Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Oct)

U.S. Average Hourly Wage MoM (SA) (Oct)A:--

F: --

P: --

U.S. Average Hourly Wage YoY (Oct)

U.S. Average Hourly Wage YoY (Oct)A:--

F: --

P: --

U.S. Retail Sales (Oct)

U.S. Retail Sales (Oct)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Oct)

U.S. Core Retail Sales MoM (Oct)A:--

F: --

U.S. Core Retail Sales (Oct)

U.S. Core Retail Sales (Oct)A:--

F: --

P: --

U.S. Retail Sales MoM (Oct)

U.S. Retail Sales MoM (Oct)A:--

F: --

U.S. Private Nonfarm Payrolls (SA) (Oct)

U.S. Private Nonfarm Payrolls (SA) (Oct)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Oct)

U.S. Average Weekly Working Hours (SA) (Oct)A:--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Nov)

U.S. Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

U.S. Retail Sales YoY (Oct)

U.S. Retail Sales YoY (Oct)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Oct)

U.S. Manufacturing Employment (SA) (Oct)A:--

F: --

U.S. Government Employment (Nov)

U.S. Government Employment (Nov)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Dec)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Dec)

U.S. IHS Markit Composite PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Dec)

U.S. IHS Markit Services PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. Commercial Inventory MoM (Sept)

U.S. Commercial Inventory MoM (Sept)A:--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Argentina GDP YoY (Constant Prices) (Q3)

Argentina GDP YoY (Constant Prices) (Q3)A:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Australia Westpac Leading Index MoM (Nov)

Australia Westpac Leading Index MoM (Nov)A:--

F: --

Japan Trade Balance (Not SA) (Nov)

Japan Trade Balance (Not SA) (Nov)A:--

F: --

P: --

Japan Goods Trade Balance (SA) (Nov)

Japan Goods Trade Balance (SA) (Nov)A:--

F: --

P: --

Japan Imports YoY (Nov)

Japan Imports YoY (Nov)A:--

F: --

P: --

Japan Exports YoY (Nov)

Japan Exports YoY (Nov)A:--

F: --

P: --

Japan Core Machinery Orders YoY (Oct)

Japan Core Machinery Orders YoY (Oct)A:--

F: --

P: --

Japan Core Machinery Orders MoM (Oct)

Japan Core Machinery Orders MoM (Oct)A:--

F: --

P: --

U.K. Core CPI MoM (Nov)

U.K. Core CPI MoM (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

U.K. Core Retail Prices Index YoY (Nov)

U.K. Core Retail Prices Index YoY (Nov)--

F: --

P: --

U.K. Core CPI YoY (Nov)

U.K. Core CPI YoY (Nov)--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Nov)

U.K. Output PPI MoM (Not SA) (Nov)--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Nov)

U.K. Output PPI YoY (Not SA) (Nov)--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Nov)

U.K. Input PPI YoY (Not SA) (Nov)--

F: --

P: --

U.K. CPI YoY (Nov)

U.K. CPI YoY (Nov)--

F: --

P: --

U.K. Retail Prices Index MoM (Nov)

U.K. Retail Prices Index MoM (Nov)--

F: --

P: --

U.K. CPI MoM (Nov)

U.K. CPI MoM (Nov)--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Nov)

U.K. Input PPI MoM (Not SA) (Nov)--

F: --

P: --

U.K. Retail Prices Index YoY (Nov)

U.K. Retail Prices Index YoY (Nov)--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo Rate--

F: --

P: --

Indonesia Deposit Facility Rate (Dec)

Indonesia Deposit Facility Rate (Dec)--

F: --

P: --

Indonesia Lending Facility Rate (Dec)

Indonesia Lending Facility Rate (Dec)--

F: --

P: --

Indonesia Loan Growth YoY (Nov)

Indonesia Loan Growth YoY (Nov)--

F: --

P: --

South Africa Core CPI YoY (Nov)

South Africa Core CPI YoY (Nov)--

F: --

P: --

South Africa CPI YoY (Nov)

South Africa CPI YoY (Nov)--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Dec)

Germany Ifo Business Expectations Index (SA) (Dec)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Dec)

Germany Ifo Current Business Situation Index (SA) (Dec)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Dec)

Germany IFO Business Climate Index (SA) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Nov)

Euro Zone Core CPI Final MoM (Nov)--

F: --

P: --

Euro Zone Labor Cost YoY (Q3)

Euro Zone Labor Cost YoY (Q3)--

F: --

P: --

Euro Zone Core HICP Final YoY (Nov)

Euro Zone Core HICP Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Nov)

Euro Zone Core HICP Final MoM (Nov)A:--

F: --

P: --

Euro Zone Core CPI Final YoY (Nov)

Euro Zone Core CPI Final YoY (Nov)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Nov)

Euro Zone HICP MoM (Excl. Food & Energy) (Nov)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Nov)

Euro Zone CPI YoY (Excl. Tobacco) (Nov)--

F: --

P: --

Euro Zone HICP Final YoY (Nov)

Euro Zone HICP Final YoY (Nov)--

F: --

P: --

Euro Zone HICP Final MoM (Nov)

Euro Zone HICP Final MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Meme stock interest is fading as investors pivot to Big Tech after strong earnings from Microsoft and Meta. Retail traders remain active but more selective, while institutional investors may drive future gains.

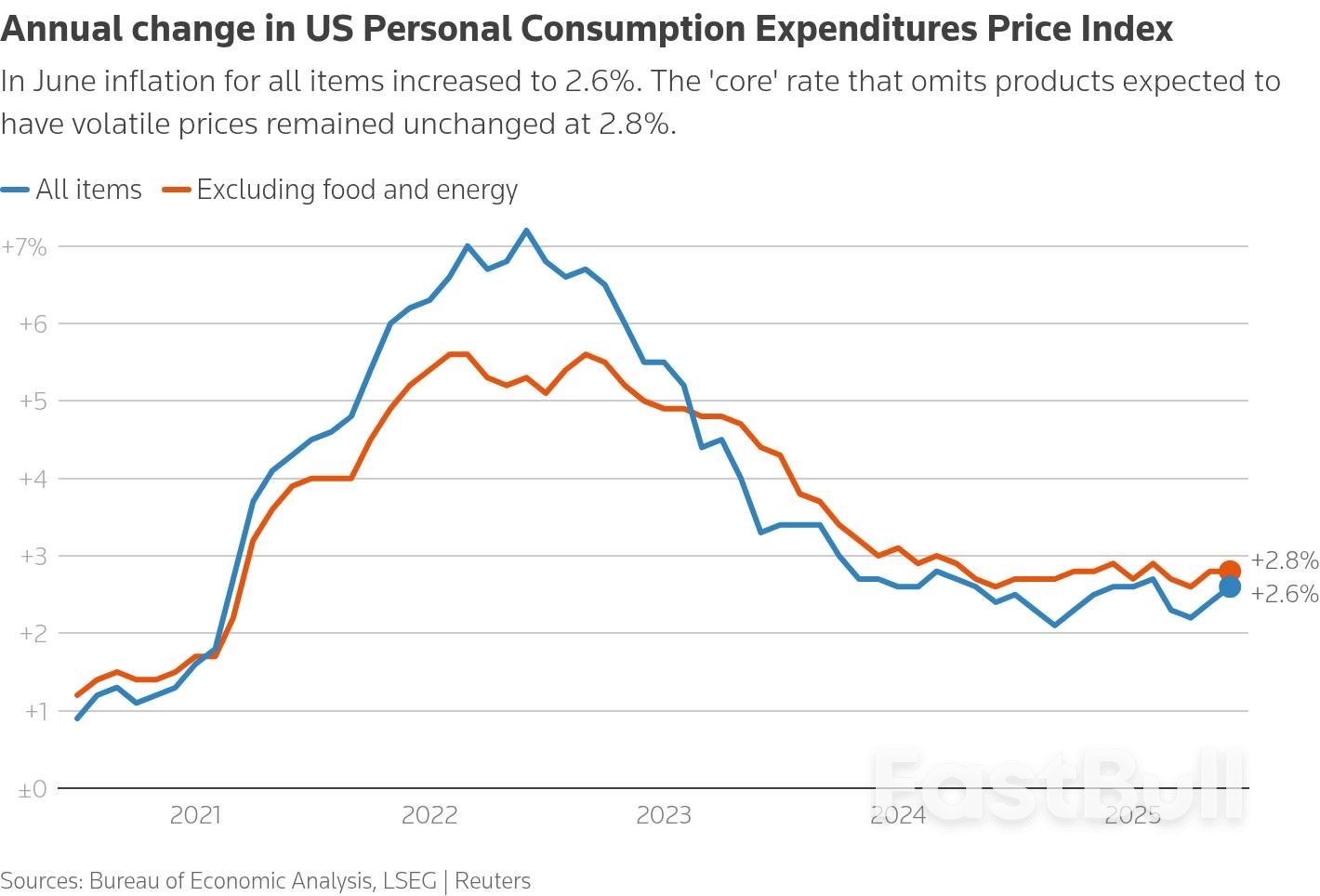

U.S. inflation increased in June as tariffs boosted prices for imported goods like household furniture and recreation products, supporting views that price pressures would pick up in the second half of the year and delay the Federal Reserve from resuming cutting interest rates until at least October.

The report from the Commerce Department on Thursday showed goods prices last month posting their biggest gain since January, with also solid rises in the costs of clothing and footwear. The U.S. central bank on Wednesday left its benchmark interest rate in the 4.25%-4.50% range and Fed Chair Jerome Powell's comments after the decision undercut confidence the central bank would resume policy easing in September as had been widely anticipated by financial markets and some economists.

"The Fed is unlikely to welcome the inflation dynamics currently taking hold," said Olu Sonola, head of U.S. economic research, Fitch Ratings. "Rather than converging toward target, inflation is now clearly diverging from it. This trajectory is likely to complicate current expectations for a rate cut in September or October."

The personal consumption expenditures (PCE) price index rose 0.3% last month after an upwardly revised 0.2% gain in May, the Commerce Department's Bureau of Economic Analysis said. Economists polled by Reuters had forecast the PCE price index climbing 0.3% following a previously reported 0.1% rise in May.

Prices for furnishings and durable household equipment jumped 1.3%, the biggest gain since March 2022, after increasing 0.6% in May. Recreational goods and vehicles prices shot up 0.9%, the most since February 2024, after being unchanged in May. Prices for clothing and footwear rose 0.4%.

Outside the tariff-sensitive goods, prices for gasoline and other energy products rebounded 0.9% after falling for four consecutive months. Services prices rose 0.2% for a fourth straight month, restrained by cheaper airline fares and steady prices for dining out and hotel stays.

In the 12 months through June, the PCE price index advanced 2.6% after increasing 2.4% in May.

The data was included in the advance gross domestic product report for the second quarter published on Wednesday, which showed inflation cooling, though remaining above the Fed's 2% target. Economists said businesses were still selling inventory accumulated before President Donald Trump's sweeping import duties came into effect.

They expected a broad increase in goods prices in the second half. Procter & Gamble (PG.N), opens new tab said this week it would raise prices on some products in the U.S. to offset tariff costs.

The Fed tracks the PCE price measures for monetary policy.

Excluding the volatile food and energy components, the PCE price index increased 0.3% last month after rising 0.2% in May. In addition to higher goods prices, the so-called core PCE inflation was lifted by rising costs for healthcare as well as financial services and insurance.

In the 12 months through June, core inflation advanced 2.8% after rising by the same margin in May.

Stocks on Wall Street were mixed. The dollar was steady against a basket of currencies. U.S. Treasury yields fell.

A line chart titled "Annual change in US Personal Consumption Expenditures Price Index" that compares two key inflation metrics over the past five years.

The BEA also reported that consumer spending, which accounts for more than two-thirds of economic activity, rose 0.3% in June after being unchanged in May. The data was also included in the advance GDP report, which showed consumer spending growing at a 1.4% annualized rate last quarter after almost stalling in the first quarter.

In the second quarter, economic growth rebounded at a 3.0% rate, boosted by a sharp reduction in the trade deficit because of fewer imports relative to the record surge in the January-March quarter. The economy contracted at a 0.5% pace in the first three months of the year.

Spending is being supported by a stable labor market, with other data from the Labor Department showing initial claims for state unemployment benefits rose 1,000 to a seasonally adjusted 218,000 for the week ended July 26.

But a reluctance by employers to increase headcount amid uncertainty over where tariff levels will eventually settle is making it harder for those who lose their jobs to find new opportunities, which could hamper future spending.

The number of people receiving benefits after an initial week of aid, a proxy for hiring, was unchanged at a lofty seasonally adjusted 1.946 million during the week ending July 19, the claims report showed.

The government's closely watched employment report on Friday is expected to show the unemployment rate rising to 4.2% in July from 4.1% in June, according to a Reuters survey of economists.

Economists expect pressure from tariffs and a slowing labor market will put a brake on consumer spending in the third quarter. Slow growth is likely already in the works as inflation-adjusted consumer spending edged up 0.1% in June after declining 0.2% in May.

Precautionary saving could also curb spending. The saving rate was unchanged at 4.5% in June.

Though a third report from the Labor Department showed wage growth picking up in the second quarter, inflation-adjusted annual gains moderated to 0.9% from 1.1% in the 12 months through March.

The BEA report showed inflation cutting into income for households after accounting for taxes, which was flat in June.

Signs of financial strain are also emerging among higher-income households, who have largely been driving spending. Lower- and middle-income families have been disproportionately affected by tariff-related price increases, higher borrowing costs and slowing economic activity.

"While consumer spending has thus held up — supported by solid income gains — it now faces mounting headwinds from a cooling labor market and renewed inflationary pressures," said Gregory Daco, chief economist at EY-Parthenon.

NZDUSD Daily Chart, July 31, 2025

NZDUSD Daily Chart, July 31, 2025 NZDUSD 4H Chart, July 31, 2025

NZDUSD 4H Chart, July 31, 2025 NZDUSD 1H Chart, July 31, 2025

NZDUSD 1H Chart, July 31, 2025President Trump announced in a Truth Social 网站 that he is extending trade talks with Mexico for another 90 days. Yahoo Finance Washington Correspondent.

President Trump announcing on Truth Social he is extending Mexico's current tariff rates for 90 days to allow more time for trade negotiations with the country. That announcement coming after Trump threatened last month to increase Mexico's country-based duty to 30% starting August 1st. The president's decision coming shortly after he said he would not extend his Friday deadline. Joining us now, Washington correspondent Ben Werschkull. Ben, we were just talking about the countries that have been left out in the cold so to speak. Mexico was one of them, but it seems like they're getting a little more time, but the time that they're getting comes still with these high tariffs attached.

For sure. Yeah. So this is, this is the 90 day pause that Trump announced just a few minutes ago, and it'll, it'll keeps the rates at 25%. So it's not a 5% increase to, to 30%. I do think it's significant that Trump talked about this call as very successful. He had a lot of kind words for Mexican president Claudia Sheinbaum, um, as, as they met this morning to, to kind of work out these deals considering how, how many, how many issues they have to work out over the next 90 days on the border and these other things. Um, other things Trump announced today in this post will be that the 25% headline rate will continue, the 25% auto rate will continue. That's, that's a big one in focus. And then as with all the other deals, the 50% tariffs on steel, aluminum and copper, which is also coming tomorrow, will, will, will stay in place. So those, those rates will stay now. Um, Trump also announced that Mexico has agreed to terminate its non-tariff trade barriers without providing any additional details there. the President Sheinbaum did already respond to confirm this call and to confirm the 90 day pause. What she says she's focused on for the next 90 days is building a long-term deal with President Trump on all these other more complex trade issues.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up