Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

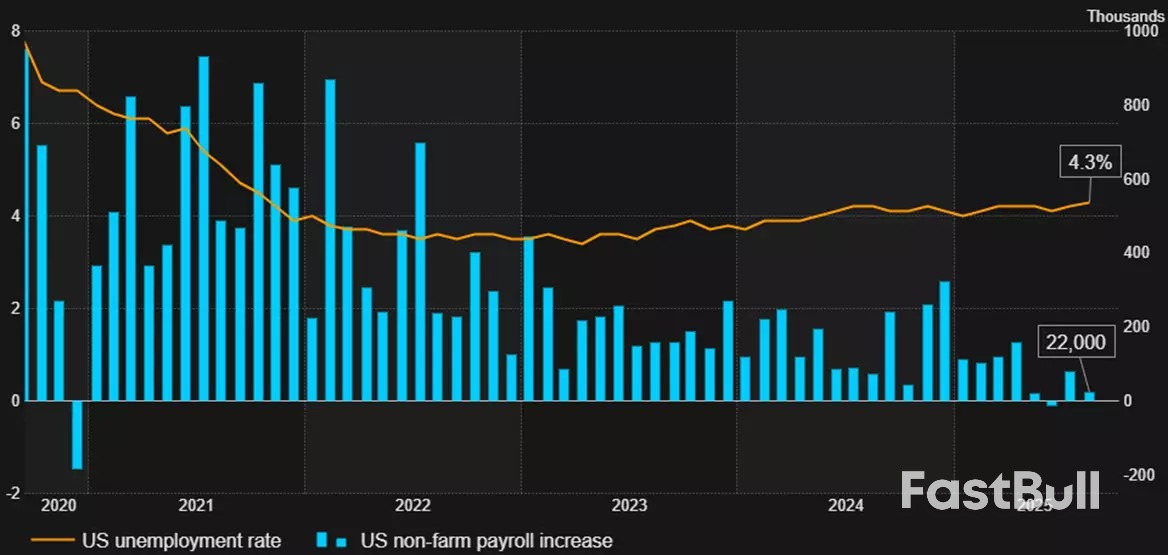

Piper Sandler warned in a note Monday that a potential U.S. government shutdown could delay key economic releases, but stressed there are “plenty of other data to gauge labor, inflation, etc.”

Piper Sandler warned in a note Monday that a potential U.S. government shutdown could delay key economic releases, but stressed there are “plenty of other data to gauge labor, inflation, etc.”

In its weekly research note, the firm said “there’s concern that if there’s a government shutdown, important economic data will be delayed, e.g., payrolls (scheduled to be released Oct 3rd), and the CPI (Oct 15th). Well, they will eventually be reported … but with a lag of perhaps 10 days after the reopening.”

In the meantime, Piper Sandler pointed investors to a wide range of private and alternative data.

“Sep 30: Conference Board’s jobs hard-jobs easy, which correlates very well with the unemployment rate,” the analysts wrote.

They added that the Oct. 1 ISM and S&P Global PMIs would provide critical labour and inflation signals, noting their price components have been “consistent with inflation cooling a bit.”

The firm highlighted other key indicators: mortgage applications on Oct. 1, ADP employment data, weekly jobless claims on Oct. 2 and Oct. 9, and industrial production on Oct. 10.

Piper Sandler emphasised that “unemployment claims WILL be reported, as they were during the 2013 shutdown,” and warned they would likely rise if federal workers are furloughed.

Later in October, the NFIB small business report (Oct. 14), Empire State and Philadelphia Fed surveys (Oct. 15–16), and NAHB housing index (Oct. 16) will offer further insights.

Piper Sandler also said it would “watch our Daily consumer confidence survey to gauge how consumers see any shutdown.”

as of 29 September 2025. Past performance is not a reliable indicator of future performance.

as of 29 September 2025. Past performance is not a reliable indicator of future performance. as of 28 September 2025. Past performance is not a reliable indicator of future performance.

as of 28 September 2025. Past performance is not a reliable indicator of future performance. as of 28 September 2025. Past performance is not a reliable indicator of future performance.

as of 28 September 2025. Past performance is not a reliable indicator of future performance.

Pending sales of US existing homes rose in August to the highest level in five months, as falling mortgage rates gave a much-needed lift to the sluggish housing market.

An index of contract signings increased 4% last month to 74.7, according to National Association of Realtors data out Monday. The gain exceeded all estimates of economists surveyed by Bloomberg. During the hot housing market of the pandemic era, the index was well above 100.

The bigger-than-expected advance follows a similar surprise in purchases of new homes last month, suggesting the housing market may be in the early stages of breaking free of a years-long slumber. Mortgage rates have fallen to the lowest in a year at 6.34%, encouraging many Americans to get off the sidelines and others to finally list their homes for sale.

“Lower mortgage rates are enabling more homebuyers to go under contract,” NAR Chief Economist Lawrence Yun said in a statement.

That was especially true in the Midwest, where sales jumped nearly 9% in August, Yun said, which was the most since early 2023. Contract signings also rose in the South and West.

While the drop in mortgage rates is welcome, millions of Americans still have rates well below current levels and aren’t inclined to move, which has suppressed inventory and kept prices elevated.

Meantime, one of the lowest rates of hiring since the early 2010s is keeping a lid on job relocations and housing activity, according to a recent blog post by Odeta Kushi, an economist at title insurance giant First American Financial Corp.

Pending-homes sales tend to be a leading indicator for previously owned homes, as houses typically go under contract a month or two before they’re sold.

Contract closings on existing homes fell slightly in August, and they’ve remained frozen in a lackluster range for the better part of the last two-and-a-half years, NAR data show.

For traders, keeping a trading journal is an important activity that helps them improve their trading skills. A trading journal is a systematic record-keeping tool that is used to document trades, strategies, and outcomes. It is a way to track performance by recording the entry and exit points, the reasons for entering the trade, and the results.

Here are three trading journal examples. You can choose a format that works best for you, whether it’s handwritten notes in a notebook, a trading journal online spreadsheet, or a specialised app. The key is to be consistent in recording your activity.

Keeping a journal has several benefits. The most important thing is that by using this tool for self-analysis and learning, you can increase your chances of success in markets and make data-driven improvements. Let’s break down why it can be useful.

Whether it’s a forex trading journal or one for stocks, crypto* or indices, the benefits will be the same. The usefulness of keeping a record will be self-evident.

It’s to be expected that over time, a journal will become an invaluable resource for improving skills, minimising risk and achieving more consistent effectiveness in the financial markets. The hardest part is getting started, although keeping a journal is actually easy. Here are the five steps you can follow.

1. Choose a Format

Decide whether you want to keep a physical trading journal book, use a digital spreadsheet, or employ specialised software. Choose a format that you’re comfortable with, and that aligns with your needs. If you’re using a spreadsheet or digital document, you can create a trading journal template that includes the key information you plan to record for each trade.

2. Record Your Trades

Record the details of each trade you make. You can include the date and time, as this information is essential for tracking the timing of trades and assessing how different market conditions may affect your decision-making.

Recording your strategy or approach is a great idea. Regardless of whether it is based on technical, fundamental, or combined analysis, be sure to state your methodology. You may also want to detail the risk management techniques you used, such as stop-loss and take-profit orders. On the TickTrader trading platform, you can find various tools for risk management. After using them, you can evaluate how effectively they protected your capital.

3. Record Reasons and Your Emotional State

Consider writing down the reasons that prompted you to enter the trade. What factors or indicators influenced your decision? For example, if you prefer currencies, did you enter the trade because of a certain technical pattern or a country’s GDP report?

Documenting your emotional state before and during the trade is also important. Were you confident, anxious or fearful? An honest self-assessment of your emotions is critical to identifying emotional triggers that can influence you.

4. Review Your Trades

Think about reviewing your trades and indicating the final result — profit or loss. Be sure to write down the actual numbers so that you can accurately assess your results. When documenting your trades, it’s crucial to remain objective. Do not justify bad decisions or self-glorify successful ones. The purpose of keeping a journal is to learn and improve.

You can schedule a regular review of your trades. This can be done weekly or monthly, depending on how often you trade. During these reviews, you are likely to find patterns and identify areas for improvement.

5. Be Consistent

Consistency is key. You can develop a routine for recording trades. Make sure you thoroughly document all of them, regardless of their size or perceived importance. If it’s too difficult to do this yourself, you can use an automated trading journal. This is a great solution for those who have a hard time making habits.

Keeping records of your trades is a way to have a structured and systematic approach to monitoring and evaluating trading activity. This leads to better-informed decisions and improved performance.By recording details of trades, strategies, emotions, results, and risk management techniques, you can gain valuable insights into your behaviour and patterns.

Bank of England Deputy Governor Dave Ramsden said there is still scope to cut interest rates further, predicting price pressures from the services sector and wages will continue to ease.

Ramsden said on Monday that the risks for prices are “balanced” and that he remains confident that the central bank can bring inflation back to its 2% target with the current policy settings.

“I see scope for further removal of policy restraint looking ahead,” he said on a panel at a European Central Bank conference. “The gradual and careful approach that the MPC (Monetary Policy Committee) has taken to removing policy restraint remains appropriate.”

Ramsden struck a more dovish tone than many of his colleagues in recent remarks, suggesting that he could still back another rate cut at the next meeting in November. While the UK central bank has maintained a once-a-quarter cutting cycle since August 2024, it is expected to slow that pace and traders see little prospect of a move in November.

Policymakers have turned more cautious following a spike in inflation to almost double the BOE’s target. They are especially concerned about rising household expectations at a time of surging food bills, given that grocery bills are particularly “salient” for consumers. Ramsden acknowledged that some of his colleagues do not share his confidence that wage growth will continue to subside to levels consistent with the 2% inflation target.

He said he is putting “a bit more weight on the risk” that the food price shocks lead to second-round effects and has been surprised by “how long it’s taken for that wage-setting behavior to come back in line.” However, he said that the underlying causes of the inflation spike — a combination of regulated price increases such as water bills, global drivers and the Labour government’s tax hikes — are unlikely to be seen again.

“If you assume that these various regulated and other price rises are not repeated this year, which I think is a fair assumption, we should see headline services inflation starting to come down much more materially,” he said. “That will be supported by the fact that underlying services inflation continues, when you look at high-frequency measures, to be on a disinflationary path.”

Ramsden also pointed to positive signs on taming wage pressures, saying that a previous BOE pay survey pointing to pay settlements of around 3.7% by the end of the year is “on track.”

“Those are also then pointing to settlements being lower, so closer to 3% further out into next year, which will be getting down to target-consistent rates,” he said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up