Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Report Shows Nearly 60% Of Surveyed US Companies Plan To Increase Investment In China] The China Council For The Promotion Of International Trade (CCPIT) Released The "2026 China Business Environment Survey Report" On The 28th, Compiled By The American Chamber Of Commerce In China. The Report Shows That Nearly 60% Of Surveyed US Companies Plan To Increase Their Investment In China. According To The Recently Released Report, Over Half Of The Surveyed US Companies Operating In China Expect To Achieve Profitability Or Significant Profitability By 2025, And Over 70% Of The Surveyed Companies Are Not Currently Considering Transferring Production Or Procurement Outside Of China. Wang Wenshuai, Spokesperson For The CCPIT, Stated At A Regular Press Conference Held That Day That This Reflects, From One Perspective, That China Will Undoubtedly Remain A Fertile Ground For Foreign Investment And Business Development For A Long Time To Come

Paris-Denmark Prime Minister: I Think There Are Som Lessons Learned For Europe In The Last Weeks

Deutsche Bank: We Are Cooperating Fully With Prosecutor's Office. We Cannot Comment Further On This Matter

US President Trump: The Next Attack On Iran Will Be Worse Than The Attack On Its Nuclear Facilities

Bank Of America Will Match The USA Government's $1000 Pilot Contribution For All Eligible USA Teammates To Trump Accounts

The US MBA Mortgage Application Activity Index Fell 8.5% Week-over-week For The Week Ending January 23, Compared To 14.1% Previously

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)A:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Jan)

Euro Zone Consumer Confidence Index Final (Jan)--

F: --

Euro Zone Selling Price Expectations (Jan)

Euro Zone Selling Price Expectations (Jan)--

F: --

P: --

Euro Zone Industrial Climate Index (Jan)

Euro Zone Industrial Climate Index (Jan)--

F: --

P: --

Euro Zone Services Sentiment Index (Jan)

Euro Zone Services Sentiment Index (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

India is monitoring Nipah virus infections, with two reported from its eastern state of West Bengal since December, the health ministry said, as some Southeast Asia nations step up scrutiny of air travellers.

India is monitoring Nipah virus infections, with two reported from its eastern state of West Bengal since December, the health ministry said, as some Southeast Asia nations step up scrutiny of air travellers.

Tuesday's confirmation came a day after Thailand said it had tightened airport screening measures, with neighbouring Malaysia following suit.

"Speculative and incorrect figures regarding Nipah virus cases are being circulated," the Indian ministry warned in a statement that put the tally of infections at two.

Authorities have identified and traced 196 contacts linked to both cases, it added, with none showing symptoms and all testing negative for the virus.

Thailand has assigned designated parking bays for aircraft arriving from areas with Nipah outbreaks, its health ministry said, while passengers must make health declarations before clearing immigration.

Malaysia's health ministry said it was beefing up preparedness via health screening at international ports of entry, especially for arrivals from countries at risk.

"The ministry remains vigilant against the risk of cross-border transmission following sporadic infections in several other countries," it added in a statement on Wednesday.

The World Health Organization (WHO), which estimates Nipah's fatality rate at 40% to 75%, ranks it as a priority pathogen for its potential to trigger an epidemic. There is no vaccine to prevent infection and no treatment to cure it.

Russia pounded Ukraine with drones and a missile overnight, killing two people in the Kyiv region, while the southern city of Odesa came under attack for the second night in a row, officials said on Wednesday.

A man and a woman were killed in the Kyiv region, and four more including two children sought medical attention, Governor Mykola Kalashnyk said on the Telegram messaging app.

Ukraine's air force said Russia launched an Iskander-M ballistic missile and 146 drones overnight - 103 of them neutralised by air defences.

In Ukraine's capital Kyiv, a 17-storey residential building was hit, causing minor damage to the roof and damaging windows on the upper floors, the emergency services said.

In Odesa, which announced a day of mourning after a drone strike killed three people overnight on Tuesday, three people were hurt, the head of the city's military administration, Serhiy Lysak, said.

Port infrastructure in the surrounding region, which houses Ukraine's Black Sea ports, was also damaged, the regional governor said.

In the central Ukrainian city of Kryvyi Rih, two people were injured in an overnight missile attack, military administration head Oleksandr Vilkul said.

The attack also "significantly" damaged an infrastructure facility, and close to 700 buildings were without heating, he added.

At dawn, Russia also attacked the southeastern city of Zaporizhzhia, Governor Ivan Fedorov reported on Telegram.

Four people were hurt in the attack, which also damaged at least 12 residential buildings, partially knocking out electricity to some of them, he said.

The city, which lies close to the frontline, has been bombed regularly by Russia since its 2022 invasion of Ukraine.

China's so-called second-tier cities are fast becoming the first stop for luxury goods vendors as middle-class consumers seek high living standards in lower-cost locales, taking with them their penchant for pricey parkers and expensive extras.

With luxury spending in places like Nanjing, Changsha and two dozen other middling cities exceeding that of a handful of economic powerhouses such as Beijing and Shanghai, bling brands like Burberry (BRBY.L) and Louis Vuitton owner LVMH (LVMH.PA) are following the money and booking sales that point to a recovery in China's battered luxury sector.

"The fact that you have all these second-tier cities now in the top 10 (luxury sales) ranking - it's crazy if you think about it," said Zino Helmlinger, head of China retail at CBRE.

China accounts for roughly a quarter of luxury spending but sales have been sluggish since the end of a post-pandemic boom while weak economic growth and fallout from a property sector crisis continue to trickle down to the shopper on the street.

However, Burberry last week said China's Generation Z helped revenue beat analyst expectations while LVMH on Tuesday flagged a recovery in China with forecast-beating fourth-quarter sales.

Notably, in August, when Louis Vuitton launched beauty line "La Beauté Louis Vuitton" in China, it made its eye shadow, lip balm and 1,200 yuan ($172) lipstick first available not in a first-tier city but at Nanjing Deji Plaza.

Months earlier, data showed Nanjing Deji Plaza had, for the first time, leapfrogged long-time luxury mall leader Beijing SKP to become China's top-performing high-end shopping centre.

The mall, in the Jiangsu provincial capital of 9.5 million people, booked sales of more than 24.5 billion yuan in 2024 compared to Beijing SKP's 22.2 billion yuan, state media said. Moreover, it likely stayed at the top in 2025, analysts said.

The mall has an art museum, modern food hall and 500 square metre (5,382 square feet) restrooms with themes such as calligraphy, classical music and cyberpunk.

So elaborate are the restrooms that they have gone viral on social media, and brands including Self-Portrait and Estee Lauder's (EL.N) MAC Cosmetics have had pop-up shops in them.

"There are many delicious types of food and the selection of shops is excellent," 24-year-old Zhou Shiyong said of Nanjing Deji Plaza. "Only Deji has this kind of assortment; other shopping malls don't have it, which is why we come to Deji."

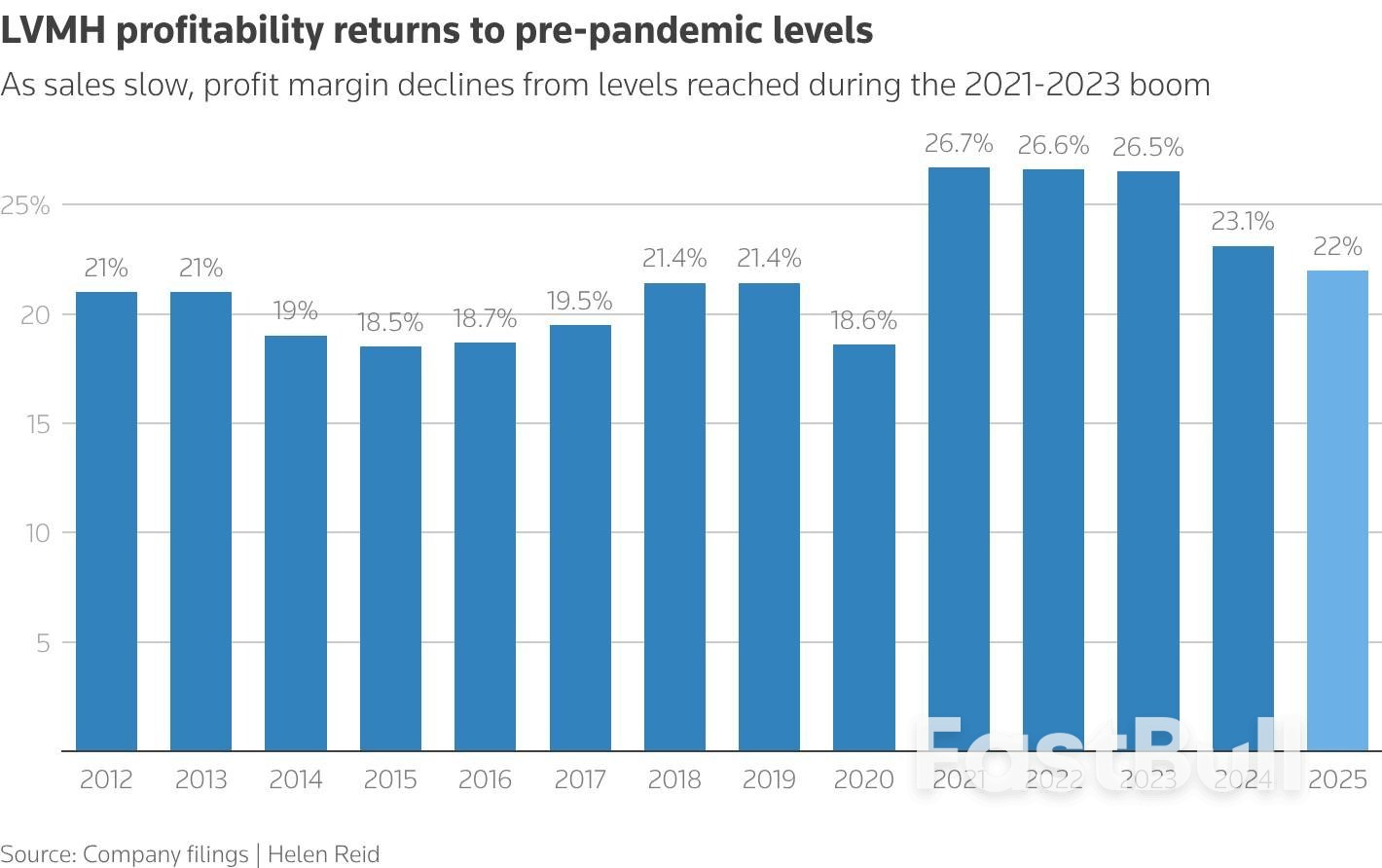

Chart showing LVMH operating profit margin annually from 2012 to the estimate for 2025

Chart showing LVMH operating profit margin annually from 2012 to the estimate for 2025Second-tier cities such as Nanjing are becoming increasingly important to luxury brands as a growing contingent of middle-class people shun more economically developed first-tier cities such as Beijing and Shanghai to benefit from lower living costs.

Latest research from insights firm MDRi showed luxury shoppers in second-tier cities spent an average of 253,800 yuan in 2024, up 22% from the previous year and surpassing first-tier consumers, whose spending fell 4% to 250,200 yuan.

Top brands are chasing these consumers as they move further afield from previous growth markets and, in the case of Burberry, trying out new methods of marketing such as setting up a branded ice rink and a pop-up shop on a ski slope.

"Recent earnings suggest a modest recovery, and part of that is due to more active investment - flagship experiences in first-tier cities, and more targeted, performance-led strategies in the top malls in lower-tier cities," said James Macdonald, head of Savills research for China.

Deji, owned by real estate conglomerate Deji Group, is the Nanjing region's only mall to house every major luxury brand. It also offers more accessible labels aimed at Gen Z shoppers - an increasingly powerful force in the luxury sector as brands seek to tap shifting tastes among fickle younger consumers.

"Deji has the highest luxury sales density in China. They have an ultra-strong VIP ecosystem, deep brand partnerships, frequent store upgrades and they basically dominate commercial efficiency," said CBRE's Helmlinger.

"Brands would rather wait for a location there than go to another project just a few kilometres away."

Malls in other second-tier cities - such as Changsha IFS, Wuhan Wushang and Hangzhou In77 - are also rising in luxury sales ranking, Helmlinger said.

Their ascendancy is partly economic. McKinsey research released last year showed that, in China, consumers in the biggest cities were most likely to cut discretionary spending.

Consumer confidence was stronger among young and middle-income shoppers in second-tier cities, where living costs are lower and local job security firmer, the research showed.

Many second-tier cities have also seen their middle-class population boosted by a net inflow of people from top-tier centres, Savills' Macdonald said.

Demographic and economic shifts aside, Helmlinger said top malls in second-tier cities have significantly improved their offerings, giving nearby consumers access to brands without having to travel to Shanghai or Beijing.

"It really shows China is going through a wide change in consumer behaviour, and in where money is localised and spent," said Helmlinger. "In the coming few years we're going to see many more second-tier cities rising, because that's where the money is."

($1 = 6.9554 Chinese yuan renminbi)

Dollar's selloff extended through the week, only managing a brief pause after slipping through the key psychological level of 1.2 against Euro briefly. While the pace of decline has slowed, there is little sign of a meaningful recovery taking shape. The bounce has so far been shallow. And, Dollar remains under pressure on multiple fronts, with headwinds increasingly coming from within the US rather than from external shocks or data surprises.

Markets took particular note of remarks from US President Donald Trump, who expressed clear comfort with Dollar's decline. In a market accustomed to verbal pushback against sharp currency moves, the lack of resistance from the White House has been interpreted as a green light for further weakness.

Asked directly whether the Dollar had fallen too far after sliding about 10% over the past year, Trump dismissed the concern, saying the currency was "doing great" and pointing to strong business activity as justification. Trump also revisited his long-standing complaints about Asian currencies, recalling past disputes with Japan and China over devaluation. The contrast between those confrontations and his current stance reinforces the impression that a weaker Dollar is no longer seen as a problem.

Such remarks matter for markets. When the President signals indifference—or endorsement—toward currency depreciation, it emboldens traders to maintain pressure rather than anticipate a policy-backed rebound.

Adding to the unease, IMF Managing Director Kristalina Georgieva said earlier this week that the Fund is preparing for scenarios involving sharp selloffs in US dollar-denominated assets. While framed as contingency planning, the comments highlights growing institutional awareness of tail risks around the Dollar. Georgieva noted that the IMF is stress-testing "unthinkable" scenarios, including potential runs on Dollar assets, as part of its broader surveillance work. Even without assigning probabilities, the acknowledgement adds to a fragile confidence backdrop.

In currency markets, the impact is clear. For the week so far, Dollar sits at the bottom of the performance table, followed by Loonie and Sterling. At the other end, Yen remains the strongest, supported by lingering intervention threats, though follow-through buying has been limited. Swiss Franc is the second strongest, with gains against both Euro and Sterling pointing to underlying risk aversion. Aussie ranks third, buoyed by strong inflation data that has all but confirmed an RBA rate hike next week. Euro and Kiwi trade in the middle of the pack.

Australia's Q4 CPI showed little relief for RBA where it matters most for policy. Headline inflation rose 0.6% qoq, slightly below expectations of 0.7% and slowing sharply from the prior quarter's 1.3% gain. However, on an annual basis, CPI accelerated from 3.2% yoy to 3.6% yoy, matching forecasts and keeping inflation well above the RBA's target band.

The more important signal came from underlying inflation. Trimmed mean CPI rose 0.9% qoq, easing marginally from 1.0% previously but beating expectations of 0.8%. Annual trimmed mean inflation climbed from 3.0% yoy to 3.4% yoy, above the expected 3.2%, reinforcing concerns that price pressures remain persistent.

December's monthly details added to that unease. Headline CPI jumped 1.0% mom, lifting the annual rate from 3.5% yoy to 3.8%, both above expectations. Trimmed mean CPI rose a more modest 0.2% mom, but annual core inflation still edged up from 3.2% yoy to 3.3% yoy.

Price pressures remain broad in December. Goods inflation accelerated from 3.2% yoy to 3.4%, driven largely by a 21.5% surge in electricity prices. Services inflation climbed from 3.6% yoy to 4.1%, led by domestic travel and accommodation and rising rents.

Markets are now firming up their expectation that RBA will return to rate hike in February.

Australian Dollar extended its rally this week, with AUD/USD breaking above 0.70 psychological level. The move has been supported by broad-based Dollar weakness, but domestic factors have played a central role following Australia's stronger-than-expected inflation data.

December CPI showed another month of acceleration, while Q4 headline inflation printed at 3.6%. More importantly for policymakers, trimmed mean CPI at 3.4% underscored persistent underlying inflation that sits uncomfortably above the RBA's target band. That inflation shock has quickly filtered into economist forecasts. Westpac and ANZ revised their outlooks, now expecting the RBA to raise the cash rate at its upcoming meeting next week. All four major Australian banks now forecast a 25bp hike back to 3.85%.

The key uncertainty now lies beyond the initial move. The question is whether the RBA would signal scope for a more extended tightening cycle, or frame the hike as a one-off adjustment designed to reassert inflation control.

Technically, AUD/USD remains in clear upward acceleration, with D MACD still pointing higher. The advance from 0.5913 is on track toward its 100% projection of 0.5913 to 0.6706 from 0.6420 at 0.7213 next. On the downside, below 0.6901 support will bring consolidations first. But downside should be contained above 0.6706 resistance turned support to bring another rally.

More importantly, the decisive break above 0.6941 structural resistance this week strengthens the case that the rise from 0.5913 is reversing the entire decline from the 0.8006 (2020 high). Next target is 61.8% retracement of 0.8006 to 0.5913 at 0.7206, which is close to the above 0.7213 projection level.

Reactions to this 0.72 resistance zone will decide whether current rise from 0.5913 is the third leg of the pattern from 0.5506 (2020 low), and open the door to further medium up trend through 0.8006.

Two major central bank decisions from North America headline the day, with both the BoC and the Fed widely expected to keep interest rates unchanged. USD/CAD, meanwhile, is unlikely to see its broader trend altered by either decision. The current selloff would likely continue through 1.3538 low as driven by the overall selloff in Dollar.

For the BoC, markets expect rates to remain at 2.25%, the lower bound of the bank's estimated 2.25–3.25% neutral range. A recent Reuters poll showed nearly 75% of economists expect the BoC to keep policy unchanged through 2026.

At this stage, the BoC appears comfortable with a prolonged wait-and-see stance. However, slack remains in the labour market, growth momentum is uncertain, and policy is not yet clearly stimulative despite the 275bp of rate cuts delivered between June 2024 and October 2025.

Hence, if policy does move again this year, risks are tilted toward further cuts rather than hikes. That bias hinges heavily on trade outcomes. As long as key sectors retain preferential access to the US—either through deals or prolonged negotiations—the growth outlook remains intact.

However, should tariffs expand to a broader range of industries, the drag on activity would intensify. In that scenario, the BoC would likely be forced to resume easing to cushion the economic impact.

Turning to the Fed, rates are expected to remain unchanged at 3.50–3.75%, making this very much a holding meeting. Markets will be listening closely for any shift in tone that hints at future action rather than focusing on the decision itself.

Voting dynamics will be watched carefully. Stephen Miran, a known dove, is expected to dissent in favor of a cut. Any additional votes for easing beyond Miran would be interpreted as a clear dovish signal.

For now, the Fed is expected to remain on hold through the remainder of Jerome Powell's term in May. Markets price roughly a 63% chance of a June cut, but conviction remains limited given multiple wild cards, including economic data, trade relations, financial market stability, and President Donald Trump's choice of the next Fed chair.

Technically, for USD/CAD, current decline should continue as long as 1.3738 resistance holds. It's seen as part of the downtrend from 14791. Break of 1.3538 will pave the way to 61.8% projection of 1.4791 to 1.3538 from 1.4139 at 1.3365 in the near term.

Daily Pivots: (S1) 1.1902; (P) 1.1992; (R1) 1.2134;

EUR/USD's rally is still in progress and breached 1.2 psychological level before retreating slightly. Intraday bias stays on the upside. Decisive break above 1.2 will carry larger bullish implications. Next near term target will be 38.2% projection of 1.0176 to 1.1917 from 1.1576 at 1.3434. On the downside, below 1.1906 minor support will turn intraday bias neutral first. But outlook will stay bullish as long as 1.1576 support holds, even in case of deep pullback.

In the bigger picture, as long as 55 W EMA (now at 1.1443) holds, up trend from 0.9534 (2022 low) is still in favor to continue. Decisive break of 1.2 key psychological level will add to the case of long term bullish trend reversal. Next medium term target will be 138.2% projection of 0.9534 to 1.1274 from 1.0176 at 1.2581. However, sustained trading below 55 W EMA will argue that rise from 0.9534 has completed as a three wave corrective bounce, and keep long term outlook bearish.

The Aussie Dollar started a major increase above 0.6800 against the US Dollar. AUD/USD cleared the 0.6880 hurdle to enter a bullish zone.

Looking at the 4-hour chart, the pair settled above 0.6920, the 200 simple moving average (green, 4-hour), and the 100 simple moving average (red, 4-hour). The bulls even pumped the pair above 0.6950.

The current price action suggests high chances of more upside. Besides, there is a major bullish trend line forming with support at 0.6900. Immediate resistance sits near 0.6985. The first key hurdle could be 0.7000.

A close above 0.7000 could open the doors for more gains. In the stated case, the bulls could aim for a move toward 0.7120. If there is a pullback, AUD/USD might find bids near 0.6900 or the trend line.

A close below the trend line might initiate an extended drop. The first major area for the bulls might be near 0.6840. The main support sits at 0.6800, below which the pair could accelerate lower. The next support could be 0.6740 and the 100 simple moving average (red, 4-hour).

Looking at EUR/USD, the pair extended gains and traded above 1.1900. The next key hurdle sits near 1.2000.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up