Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Learn how to use the economic calendar MarketWatch offers for real-time data, key indicators, and market impact. A complete 2025 guide for traders and investors.

The economic calendar MarketWatch provides is one of the most reliable tools for tracking major financial events and market-moving indicators. From interest rate decisions to CPI, GDP, and employment reports, traders rely on this calendar to prepare for volatility and plan entries with better timing. This guide explains how to use it effectively in 2025.

Economic calendars help traders anticipate market volatility by tracking scheduled data releases such as GDP, CPI, interest rate decisions, and employment reports. Tools like the economic calendar MarketWatch publishes allow investors to prepare strategies ahead of major announcements that influence stocks, forex, bonds, and commodities.

The MarketWatch economic calendar highlights major U.S. and global indicators with clear time stamps, impact levels, and forecast versus actual values. It is widely used by traders who want simple navigation and reliable data updated throughout the day.

MarketWatch pulls economic releases from official institutions such as the U.S. Bureau of Labor Statistics, Federal Reserve, and international government agencies. Data is refreshed in real time as soon as the official releases are published, making the marketwatch.com economic calendar a dependable reference for time-sensitive trading.

Unlike platforms that focus heavily on forex or crypto, MarketWatch emphasizes U.S. macroeconomic releases, making it especially useful for traders tracking the S&P 500, Dow Jones, U.S. Treasury yields, and USD-related markets. It offers a cleaner interface compared to forex-focused calendars and is preferred for its media-style presentation.

You can access the MarketWatch US economic calendar directly from the main site. Navigation is simple and works on both desktop and mobile.

The calendar includes several key columns that help traders interpret macro data efficiently. Understanding these fields allows you to forecast volatility and compare the market’s expectations to real outcomes.

| Column | Meaning |

|---|---|

| Time | Event release time in Eastern Time (ET), essential for global traders. |

| Event | The name of the economic indicator such as CPI, NFP, PMI, or GDP. |

| Impact | Shows expected volatility: High, Medium, or Low. |

| Previous | Last month or last period’s result. |

| Forecast | Market expectation before the event releases. |

| Actual | The real number released at the scheduled time. |

These components are essential whether you use the economic calendar MarketWatch offers or other mainstream calendars.

One of the standout strengths of the MarketWatch weekly economic calendar is its real-time update mechanism. As soon as official agencies publish new data, MarketWatch updates the calendar instantly, letting traders react without delay.

Although the MarketWatch economic calendar offers simpler filtering than forex-oriented tools, it still provides essential features to organize events efficiently. This is useful for traders who want quick access to U.S.-focused releases or specific event categories.

These filters help personalize your calendar view when using the marketwatch.com economic calendar across different trading styles.

The MarketWatch economic calendar is designed to help traders quickly understand key financial events and their expected market influence. Each row shows an event, its scheduled time, forecast figures, and the actual numbers once released. Knowing how to read these columns allows traders to anticipate price volatility and plan positions more effectively.

Impact levels help traders identify which economic events matter most. The economic calendar MarketWatch displays uses simple importance labels to show expected volatility. High-impact events typically cause strong market reactions in stocks, forex, and commodities, while lower-impact events might produce smaller intraday shifts.

These levels help users of the MarketWatch US economic calendar prioritize which events deserve deeper attention or risk management planning.

Forecast and actual values determine how markets react after an economic release. Large deviations typically trigger strong moves. Traders who rely on the MarketWatch weekly economic calendar use these figures to anticipate volatility immediately after data is published.

Understanding these gaps is essential when using real-time data from the MarketWatch economic calendar for active trading decisions.

The economic calendar MarketWatch highlights a range of indicators, but some consistently move global markets. These events affect currencies, interest rates, stocks, and bonds, making them essential for both day traders and long-term investors.

FOMC meetings and speeches from Federal Reserve officials are among the most influential events on the MarketWatch US economic calendar. These updates provide insights into future interest rate decisions and policy shifts, which directly influence USD pairs, equities, and Treasury yields.

Employment indicators often trigger the strongest short-term volatility. The marketwatch.com economic calendar clearly marks these releases as high impact due to their direct link to economic strength and Federal Reserve policy decisions.

Inflation data plays a dominant role in financial markets. Traders use the MarketWatch weekly economic calendar to track these releases because they strongly influence interest rate expectations, bond yields, and sector performance.

GDP and retail sales provide broader insights into economic momentum. These indicators influence risk sentiment and help traders adjust exposure to equities, currencies, and commodities.

The economic calendar MarketWatch provides can be integrated into multiple trading strategies. Whether you are a day trader focusing on short-term volatility or an investor reacting to macroeconomic cycles, the calendar helps align decisions with upcoming data.

This makes the MarketWatch US economic calendar a practical tool for planning entries, exits, and risk management across multiple asset classes.

The economic calendar MarketWatch offers is a valuable tool for tracking essential economic indicators, planning trades, and managing market risk. By understanding impact levels, forecast deviations, and key events such as CPI, NFP, and Fed meetings, traders can make more informed decisions. Using the calendar effectively helps align strategies with real-time market conditions and long-term economic trends.

President Donald Trump rolled back tariffs on more than 200 food items. The exemption list includes everyday essentials such as beef, bananas, coffee, and orange juice, all of which have seen steep price increases. The rollback takes effect retroactively and comes amid growing public frustration over rising grocery bills.

Officials acknowledged that specific tariffs may contribute to higher prices but stated that overall inflation remains contained. The exemption was described as a strategic step, especially for items not made locally. Authorities also pointed to new trade agreements with countries such as Argentina, Ecuador, Guatemala, and El Salvador, noting that the exemptions are part of broader trade progress.

Inflation has become a significant concern for voters. In recent elections in Virginia, New Jersey, and New York, Democrats won several races by focusing on the rising cost of living. Food prices were a significant concern in their campaigns.

Ground beef prices surged nearly 13%, while steak costs rose 17% year-over-year. Meanwhile, banana prices increased by 7%, while tomato prices rose by 1%, and overall food-at-home inflation reached 2.7% in September. Although the U.S. is a major beef producer, cattle shortages have limited supply and kept prices elevated.

Trump announced a plan to give $2,000 to lower- and middle-income Americans next year, using money collected from tariffs. Some observers believe the move is a response to economic pressures linked to rising consumer prices. Moreover, the policy shift reflects growing concern about the broader impact of tariffs on affordability.

Trump's trade strategy includes a 10% base tariff on imports from every country, along with additional state-specific duties. Many economists argue that tariffs have been a direct source of inflation, potentially contributing to increased inflation.

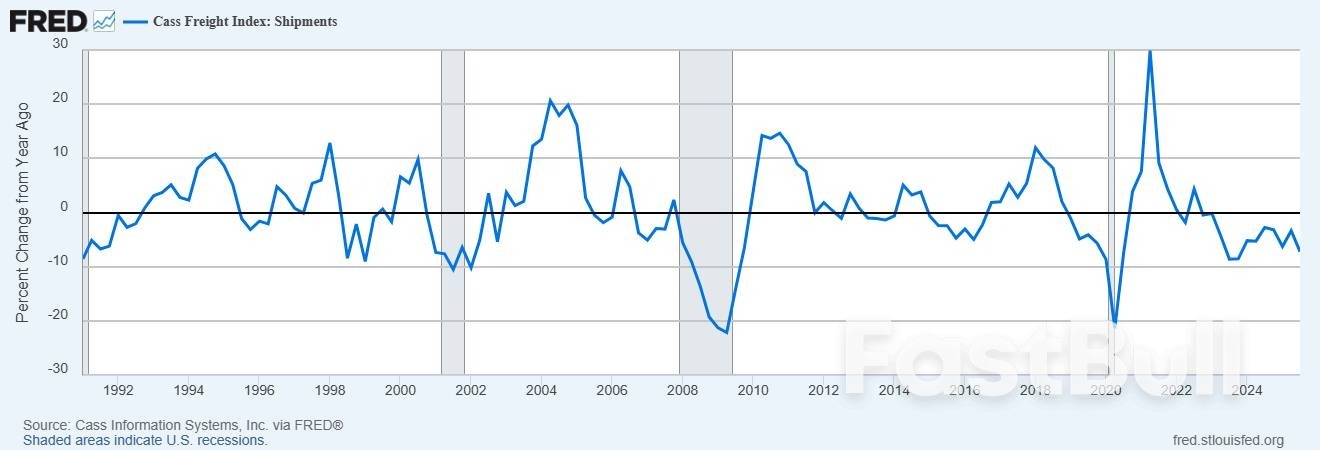

The tariff-related costs will continue rising as more companies pass along expenses to consumers. The Cass Freight Index also declined to recessionary thresholds, as seen in the chart below.

The chart below confirms that the year-over-year change in the Cass Freight Index indicates a warning of a sharp contraction in shipment volumes. This freight weakness, along with lower industrial activity, points to a broader economic slowdown.

Despite broader macroeconomic concerns, the S&P 500 remains at elevated levels. However, the index is currently consolidating near overbought territory, signaling growing uncertainty. At the same time, financial liquidity remains tight.

The daily chart of the S&P 500 shows that the index has reached the red dotted trendline, indicating uncertainty in the short term. A breakout above the $6,900 level could signal further upside toward the $7,000 mark. However, a breakdown below $6,600 would confirm a negative trend and lead to a decline toward the $6,200 level.

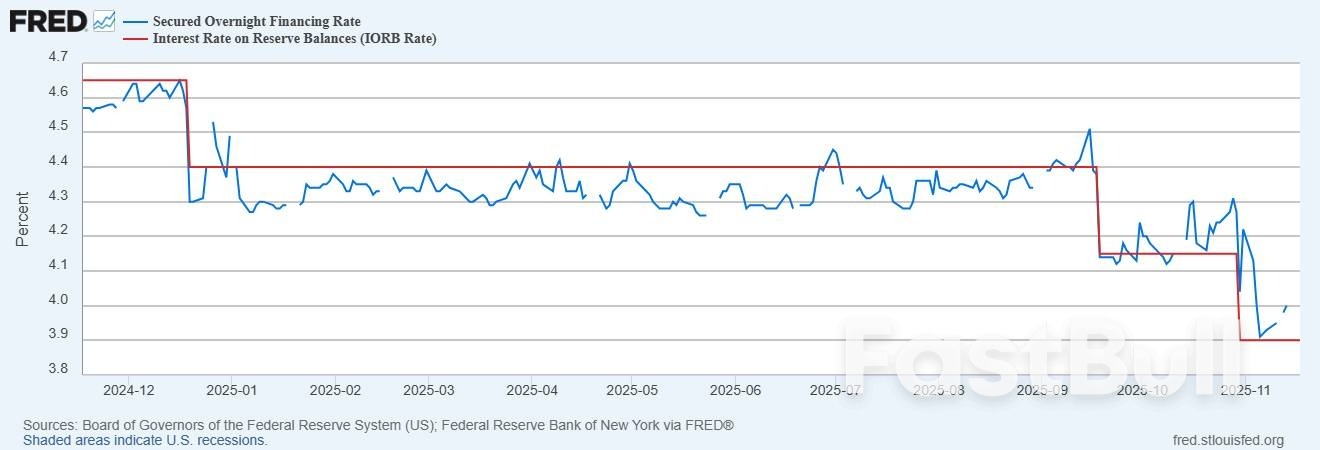

The Secured Overnight Financing Rate (SOFR) has risen to 4.0%, aligning with the Federal Reserve's standing repo facility. This suggests that banks are paying more to access short-term funding, which is a classic sign of stress in money markets.

Despite the extremely overbought conditions in the S&P 500, the overall outlook remains strongly bullish. This is supported by the formation of an ascending broadening wedge pattern that has been developing since the 2016 bottom.

Additionally, the presence of an inverted head and shoulders pattern reinforces the bullish momentum. A pullback in the S&P 500 from its overbought condition may present a buying opportunity for investors.

The effects of the trade war are becoming increasingly difficult to ignore. Tariff rollbacks reflect mounting pressure from rising food prices and growing public concern. Inflation is no longer just a headline; it has become a daily reality, and policy responses, such as tariff exemptions and proposed payments, highlight affordability as a central economic issue.

Meanwhile, the market is showing mixed signals. The S&P 500 remains near record highs, but liquidity conditions are tightening, and technical patterns suggest a potential top may be forming. Freight data and industrial output also point to underlying economic weakness. If these trends persist, the long-term impact of the trade war could extend to broader areas of the economy.

A special tribunal in Bangladesh is expected to rule Monday on whether ousted leader Sheikh Hasina is guilty of crimes against humanity for her role in the deadly crackdown of student-led protests last year.

The country has been on edge for several days following a wave of bomb and arson attacks that took place amid protests organized by Hasina's Awami League party, which is currently banned from political activity. Hasina remains in exile in New Delhi after fleeing the country in August 2024 after 15 years in power.

Security in the capital, Dhaka, has been tightened ahead of Monday's verdict by a special tribunal led by Justice Golam Mortuza Mozumder. Hasina's party last week called for a citywide "lockdown," urging supporters to take to the streets in a direct challenge to the interim government led by Nobel laureate Muhammad Yunus.

Prosecutors have previously sought the death penalty for Hasina, accusing her of directly ordering the killing of hundreds of mainly young protesters in clashes with security forces last year. A February report from the United Nations estimated about 1,400 people were killed between July 15 and Aug. 5 last year, the vast majority of who were shot by Bangladesh's security forces.

Hasina has denied the charges and rejected the trial as "politically motivated."

"I categorically deny all charges brought against me," Hasina said in a emailed response to questions. "The claim that I ordered security forces to open fire on protesters is categorically untrue. At no time did I issue or authorize such an order. It didn't happen, and the transcripts cited by the prosecution have been taken out of context and misused."

She questioned the motives of the tribunal and said she wouldn't return to Bangladesh to stand trial as she wouldn't get a fair hearing.

"Returning to my home under the current circumstances would not be justice, it would be a political persecution," she said.

Yunus continues to face challenges in stabilizing the country more than a year after he was appointed transitional leader. He's pledged to hold elections and a vote on constitutional reforms in February.

Hasina said the decision to ban her Awami League party from the elections was unconstitutional and would disenfranchise her supporters.

"Bangladesh's history shows that when voters are blocked from supporting their favoured party, they do not vote at all," she said. She urged her supporters to "remain peaceful, remain patient, and continue to believe that democracy will return to our country."

![What Is Copy Trading and How It Works [Pros & Cons]_1 What Is Copy Trading and How It Works [Pros & Cons]_1](https://img.fastbull.com/prod/image/2025/11/303FE6115F664C72B2EE6297CA90D5D7.jpeg) Copy trading has become one of the most popular ways for beginners to enter the financial markets, but many still wonder what is copy trading and how it actually works. Instead of trading on your own, you automatically mirror the decisions of experienced traders. This introduction explains the concept, why it appeals to new investors, and what you should know before relying on it.

Copy trading has become one of the most popular ways for beginners to enter the financial markets, but many still wonder what is copy trading and how it actually works. Instead of trading on your own, you automatically mirror the decisions of experienced traders. This introduction explains the concept, why it appeals to new investors, and what you should know before relying on it.

Copy trading allows you to automatically replicate the trades of an experienced investor. Instead of placing your own orders, your account mirrors the strategy provider’s positions in real time. Many beginners search “what is copy trading” because it offers an easier entry into financial markets without needing advanced technical skills.

This method is used across forex, stocks, indices, and even crypto, making it popular for those exploring “what is copy trading in crypto” as well.

Copy trading is legal in most major financial jurisdictions but regulated differently depending on the region. Platforms offering copying services must comply with local rules designed to protect retail investors.

A “copy trading account” is typically viewed as an execution-only service. Traders still maintain full control over their funds, and platform providers cannot act as discretionary fund managers unless licensed.

Although these terms are often grouped together, they serve different purposes. Understanding the differences helps beginners avoid confusion when looking for a copy trading app or platform.

| Type | Description |

|---|---|

| Copy Trading | You automatically follow another trader’s positions proportionally. |

| Social Trading | Focuses on community interaction, sharing ideas, and manual copying. |

| Mirror Trading | Copies algorithmic strategies exactly as programmed. |

Copy trading is the most beginner-friendly because it combines automation with transparency, and works across forex, stocks, and crypto.

You remain in full control of your account. This includes:

The strategy provider controls the trading logic, but you have the authority to exit positions, close your account, or override the system. This flexibility is one reason users search “what is auto copy trading” when comparing platforms.

Your platform choice determines your available markets, fees, execution speed, and risk tools. Many new traders search “what is the best copy trading platform” because features differ widely across providers. Key comparison dimensions include:

Well-known platforms include eToro, ZuluTrade, and Ava Social. FastBull also offers a data-driven environment where users can analyze market trends before selecting a trader or strategy, making it suitable for beginners who want strong research tools alongside copy trading functions.

Choosing the right trader is the most important step in copy trading. Platforms typically sort traders by return, risk level, trading style, and time horizon.

This step ensures you follow a strategy aligned with your financial goals and risk tolerance.

Before copying a trader, evaluate their performance using objective metrics rather than just high returns. Important indicators include:

These metrics help you avoid unstable traders with dangerous volatility patterns.

After choosing a trader, decide how much capital to allocate. Platforms let you set:

Proper risk settings help prevent severe losses during volatile market conditions.

Once copying begins, your account will automatically follow every new position the trader opens or closes. Execution quality depends on platform speed and market liquidity.

Yes. You can manually close a losing position, pause copying temporarily, or exit the strategy completely. Override actions give you control without breaking the automation. Many copy trading apps also allow partial unwinding of trades if conditions change unexpectedly.

Copy trading offers several benefits for beginners and time-poor investors who search terms like “what is copy trading and how does it work.” Its automated nature lowers the barrier to entry while giving users access to skilled traders.

Despite its advantages, copy trading carries notable risks that beginners often overlook. Understanding these risks is essential before opening a copy trading account.

Beyond spreads and commissions, copy trading can include additional costs that vary across platforms. These fees directly affect overall ROI, making platform comparison crucial for users exploring what is the best copy trading platform.

Copy trading is suitable for individuals who want market exposure without deep technical knowledge. It’s especially useful for those who prefer automated systems similar to what is auto copy trading.

Most platforms allow you to copy strategies across multiple markets. This flexibility appeals to users exploring what is copy trading in crypto or traditional asset classes.

Good platforms include built-in risk tools to protect your capital and prevent large losses. These tools are crucial to understanding how copy trading works safely.

Beginners should start small and scale up gradually as they learn how copy trading works in real conditions. Most platforms allow entry with amounts as low as 50–200 USD.

Yes. A demo account helps you practice with virtual funds before risking real capital. It’s a safe way to test how automatic copying behaves under different market conditions.

New users often rush into copying high-return traders without understanding long-term risks. Avoid these common errors to build a stable foundation.

Copy trading can be profitable, but results depend on the trader you follow, your risk settings, and market conditions. It is not guaranteed income, and even top traders experience drawdowns. Beginners should focus on long-term consistency rather than short bursts of high returns.

To start, open a copy trading account on a regulated platform, choose a trader based on performance metrics, set your allocation, and enable automatic copying. Understanding what is copy trading and how it works helps you evaluate strategies more objectively and avoid unnecessary risks.

While some professional traders may reach this level, it is not typical for beginners and should not be expected from copy trading alone. Earnings vary based on capital size, strategy volatility, and market conditions. No legitimate platform guarantees fixed daily profits.

Understanding what is copy trading is essential before using automated strategies to enter financial markets. This method can simplify trading for beginners, but success depends on platform choice, trader selection, and strong risk management. By learning how the system works and applying disciplined controls, investors can use copy trading as a practical tool to build diversified market exposure.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up