Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Japanese Prime Minister Sanae Takaichi has ordered a fresh package of economic measures aimed at easing the burden of inflation on households and companies.

Japanese Prime Minister Sanae Takaichi has ordered a fresh package of economic measures aimed at easing the burden of inflation on households and companies.

Takaichi, who became Japan’s first female premier on Tuesday, did not specify the size of the package or indicate whether additional bond issuance would be needed to finance it. A supplementary budget will be compiled to finance the measures, according to an order from Takaichi to compile the package.

Details will follow, but the order suggests that the package will include subsidies for electricity and gas charges during the winter, along with regional grants to ease price pressures. It also encourages small and medium-sized businesses to raise wages and increase capital investment.

Cash handouts, which failed to gain public support during the July national election campaign, are not mentioned in the order.

Takaichi has identified rising living costs as a top economic priority, reflecting public concern over inflation. The order suggests she’ll favor targeted steps over a large-scale spending plan.

While Takaichi is known for her past support of aggressive monetary and fiscal stimulus, she has tempered her stance more recently, pledging instead to pursue expansionary but responsible fiscal policies. She faces the challenge of supporting the economy while addressing concerns about Japan’s massive public debt, which has contributed to rising long-term bond yields.

Consumer inflation has remained at or above the Bank of Japan’s 2% target for more than three years. Meanwhile, the central bank has been raising interest rates gradually, pushing up borrowing costs for the government. On Tuesday, Takaichi said she hopes inflation will become demand-driven as wages rise, rather than the result of cost-push factors.

Two other key pillars of the upcoming package are strengthening economic security and defense. The order calls for investment in strategic sectors, including artificial intelligence and semiconductors, as well as enhancing supply chains for critical goods.

The package is also expected to include some responses to US tariff measures, including steps to implement an investment scheme announced earlier with Washington. Japan has pledged to invest $550 billion in key US sectors in exchange for reduced tariffs as part of that deal.

The concept of a price battleground in Bitcoin markets refers to a critical price range where the forces of buying and selling pressure are in a fierce and decisive contest. This is where the outcome is expected to determine BTC’s overall direction and confirm a continuation of a bull market or bear market correction.

In an X post, an institutional-grade reporter, Bitcoin Vector, has highlighted that BTC has entered its decisive battleground between $110,000 and $115,000, which could determine the trajectory of the entire cycle. In the past week, spot demand, which is the engine of sustained rallies, was notably weak and capped by the escalating US-China trade tensions.As those tensions eased, that spot demand showed signs of returning, allowing BTC to claw its way back above the critical $110,000 level. Despite recovery back into the battleground, momentum remains negative and flat. Without sustained inflow and spot demand, the bullish structure could fade fast, leaving BTC exposed to another pullback.

Technically, BTC price is moving back above the 4-hour 50-period Simple Moving Average (SMA). Each time, Bitcoin successfully retests this level as support, the price continues to expand higher. “I think the worst is behind us,” Sykodelic noted.

The current Bitcoin market is in a supply tug-of-war between two powerful forces. According to the ambassador of MGBX_EN, BitBull, long-term holders (LTHs) have been constantly offloading their coins, while institutions are aggressively absorbing the supply through Spot ETFs and Digital Asset Treasuries (DATs).Meanwhile, the treasury holdings have quietly surpassed $120 billion, with BTC still dominating the stack. Spot ETFs alone have absorbed tens of thousands of coins this quarter, proving that institutional demand remains strong. However, LTHs are still selling faster than ETFs, and DATs can absorb. Historically, when this kind of accelerated LTH distribution occurs, BTC tends to lose short-term momentum.

This is not a bearish setup, but it does imply that the upside remains temporarily capped until the selling pressure fades. Thus, institutions are buying the strength, not the bottoms. Ultimately, the next major breakout hinges on when long-term holders stop distributing and return to accumulation mode.

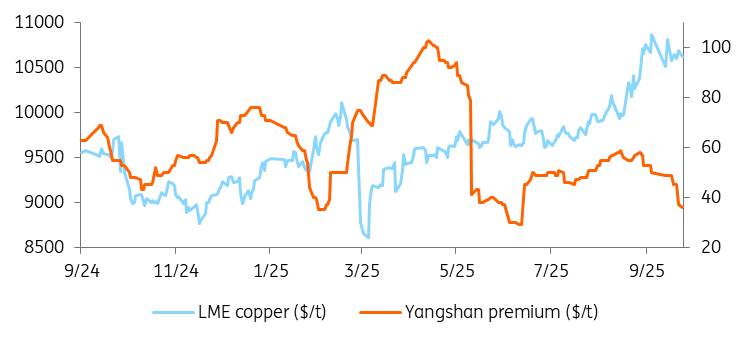

The mood on metals has been positive in recent weeks, with copper trading near all-time highs and other metals also rising. A supportive macro backdrop, falling US dollar, rate cuts and low inventories have lifted metals prices.Copper is the standout performer in the base metals complex. Prices surged more than 20% year-to-date despite concerns that trade frictions would undermine global growth. The surge in copper prices comes as the US Federal Reserve has begun its monetary easing cycle. Supply disruptions are stacking up, most recently Freeport’s declaration of force majeure at its giant Grasberg mine in Indonesia. Grasberg is the world’s second-largest copper mine, contributing around 4% of global production. The disruption adds to the already high number of supply disruptions this year.

Macro uncertainty, particularly around US-China trade negotiations and its implications on copper demand, continues to cloud the near-term demand outlook. Yet the long-term bullish narrative remains intact for the base metal, supported by structural demand from grid, electrification and renewable infrastructure and, increasingly, from data centres and AI infrastructure.For now, China is showing some signs of price sensitivity, with mainland smelters planning to step up shipments abroad, Bloomberg recently reported, as higher prices deter domestic buyers. The Yangshan premium, paid by traders for imported metal and a key indicator of physical demand in China, has slumped more than 20% since late September.

While near-term demand indicators remain mixed, supply disruptions will keep a floor under prices around the $10,000/t level. However, to push that rally further, copper will also need to see strong demand growth, especially from China, the biggest consumer. But in the near term, prices are likely to remain range-bound.

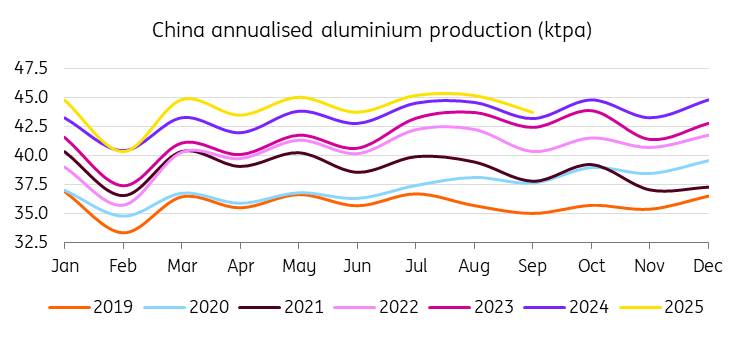

China’s aluminium output is close to its self-imposed 45 million tonne capacity cap. The global aluminium market looks largely balanced for next year, assuming the cap holds. This is also weighing on exports, keeping markets ex-China tight.China’s aluminium capacity cap was introduced in 2017 to curb oversupply and reduce emissions. For now, we assume the cap will hold. However, there are discussions about whether renewable power smelters could be exempt from the cap, as a growing number of Chinese smelters switch to renewable power.

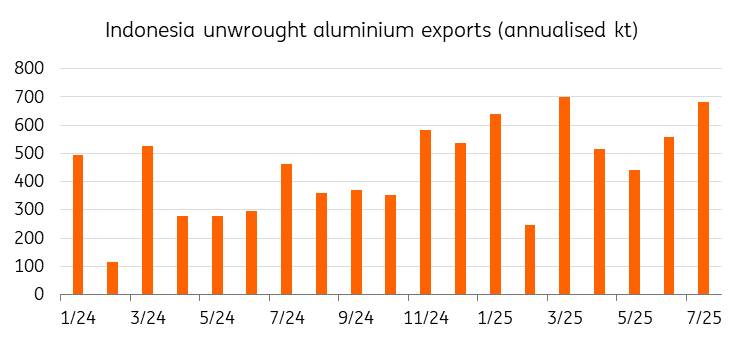

Outside of China, there have been few recent European or US restart announcements, largely due to difficulties in securing long-term power contracts at viable prices. This is the challenge facing the South 32 Mozal smelter, which plans to shut down in March due to a lack of confidence in securing sufficient and affordable electricity beyond that time.This should keep global inventories low, while prices are expected to see a further modest upside next year, in our view.With China reaching its capacity cap, Indonesian supply growth is now in focus, with annualised exports from the country up 40% year-to-date as projects in the region ramp up. For now, we think the aluminium market can absorb the growing Indonesian supply, although sustained expansion could test global balance later in 2026.

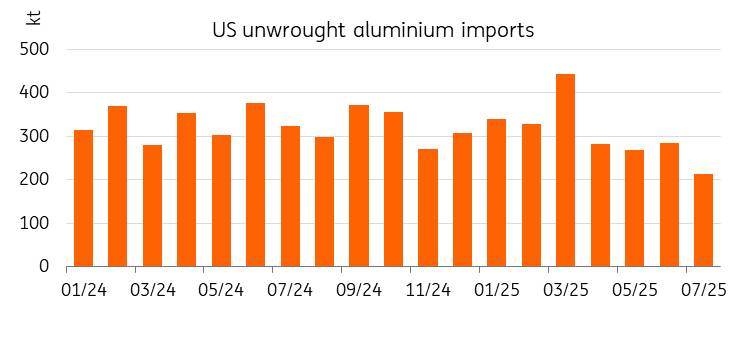

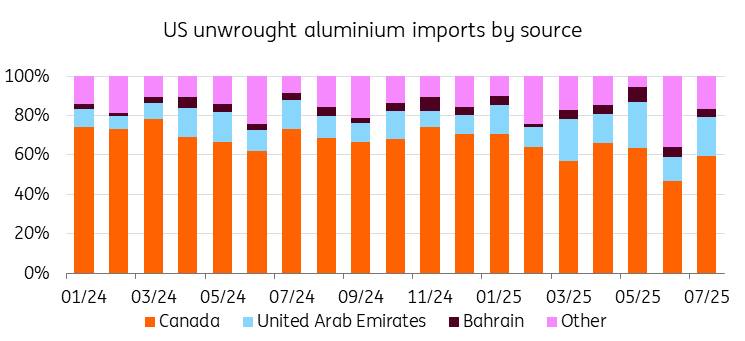

For aluminium, tariffs continue to be the key driver shaping trade flows and pricing. US primary imports have slowed down considerably since the tariffs took effect, with Canadian volumes in particular under pressure. Premiums, meanwhile, have seen a dramatic divergence between regions, with the US Midwest premium reaching record highs and European premiums falling on concerns over Canadian material being rerouted away from the US.Although tariffs on aluminium and steel are likely to remain for now, they may evolve in form. We do expect some form of rollback as US demand softens, with consumers increasingly resistant to high prices. This could take the form of quota-based systems or bilateral agreements with key exporters, rather than blanket removal.

Most recently, the US-Canada trade negotiations are in focus. Canada has the potential to supply 75% of the US’s unwrought aluminium needs. Earlier this week, Canada offered tariff relief on some steel and aluminium products imported from the US and China to help domestic businesses battered by a trade war on two fronts.In March, the US placed a 25% tariff on Canadian steel and aluminium, prompting Canada to enforce a 25% retaliatory tariff on American steel. In June, the US doubled its tariffs on Canadian steel and aluminium to 50%. Canada also has a 25% tariff on Chinese steel and aluminium.

Earlier this year, the UK trade deal included a reduced 25% tariff on aluminium and steel imports. The agreement with the EU also included potential carve-outs for steel, aluminium and copper.Yet until additional tariff agreements are reached, volatility in the aluminium market will persist, with premiums reflecting ongoing uncertainty.

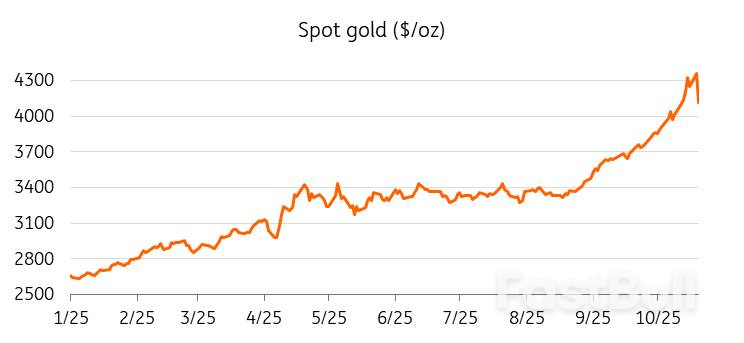

Gold drew attention during LME Week, with prices up by around 60% this year. The rally has been driven by uncertainties over global trade, heightened geopolitical tensions, US fiscal stability and the Fed’s independence. The start of the Fed’s easing cycle also boosted gold, which doesn’t pay any interest. The rally has been driven by physical buying, with central banks and private investors accumulating gold at record volumes.

But after a weeks-long rally that saw the precious metal hitting successive record highs, gold slid the most in 12 years this week. This signalled that some momentum might have been stretched. Gold was dragged down by a combination of factors, including profit-taking across precious metals, easing seasonal demand from Diwali, positive trade talks between China and the US, uncertainty over investor positions amid the US government shutdown, and a stronger dollar. The pullback underscores the risk that the rally might have moved ahead of underlying fundamentals.

But despite this sharp pullback, gold’s outlook remains constructive, underpinned by macro uncertainty and diversification demand.

The shift in central banks' purchases has been structural, with the pace of buying doubling in 2022 following Russia’s invasion of Ukraine. Central banks’ appetite for gold is driven by concerns from countries about Russian-style sanctions on their foreign assets, as well as shifting strategies on currency reserves. The top year-to-date buyer has been the National Bank of Poland, and it just announced it aims to increase its reserves from 21% to 30%.ETFs have been another powerful force behind gold’s record-breaking rally this year, with holdings surging in recent weeks. In fact, gold ETFs have added as much gold in September alone as central banks did during the first quarter of this year combined, according to the World Gold Council. With ETF holdings still shy of a peak hit in 2022, there could be room for further increases.

The downside should be limited, supported by geopolitical concerns, sustained central bank demand and expectations of further monetary easing, although near-term volatility may persist. For now, gold’s pullback looks like a healthy correction within a still-positive trend.

Canada’s statistics agency says it hasn’t received any data on US imports of Canadian goods for September, raising the possibility that it won’t be able to proceed with a scheduled release of trade figures on Nov 4.

Government agencies collaborate to share information on the shipment of goods across borders. But when the US government began a partial shutdown on Oct. 1, “no data on Canada’s exports to the United States for September 2025 had been received,” Cristobal D’Alessio, a spokesperson for Statistics Canada, said by email.

Without those inputs, the agency won’t be able to calculate key trade metrics relating to Canada’s largest trading partner. The agency hasn’t yet decided to postpone the November release. The “situation remains fluid,” D’Alessio said.

The missing trade data captures another complication of the US shutdown. The Trump administration is focused on changing perceived imbalances in global trade — but with US government employees off the job, it will be difficult to measure trade deficits and surpluses.

Canada’s trade surplus with the US narrowed in August to C$6.4 billion ($4.6 billion) as exports fell 3.4%, while imports from the US declined 1.4%. Exports to the US represented nearly 73% of Canada’s goods shipments abroad that month.

The last time a US government shutdown caused a delay in Canadian trade statistics was in early 2019, during President Donald Trump’s first term.

Several European countries are determined to support Ukraine’s defense for the long term.The leaders of the most powerful European countries issued a joint statement in support of Ukraine following reports of a rift between US president Donald Trump and Ukrainian president Volodymyr Zelenskyy.

The war in Ukraine seems to be at a pivotal point. The Russian forces are making slow but costly progress. The Ukrainian military is fighting hard but does not seem to have the resources to counterattack. The United States is changing tack repeatedly on the issue and does not provide the military assistance it used to.In response to a reported rift between Trump and Zelenskyy, the leaders of eight European nations (the United Kingdom, Germany, France, Italy, Norway, Finland, Denmark, and Poland), as well as the head of the European Union, issued a joint statement in support of Ukraine.

“We strongly support President Trump’s position that the fighting should stop immediately, and that the current line of contact should be the starting point of negotiations. We remain committed to the principle that international borders must not be changed by force,” the European leaders stated.However, the European leaders cautioned, Russia is using stalling tactics to prolong the conflict and the suffering of millions in an attempt to better its negotiating position. Contrary to Ukraine, which relies on the continuous support of its allies and partners to continue fighting, Russia answers to no one and is able to wage war unperturbed by international or domestic political considerations.

“Therefore we are clear that Ukraine must be in the strongest possible position – before, during, and after any ceasefire. We must ramp up the pressure on Russia’s economy and its defence industry, until Putin is ready to make peace. We are developing measures to use the full value of Russia’s immobilised sovereign assets so that Ukraine has the resources it needs,” the statement continued.The joint statement ended by saying that the European Council will meet later in the week, while the leaders of the “coalition of the willing” will gather together to discuss the specifics of the announced measures.

Several European countries have shown a determination to support Ukraine’s defense against Russia regardless of what the United States decides to do. The UK, in particular, has assumed a leadership role in the international effort to support Kyiv, providing weapon systems, munitions, money, and training to the Ukrainian forces.

Since coming to office, the Trump administration has changed tack several times on Ukraine.Initially, the Trump administration stopped the generous military aid of the previous administration, while also urging Ukraine to sit down at the negotiation table. Then, the administration resumed some military aid and allowed NATO allies to send US-made weapons systems and munitions to the embattled nation. Thereafter, for the first time since the Russian invasion, the US president met Russian president Vladimir Putin in Alaska with high hopes that the summit would bring the almost four-year conflict to an end. It did not. The White House then changed tack once more and came out in full support of Ukraine, with Trump even saying that Kyiv could prevail and even liberate all of its Russian-occupied territory. Finally, in the latest episode of the saga, Trump urged Zelenskyy to accept the Russian terms and concede Donbas and Crimea to Russia.

It is still unclear whether Trump’s stance toward Ukraine is a negotiating ploy to bring the two countries to the negotiating table and end the bloodiest conflict on European soil since the end of World War II.

Japanese exports in September snapped four months of declines, climbing 4.2% year on year, as shipments to Asia saw robust growth, partially offsetting the drop in exports to the U.S.

Exports, however, missed expectations of a 4.6% rise, according to median estimates in a Reuters poll of economists.

The world's fourth-largest economy saw imports increase 3.3% year on year, reversing course from the 5.2% decline in August and beating the 0.6% growth expected by the Reuters poll.

Japan's exports had fallen into negative territory as the country grappled with U.S. tariffs with its shipments of automobiles to the world's largest economy taking a huge hit. Tokyo in July clinched a trade deal with Washington, bringing down tariffs on its exports to the U.S. to 15% from the 25% initially proposed by President Donald Trump.

The data comes a day after the country got its first female prime minister in Sanae Takaichi, after months of political turmoil following electoral losses of the ruling Liberal Democratic Party under former Prime Minister Shigeru Ishiba.

Takaichi's stance of a loose momentary policy and massive fiscal stimulus is likely to weaken the yen, making Japan's exports more competitive and benefiting exporters — heavyweights on the benchmark Nikkei 225 that hit a record high on Tuesday.

Markets have priced in the so-called "Takaichi trade" since she took the helm of the LDP in September, which has seen the Nikkei rise to record highs and the yen weakening past the 150 mark.

However, the country's economy has seemed to hold up better than expected, with second quarter GDP being revised upward in September compared to advance estimates.

President Donald Trump said he spoke to Indian Prime Minister Narendra Modi earlier Tuesday and reiterated claims that New Delhi would ease its purchases of Russian energy.

“I just spoke to your prime minister today. We had a great conversation. We talked about trade,” Trump said as he hosted a Diwali celebration in the Oval Office of the White House. “We talked about a lot of things, but mostly the world of trade — he’s very interested in that.”

Trump hit India with 50% tariffs on its exports to the US in part to pressure New Delhi to stop buying Russian oil, purchases which are seen as buoying the Kremlin’s economy and its war effort in Ukraine. In recent weeks, however, Trump has softened his rhetoric as the two nations carry out talks to clinch a trade deal and lower tariffs and suggested that Modi was on board with reducing those energy buys

“He’s not going to buy much oil from Russia. He wants to see that war end as much as I do. He wants to see the war end with Russia, Ukraine, and as you know, they’re not going to be buying too much oil,” Trump said Tuesday.

The US president last week also said that India had agreed to stop buying oil from Russia, saying he had received assurances from Modi in a phone call. India’s foreign ministry, however, had said they were not aware of that conversation. Any effort to scale back Russian energy buys would be a gradual process and Modi’s government has previously indicated that the country would continue to make those purchases if it is economically viable.

India became a major importer of Russian crude after the start of the war in Ukraine in 2022, buying oil at a discount. Russian oil makes up about one-third of India’s overall imports in spite of the US push to curb flows.

Trump and Modi have also been at odds over the US president’s claims that he used trade as leverage to broker a ceasefire between India and Pakistan in May. While Pakistan has embraced that assertion — and nominated Trump for a Nobel Peace Prize — Modi and Indian officials have bristled at the notion that the US pressured them into a ceasefire.

Trump on Tuesday reiterated those claims, saying that he and Modi spoke “a little while ago about — let’s have no wars with Pakistan.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up