Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. President Donald Trump on Thursday said he will nominate Council of Economic Advisers Chairman Stephen Miran to serve as a Federal Reserve governor.

U.S. President Donald Trump on Thursday said he will nominate Council of Economic Advisers Chairman Stephen Miran to serve as a Federal Reserve governor.

Here are some investor comments about the impact to markets:

ANDREW BRENER, HEAD OF INTERNATIONAL FIXED INCOME SECURITIES NATALLIANCE SECURITIES, NEW YORK:

"Our view is he is very controversial and will not pass the Senate. He will try to change the Fed. First he has no experience. No street. No business. Always politics."

ROBERT TIPP, CHIEF INVESTMENT STRATEGIST, HEAD OF GLOBAL BONDS, PGIM FIXED INCOME, NEW YORK:

"So far bashing the Fed this term has been fruitless, or possibly even counter-productive — it certainly appeared to be counterproductive in the December 2018 Trump/Powell episode …

Presumably it (Miran's appointment) will have at least a marginal impact — but it will depend on the pliability of the rest of the committee members — which is certainly not a given.

Furthermore, as situations evolve, and nominees become acting chairs, there is at least one prominent example of a Fed Chair — the first appointee following the 1951 Accord, Martin, who worked on the Accord from the administration's side – (who) proceeded in his long tenure to anger more than one president with his tight money policies ...

Again, while Trump is likely to choose someone more aligned with his thinking than Powell, the impact may not prove as material as some may fear."

RYAN SWEET, CHIEF US ECONOMIST, OXFORD ECONOMICS, PHILADELPHIA:

"I don't think it means too much in the context of altering the course of monetary policy.

I think the biggest question mark is whether or not he gets confirmed in time to vote at the September meeting. If he does, then that increases the odds that we get three dissents if the Fed opts to not cut in September.

I do think the odds of a September cut are rising, not because of this nomination, but just because of the recent data on the labor market."

TOM DI GALOMA, MANAGING DIRECTOR OF RATES AND TRADING, MISCHLER FINANCIAL, PARK CITY, UTAH:

"Stephen Miran will be good for the Fed because he will probably be inclined to lower rates. And I think he worked in the first Trump administration. So he has been in two Trump administrations. I think it's going to be a long-term deal for Miran and he will be Fed governor for a while. I don't think this is something that they want to do temporarily."

JOHN VELIS, AMERICAS MACRO STRATEGIST, BNY, NEW YORK:

"A bit of surprise to nominate Miran – he wasn't mentioned as a likely candidate by markets, although he is likely to be a reliable dove, given his current political position (as Chair of CEA) and his public comments to date.

"This is a recess appointment, so it does not need Senate confirmation. As far as I understand about recess appointments, they remain valid until the next session of the Senate is complete.

"This still doesn't remove the current chatter about Christopher Waller being named Fed Chair to replace Powell."

JAY HATFIELD, CHIEF EXECUTIVE OFFICER, INFRASTRUCTURE CAPITAL MANAGEMENT, NEW YORK:

"Miran is somewhat unconventional for this job because he was head of the Council of Economic Advisors and has made some controversial or hard to justify comments about forcing people to buy Treasuries, which doesn't make any sense. But I don't think this is going to be relevant to serving on the Fed board."

"It's an insider, someone who's willing to take one for the team because it's not that great of a position to be the...governor for a short period of time. It's a fairly practical decision because you can't recruit someone from the private sector for such a short period."

The main focus is on the Fed chair appointment, but he believes Miran will put more pressure on Powell to lower rates.

MARC CHANDLER, CHIEF MARKET STRATEGIST, BANNOCKBURN GLOBAL FOREX, NEW YORK:

"I don't think it really matters much because people like me have more or less decided that the Federal Reserve is most likely going to cut rates in September and probably at least one more cut before the end of the year."

"At the end of the day does it really influence our outlook for the Federal Reserve? I'd say probably not."

"Is he qualified? I'd say, yes... he is an economic advisor to the President. He obviously understands the markets. Broadly speaking, we should welcome the view that the Federal Reserve is not going to be picked from a very small inner circle of people."

U.S. President Donald Trump signed an executive order on Thursday that aimed to allow more private equity, real estate, cryptocurrency, and other alternative assets in 401(k) retirement accounts – opening the way for alternative asset managers to tap a greater share of trillions of dollars in Americans' retirement savings.The White House said regulatory overreach and litigation risks have prevented retirees from benefiting from potentially higher returns, while critics warned the investments were inherently riskier, lacked the same disclosures and carried higher fees than traditional retirement investments.

"My Administration will relieve the regulatory burdens and litigation risk that impede American workers’ retirement accounts from achieving the competitive returns and asset diversification necessary to secure a dignified, comfortable retirement," the order said.It directed the Labor Secretary and Securities and Exchange Commission to make it easier for investors to access alternative assets in their defined contribution retirement plans. It did not expressly ask the agencies to add more legal protections for investments, but directed them to clarify or potentially revise rules that could help shield the industry from litigation risk.

Asset managers welcomed the news, saying it was a major step toward modernizing retirement savings."Expanding access to investments long out of reach will help ensure millions of Americans build stronger, more diversified portfolios designed to increase savings and address the practical considerations of DC plan fiduciaries," Jaime Magyera, head of retirement for leading asset manager BlackRock (BK.N), opens new tab said in a statement, referring to defined-contribution plans like 401(k)s.

The move could be a boon for big alternative asset managers such as Blackstone , opens new tab, KKR , and Apollo Global Management , opens new tab by opening the $12-trillion market for all defined-contribution plans, of which 401(k)s are the most popular, to their investments. Some of those firms have already struck partnerships with asset managers who run those plans. A Blackstone spokesman said the firm welcomed the decision.BlackRock, which lobbied the Trump administration to expand asset options, plans to launch its own retirement fund that includes private equity and private credit assets next year.

Proponents have argued that younger savers can benefit from potentially higher returns on riskier investments in funds that get more conservative as they approach retirement.

"On the asset manager side, it's a $12-trillion retirement market that they have previously not had access to. For them, there's certainly a lot of opportunity," said Morningstar analyst Jason Kephart."From the individual investor standpoint, though, that's where it's less clear after all the additional fees, the additional complexity, and less transparency," Kephart added.

The new investment options carry lower disclosure requirements and are generally less easy to sell quickly for cash than the publicly traded stocks and bonds that most retirement funds rely on. Investing in them also tends to carry higher fees.In defined contribution plans, employees make contributions to their own retirement account, frequently with a matching contribution from their employer. The invested funds belong to the employee, but unlike a defined benefit pension plan, there is no guaranteed regular payout upon retirement.

Many private equity firms are hungry for the new source of cash that retail investors could offer after three years in which high interest rates shook their time-honored model of buying companies and selling them at a profit.Whatever results may come from Trump's order, it likely will not happen overnight, private equity executives say. Plaintiffs' lawyers are already preparing for lawsuits that could be filed by investors who do not understand the complexity of the new forms of investments.

BlackRock CEO Larry Fink acknowledged in a recent call with analysts that the change posed challenges for asset managers."The reality is, though, there is a lot of litigation risk. There's a lot of issues related to the defined contribution business," Fink said. "And this is why the analytics and data are going to be so imperative way beyond just the inclusion."

CFO Martin Small said the industry may seek litigation reform before it can expand into the market.The Department of Labor issued guidance during Trump's previous presidency on how such plans could invest in private equity funds within certain limits, but few took advantage, fearing litigation.Easing access to cryptocurrencies to be included in 401(k)s would be Trump's latest embrace of digital assets, and could be a potential boon for the sector, including asset managers that operate crypto exchange-traded funds, such as BlackRock and Fidelity.

"Bitcoin has moved beyond its early days as a merely speculative asset and is slowly entering into many investors’ long-term investment strategy," said Gerry O'Shea, head of global market insights at Hashdex Asset Management. "This EO will help accelerate this trend."Democratic Senator Elizabeth Warren wrote in June to the CEO of annuity provider Empower Retirement, which oversees $1.8 trillion in assets for more than 19 million investors, asking how retirement savings placed in private investments could be safeguarded "given the sector's weak investor protections, its lack of transparency, expensive management fees, and unsubstantiated claims of high returns."

In a much-anticipated move, the BoE cut its Bank Rate by 25 basis points to 4.00% early Thursday morning. Five of nine Monetary Policy Committee members voted in favor of the cut, with the other four voting to leave the rate unchanged.The central bank said that it had room to cut rates as inflation has continued to fall.

“There has been substantial disinflation over the past two and a half years, following previous external shocks, supported by the restrictive stance of monetary policy,” the BoE said in its statement. “That progress has allowed for reductions in Bank Rate over the past year. The Committee remains focused on squeezing out any existing or emerging persistent inflationary pressures, to return inflation sustainably to its 2% target in the medium term.”Looking ahead, the BoE said that it expects to cut rates further in 2025, but it will proceed with caution.

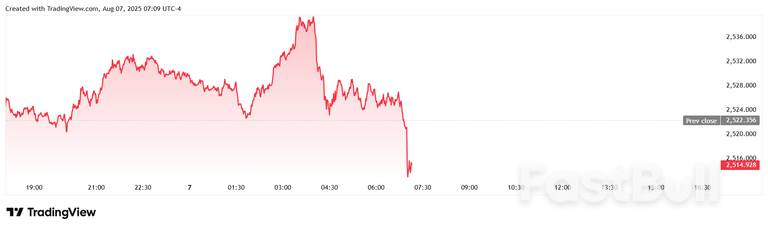

“A gradual and careful approach to the further withdrawal of monetary policy restraint remains appropriate,” the statement said. “The restrictiveness of monetary policy has fallen as Bank Rate has been reduced. The timing and pace of future reductions in the restrictiveness of policy will depend on the extent to which underlying disinflationary pressures continue to ease. Monetary policy is not on a pre-set path, and the Committee will remain responsive to the accumulation of evidence.”Gold sold off against the British pound following the rate cut and signal of further easing. XAU/GBP last traded at £2,514.67 an ounce for a loss of 0.30% on the day.

Key Takeaways:

President Trump has nominated pro-Bitcoin advocate Stephen Miran to the Federal Reserve Board, sparking discussions across U.S. economic and financial sectors.

Miran's nomination signals potential shifts in Federal Reserve policies towards lower interest rates, influencing cryptocurrency markets by enhancing liquidity and impacting the value of assets like Bitcoin and Ethereum.

President Trump has nominated Stephen Miran to the Federal Reserve Board, a decision generating discourse among financial experts. Miran, a known proponent of cryptocurrency, brings an expectation for pro-growth policy shifts at the institution.

Stephen Miran is involved, taking actions that lean towards delivering a pro-growth economic agenda through adjusted monetary conditions. His nomination implies a shift at the Federal Reserve, focusing on reducing regulations and fostering lower interest rates.

The nomination impacts expectations in financial markets with potential adjustments towards lower interest rates.

Financial implications involve potentially looser monetary conditions, fostering borrowing and investing activity. Politically, this move suggests a more market-oriented Federal Reserve approach, aligning with Miran's historical economic positions during prior administration roles.

Eyes are on how financial markets react, especially concerning risk assets.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up