Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Investors face a monumentally busy week ahead that includes rates decisions by the big G7 central banks, as well as a packed earnings calendar will see reports from five of the Mag-7. The Trump-Xi summit rounds off the week.

As noted earlier, investors face a monumentally important and extremely busy week ahead that includes rates decisions by four of the G7 central banks, with the Fed and BoC on Wednesday followed by the BoJ and ECB on Thursday. A packed earnings calendar will see reports from five of the Mag-7 (Microsoft, Alphabet, Meta, Apple and Amazon), together representing a quarter of the S&P 500 market cap. But ahead of all that, markets are in a buoyant mood this morning as US and China officials indicated that they have largely aligned a deal to ease trade tensions ahead of the Trump-Xi meeting this Thursday.

Starting with the US-China news, China's Ministry of Commerce said that the sides reached an initial consensus on a range of issues including an extension of the tariff truce, fentanyl, agricultural trade, export controls and shipping levies. In turn, US Treasury Secretary Bessent suggested that China would defer its new rare-earth export controls for one year and make "substantial" purchases of US soybeans, while the US threat of 100% tariffs on China was "effectively off the table". Bessent signaled that the agreed "framework" should allow Presidents Trump and Xi to have "a very productive meeting" when they meet on Thursday on the sidelines of the APEC summit. The details from that meeting should give a clearer sense whether this represents a genuine stabilisation in US-China trade relations or only a return to the uneasy trade truce in place before the rhetoric escalated earlier this month. Any reduction of the 20% fentanyl tariffs by the US will be one key barometer to watch.

In other weekend trade news, Trump signed trade framework pacts with Malaysia, Thailand, Vietnam and Cambodia. The countries will allow preferential access for US goods in return for tariff exemptions on some of their exports to the US, though many of exact details are still to be finalised. By contrast, Trump announced a 10% additional tariff on Canada amid a spat over an anti-tariff ad released by the government of Ontario. It's not clear whether USMCA-compliant goods would remain exempt from the extra 10% levy, which would mitigate much of its impact, but it's a reminder that tariffs remain a go-to policy tool for the US administration even if peak trade uncertainty is behind us.

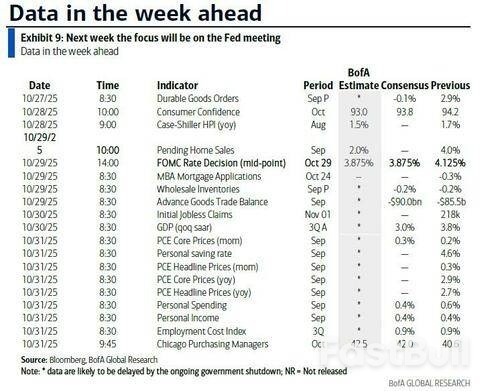

Looking to the week ahead, a second consecutive 25bps Fed cut looks locked in for Wednesday's FOMC meeting, with markets pricing 49bps of cuts across the next two meetings. With a dearth of data and a still-divided FOMC, economists think Chair Powell is unlikely to provide clear signals on the policy path ahead, focusing more on topics including balance sheet policy and financial stability. Meanwhile, as we first discussed here first, the emerging baseline is that the Fed will this week announce an end to QT in response to the recent tightening in funding markets.

In Europe, the ECB is widely expected to keep the deposit rate steady at 2% for a third consecutive meeting. DB economists think ECB President Lagarde will again describe policy as "in a good place" and will be watching whether she maintains the net hawkish tone that she struck in July and September (see their preview here). The Bank of Japan (Thursday) is expected to maintain its current policy stance (see preview here), while the Bank of Canada is likely to deliver its own 25bp rate cut on Wednesday.

The Q3 earnings season will reach its apex this week with key reports due from Microsoft, Alphabet and Meta on Wednesday as well as Apple and Amazon on Thursday. The five biggest companies in the world after Nvidia now make up $15tn in total market capitalization or 25% of the S&P 500. The full list of key reports is in the week ahead calendar at the end as usual.

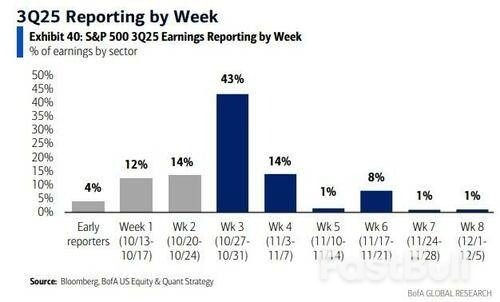

Overall, some 43% of the S&P500 by market will report this week.

On the data front, in the US the Conference Board's October consumer confidence readings (Tuesday) are likely to be the main indicator of note amid the government shutdown. In the euro area, Germany's ifo survey today will receive extra attention after last Friday's jump in the PMIs, the ECB's quarterly Bank Lending Survey (Tuesday) will precede its rates decision, and we'll get the October inflation readings for Germany and Spain on Thursday, followed by France, Italy and the Eurozone on Friday. In Asia, we have the October PMIs in China (Friday) as well as September retail sales, industrial production and the Tokyo CPI for October in Japan (Thursday).

Monday October 27

Tuesday October 28

Wednesday October 29

Thursday October 30

Friday October 31

Finally, looking at just the US, several key data releases will almost certainly be postponed this week because of the government shutdown, including the durable goods report scheduled for release on Monday, the advance goods trade balance scheduled on Wednesday, the Q3 advance GDP report scheduled on Thursday, and the core PCE inflation scheduled on Friday. The Department of Labor will also postpone the official release of the jobless claims report if the government shutdown continues through Thursday, but preliminary state-level claims data will likely be available. There are no speaking engagements by Fed officials this week, reflecting the FOMC's blackout period.

Monday, October 27

Tuesday, October 28

Wednesday, October 29

Thursday, October 30

Friday, October 31

Early results in Argentina's legislative elections on Sunday showed a victory for President Javier Milei as voters strongly backed his free-market reforms and deep austerity measures, providing a strong boost for the libertarian leader to continue his economic overhaul.The president's party, La Libertad Avanza, took 41.5% of the vote in Buenos Aires province compared with 40.8% for the Peronist coalition, according to official results. The province has long been a political stronghold for the Peronists and the election marked a dramatic political shift.

COMMENTS:

"This evening's unexpectedly strong performance for Milei's La Libertad Avanza should see the peso rally when spot markets reopen and smooth the way for more comprehensive economic reforms in the months ahead. U.S. Treasury Secretary Scott Bessent's bet on Argentina could look a little less terrible by tomorrow morning."

"Milei's victory should insulate him against veto overrides and impeachment processes for now, but plunging approval ratings mean he could face difficulty in finding coalition partners to pass some of the most controversial planks of his agenda. Structural contradictions in the (Argentine) economy will continue to frustrate peso bulls for a long time to come."

"The scale of Milei's victory ranks at the most optimistic end of pre-election expectations. His party now holds the political capital needed to accelerate structural reforms. Milei is now able to move forward with an ambitious deregulation agenda, pursue labor, tax, and potentially social security reforms in Congress, and implement changes to Argentina's FX regime.""From a financial markets perspective, this electoral outcome was far from priced in. Ahead of the vote, Argentina's "country risk" - the spread its U.S. dollar sovereign bonds pay over U.S. Treasuries - was at distressed levels, as investors were extrapolating Milei's weak performance in September's Buenos Aires province election. With this result, Argentine risk assets should now benefit from greater political stability, a renewed push for pro-market reforms, and robust support from the U.S."

"It was a surprisingly strong endorsement of Milei's policies. It's reasonable to expect that we could see an 'everything rally' given the resolution of the uncertainty. I'm expecting to see a return of the price levels on bonds to the pre-September levels if not better.""The currency is still overvalued, but this result could encourage policymakers to continue to move the trading band to allow the currency to depreciate.""This election result keeps the country in the 'nice' column of President Trump's 'naughty and nice list.' The bulls can charge ahead."

"Results appear to be well better for Milei than expected ... still hard choices lie ahead.""Alongside U.S.-China seemingly moving away from the brink, and trade deals or frameworks with four east Asian countries, risk-on sentiment has been fanned."

"The result was impressive, and hugely significant for Milei's pro-market project.""Up until now, Milei had mostly governed by executive order. That gave investors little reason to believe his policies would not be quickly reversed by a Peronist down the road.""In recent weeks, the Congress was challenging Milei's fiscal adjustment.""Now, Milei has a shot at tackling the deep structural dysfunction that long clipped Argentina's wings, including its tax and pension systems and labor code.""It could still be a hard slog, unless the economy turns around quickly. But at least he'll have a chance."

Global tensions are escalating over rare earth minerals after China applied severe export controls on critical minerals required to manufacture almost everything - from cars to weapons. The move has also sparked concerns about the global supply chain.

Strategic meetings will be held between European Union officials and Chinese representatives, starting with a videoconference Monday, to be followed by a meeting in Brussels the following day. Meanwhile, US President Donald Trump will meet his Chinese counterpart Xi Jinping on Thursday in South Korea, with financial markets attentive to whether the world's two largest economic powers can bury the hatchet in their trade war.

At the heart of the dispute is China's 9 October decision to restrict exports of rare earth elements. While these controls were mostly a response to US tariffs initially, the EU has become collateral damage in the dispute and is considering ways to respond.

Tensions first emerged between the US and China after Donald Trump returned to the White House and carried through an aggressive tariff policy - which the administration argues is needed to narrow a growing trade deficit - on allies and rivals alike.

On April 2, 2025 — coinciding with what Trump defined as American's "Liberation Day" — the US announced a 34% tariff on Chinese goods imported into the country, which, added to the existing 20%, brought total duties to 54%.

The trade war escalated after China responded with counter-tariffs, which surpassed the 100% threshold making trade between the two practically impossible. Beyond the tariffs, in order to hit, China looked to weaponize its monopoly on rare earth elements, imposing additional export restrictions on 4 April, which have since remained.

Rare earths are a group of 17 elements used across the defence, electric vehicle, energy and electronics industries. The world, including the EU, is heavily dependent on China for them, as the country controls 60% of global production and 90% of refining, according to the International Energy Agency (IEA).

After a short truce, the dispute flared up again in September, and on 9 October 2025, China decided to extend its control over rare earth elements from 7 to 12. The announcement was seen as China building leverage over the United States. The meeting between the two sides this week is crucial in dictating the path forward.

Meanwhile, the EU is caught between the two. While these restrictions aimed mostly at the US, it has also impacted the European industry. The controls take the form of licenses that are difficult to obtain, with European companies bearing the brunt, as EU Trade Commissioner Maroš Šefčovič has repeatedly pointed out.

In a speech over the weekend, Commission President Ursula von der Leyen, said the Union is prepared to use all the tools at its disposal to combat what some European leaders, including French President Emmanuel Macron, have described as economic coercion from China.

The remarks from the Commission President alluded to what is known as the anti-coercion instrument - designed with China in mind but never used. The ACI, adopted in 2023, would allow the EU hit back at a third country by imposing tariffs or even restricting access to public procurement, licenses, or intellectual property rights.

"In the short term, we are focusing on finding solutions with our Chinese counterparts," Commission president Ursula von der Leyen said on Saturday, warning however: "But we are ready to use all of the instruments in our toolbox to respond if needed."

European Council President António Costa met on Monday with Chinese Premier Li Qiang on the sidelines of the ASEAN Summit in Kuala Lumpur.

"I shared my strong concern about China's expanding export controls on critical raw materials and related goods and technologies," Costa said after the meeting, adding: "I urged him to restore as soon as possible fluid, reliable and predictable supply chains."

Yet, tensions persist.

A planned meeting between Šefčovič and his Chinese counterpart Wang Wentao was canceled and replaced by high-level talks between Chinese and European experts, a commission's spokesperson has confirmed. A video conference took place Monday and Chinese officials are set to arrive in Brussels for a meeting Thursday.

While Brussels insists it wants to achieve a constructive solution without escalating, the Commission is pursuing a "de-risking" strategy to reduce its dependence on Chinese minerals. In addition, Germany and France have also suggested they would support stronger trade measures if a comprehensive solution cannot be found.

On Saturday, Von der Leyen announced a new plan - RESourceEU - exploring joint purchasing and stockpiling of rare earth, as well as "strategic" projects for the production and processing of critical raw materials here in Europe.

The EU hopes also to diversify its suppliers across the globe.

"We will speed up work on critical raw materials partnerships with countries like Ukraine and Australia, Canada, Kazakhstan, Uzbekistan, Chile or Greenland," von der Leyen said.

AUDUSD opened with a gap higher and hit two-week high in almost 1% advance in early Monday trading.

Fresh risk appetite dominated in the market at the start of the week, as growing optimism of US-China trade deal, fueled demand for riskier assets and inflated risk-sensitive Aussie dollar.

Softer US dollar on cooler than expected US inflation in September (report released on Friday) also contributes to fresh strength.

Monday's acceleration pressures significant resistance at 0.6560 (base of daily Ichimoku cloud, spanned between 0.6560 and 0.6600) where increased headwinds could be expected, as daily studies are mixed (north-heading 14-d momentum is still in the negative territory / stochastic is overbought against rising RSI that moved above 50 and MA's turning to bullish setup).

Bullish scenario requires penetration of daily cloud and rise above nearby 0.6573 Fibo barrier (50% retracement of 0.6706/0.6440) to strengthen near-term structure and open way for attack at next key barriers at 0.6600 zone (cloud top / Fibo 61.8%).

Conversely, failure at cloud base may keep an action on hold, but biased higher while holding above 100DMA (0.6533).

Investors await Fed's rate decision, due on Wednesday (0.25% rate cut is widely expected, with focus on speech of Fed chief Powell, expected to provide signals of central bank's next steps, as well as release of US PCE Index on Friday, Fed's preferred inflation gauge).

Res: 0.6560; 0.6573; 0.6600; 0.6629.

Sup: 0.6542; 0.6533; 0.6500; 0.6472.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up