their voting intentions.

"We expect to see some dissents, potentially from both hawkish and dovish members," said BNY's head of markets macro strategy Bob Savage in a note to clients.

The Federal Open Market Committee has not had three or more dissents at a meeting since 2019, and that has happened just nine times since 1990.

Even though the U.S. currency has drifted lower for the past three weeks, dollar bulls have recovered some of their bottle. Weekly positioning data shows speculators hold their largest long position - one that assumes the value of the dollar will rise - since before President Donald Trump's "Liberation Day" tariff bombshell that sent the currency tumbling.

The labour market is softening, but overall growth is holding up, the stimulus from the "One Big Beautiful Bill" should start to filter through and inflation is still well above the central bank's target rate of 2%.

"These factors could discourage additional rate cuts if they spill over into stronger labour market conditions," MUFG currency strategist Lee Hardman said.

Beyond U.S. monetary policy, the euro edged up 0.1% to $1.1652, lifted by higher euro zone bond yields. German 30-year yields hit their highest since 2011 in early trading.

Unlike the Fed, the ECB is not expected to cut rates again in the coming year. Influential policymaker Isabel Schnabel on Monday said the central bank's next move could even be a hike.

The Australian dollar briefly touched a high of $0.6649, the highest since mid-September, to last trade down 0.1% on the day at $0.6635.

The Reserve Bank of Australia meets on Tuesday after a run of hot data on inflation, economic growth and household spending. Futures imply the next move will be up and possibly as soon as May, leaving the focus on the post-meeting statement and media conference.

"We expect the RBA to be on an extended hold, with the cash rate to remain at its current level of 3.60%," said analysts at ANZ in a note last week, revising previous expectations for a cut.

The Bank of Canada is also widely expected to leave its interest rate on hold on Wednesday and a hike is fully priced by December 2026. The currency was steady at C$1.3819 on Monday, having hit 10-week highs on Friday following strong jobs data.

The yen , which has stabilised in this past week, having weakened sharply in November, was mostly steady at 155.44 per dollar, while sterling held around $1.3325 and the Swiss franc was a touch stronger at 0.804 francs.

Bloomberg's Eric Balchunas dismisses comparisons between Bitcoin and tulip mania, citing its resilience and institutional adoption at a recent financial analysis event.

This perspective strengthens Bitcoin's position as a durable macro asset, supporting institutional interest and market confidence amidst ongoing asset volatility.

Eric Balchunas, a senior ETF analyst at Bloomberg, has rejected the notion that Bitcoin is a modern tulip mania, highlighting its long-term resilience and institutional interest.

This analysis underscores Bitcoin's lasting appeal and invalidates the comparison to historical speculative bubbles, reassuring both institutional and retail investors.

Balchunas refutes the "Bitcoin = tulip mania" analogy, arguing Bitcoin's 17‑year history of resilience differs vastly from the three-year tulip bubble. He highlights ongoing institutional adoption as a key factor in Bitcoin's durability.

Bloomberg's senior ETF analyst noted Bitcoin's performance, gaining approximately 250% over the past three years. His statements challenge historical perceptions and support Bitcoin as a durable financial asset.

"The tulip market rose and collapsed in around three years, punched once in the face and knocked out, whereas Bitcoin has been through 6–7 brutal selloffs over 17 years and still makes new highs." - Eric Balchunas, Senior ETF Analyst, Bloomberg Intelligence

Balchunas' assertions bolster confidence in Bitcoin's stability among investors. His analysis emphasizes continuing institutional interest, contrary to the short-lived tulip mania. Institutional flows remain strong, highlighting Bitcoin's sustained market presence.

Financially, Bitcoin's resilience enhances its status among non-productive store-of-value assets like gold. Institutional backing and ETF flows signify an asset exceeding typical bubble characteristics, supporting long-term strategic investments.

Historically, Bitcoin has rebounded from deep drawdowns, mirroring other resilient assets like gold. Balchunas' insights indicate a pattern of recovery and growth not aligned with single-cycle bubbles.

This analysis suggests that Bitcoin's role as a macro asset is cemented by its historical performance, encouraging ongoing adoption and positioning it beyond mere speculative comparisons.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up