Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

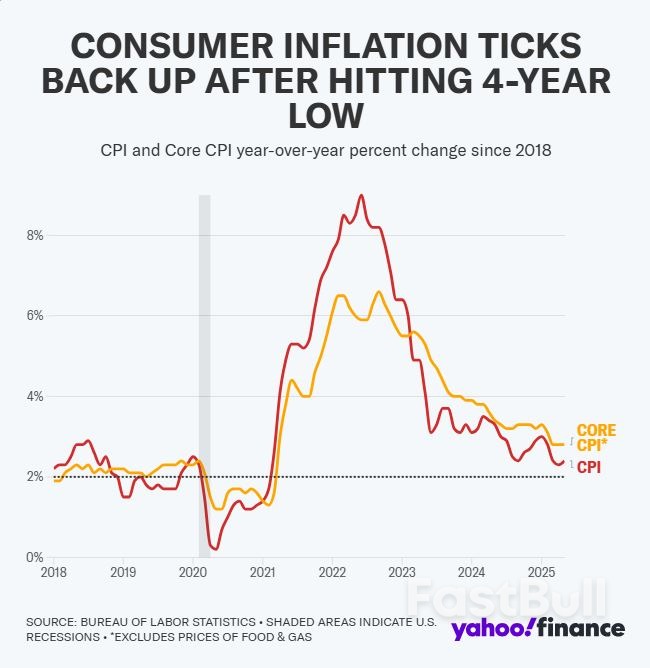

May’s mild CPI data reinforces the Fed’s cautious stance, with policymakers likely to hold rates steady as they await clearer evidence of tariff impacts on inflation. Rate cuts are not expected before September.

U.S. Treasury yields are set to decline further according to bond strategists who are clinging to expectations the Federal Reserve resumes cutting interest rates after pausing for more than half a year even as dealers are set to underwrite a deluge of new supply.

A slight majority now expect another sell-off in longer-dated bonds, the maturities most at risk, by the end of this month.

Concerns that President Donald Trump’s tax-cut and spending bill will add trillions of dollars to an already-staggering $36.2 trillion debt pile by 2034, along with tariff brinkmanship already have many holders of U.S. assets scrambling for the exit.

The rising "term premium" – what investors demand as compensation for holding longer-dated debt – leaves the market more vulnerable, particularly among foreign investors, ahead of upcoming Treasury bond auctions.

"The amount of debt we need to issue keeps rising and there doesn't appear to be anyone in Washington on either side that really has a plan to bring down deficits and address our fiscal situation," said Collin Martin, fixed income strategist, Schwab Center for Financial Research.

"That'll weigh on the long end of the curve where we need to see yields rise a bit to attract that marginal buyer."

Global sovereign bond yields have mostly risen in tandem over the past two months. A rapid sell-off in benchmark U.S. 10-year Treasuries in April pushed the yield up around 60 basis points.

That yield, which rises when prices fall, has since steadied, oscillating around 4.50%.

Median forecasts from nearly 50 bond strategists in a June 6-11 Reuters survey, most from dealers and sell-side firms, predicted the 10-year yield would decline a modest 13 bps to 4.35% in three months and to 4.29% in six from its current 4.48%.

Despite predicting a decline, more than half upgraded their forecasts from a May survey with many flagging the risk of yields moving higher.

"The 10-year will probably trade range-bound for a while between 4-4.50% and maybe even rise a little bit further, particularly given deficit concerns. The yield curve should continue to steepen as short-term yields drift gradually lower as the Fed cuts rates one or two more times by year-end," Schwab's Martin added.

The more interest rate-sensitive 2-year yield was forecast to decline a slightly steeper 17 bps to 3.85% in three months and to 3.73% by end-November, the survey showed.

Most economists polled by Reuters predict two or fewer rate cuts this year while rate futures are currently pricing two.

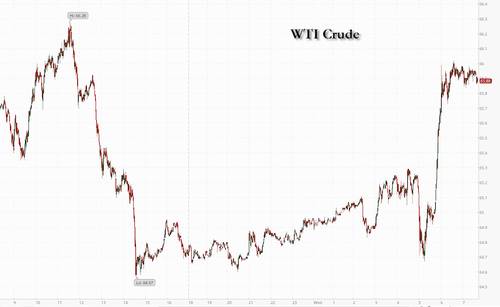

The NY Post has published a new Trump interview focused on apparently stalled Iran nuclear deal efforts which resulted in a surge in oil prices.

The President said in the interview he's getting "less confident" about ongoing nuclear negotiations with Iran, soon after which oil rose as well as benchmark treasury yields and gold, as investors weigh the possibility of US-Iran nuclear talks falling apart.

Trump was asked whether he thinks the Islamic Republic will agree to shut down its nuclear program. "I don’t know. I did think so, and I’m getting more and more — less confident about it," he responded.

"They seem to be delaying, and I think that’s a shame, but I’m less confident now than I would have been a couple of months ago," Trump continued. "Something happened to them, but I am much less confident of a deal being made."

Then the question was raised by the Post, "what happens then?" To which Trump responded:

“Well, if they don’t make a deal, they’re not going to have a nuclear weapon,” Trump answered. “If they do make a deal, they’re not going have a nuclear weapon, too, you know? But they’re not going a have a new nuclear weapon, so it’s not going to matter from that standpoint.

“But it would be nicer to do it without warfare, without people dying, it’s so much nicer to do it. But I don’t think I see the same level of enthusiasm for them to make a deal. I think they would make a mistake, but we’ll see. I guess time will tell.”

On the question of China's influence on Tehran, Trump described, "I just think maybe they don’t want to make a deal. What can I say?” he said. “And maybe they do. So what does that mean? There’s nothing final."

Via AFP

Via AFPOn Tuesday Trump acknowledged in a Fox News interview that Iran is becoming "much more aggressive" in these negotiations. And the day prior he had told reporters that the Iranians are "tough negotiators" and sought to clarify that he would not allow Tehran to enrich uranium on its soil, after some recent contradictory reports suggested the White House had backed off this demand.

Washington is awaiting a formal response from the Islamic Republic, which is expected to submit a counter-proposal in the coming days, just ahead of an expected sixth round of indirect talks with the US in Muscat, Oman, slated for Sunday, June 15.

More geopolitical headlines via Newsquawk:

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up