Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Japan's economy expanded an annualised 2.2% in the April-June period from the previous quarter, much faster than the preliminary reading, anchored by upward revision in consumption, government data showed on Monday.

Japan's economy expanded an annualised 2.2% in the April-June period from the previous quarter, much faster than the preliminary reading, anchored by upward revision in consumption, government data showed on Monday.

The revised gross domestic product (GDP) reading released by the Cabinet Office compared with economists' median forecast and the initial reading of 1.0% growth.

On a quarter-on-quarter basis, GDP grew 0.5%, compared with a median forecast and the initial estimate of a 0.3% rise.

While the figures show brisk growth in the world's fourth-largest economy, growing political uncertainty could complicate policymaking in the months ahead after Prime Minister Shigeru Ishiba resigned on Sunday.

The focus will now turn to July-September GDP figures to gauge how far U.S. tariffs have weighed on the economy.

Tokyo and Washington last week formalised a trade deal, implementing lower tariffs on Japanese automobile imports and other products that were announced in July, providing some relief to the country's export-heavy economy.

Private consumption, which accounts for more than half of the Japanese economy, inched up 0.4%, versus a 0.2% uptick in the preliminary reading.

The capital expenditure component of GDP, a barometer of private demand, rose 0.6% in the second quarter, revised down from 1.3% in the initial estimate. Economists had estimated a 1.2% rise.

External demand, or exports minus imports, contributed 0.3 percentage point to growth, in line with the preliminary reading. Domestic demand contributed 0.2 percentage point, reversing a 0.1 percentage point drag in the initial figure.

For much of the past two months, ever since the historic loss of Japan's LDP in July's parliamentary elections, we have mocked the highly unpopular Japanese PM Shigeru Ishiba, who was clinging to the post despite record disapproval and a clear shift in popular sentiment that had clearly stripped him of mandate to be Japan's leader.

A few hours ago, Ishiba finally decided to prove us wrong and announced he will step down - following weeks of calls for his departure - a decision that will set in motion a leadership race that may generate concerns for investors.

“While I feel there are still things I wish to do as premier, I have made the difficult decision to step down,” Ishiba said at a press conference in Tokyo on Sunday. “Having seen the US trade negotiations through, I felt that now is the right time to stand down and give way to my successor.”

“I felt that if I continued amid a vote on an early leadership race, it could have created an irreversible division within the party, which is certainly not my intention.” He will stay on as prime minister until his successor takes over.

Ishiba’s resignation brings to an end a tenure marked by humiliating election results that stripped the Liberal Democratic Party’s ruling coalition of its majorities in both chambers of parliament and left market participants unsure of Japan’s fiscal plans. His departure is likely to fuel uncertainty among investors over the coming weeks until a new leader is chosen. It will also likely spark debate among market participants whether his replacement will follow through with the trade deal that Japan reach with Trump.

As Bloomberg warns, the risk of further instability could weigh on the yen and longer-term bonds when trading opens Monday in Asia. Japan’s currency was one of the weakest performers among its Group of 10 peers last week, while yields on longer-term Japanese government debt reached fresh multi-decade highs.

“Prime Minister Ishiba was known for his strict stance on fiscal discipline,” said Katsutoshi Inadome, senior strategist at Sumitomo Mitsui Trust Asset Management, flagging the likelihood of upward pressure on super-long yields. “While it remains unclear who will become the next prime minister, it’s difficult to envision anyone with a fiscal discipline stance better than or even equivalent to his.”

Which, in a country best known for the short tenure of its prime minister, more easing to placate the masses is on deck, even if it means another surge in inflation, and even higher prices in gold and crypto as the local population protects what little is left of its purchasing power.

The LDP was set to hold a vote Monday if it should bring forward a leadership election by two years, but that had looked increasingly likely to turn into a vote of no confidence in the premier. That vote will now be canceled, and instead the LDP will hold a leadership race, Ishiba said.

Lawmakers jockeying to position themselves as the next premier will need at least 20 other members of parliament to support their candidacy in order to enter the race. Whoever emerges top in the party contest will then have to win a vote in parliament to become prime minister in a fractured Diet.

Potential candidates within the ruling party include Sanae Takaichi, 64, a former internal affairs minister who finished second to Ishiba in an LDP leadership race last year. If chosen, Takaichi would be Japan's first female prime minister.

A party veteran who has held a variety of roles, including economic security and internal affairs minister, she is known for conservative positions such as revising the pacifist postwar constitution; Takaichi is a regular visitor to the Yasukuni shrine to honor Japan's war dead, viewed by some Asian neighbors as a symbol of past militarism.

She is a fan of Abenomics economic policies and favors stimulus measures which means any hope for a rate hike by the "independent" Bank of Japan would be quietly put to pasture under her leadership (we leave the discussion of BOJ "independence" to an other time).

A member of Japan’s largest nationalist organisation Nippon Kaigi and known as a hard-line conservative, Takaichi opposes same-sex marriage and supports a requirement for couples to share a surname after marriage. She has also stated that a government gender equality plan could "destroy the social structure based on family units" has voiced opposition to proposals to change the law so that a woman could become the Emperor of Japan.

Takaichi supports imprisoning those who damage Japan's national flag, and is considered a China-hawk when it comes to foreign policy and supports revising article 9 of the Japanese constitution which prohibits Japan from entering armed conflict. She’s also a vocal critic of Chinese economic practices such as intellectual property theft and calls on Japan to lessen its economic dependence on China.

Most notably, she believes that immigration to Japan risks destabilizing Japanese society and argues that Japanese heritage must be protected. As such, should she replace Ishiba, she would become the latest hard-line conservative to take charge in blowback to the catastrophic policies unleashed by the liberal left in recent years.

Among other possible candidates, Takayuki Kobayashi, a former economic security minister, is on the right-wing of the party and would be a possible rival to Takaichi in garnering support from that section of lawmakers. Yoshimasa Hayashi, the current chief cabinet secretary, as well as Finance Minister Katsunobu Kato, might also show interest in succeeding Ishiba.

“If Ms. Takaichi is appointed, bond selling could intensify due to the risk of a credit rating downgrade,” Sumitomo Mitsui Trust’s Inadome said. In that scenario, “we could see a triple dip: falling bond prices, a weaker yen, and declining stock prices.”

A Koizumi or Hayashi win is more likely to return the yield curve to its previous shape, he added.

Traditionally, the LDP’s dominance in parliament all but assures that its leader will become prime minister. With no majority in either house, there’s only a slim chance the leader of the LDP could fail to clinch the premiership, though that decision is still some weeks away.

The next premier will have to navigate challenges ranging from global trade headwinds to simmering resentment at home over soaring costs of living. Ishiba had called for fresh cash handouts to support consumers, while opposition parties sought tax cuts or higher spending, proposals that have given investors cause for concern.

In the press conference held Sunday, Ishiba said that consumers and businesses will need more support and pressed the need to maintain momentum for wage hikes. He indicated that he essentially decided to step down following the July election setback, but saw a need to make more progress on the trade deal with the US first.

US President Donald Trump signed his trade agreement with Japan and put it into effect with an executive order on Thursday. Although current tariff rates will be lowered with the new order, Japan will still have to pay a maximum 15% tariff on its products, including exports of cars and auto parts.

Still, the signing of the deal leaves Ishiba with some kind of legacy to walk away with after a troubled year at the helm.

The yen fell broadly on Monday following news that Japanese Prime Minister Shigeru Ishiba had resigned, while the dollar was nursing losses after tumbling on a weak U.S. jobs report that cemented expectations for a Federal Reserve rate cut this month.Ishiba on Sunday announced his resignation, ushering in a potentially lengthy period of policy uncertainty at a shaky moment for the world's fourth-largest economy.

The yen slumped in response in early Asia trade on Monday, falling 0.7% against the dollar to 148.43.The Japanese currency similarly slid more than 0.5% against the euro and sterling to 173.77 and 200.15, respectively.Investors are focusing on the chance of Ishiba being replaced by an advocate of looser fiscal and monetary policy, such as Liberal Democratic Party (LDP) veteran Sanae Takaichi, who has criticised the Bank of Japan's interest rate hikes."The probability of an additional rate hike in September was never seen as high to begin with, and September is likely to be a wait-and-see," Hirofumi Suzuki, chief currency strategist at SMBC in Tokyo, said of the BOJ's next move.

"From October onward, however, outcomes will in part depend on the next prime minister, so the situation should remain live."Concerns over political uncertainty prompted a selloff in the yen and Japanese government bonds (JGBs) last week, sending the yield on the 30-year bond to a record high."With the LDP lacking a clear majority, investors will be cautious until a successor is confirmed, keeping volatility elevated across yen, bonds and equities," said Charu Chanana, chief investment strategist at Saxo."Near-term, that argues for a softer yen, higher JGB term-premium, and two-way equities until the successor profile is clear."

In other currencies, the dollar was recouping some of its heavy losses, helped in part by the yen's weakness, after falling sharply on Friday on data that showed further cracks in the U.S. labour market.The closely watched nonfarm payrolls report showed U.S. job growth weakened sharply in August and the unemployment rate increased to nearly a four-year high of 4.3%.Investors ramped up bets of an outsized 50-basis-point rate cut from the Fed later this month in the wake of the release and are now pricing in an 8% chance of such a move, as compared to none a week ago, according to the CME FedWatch tool.

Against the dollar, sterling fell 0.14% to $1.3488, having risen more than 0.5% on Friday. The euro was similarly down 0.13% at $1.1705, after hitting a more than one-month high on Friday.Focus for markets on Monday will also be on French Prime Minister Francois Bayrou's confidence vote, which he is expected to lose, plunging the euro zone's second-largest economy deeper into political crisis.

"Given the more elevated downside risks to the employment side of the mandate, we think a rate cut at the September meeting is all but assured. We continue to expect a 25bp cut at that meeting," said Barclays economists in a note."However, we change our Fed call by adding another 25bp cut in October, while leaving our December cut unchanged. In all, we now think the FOMC will proceed with three 25bp cuts this year, easing the policy stance in the face of the slowing labor market."U.S. Treasury Secretary Scott Bessent on Friday called for renewed scrutiny of the Fed, including its power to set interest rates, as the Trump administration intensifies its efforts to exert control over the central bank.

President Donald Trump is considering three finalists for Federal Reserve chair to replace Jerome Powell, whom the president has criticised all year for not cutting rates as he has demanded.Elsewhere, the Australian dollar eased 0.06% to $0.6551, while the New Zealand dollar was down 0.1% at $0.5886.

Imagine a digital currency that combines the unwavering reliability of traditional banking with the lightning-fast innovation of fintech. That’s precisely what South Korea is envisioning. A groundbreaking proposal is currently under consideration that could reshape the future of digital finance, specifically concerning won stablecoin issuance.

South Korea’s State Affairs Planning Committee is exploring a plan to grant the authority for a Korean won-pegged stablecoin to a unique consortium. This group would comprise both established banks and agile non-bank entities, as reported by News1. This approach isn’t just a whim; it’s a carefully considered strategy.

The committee strongly favors this consortium model for several compelling reasons:

Interestingly, the proposal also suggests a significant shift in regulatory oversight. Instead of the existing Financial Services Commission (FSC), the licensing authority for won stablecoin issuance would be granted by a new body: the Financial Stability Council.This new council is envisioned as the country’s economic and financial ‘control tower.’ Such a move indicates a desire for a more centralized and comprehensive approach to managing the financial implications of digital currencies, underscoring their growing importance to national economic stability.

This strategic direction for won stablecoin issuance holds immense promise, but like any significant financial innovation, it also presents challenges.

Potential Benefits:

Potential Hurdles:

The discussions surrounding won stablecoin issuance are still in their early stages, but the direction is clear: South Korea is serious about its place in the digital finance future. This move could set a precedent for other nations considering their own central bank digital currencies (CBDCs) or privately issued stablecoins.For businesses, this could mean new payment rails and opportunities for digital product development. For consumers, it promises more efficient and potentially cheaper ways to transact. It’s a fascinating development that bears close watching as South Korea aims to lead in the evolving digital currency landscape.

South Korea’s thoughtful approach to won stablecoin issuance, leveraging both traditional banking strength and fintech agility, is a strategic masterstroke. By aiming for a stable, innovative, and globally competitive digital currency, the nation is positioning itself at the forefront of the future of finance. This blend of stability and innovation is precisely what could make a Korean won-pegged stablecoin a formidable player in the global digital economy.

Frequently Asked Questions (FAQs)

Q1: What is a won-pegged stablecoin?A1: A won-pegged stablecoin is a type of cryptocurrency designed to maintain a stable value by being directly tied to the value of the South Korean won. This means one stablecoin would ideally always be worth one won.

Q2: Why is South Korea considering a consortium model for issuance?A2: The consortium model, involving both banks and fintech firms, aims to combine the stability and trust of traditional financial institutions with the innovation and technological expertise of fintech companies. This blend is crucial for a successful and widely adopted digital currency.

Q3: How would the new Financial Stability Council differ from the FSC?A3: The proposed Financial Stability Council would serve as a new, overarching economic and financial ‘control tower,’ potentially taking over stablecoin licensing from the existing Financial Services Commission (FSC). This suggests a more centralized and strategic regulatory approach to digital assets.

Q4: What are the main benefits of a South Korean stablecoin?A4: Key benefits include enhanced financial stability, fostering fintech innovation, boosting the global competitiveness of the Korean won, and expanding use cases for digital payments, leading to more efficient transactions.

Q5: What challenges might this initiative face?A5: Challenges could include developing complex regulatory frameworks, ensuring interoperability with existing financial systems, and successfully educating and encouraging public adoption of the new digital currency.

Oil prices climbed on Monday in early trade, trimming some of last week's losses, after OPEC+ agreed over the weekend to raise output at a slower pace from October on expectations of weaker global demand.

Brent crude gained 34 cents, or 0.5%, to $65.84 a barrel by 0047 GMT, while U.S. West Texas Intermediate crude rose 30 cents, or 0.5%, to $62.17 a barrel.

Both benchmarks fell more than 2% on Friday as a weak U.S. jobs report dimmed the outlook for energy demand. They lost more than 3% last week.

OPEC+, which includes the Organization of the Petroleum Exporting Countries plus Russia and other allies, agreed on Sunday to further raise oil production from October as its leader Saudi Arabia pushes to regain market share, while slowing the pace of increases compared with previous months.

OPEC+ has been increasing production since April after years of cuts to support the oil market, but the latest decision to further boost output came as a surprise amid a likely looming oil glut in the northern hemisphere winter months.

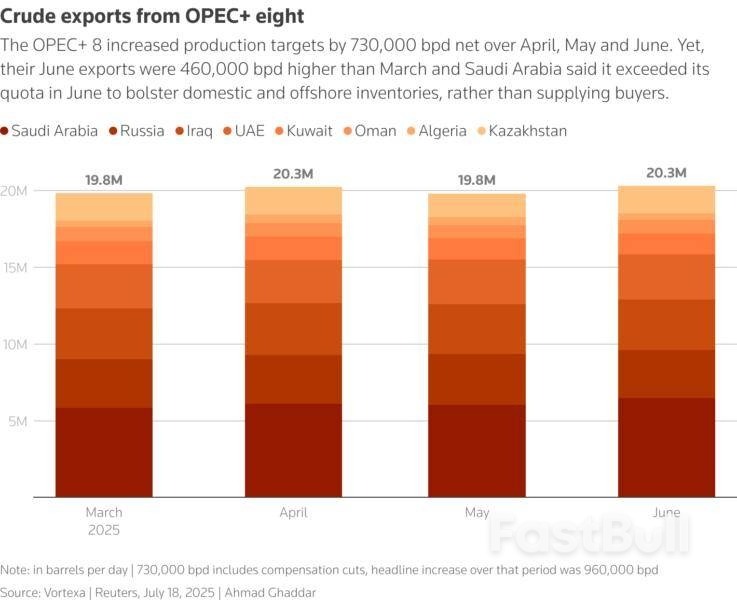

Eight members of OPEC+ will lift production from October by 137,000 barrels per day, far below the monthly increases of about 555,000 bpd for September and August and 411,000 bpd in July and June.

"The oil market rebounded slightly, supported by relief over OPEC+'s modest output hike and a technical bounce following last week's decline," said Toshitaka Tazawa, an analyst at Fujitomi Securities.

"Expectations of tighter supply from potential new U.S. sanctions on Russia are also lending support," he said, adding that downward pressure is likely to persist as OPEC+ continues to raise production and supplies ease.

Russia launched its largest air attack of the war on Ukraine, setting the main government building on fire in central Kyiv and killing at least four people, including an infant, Ukrainian officials said on Sunday.

U.S. President Donald Trump said on Sunday that individual European leaders would visit the United States on Monday and Tuesday to discuss how to resolve the Russia-Ukraine war.

Trump added that he was "not happy" about the status of the war, after reporters asked about the massive Russian air assault. But he again expressed confidence that the war would soon be settled.

The European Union is sticking to its plans to phase out Russian oil by 2028, the bloc's energy chief told Reuters on Friday, adding that he had not faced pressure from Washington to bring forward this deadline.

At this moment in the U.S. economy — when interest rates are higher than usual and inflation still above the Federal Reserve's 2% target — the jobs report is rather like an injury. You want it bad enough, like a gash, to elicit sympathy from others, but not so serious that it rends flesh and exposes bone.The August jobs report was more like the latter. New payrolls came in more than one-third below expectations. On the bright side, even though the unemployment rate rose to 4.3% from 4.2% the month prior, it was largely because of a 436,000 increase in the size of the labor force — meaning it's not so much layoffs but more job seekers that caused the increase in unemployment.

That said, the wound to the U.S. economy was severe enough that traders expect the Federal Reserve to administer some tender loving care soon. According to the CME FedWatch tool, the futures market, as of Sunday night stateside, has priced in an 8% chance of a supersized 50 basis points rate cut at the Federal Reserve's September meeting. The probability was 0% a month ago. And a 25 basis points reduction is all but certain.The prospect of such soothing by the central bank helped investors bear the pain of the jobs report stoically. Major U.S. indexes fell Friday, but only moderately. The Nasdaq Composite closed around the flatline, supported by strong bones in the tech sector.If the Fed cuts rates later this month — a move it'll almost certainly make — it'll be a stitch, just in time, to save investors more than a dime.

Dismal U.S. jobs report for August. Nonfarm payrolls in the U.S. rose by 22,000 for the month, below the 75,000 expected by a Dow Jones survey. While job numbers for July were revised up, June's figures were revised down to result in a net loss of 13,000 jobs.Massive refunds if tariffs ruled illegal, Bessent warns. In a Sunday interview, U.S. Treasury Secretary Scott Bessent said if the Supreme Court strikes tariffs down, "we would have to give a refund on about half the tariffs, which would be terrible for the Treasury."Trump threatens to launch a trade probe to nullify EU fines. The U.S. president issued the threat hours after the European Union slapped a $3.45 billion penalty on Google for the company's anti-competitive practices.

U.S. markets ended the week in the green. However, all three major indexes fell Friday after touching intraday highs earlier in the session. Likewise, the pan-European Stoxx 600 gave up earlier gains and ended the day 0.2% lower.Inflation data on the radar this week. After August's jobs report, the U.S. producer and consumer price indexes are in focus. They will give an indication on how the Fed can balance its twin mandates of maximum employment and stable inflation.

And finally...

Italy — a perennial favorite of the rich and famous — is attracting a new wave of ultra-wealthy arrivals looking to take advantage of its investor friendly environment, thriving real estate market and low tax regime.As many other countries clamp down on the super-rich, Italy has been bucking the trend; its accommodative flat-tax regime has enticed hordes of big spenders drawn to luxury living and Milan's increasingly bustling business scene.

OPEC+’s surprise announcement that it will further accelerate oil production may seem like a threat to an already oversupplied market, but the actual market impact is likely to be limited.

The same cannot be said of the political benefits for the group's leader Saudi Arabia, which is seeking to reassert group discipline while expanding its market share and solidifying its relationship with the United States.

The Organization of the Petroleum Exporting Countries plus Russia and other allies, the group collectively known as OPEC+, agreed on Sunday to begin unwinding 1.65 million barrels per day of production cuts that were set to remain in place until the end of 2026.

The group of eight core OPEC+ members said it will raise its oil output target by 137,000 bpd in October.

At this pace, it will take the group 12 months to remove the full tranche of 1.65 million bpd of cuts, leaving the alliance with another 2 million bpd of production cuts still in place until the end of 2026. OPEC+ said it retained options to accelerate, pause or reverse hikes at future meetings. It scheduled the next meeting of the eight countries for October 5.

The group had already raised production quotas by about 2.5 million bpd, around 2.4% of global demand, between April and September. This put downward pressure on oil prices, which have declined by about 18% from their 2025 high in mid-January to $67 a barrel.

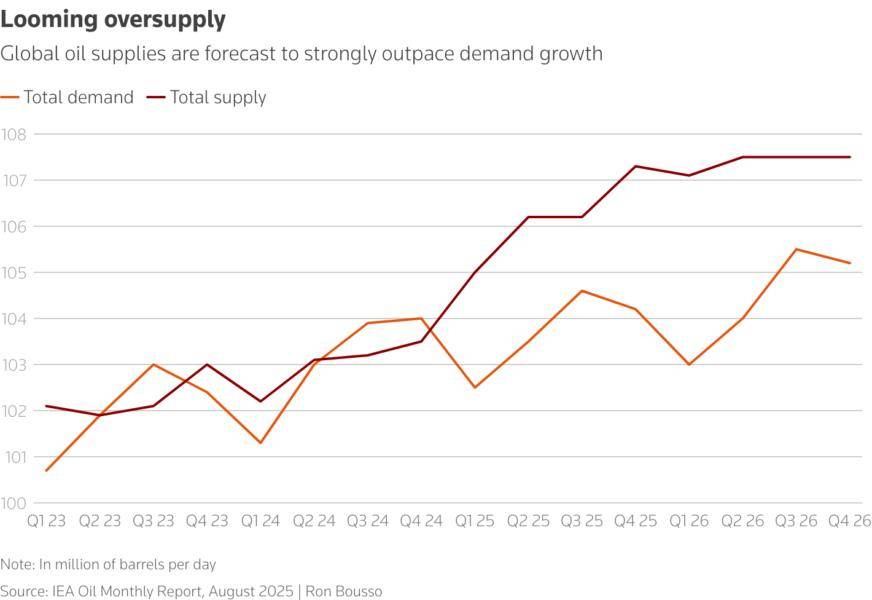

The new additions seemingly come at the worst possible moment for the market, which is widely expected to have already entered an extended period of oversupply due to production increases in Argentina, Canada, the United States and elsewhere.

The International Energy Agency previously forecast that supply would outstrip demand by an average of 3 million bpd between October 2025 and the end of 2026 – and that was before Sunday’s announcement.

In theory, adding more barrels in this environment should weigh heavily on oil prices.

In practice, however, the impact may be muted.

An analysis of OPEC+ production suggests the actual additions are likely to be far more modest than advertised, as most members are already producing at or near full capacity.

In March 2025, just before the group began unwinding its first layer of cuts, joint production reached 31.83 million bpd, only 1 million bpd below its 32.88 million bpd production target for September, according to IEA figures.

That was largely because several OPEC+ members, notably Kazakhstan, the United Arab Emirates and Iraq, had already far exceeded their OPEC+ production quotas. In July, that trio jointly outpaced their September quotas by some 500,000 bpd.

The new quotas are therefore not actually going to add many additional barrels to the market because, for the most part, these guidelines are simply catching up with the reality on the ground.

For Saudi Arabia, however, the changes are significant. The Kingdom’s output is set to increase from 9.07 million bpd in March to 9.98 million in September. This will leave it with around 2.2 million bpd of spare capacity, according to IEA estimates, far more than any other OPEC+ member.

Under the tranche of cuts that are now being unwound, Saudi Arabia and Russia each reduced output by roughly 500,000 bpd. But Russia has little, if any, spare capacity, given that strict Western sanctions have limited investments in new production.

Saudi Arabia therefore stands to benefit the most from this rollback, with Riyadh well positioned to capture more market share, in particular from U.S. shale firms that will need to slow down drilling activity in the face of lower oil prices.

Saudi Energy Minister Prince Abdulaziz bin Salman, the architect of the original OPEC+ supply cuts, now appears to be firmly back in the driver's seat after spending years battling the group’s breakdown in internal discipline.

And, importantly, this new move gives Riyadh the ability to garner valuable political capital, as U.S. President Donald Trump has urged OPEC to lower oil prices. The Saudis can now show that they are trying to do just that.

The Saudis therefore appear willing to withstand an environment of low oil prices for an extended period of time both to make long-term gains in market share and to support its relationship with its key ally.

Indeed, Saudi Crown Prince Mohammed bin Salman is reportedly scheduled to visit Washington, D.C., in November. This follows Trump's visit to the Gulf nation in May when Riyadh pledged to invest $600 billion in the United States while Washington agreed to sell Saudi Arabia an arms package worth $142 billion. It's safe to say that supply cuts and crude prices will be on the agenda for the new meeting in November.

OPEC+’s new production targets are therefore unlikely to significantly disrupt the oil market – and thus probably will not massively shift prices – but they could still have long-term consequences because of the geopolitical backdrop.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up