Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Sweden Finance Minister: The Plan This Year And In The Years To Come Is To Protect And Strengthen Finances

Hsi Down 611 Pts, Hsti Down 191 Pts, Baba Down Over 3%, Bj Ent Water Hit New Highs, Market Turnover Rises

Hungary's Seasonally-Adjusted PMI Falls To 49.3 In January From Revised 54 In December -Publisher

OPEC Secretariat Receives Updated Compensation Plans From Iraq, The United Arab Emirates, Kazakhstan, And Oman

Stats Office - Swiss December Retail Sales +2.9% Year-On-Year Versus Revised +1.7% In Previous Month

Iran's Foreign Ministry Spokesperson Baghaei Says Tehran Is Examining Details Of Various Diplomatic Processes, Hopes For Results In Coming Days

FAA Head Says Concerned Other Countries Aren't Putting Enough Resources Into Certifying USA Aircraft

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Indonesia's economy sent mixed signals as January inflation hit a near three-year high, juxtaposed with surprisingly robust December trade growth.

Indonesia's economy sent mixed signals as January inflation accelerated to its fastest pace in nearly three years, just as the country reported surprisingly strong trade growth for December.

The annual inflation rate climbed to 3.55% in January, up from 2.92% in the previous month. This reading pushed consumer price growth slightly above the central bank's target range of 1.5% to 3.5% and marked the highest level recorded since May 2023.

While the inflation figure was higher than desired, it came in below the 3.78% median forecast from analysts surveyed by Reuters.

According to Ateng Hartono, a senior official at Statistics Indonesia, the sharp increase was largely due to a low base effect. In early 2025, the government provided electricity tariff discounts, which artificially lowered the comparison point for this year's data.

"In March or April, I'm sure the inflation rate will normalize as long as there is no other government policy affecting the rate," he said.

Inflation in Southeast Asia's largest economy had remained within or below Bank Indonesia's target since mid-2023, a trend that supported a projected rate-cutting cycle of 150 basis points between September 2024 and September 2025.

Core inflation, which excludes volatile food prices and government-controlled items, also saw a slight uptick, rising to 2.45% in January from 2.38% in December.

In a separate release, Indonesia announced robust trade figures for December that contradicted analyst forecasts for a contraction.

Exports and Imports Surge

Both exports and imports posted strong year-over-year growth, signaling healthy economic activity.

• Exports: Grew by 11.64% to $26.35 billion, easily beating the consensus expectation of a 2.40% decline. The growth was driven by larger shipments of palm oil, nickel, semiconductors, and other electric components.

• Imports: Rose 10.81% to $23.83 billion, defying forecasts of a 0.7% drop.

This performance resulted in a trade surplus of $2.52 billion for December, slightly ahead of the predicted $2.45 billion.

Full-Year Surplus Widens in 2025

For the full year of 2025, Indonesia's trade surplus expanded significantly to $41.05 billion, up from $31.33 billion a year earlier.

The country also improved its trade balance with key partners despite global trade tensions. The trade surplus with the United States grew from $14.52 billion in 2024 to $18.11 billion in 2025. Similarly, the surplus with the European Union increased from $4.43 billion to $6.98 billion.

The Bank of England is widely expected to hold its benchmark interest rate at 3.75% this Thursday, signaling that while borrowing costs will likely fall this year, the timing and pace of cuts remain highly uncertain.

As Governor Andrew Bailey and his colleagues prepare their decision, they face a complex economic picture. While the UK's inflation rate is projected to fall, persistent underlying price pressures, particularly from wage growth, are keeping policymakers cautious and their options open.

Even after six rate cuts since mid-2024, the UK still has the highest official borrowing costs among the world's large, developed economies. This presents a challenge for Prime Minister Keir Starmer and finance minister Rachel Reeves, who are looking for ways to stimulate a sluggish economy.

However, the inflation side of the equation is equally challenging. December's inflation reading of 3.4% was also the highest in the Group of Seven (G7). Although forecasts suggest it will soon approach the Bank's 2% target, some officials fear that underlying pressures are still too strong to justify immediate easing.

"We expect Bank Rate to be cut twice this year," noted Sanjay Raja, Chief UK Economist at Deutsche Bank. "The timing of those rate cuts, however, is coming increasingly into question," he added, suggesting his forecast for cuts in March and June could be delayed.

Investors have dramatically scaled back their expectations for rate cuts. The market is pricing in almost no chance of a reduction after this week's Monetary Policy Committee (MPC) meeting and sees less than a 50% probability of more than one cut throughout the year. This marks a significant reversal from mid-January when two quarter-point cuts were almost fully priced in.

This shift in sentiment was triggered by tentative signs of renewed momentum in the British economy and a broader pullback in expectations for rate cuts in the United States, which heavily influences UK financial markets.

The main focus for investors on Thursday will be any change in the BoE's official messaging. In December, the MPC stated that rates were "likely to continue on a gradual downward path" but warned that "judgements around further policy easing will become a closer call."

The central concern for some policymakers is the resilience of wage growth. Despite a recent rise in unemployment, there are fears that the slowdown in pay increases could stall.

An annual BoE pay survey will be a key piece of data for the committee. MPC member Megan Greene said last month that she was worried about preliminary figures from the survey, which suggested pay settlements of around 3.5% for 2026. This is above the roughly 3% level considered consistent with achieving the 2% inflation target.

Governor Bailey has also acknowledged geopolitical risks, noting last month that the BoE was "very alert" to them, though market reaction to recent events has been muted.

The MPC's last decision in December was a narrow 5-4 vote to cut the Bank Rate, the fourth quarter-point reduction of 2025. Even then, most members signaled that the pace of easing could slow.

Recent signs of a tentative recovery among consumers and businesses may strengthen the case for a more cautious approach. Reflecting this shift, a Reuters poll of economists predicts a decisive 7-2 vote for holding rates this week.

Analysts remain divided on what comes next:

• Barclays expects one more cut in March, bringing the Bank Rate to 3.5%, followed by a pause. They cite "the caution on the committee that rates at that level may no longer be restrictive."

• Capital Economics, however, believes inflation will slow more than anticipated. Chief UK Economist Paul Dales forecasts three rate cuts in 2026, beginning in April.

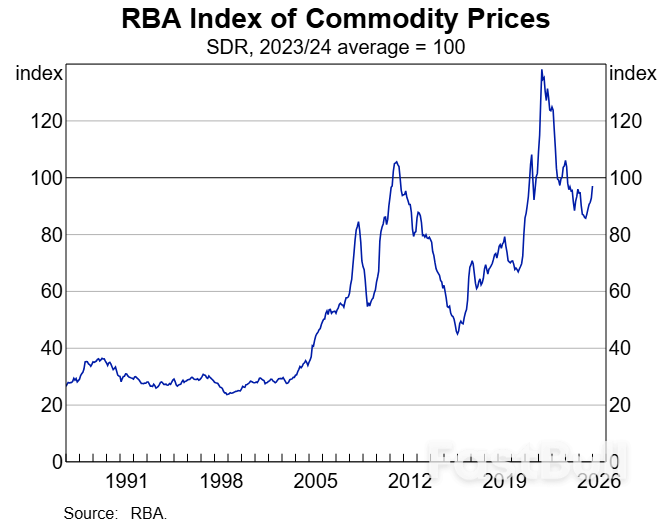

Preliminary estimates for January indicate that the index increased by 4.6 per cent (on a monthlyaverage basis) in SDR terms, after increasing by 1.7 per cent in December. The non-rural, ruraland base metals subindices all increased in the month. In Australian dollar terms, the indexincreased by 2.6 per cent in January.

Over the past year, the index has increased by 2.6 per cent in SDR terms. Decreases in the pricesof iron ore, oil, and coking coal have been more than offset by increases in gold, lithium andrural commodity prices. The index has decreased by 0.9 per cent in Australian dollar terms.

Consistent with previous releases, preliminary estimates for iron ore, coking coal, and LNGexport prices are being used for the most recent months, based on market information. Using spotprices for the bulk commodities index, the index increased by 5.4 per cent in January in SDRterms, to be 5.3 per cent higher over the past year.

For further details regarding the construction of the index, please refer to'Changes to the RBA Index of Commodity Prices: 2013'in the March 2013 issue of the Bulletin and 'Weights for the Index of Commodity Prices' (April 2025).

Details are in the attached table and graph.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up