Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Microsoft asked police to remove people who improperly entered a building at its headquarters in protest of the Israeli military's alleged use of the company's software as part of the invasion of Gaza.

Microsoft asked police to remove people who improperly entered a building at its headquarters in protest of the Israeli military's alleged use of the company's software as part of the invasion of Gaza.On Tuesday, current and former Microsoft employees affiliated with the group No Azure for Apartheid started protesting inside a building on Microsoft's campus in Redmond, Washington, and gained entry into the office of Brad Smith, the company's president. The protesters delivered a court summons notice at his office, according to a statement from the group.

"Obviously, when seven folks do as they did today — storm a building, occupy an office, block other people out of the office, plant listening devices, even in crude form, in the form of telephones, cell phones hidden under couches and behind books — that's not OK," Smith told reporters during a briefing.

"When they're asked to leave and they refuse, that's not OK. That's why for those seven folks, the Redmond police literally had to take them out of the building."Smith said that out of the seven people who entered his office, two were employees.While the company doesn't retaliate against employees who express their views, Smith said, it's different if they make threats. Microsoft will look at whether to discipline the employees who participated in the protest, Smith said.

Once inside Microsoft's building 34, the No Azure For Apartheid protesters demanded that the company cut its ties with Israel and ask for an end to the country's alleged genocide.Tech's megacap companies are doing more work with defense agencies, particularly as demand increases for advanced artificial intelligence technologies. Many of those activities were already controversial, but the issue has gotten more intense as Israel has escalated its military offensive in Gaza.

Last year Google fired 28 employees after some trespassed at the company's facilities. Some employees gained access to the office of Thomas Kurian, CEO of Google's cloud unit, which had a contract with Israel's government.No Azure for Apartheid has held a series of actions this year, including at Microsoft's Build developer conference and at a celebration of the company's 50th anniversary. A Microsoft director reached out to the Federal Bureau of Investigation as the protests continued, Bloomberg reported earlier on Tuesday.

Last week, No Azure For Apartheid mounted protests around the company's campus, leading to 20 arrests in one day. Of the 20, 16 have never worked at Microsoft, Smith said.The Guardian reported earlier this month that Israel's military used Microsoft's Azure cloud infrastructure to store Palestinians' phone calls, leading the company to authorize a third-party investigation into whether Israel has drawn on the company's technology for surveillance.

"I think the responsible step from us is clear in this kind of situation: to go investigate and get to the truth of how our services are being used," Smith said on Tuesday.Most of Microsoft's work with the Israeli Defense Force involves cybersecurity for Israel, he said. He added that the company cares "deeply" about the people in Israel who died from the terrorist attack by Hamas on Oct. 7, 2023, and the hostages who were taken, as well as the tens of thousands of civilians in Gaza who have died since from the war.

Microsoft intends to provide technology in an ethical way, Smith said.

The US 30 index updated its all-time high, but the trend remains unstable. The US 30 forecast for today is positive.

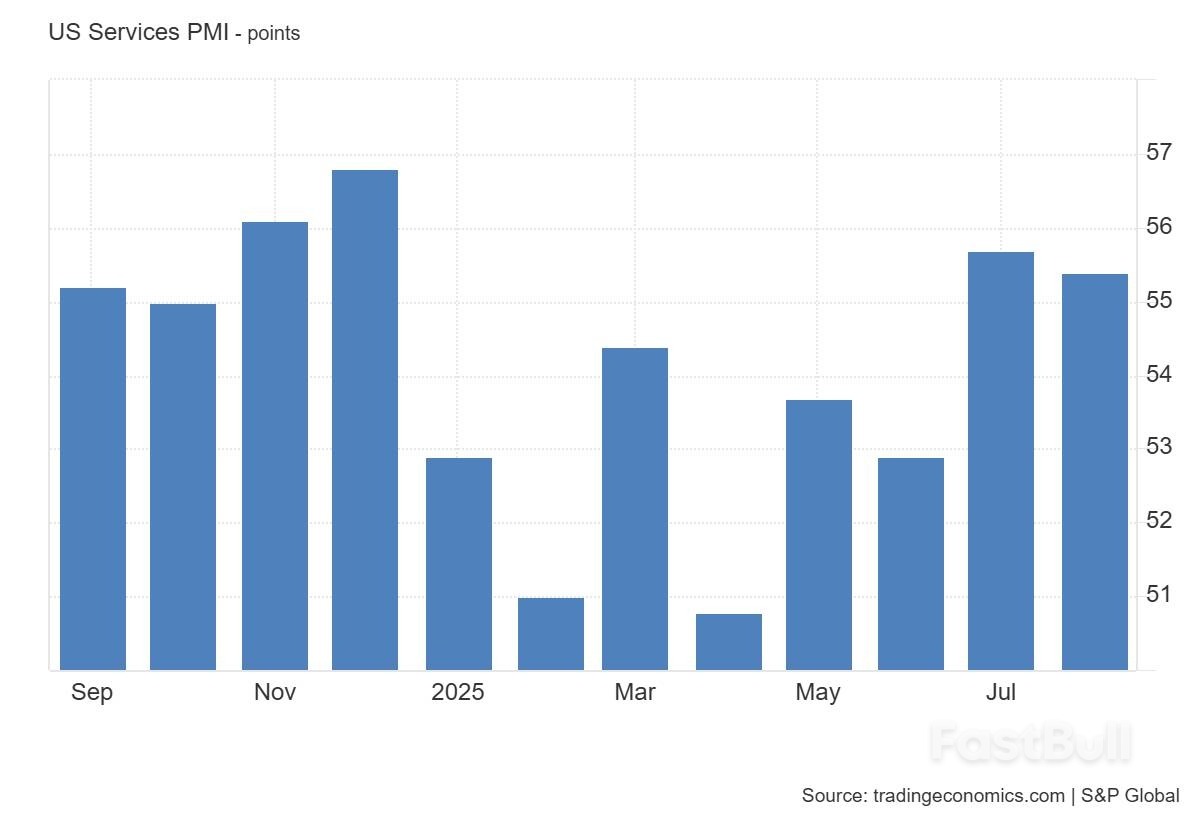

The published services PMI for July 2025 came in at 55.4 points, above the forecast of 54.2 but slightly lower than the previous reading of 55.7. This figure shows that the services sector continues to demonstrate solid growth, remaining well above the key 50-point threshold that separates expansion from contraction. As the services sector accounts for more than two-thirds of US GDP, its steady performance indicates the economy’s overall positive momentum.

This supports the US 30 index, as investors see confirmation that corporate earnings in the services sector have a strong basis for further growth. However, PMI staying at elevated levels may also raise concerns about persistent inflationary pressure in services, which could prevent the Fed from cutting interest rates in the near future.

The US 30 index is again in an uptrend. The resistance level has formed at 45,790.0, with the support level at 44,590.0. Volatility remains elevated for the US 30. The uptrend is rather weak, meaning it could shift into a downtrend. The upside potential is limited in the short term.

The US 30 price forecast considers the following scenarios:

PMI data is perceived by the market as generally positive for equities and the US 30 in the short term, but investors remain attentive to the Fed’s policy stance and its response to inflation dynamics. The financial sector benefits from stable economic activity that supports lending and investment processes. Tech and communications firms also gain indirectly, as services growth increases demand for digital solutions and online platforms. The next upside target for the index could be 46,595.0.

In the wake of Ukraine attacking yet again the Druzbha or “Friendship” pipeline on Aug. 22, Ukrainian President Volodymyr Zelensky has come out with a not-so-subtle warning of his own.

According to the Ukrainian Interfax, the Ukrainian president told press on Sunday that Ukraine has always supported friendly relations with Hungary, but that “friendship” really depends on the position of the Hungarian government.

Zelensky did not specify if he was referring to relations between the two countries or “friendship” as in the Friendship pipeline, but Ukrainian media state he was talking about the latter.

Hungary’s foreign minister, Péter Szijjártó, posted a clip of Zelensky’s threats on X, writing:

“Zelensky used Ukraine’s national holiday to threaten Hungary. We firmly reject the Ukrainian president’s intimidation.”

Kyiv would then be clearly threatening Budapest that they will continue sabotaging the oil pipeline if the Hungarian government does not support Ukraine in its efforts against Putin, and potentially change its stance on Ukraine’s EU membership, which the Hungarian government opposes.

The Druzbha carries vital energy supplies to both Hungary and Slovakia, and Hungary’s foreign minister, Szijjártó, has repeatedly warned Kyiv not to strike again.

After the latest damage, Hungary expects repairs to take a few days.

Heading into the cold winter months, this issue is sure to escalate, and U.S. President Trump has already expressed his displeasure, saying he was “very angry” about it.

Hungary is also a major supplier of electricity to Ukraine.

A blockchain reorganization, or reorg, happens when a chain of blocks is abandoned in favor of a competing version with greater cumulative proof-of-work (PoW), effectively rewriting a piece of the ledger. Reorgs roll back transactions in orphaned blocks, sending them back into the mempool for possible inclusion—or omission—later.

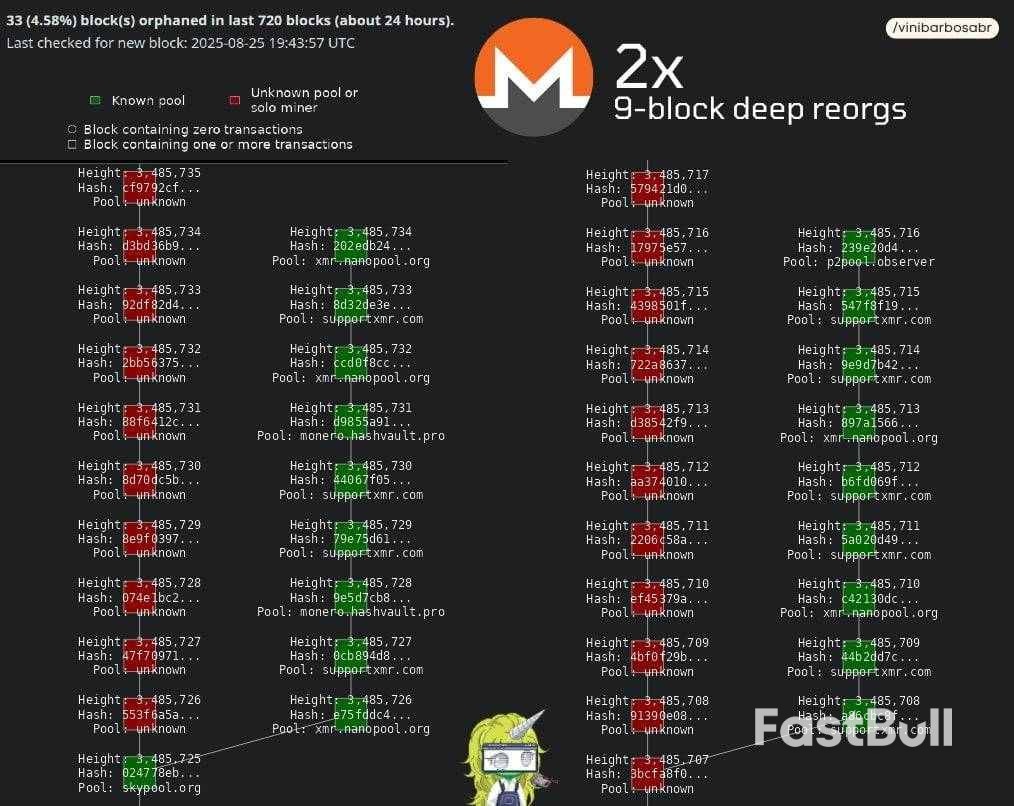

This creates openings for double-spending, where attackers can spend coins on a discarded chain yet still retain them after the reorg. In August 2025, Monero endured repeated reorgs tied to the Qubic mining pool, which amassed a dominant share of hashrate. Qubic publicly described the effort as an experiment, leveraging its PoW setup to mine Monero blocks and claim rewards.

Image source: Vini Barbosa. The X account Vini Barbosa reported that Monero had two 9-block-deep reorgs within 60 minutes from blocks 3485726 → 3485734 to 3485708 → 3485716.

Image source: Vini Barbosa. The X account Vini Barbosa reported that Monero had two 9-block-deep reorgs within 60 minutes from blocks 3485726 → 3485734 to 3485708 → 3485716.That strength initially enabled a six-block reorg, showing how the ledger could be rewritten. Several more followed, including a recently reported nine-block reorg that took place two times. Monero’s reorgs stemmed from Qubic’s superior hashrate, allowing private mining of a longer chain before revealing it, which forced nodes to switch. The risks include double-spending, transaction censorship, and the headache of erased blocks.

Exchanges like Kraken suspended deposits, later demanding 720 confirmations—far beyond the usual 10—to guard against losses. The turmoil sparked debate over revamping Monero’s consensus, with proposals ranging from merge mining with Bitcoin, to geographically distributed hardware to weaken large pools, to Dash’s Chainlocks, where masternodes lock blocks to block reorgs.

In August 2021, Bitcoin SV faced a similar test when an unknown miner controlled over half its hashrate, pulling off a reported a massive 100-block reorg. The event splintered the chain into three versions, shaking reliability. The cause was traced to stealth miners building hidden chains, leading to familiar risks: double-spends, instability, and shaken confidence.

Reorgs highlight PoW’s probabilistic finality: Transactions become more secure with additional confirmations, but a 51% advantage can override them. Both episodes reveal reorgs as natural correction tools twisted into attack methods, fueling calls for stronger decentralization and hybrid protections.

Monero and BSV’s experiences reveal the two-sided nature of reorgs—ordinary in healthy operation but disruptive when weaponized—pointing to the importance of widely distributed hashrate to preserve a blockchain’s integrity.Bitcoin is far more expensive to attack because of its sheer hashrate dominance compared to other PoW blockchains. The network runs on hundreds of exahashes per second (EH/s), powered by globally distributed mining farms operating specialized ASIC hardware.

To reorganize Bitcoin’s chain, an attacker would need to secretly marshal a majority of that hashrate, a feat that requires billions of dollars in mining rigs, industrial-scale infrastructure, and massive amounts of electricity. The level of investment needed makes such an attempt economically irrational.Monero ( XMR) and Bitcoin SV ( BSV) are far cheaper to attack because their PoW systems operate on a fraction of Bitcoin’s hashrate, and the cost of entry for mining is drastically lower.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up