Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

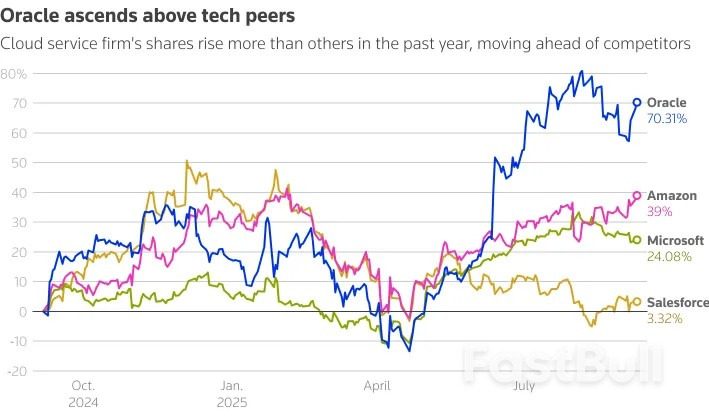

U.S. futures edge higher before CPI data; Fed policy outlook in focus. ECB expected to hold rates. Oracle’s surge lifts markets. Adobe earnings awaited. Oil and gold ease on demand concerns, inflation watch.

U.S. inflation for August came in hotter than expected, though likely not enough to derail the Federal Reserve from cutting interest rates next week.

The Consumer Price Index (CPI) rose 0.4% last month versus expectations for 0.3% and 0.2% in July. On a year-over-year basis, CPI was higher by 2.9% versus a forecast 2.9% and 2.7% in July.

Core CPI, which excludes the volatile food and energy components, climbed 0.3% in August against forecasts for 0.3% and July's 0.3%. Year-over-year core CPI rose 3.1% compared with the 3.1% forecast and July’s 3.1%.

Bitcoin slipped about 0.5% from $114,300 to $113,700 in the immediate aftermath of the data.

Prior to the CPI data, markets were pricing in a 92% chance of a 25 basis point cut at the upcoming Fed meeting and an 8% chance of a 50 basis point cut, according to CME FedWatch. The report likely puts to rest any idea of a 50 basis point move, which had gained steam following last Friday's soft jobs report and Wednesday's weak PPI numbers.

The European Central Bank held interest rates steady on Thursday as economic uncertainty persists in the wake of U.S. Donald Trump's aggressive tariff agenda.

Ahead of the decision, markets had been pricing in an around 99% chance of the ECB's key deposit facility rate being left at 2% for the second consecutive time. The central bank last cut rates in June, bringing rates further down from last year's record high of 4%.

The ECB is grappling with global economic uncertainty, despite inflation in the euro zone hovering around the central bank's 2% target in recent months, and the EU striking a trade agreement with the U.S.

The transatlantic partners agreed to 15% blanket tariffs on EU exports to the U.S. in July, with further details about the framework emerging last month. It addressed some questions for key European sectors like pharmaceuticals.

However, questions remain as some issues — such as provisions for the wine and spirits sector — were left open. Concerns over further tariffs have also grown following Trump's threat of retaliations against the EU after it hit Alphabet's Google with a $3.45 billion antitrust fine.

Fears about the impact tariffs could have on economic growth remain. Growth in the euro zone has remained sluggish even as rates have come down, with the latest figures showing just 0.1% growth in the second quarter after a 0.6% expansion in the previous period.

While the interest rate decision itself was widely anticipated, Deutsche Bank economists last week noted that "the focus will be on the signals for the path that lies ahead for monetary policy."

Markets on Thursday are therefore expected to focus on ECB President Christine Lagarde's press conference and the latest projections for inflation and economic growth. The central bank last updated its economic forecasts in June.

Key points:

Saudi Aramco, the world's biggest oil company, raised $3 billion from a sale of Islamic bonds, a term sheet showed on Thursday, as investors appeared unperturbed by an Israeliattackon neighbouring Qatar this week.Aramco priced $1.5 billion in five-year Islamic bonds, or sukuk, at a profit rate of 4.125% and $1.5 billion in 10-year sukuk at a profit rate of 4.625%, the term sheet seen by Reuters showed.Solid demand helped Aramco tighten both tranches' spreads to U.S. Treasuries by 35 basis points from initial price guidance, the term sheet showed, signalling investors shrugged off Tuesday's attack on Qatar.

Final order books for both tranches topped $16.85 billion, a separate bank document seen by Reuters showed. Demand had peaked at over $20 billion, according to fixed income news service IFR."I don't see much reaction (from the attack on Qatar)," a Saudi-based investment banker said as the sale kicked off, requesting not to be named.Saudi Aramco did not immediately respond to a request for comment from Reuters on the transaction.Aramco's debt sale follows a surge in bond issuance from the Gulf region this month, including Saudi Arabia's $5.5 billion sukuk sale, driven by strong investor demand and heavy inflows into bond funds.

But it was also a test of investor appetite for regional deals a day after Israel attempted to kill the political leaders of Hamas with airstrikes on Qatar, escalating its military action in the Middle East.Reuters reported last week that Aramco, in which the Saudi government is the majority shareholder, could raise between $2 billion and $4 billion from the sukuk sale amid weaker oil prices. The debt will be used for general corporate purposes, the term sheet said.Al Rajhi Capital Company, Citi, Dubai Islamic Bank, First Abu Dhabi Bank, Goldman Sachs International, HSBC, JPMorgan, KFH Capital, and Standard Chartered Bank are mandated active bookrunners on the transaction.

Aramco has been seeking other avenues to raise funds. Last month, it signed an $11 billion lease and leaseback agreement involving its Jafurah gas processing facilities with a consortium led by Global Infrastructure Partners (GIP), part of BlackRock. The consortium is in talks to raise around $10 billion in debt to back the deal, Reuters reported on Wednesday.

Palestinians in the relatively unscathed Nasser area of Gaza City were having to decide whether to stay or go on Thursday after the Israeli military dropped leaflets warning that troops would take control of the western neighbourhood.

Israel has ordered the hundreds of thousands of people living in Gaza City to leave as it intensifies its all-outwaron the Palestinian militant group Hamas, but with little safety, space and food in the rest of Gaza, people face dire choices.

"It has been almost two years, with no rest, no settling down, not even sleep," said Abu Ahmed, a father, as he and his family prepared to flee the city in a truck pulled by a motorcycle, laden with some of their belongings.

"We can't sit with our children just to sit with them. Our life revolves around war," he said. "We have to go from this area to that area. We can't take it anymore, we are tired."

FATAL SEARCH FOR FOOD

Israeli forces killed 18 people across the territory on Thursday, according to medics and local health authorities, including 11 in strikes on various parts of Gaza City, five in a strike on a single location in Beach refugee camp, and two who were searching for food near Rafah in the south.

Israeli ground troops had operated in parts of the Nasser area at the start of the war in October 2023, and the leaflets dropped late on Wednesday left residents fearful that tanks would soon advance to occupy the entire neighborhood.

In the past week, Israeli forces have been operating in three Gaza City neighborhoods further east - Shejaia, Zeitoun, and Tuffah - and sent tanks briefly into Sheikh Radwan, which is adjacent to Nasser. It said last Thursday it controlled 40% of the city.

On Wednesday, the Israeli military said it struck 360 targets in Gaza in what it said was an escalation of strikes that targeted "terrorist infrastructure, cameras, reconnaissance operations rooms, sniper positions, anti-tank missile launch sites, and command and control complexes".

It added that in the coming days, it would intensify attacks in a focused manner to strike Hamas infrastructure, "disrupting its operational readiness, and reducing the threat to our forces in preparation for the next phases of the operation".

Gaza City families continued to stream out of their homes in areas targeted by Israeli aerial and ground operations, heading either westward towards the centre of the city and along the coast, or south towards other parts of the strip.

But some were either unwilling or unable to leave.

"We don't have enough money, enough to flee. We don't have any means to go south like they say," said Ahmed Al-Dayeh, who was attending the funeral of one of the people killed in Thursday's strikes, who was his friend.

The war was triggered by Hamas-led attacks launched from Gaza on southern Israel on October 7, 2023, in which 1,200 people, mostly civilians, were killed, and 251 taken hostage, according to Israel.

Israel's military assault on Gaza has killed over 64,000 people, also mostly civilians, according to local health authorities, caused a hunger crisis and wider humanitarian disaster, and reduced much of the enclave to rubble.

Seven more Palestinians, including a child, have died of malnutrition and starvation in Gaza in the past 24 hours, the territory's health ministry said on Thursday, raising the number deaths from such causes to at least 411, including 142 children.

Israel says it is taking steps to prevent food shortages in Gaza, letting hundreds of trucks of supplies into the enclave though international agencies say far more is needed.

The status of negotiations towards a ceasefire in Gaza that were being hosted and co-mediated by Qatar has been uncertain since Israel attempted to kill the political leaders of Hamas in an airstrike on the Qatari capital Doha on Tuesday.

The airstrike took place shortly after Hamas claimed responsibility for a shooting on Monday that killed six people at a bus stop on the outskirts of Jerusalem.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up