Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Japan’s economy contracted by an annualized 1.8% in Q3 2025, largely due to steep drops in exports triggered by new U.S. tariffs under President Trump, highlighting the vulnerability of its export-dependent economy....

ICE Brent settled almost 1.2% higher last week after a Friday rally following a Ukrainian attack on the Russian port of Novorossiysk. This led to a temporary suspension of oil exports from the port, which handles approximately 2.2m b/d of oil, including Kazakhstan crude from the Caspian Pipeline Consortium (CPC) terminal. However, reports that port operations resumed saw oil prices coming under pressure early today.

While the oil market is expected to remain in a large surplus through 2026, it is also facing growing supply risks. The scale and intensity of Ukrainian drone attacks on Russian energy infrastructure are picking up. In addition to Friday's attack on Novorossiysk, Ukraine claimed responsibility for a strike overnight on Rosneft's 170k b/d Novokuibyshevsk refinery.

Risks are also emerging elsewhere, with Iran seizing an oil tanker in the Gulf of Oman after it passed through the Strait of Hormuz. The Strait is a key choke point for the global oil market, with around 20m b/d passing through it.

The latest positioning data shows that speculators increased their net long in ICE Brent by 12,636 lots over the last reporting week to 164,867 lots as of last Tuesday. This was predominantly driven by short covering. It suggests that some participants are reluctant to be short at the moment amid supply risks related to uncertainty over sanctions.

Speculators also increased their net long in ICE gasoil over the last week amid growing concerns over tightness in the middle distillate market. Speculators purchased 11,797 lots, leaving them with a net long position of 98,286 lots. The impact of sanctions on Russian diesel exports, along with continued Ukrainian drone attacks on Russian refineries, means tightness concerns are unlikely to disappear anytime soon, particularly as we head deeper into winter.

LME copper and aluminium pared weekly gains as China's economy cooled more than expected in October. Record-low investment and slower industrial growth compounded already weak consumer demand. Copper saw a little more than a 1% weekly gain in London, extending a year-to-date rally of over 20%. This is being driven by supply disruptions and trade risks linked to potential US tariffs. Some relief emerged as Freeport-McMoRan resumed partial operations at Indonesia's Grasberg mine after a fatal accident halted output in September. Aluminium held modest weekly gains, supported by concerns that Chinese smelters are nearing government-imposed capacity limits, constraining supply. Primary aluminium output in October reached 3.8mt (+0.4% year-on-year), but fell 9% from September.

The latest data from the Shanghai Futures Exchange (SHFE) shows weekly inventories for base metals -- except copper -- rose over the reporting period. Copper stocks declined for the fourth consecutive week, down 5,628 tonnes to 109,407 tonnes as of Friday. Aluminium inventories increased by 1,564 tonnes to 114,899 tonnes after four weeks of declines. Lead stocks rose by 4,208 tonnes for a second straight week to 42,790 tonnes. Nickel and zinc inventories also climbed, reaching 40,573 tonnes (+9.1% week on week) and 100,892 tonnes (+0.7% WoW), respectively.

Recent reports suggest that India may resume wheat product exports (wheat flour and semolina) after more than three years of curbs. This reflects strong domestic supplies and an expected bumper harvest. The Ministry of Commerce and Industry is expected to initially permit 1mt of shipments. This follows India's recent approval of 1.5mt of sugar exports over the 2025/26 season.

The latest fortnightly report from the Brazilian Sugarcane and Bioenergy Industry Association (UNICA) shows sugarcane crushing in Central-South Brazil stood at 31.1mt in the second half of October, an increase of 14.3% YoY. Sugar output over this period rose 16.4% YoY to 2.1mt. Meanwhile, the sugar mix in CS Brazil over the fortnight was 46.02%. That's up slightly from 45.9% a year ago, but down from the previous fortnight. The cumulative cane crush so far this season still lags last year, down 2% to stand at 556mt, while cumulative sugar production totals 38.1mt, up 1.6% YoY.

Japan is set to send a senior diplomat to China in a bid to soothe tensions, public broadcaster NHK reported Monday, after China ratcheted up its response to Japanese Prime Minister Sanae Takaichi's comments over Taiwan.

Masaaki Kanai, a senior official at Japan's Ministry of Foreign Affairs, will be heading to China on Monday, the report said, in a move that follows China's issuance of an advisory against travel to Japan and a safety warning to students who live there.

Tensions between the neighbors have risen since Takaichi said this month that military force used in any Taiwan conflict could be considered a "survival-threatening situation," a classification that would provide a legal justification for Japan to support friendly countries that choose to respond.

Beijing has accused Takaichi of meddling in its internal affairs and demanded a retraction of the comment, but Tokyo has said its stance is unchanged from previous administrations.

In another sign of tension, four armed Chinese Coast Guard vessels sailed through disputed waters controlled by Japan on Sunday before leaving the area. Both countries lay claim to the cluster of uninhabited islands in the East China Sea called the Senkaku by Japan and the Diaoyu by China. The islands are administered by Japan. Chinese vessels are often spotted in or near the disputed waters.

China's Coast Guard said in a statement that it carried out a "rights enforcement patrol" through the waters and that it was a lawful operation.

Separately, an announcement of public sentiment among both Chinese and Japanese people was postponed at the request of the Chinese organizers, according to Japan's Genron NPO. The Japanese think tank releases regular public sentiment surveys in cooperation with China International Communications Group, a Chinese publishing group.

Last year's poll showed that about 90% of both Japanese and Chinese respondents did not think well of the other country.

Gold edged higher, halting two days of losses spurred by fading optimism the US Federal Reserve will cut interest rates next month.

Bullion was trading around $4,100 an ounce on Monday, having lost more than 2% in the previous session. Expectations for another rate cut were scaled back last week as Fed officials showed little conviction for reducing borrowing costs. Lower interest rates typically make non-yielding bullion more appealing to investors.

A faction of Fed policymakers has stepped up warnings that inflation progress could slow or stall, with some – including Kansas City Fed chief Jeff Schmid and Boston head Susan Collins – speaking out against another rate cut in December. Others appear undecided: Atlanta President Raphael Bostic said "we'll see" about a December reduction.

Precious metals, meanwhile, are finding support from the prospect of the Fed injecting further liquidity into the financial system and a pivot to looser monetary policy. Barclays Plc now expects the Fed's reserve management purchases of Treasury bills to begin in February, sooner than previously forecast.

Gold rose 0.3% to $4,097.22 an ounce as of 8:00 a.m. in Singapore. The Bloomberg Dollar Spot Index was little changed. Silver gained, while palladium and platinum were flat.

The Federal Reserve delivered mixed signals ahead of its December 2025 meeting, with officials Mester and Williams cautioning against rate cuts while Brainard remains open to easing measures.

This uncertainty has led to market turbulence, impacting cryptocurrencies significantly, with Bitcoin and Ethereum prices reacting to the potential shifts in U.S. monetary policy.

Loretta Mester and Lael Brainard have voiced opposing views regarding potential December interest rate cuts. Mester favors caution, citing the enduring strength of the labor market and inflation risks.

Brainard, however, supports the idea of a modest rate cut, pointing to data favoring a softer economic landing.

"The labor market remains resilient, but the risks of further rate cuts at this stage are not warranted unless we see a clear deterioration in employment data. Preemptive easing could undermine our inflation credibility." — Loretta Mester, President, Federal Reserve Bank of Cleveland

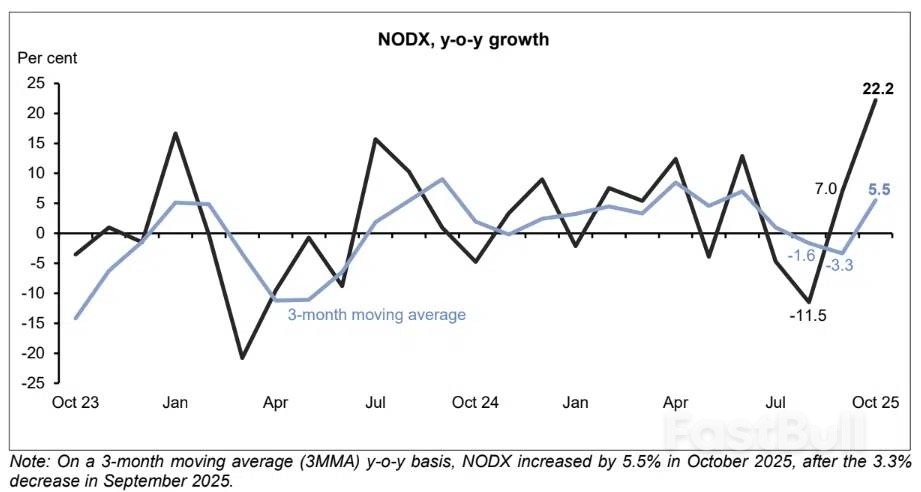

Singapore's key exports expanded 22.2 per cent in October, beating expectations as electronics and non-electronics grew.

Non-oil domestic exports (Nodx) expanded 22.2 per cent in October from a year ago, after a revised 7 per cent expansion in September, data from Enterprise Singapore (EnterpriseSG) on Nov 17 showed.

The reading was well above the 7.5 per cent rise forecast by economists in a Bloomberg poll.

Shipments of electronic products rose 33.2 per cent in October, extending the 30.4 per cent rise in the previous month.

The rise came on the back of an 77.7 per cent surge in personal computer exports. Shipments grew 31.4 per cent for disk media products and 40.9 per cent for integrated circuits (ICs), or chips.

Non-electronics shipments, of which pharmaceuticals are a big part, expanded 18.8 per cent year on year in October, following the 0.5 per cent increase in the previous month.

The growth was led by an 176.8 per cent jump in non-monetary gold exports, a 25.2 per cent increase for pharmaceuticals and a 16.1 per cent rise for specialised machinery.

Nodx to Taiwan expanded 61.5 per cent, extending the 31.9 per cent rise in September, due to a 119.8 per cent jump in specialised machinery exports, a 30.7 per cent rise in ICs and a 289.1 per cent jump in disk media products.

Those to Thailand expanded 91.1 per cent in October, extending the 23.9 per cent growth in the previous month, as non-monetary gold exports jumped 844.6 per cent, while shipments in ICs increased 73.9 per cent and bare printed circuit boards were up 71.3 per cent.

Nodx to Hong Kong expanded 66.9 per cent in October, from the 56.3 per cent expansion in the previous month, on the back of a 93.3 per cent growth in shipments of ICs, while specialised machinery exports jumped 848.1 per cent and those of non-monetary gold were up 68.9 per cent.

Key exports to the United States, Singapore's single largest export market, declined 12.5 per cent, while those to Japan dropped 0.1 per cent.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up