Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold and silver saw modest gains amid quiet summer trading. Technicals favor bulls, with gold targeting $3,400 and silver $40. Broader markets are mixed, with lower oil and a weaker dollar.

Short-maturity US Treasuries jumped and the dollar plunged after a White House official said President Donald Trump is likely to fire the chief of the Federal Reserve soon.

Yields on two-year notes, which are most sensitive to changes in Fed monetary policy, fell seven basis points to about 3.87% as traders bet that Trump would choose a more dovish successor to Chair Jerome Powell. Powell has signaled the need to monitor the impact of Trump’s tariffs on the economy before lowering interest rates further.

“US rates appear to be coming lower no matter what, the US curve will steepen and the dollar will continue weakening, especially vs those with central banks that will not follow the Fed,” said Alvaro Vivanco, head of strategy at TJM FX.

The yield gap between 5- and 30-year Treasuries rose to the highest since 2021 on the news. Meanwhile, the Bloomberg Dollar Spot Index sold off, falling the most since late June on an intraday basis. All G-10 currencies advanced, led by the yen, which rose more than 1% at one point before paring gains.

In Treasuries, the steepening move extended as traders priced in a greater chance that the Fed will cut rates as soon as September.

The GBPUSD is joining the dollar selling also the news that Trump is set to fire Fed chair Powell. The low price for the day reached into a swing area between 1.33607 and 1.33784.

The news has helped to push the price up sharply higher and up toward the 50% midpoint of the move higher from the May 2024 low to the high price reached on July 1, and the 100 hour moving average. Both those levels come near 1.3464. Move and stay above those levels would open the door for further upside momentum.

The New York Times is now reporting that Trump has drafted a letter to chair Powell. He apparently showed the letter to around a dozen GOP members in the White House late yesterday.

The yield curve is steepening with the 2-year yield down -8.6 basis point at 3872%. The 30-year yield is back above 5% at 5.055% up 4.0 basis points.

US stocks are not taking the news that well – at least initially. The NASDAQ index is down -89 points or -0.44%. The S&P index is down -26 points or -0.41%.

President Trump on Tuesday told reporters that Jerome Powell’s handling of a $2.5 billion renovation of the Federal Reserve headquarters “sort of is” a fireable offense, and reportedly asked some GOP lawmakers Tuesday night if he should remove the central bank chairman.

CBS News reported Wednesday that Trump posed the question during a meeting in the Oval Office with House GOP members; that some lawmakers agreed; and several indicated he will do it.

Trump's latest comments and the new CBS report raise new questions about whether the president may in fact seek to oust the Fed chair, a move that would surely lead to a legal war with Powell, who has argued he can't be removed by law.

The president also appeared in his latest comments to narrow his choices to replace Powell. Treasury Secretary Scott Bessent is an "option," but not the top choice, “because I like the job he is doing,” he said.

The Washington Post and Bloomberg reported this week that National Economic Council Director Kevin Hassett is rising as an early front-runner in the race to replace Powell, although former Fed governor Kevin Warsh is also under consideration. Fed governor Christopher Waller is another possibility.

Bessent, though, is “probably not that much of an option," Trump said Tuesday, citing what he views as his good performance as Treasury secretary.

Trump has been hammering Powell for months over what Trump viewed as a refusal to ease monetary policy for political and personal reasons, referring to Powell publicly as “dumb,” a numbskull,” a “stubborn mule,” “stupid,” a “moron,” and a “fool.”

Trump nominated Powell for the Fed chair seat during his first administration, and his current term is scheduled to run until May of 2026.

Trump’s allies in recent weeks have used another tactic to turn up the pressure on Powell: They have invoked a $2.5 billion renovation of the Fed’s headquarters as a way to question the chair’s management of the institution and whether he told Congress the truth about the project during testimony in June.

Trump said Tuesday that "the one thing I wouldn't have guessed is he would be spending two and a half million dollars to build a little extension onto the Fed."

When asked if it was a fireable offense, Trump said, "I think it sort of is, because if you look at his testimony ... he's not talking about the problem. It's a big problem."

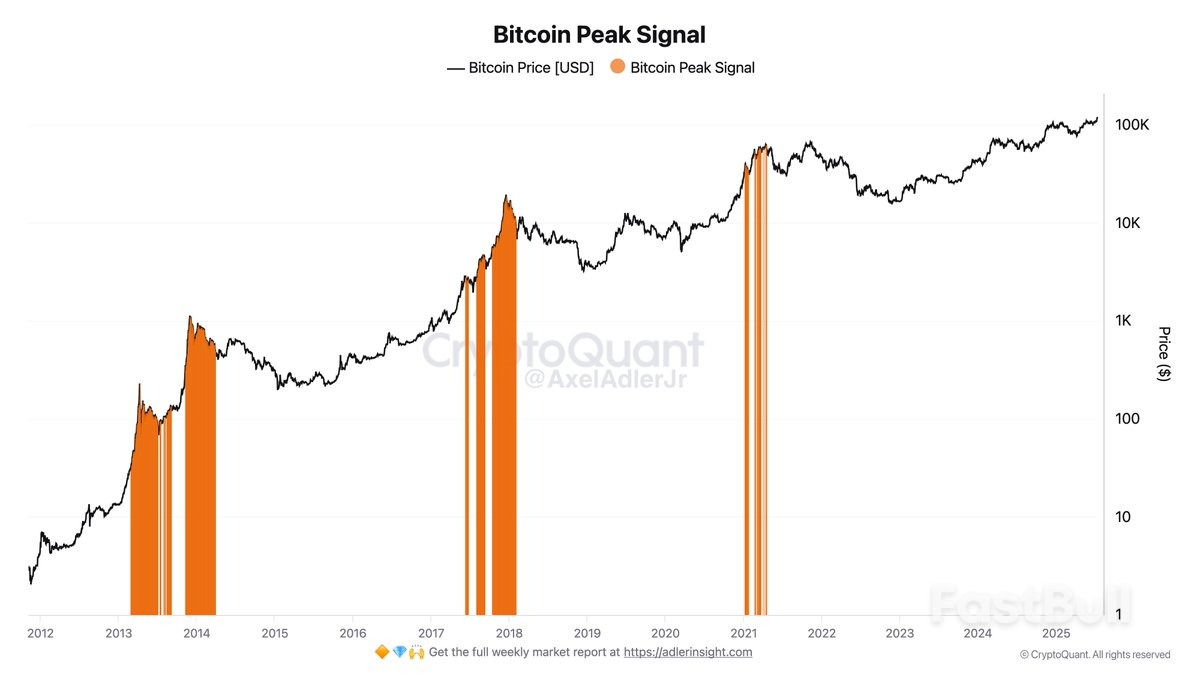

Bitcoin: Realized Cap - UTXO age bands (%). Source: CryptoQuant

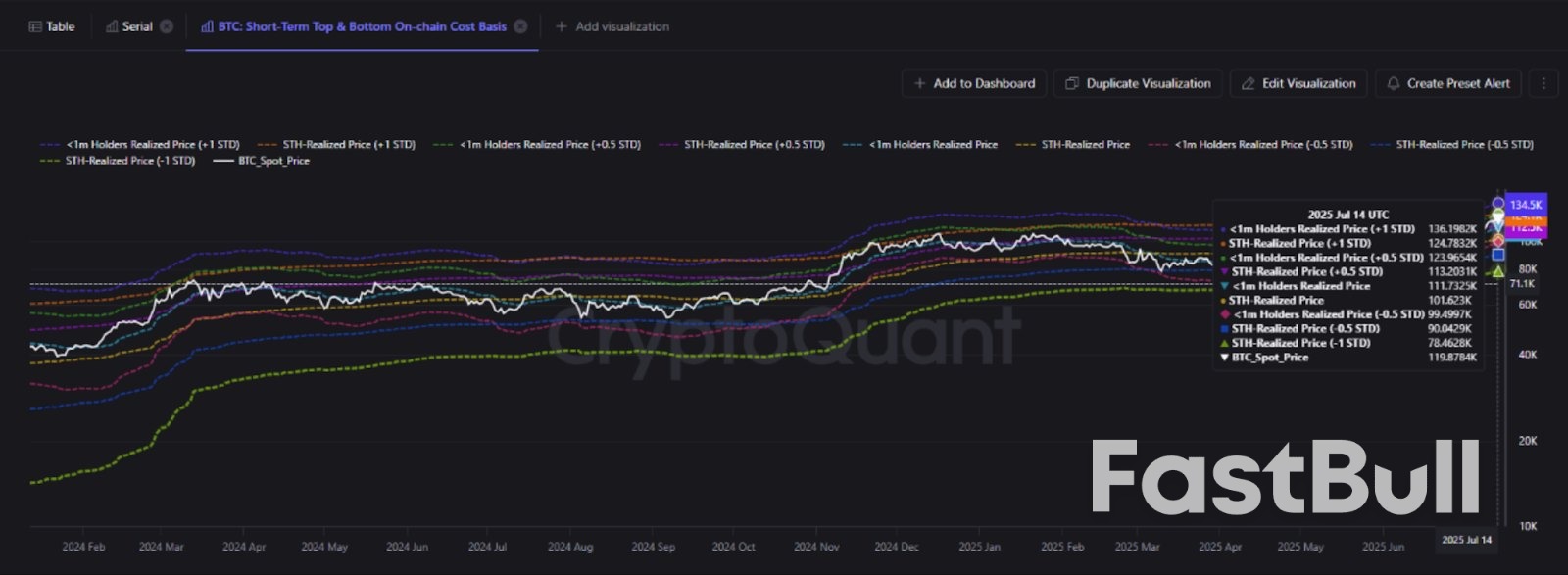

Bitcoin: Realized Cap - UTXO age bands (%). Source: CryptoQuant Bitcoin STH cost basis. Source: CryptoQuant

Bitcoin STH cost basis. Source: CryptoQuant

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up