Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Learn how to sell Pi Coin safely in 2025. Step-by-step guide covering KYC, mainnet migration, trusted exchanges, and the best ways to trade or withdraw Pi for cash or USDT.

Wondering how to sell Pi Coin in 2025? As Pi Network transitions toward its open mainnet, many holders are eager to turn mined Pi into real money. This guide explains the current status, what you must do before selling, and the safest ways to trade or withdraw your Pi coins for cash or USDT.

Before you learn how to sell Pi Coin, it’s important to understand that Pi Network is still operating under an “enclosed mainnet” phase. This means coins cannot yet be freely transferred or traded on major exchanges such as Binance or Coinbase. While internal apps and Pi ecosystem projects allow limited transactions, open exchange listings remain pending until regulatory and technical conditions are fully met. For users wondering how to sell Pi Coin in the US or globally, official access will only begin once Pi’s open mainnet is live.

With the growing interest in how to sell my Pi Coin, many fake platforms and social media schemes have appeared—especially those promising instant withdrawals. Stay alert to these red flags:

Always verify with official Pi Network channels and avoid any service that demands payment upfront or your credentials. On platforms like how to sell Pi Coin Reddit threads, many users report losing access to their coins through such scams.

Technically, you can’t yet sell Pi coins on open markets. However, understanding how to sell Pi Coins when the mainnet opens will help you prepare. Holding your Pi in a verified mainnet wallet ensures eligibility once Pi is listed. Early “unofficial” sales through P2P groups remain risky—especially if you’re exploring how to sell Pi Coin 2024 methods. It’s wiser to wait for the legitimate launch rather than jeopardize your holdings.

Before attempting how to sell Pi Coin, every user must pass Pi Network’s Know Your Customer (KYC) verification. This process ensures compliance with global regulations and prevents fraudulent transactions. Verification can be completed directly through the Pi Browser app using government-issued identification and face recognition. Without KYC approval, you cannot migrate tokens or withdraw assets—even if you know how to sell your Pi coins later.

Once KYC is approved, your next step is to migrate tokens to the official Pi mainnet wallet. This confirms your Pi holdings are real and recorded on the blockchain. Testnet Pi coins cannot be sold or transferred. Users asking how to sell my Pi Coin or how to sell Pi Coin in the US need to ensure their tokens have completed this migration. Keep your seed phrase private to protect your holdings.

Only verified mainnet users can transfer Pi. Within the Pi Wallet, check the “Transfer Eligibility” tab to confirm if your coins are unlocked and transferable. Knowing your wallet’s available balance helps avoid failed transactions once you explore how to sell Pi coins through official exchanges or peer-to-peer options.

After migration, set up an account with a trusted exchange such as BitMart, HTX, or PiBridge. Although how to sell Pi Coin on Binance isn’t possible yet, having an exchange account ready will streamline your first trade once listings go live. Enable two-factor authentication (2FA) and email verification for enhanced security before linking your wallet.

When preparing for how to sell Pi Coin 2024 or beyond, always research each platform’s reputation, liquidity, and withdrawal fees. Choose exchanges with transparent pricing, high daily volume, and strong user protection. Community sources like how to sell Pi Coin Reddit threads can provide useful feedback on trading safety and withdrawal times, but verify all information through official channels before committing.

Before you begin how to sell Pi Coin, make sure your tokens are migrated to a verified mainnet wallet. Only mainnet coins are eligible for trading or transfers. Testnet or “app-only” balances cannot be exchanged. To ensure smooth transactions, always back up your wallet’s seed phrase and confirm that your Pi is unlocked for transfer. This is the first requirement whether you’re in Asia, Europe, or learning how to sell Pi Coin in the US.

Not all exchanges currently support Pi trading. For those exploring how to sell Pi Coins, early trading may be available on smaller platforms such as BitMart, PiBridge, or HTX once listings become official. Avoid unauthorized apps that promise “instant Pi sales.” Binance has not yet listed Pi, so queries like how to sell Pi Coin on Binance currently have no legitimate solution.

| Platform | Trading Pair | Approx. Fee | Withdrawal Options |

|---|---|---|---|

| BitMart | PI/USDT | 0.25% | Crypto or Bank Transfer |

| PiBridge | PI/BUSD | 0.30% | Crypto Only |

Once your account is set up, choose a stable trading pair—such as PI/USDT or PI/USD. This allows you to easily convert Pi into stable assets that can later be withdrawn or reinvested. When researching how to sell your Pi coins, check the liquidity and 24-hour volume to avoid slippage during execution.

To sell your Pi, enter the desired amount and confirm the order on your exchange dashboard. For beginners searching how to sell my Pi Coin, start with small test trades to understand fee structures and settlement times. Once executed, verify your transaction in the order history or blockchain explorer before proceeding with withdrawals.

After selling, convert your USDT or USD balance to your preferred withdrawal method. For users studying how to sell Pi Coin 2024 or preparing for future trades, withdrawals can be made via:

Always double-check withdrawal addresses and fees. If unsure, seek guidance on how to sell Pi Coin Reddit threads but confirm advice with official Pi sources.

Whether you’re figuring out how to sell my Pi Coins or planning a first withdrawal, patience and verification are crucial. Selling Pi safely is better than selling it fast.

While official exchanges are still limited, some users explore how to sell Pi Coin through peer-to-peer (P2P) transactions. In this setup, you directly sell your Pi to another user instead of a centralized platform. Payments are often made in USDT, local currency, or goods and services. This method appeals to users researching how to sell Pi Coin in the US or regions where exchange access remains restricted.

Here’s how it generally works:

Although flexible, this approach requires trust and careful verification, as disputes can’t always be reversed on blockchain once executed.

Two popular community-backed solutions—PiBridge and PiChainMall—enable limited trading and internal value exchange. Users exploring how to sell my Pi Coin or how to sell Pi Coin 2024 often begin here:

| Platform | Features | Security Level | Suitable For |

|---|---|---|---|

| PiBridge | Hybrid DEX–P2P system with cross-chain conversion | Moderate (requires manual verification) | Users seeking early Pi–USDT swaps |

| PiChainMall | Marketplace allowing Pi payments for goods | Low–Medium (buyer–seller trust-based) | Merchants testing Pi’s utility |

Keep in mind these are experimental networks, not officially endorsed exchanges. Always verify contract addresses and user reputation before committing your Pi.

On forums like how to sell Pi Coin Reddit, experienced users warn that even trusted buyers may exploit beginners. Always double-check the buyer’s identity and proof of payment before releasing coins.

For many holders waiting for official listings, P2P trading offers temporary liquidity. It helps users who want to understand how to sell your Pi Coins before global exchanges open. However, without regulation or mediation, risk exposure remains high—scams, fake receipts, and failed transfers are common. Until exchanges like Binance or BitMart fully support Pi, exercising caution is essential for anyone learning how to sell my Pi Coins through informal markets.

Pi’s value is still speculative since it’s not yet openly listed on major exchanges. Estimates vary across unofficial P2P trades. Once the open mainnet launches, prices will stabilize, making it easier to calculate and track value for how to sell Pi Coin globally.

UK users can explore verified exchanges like BitMart once listings go live. Until then, P2P options via PiBridge or PiChainMall are possible but risky. Always confirm KYC and wallet migration before attempting how to sell Pi Coin in the UK or similar regions.

If your goal is short-term profit, waiting for exchange listings is wise. For believers in Pi’s ecosystem growth, holding may provide long-term benefits. Your decision depends on risk tolerance and understanding how to sell Pi Coins safely once official trading begins.

No. KYC verification is mandatory before migration and selling. Without it, transactions won’t be valid. Even if you know how to sell my Pi Coin on paper, Pi Network will block unverified transfers. Complete KYC first to protect your wallet and assets.

The process of how to sell Pi Coin requires patience, verification, and awareness. Completing KYC, migrating to the mainnet, and using trusted exchanges are crucial steps. While P2P trading offers early liquidity, official listings will provide safer, transparent options. Stay alert, verify all platforms, and sell only through legitimate Pi Network channels.

This heightened volatility signals uncertainty and can result in rapid and unpredictable price changes. For investors, this means both opportunities and risks are amplified, and the coming days could be pivotal.

There are several possible factors behind this spike in volatility. Speculation around the U.S. spot Bitcoin ETF approvals, shifting macroeconomic conditions, and upcoming central bank meetings are all contributing to the market's unpredictability. The geopolitical landscape and ongoing regulatory news also fuel uncertainty in crypto markets.

Bitcoin's price has shown sudden moves in recent weeks—jumping or dipping by thousands of dollars within hours. These quick changes are now reflected in the rising volatility index, making this a crucial time for both short-term traders and long-term holders to stay alert.

Traders should proceed with caution. A volatility index above 95% indicates turbulent conditions where prices may swing sharply in either direction. This could lead to sudden liquidations in leveraged positions or unexpected entry and exit points for spot traders.

To manage risk, traders might consider tightening stop-losses, reducing leverage, or simply waiting out this uncertain period. Meanwhile, seasoned investors often view such volatility as an opportunity—buying during dips and selling into rallies.

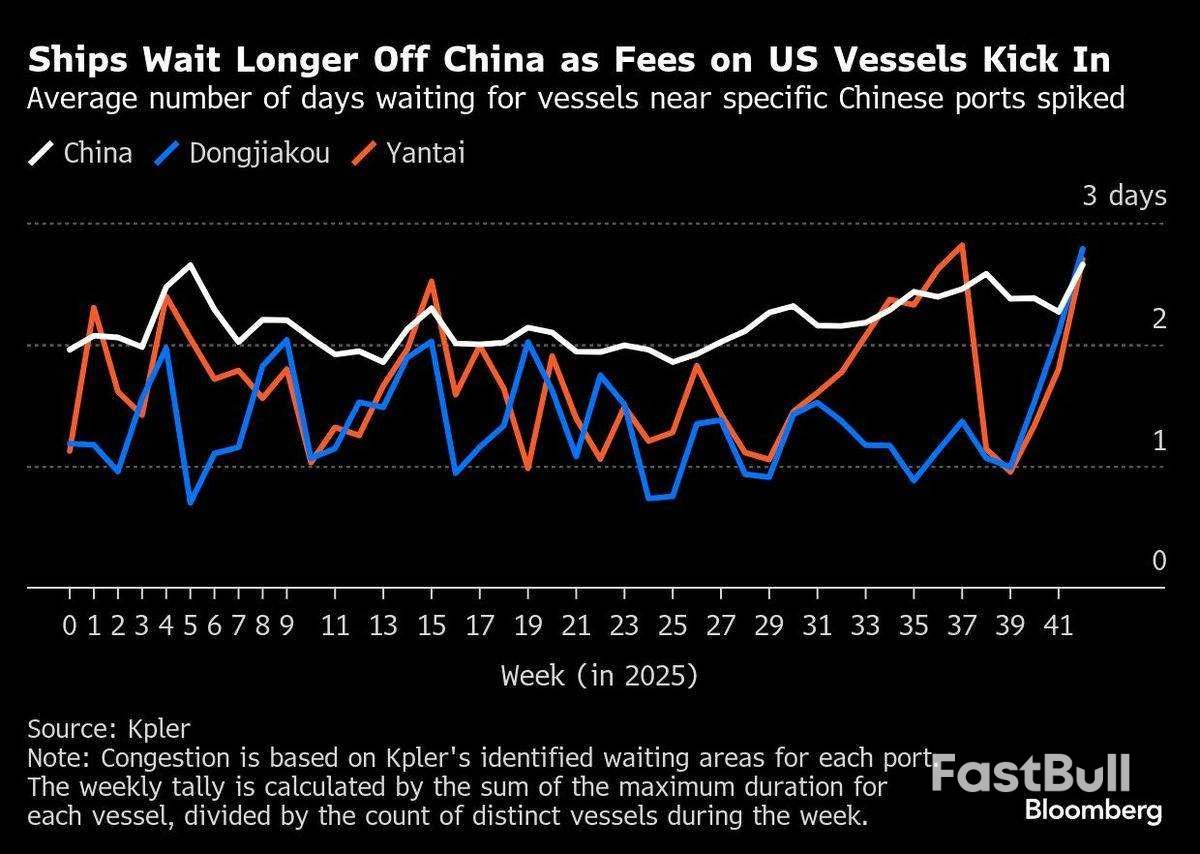

Waiting times for commodity vessels queued off China’s ports increased to the lengthiest this year, as geopolitical sparring between Beijing and Washington disrupts global trade.It took an average of 2.66 days for a vessel to get into a berth after arrival in the week to Oct 19, according to Bloomberg calculations based on data from ship-tracking platform Kpler on Tuesday (Oct 21). That’s an increase of 17% on the week and the longest period this year, the calculations show.

China has introduced a hefty extra fee on vessels known to have American links, following a similar US move. The maritime friction forms one part of the nations’ broader trade dispute and has left the shipping industry scrambling to prepare documents or find workarounds.Beijing's new levies came into effect last week, just days after the announcement. Among them, the requirement that any vessel with at least 25% American ownership is subject to the duties means that any owner or operator — regardless of whether they’re based in the US — could be impacted. That short lead time has prompted shipping companies to review their ownership structures, prepare required documents or swap out vessels.

The disruption jolted shipping markets as charterers and shipowners rushed to settle trades and book compliant ships. The cost to book a very large crude carrier on the benchmark Middle East-to-China route was near US$84,000 (RM355,278) as of Tuesday, 48% higher than on the day before the announcement.

China is the world’s largest commodity importer. Vessel snarls — if prolonged — could ripple through the global supply chain, affecting liquid cargoes such as crude, as well as bulk carriers like iron ore.The average cost to book Capesizes on major routes remained elevated on Tuesday, despite a carve-out unveiled by Beijing at the last minute that spares most of these large bulk carriers. Some 88 Capesize carriers were waiting to discharge in China in the first two weeks of October, up from 55 at end-September, according to BRS Shipbrokers analysis of AXSMarine data.

However, “port congestion is still comfortably within historical norms”, said Wilson Wirawan, BRS’s head of dry bulk research.In addition, Washington also imposed sanctions on a major oil-import terminal operator in China’s east, Rizhao. That move was the latest in a long line of moves aimed at frustrating shipments of crude oil from Iran to China.

Some oil hubs have seen wait times lengthen as tanker owners sought to comply with the new directives. Ships at Dongjiakou waited an average of 2.79 days last week, the second-highest period in Kpler figures as of Tuesday. Those at Yantai, meanwhile, idled for 2.7 days, up from about 1.8 the prior week.“Shipowners are thinking they should hold on and wait until they can enter the port,” said Matt Wright, freight analyst at Kpler. “There is still a great deal of uncertainty surrounding which owners face fees.”

In a report sent to Rigzone by the Macquarie team late Monday, Macquarie strategists, including Walt Chancellor, revealed that they are forecasting that U.S. crude inventories will be down by 2.5 million barrels for the week ending October 17.

“This follows a 3.5 million barrel build in the prior week, with the crude balance realizing modestly tighter than our expectations,” the strategists said in the report.

“For this week’s balance, from refineries, we model an increase in crude runs (+0.3 million barrels per day) following a surprisingly weak print last week; turnaround timing represents a source of meaningful potential variability in this week’s stats,” they added.

“Among net imports, we model a moderate reduction, with exports higher (+0.6 million barrels per day) and imports up slightly (+0.1 million barrels per day) on a nominal basis,” they continued.

The strategists also warned in the report that the timing of cargoes remains a source of potential volatility in this week’s crude balance.

“From implied domestic supply (prod.+adj.+transfers), we look for a slight decrease (-0.1 million barrels per day) on a nominal basis this week,” the strategists went on to note.

“Rounding out the picture, we anticipate a slightly larger increase (+0.9 million barrels) in SPR [Strategic Petroleum Reserve] stocks this week,” they added.

The strategists stated in the report that, “among products”, they “look for draws in gasoline (-4.0 million barrels) and distillate (-1.2 million barrels), with a build in jet (+0.5 million barrels)”.

“We model implied demand for these three products at ~14.4 million barrels per day for the week ending October 17,” the strategists added.

In its latest weekly petroleum status report at the time of writing, which was released on October 16 and included data for the week ending October 10, the U.S. Energy Information Administration (EIA) highlighted that U.S. commercial crude oil inventories, excluding those in the SPR, increased by 3.5 million barrels from the week ending October 3 to the week ending October 10.

The EIA report showed that crude oil stocks, not including the SPR, stood at 423.8 million barrels on October 10, 420.3 million barrels on October 3, and 420.6 million barrels on October 11, 2024. Crude oil in the SPR stood at 407.7 million barrels on October 10, 407.0 million barrels on October 3, and 383.9 million barrels on October 11, 2024, the report revealed.

Total petroleum stocks - including crude oil, total motor gasoline, fuel ethanol, kerosene type jet fuel, distillate fuel oil, residual fuel oil, propane/propylene, and other oils - stood at 1.696 billion barrels on October 10, the report highlighted. Total petroleum stocks were up 2.4 million barrels week on week and up 60.7 million barrels year on year, the report showed.

Frank Walbaum, a market analyst at Naga, defined the crude inventory build of 3.5 million barrels as “larger than expected” in a market analysis sent to Rigzone on October 17.

In a Skandinaviska Enskilda Banken AB (SEB) report sent to Rigzone by the SEB team on October 16, which focused on the EIA’s latest weekly petroleum status report at the time of writing, Ole R. Hvalbye, Commodities Analyst at the company, highlighted that, “in total, commercial petroleum inventories (excluding SPR) increased by 1.7 million barrels on the week”.

“The build was not as large inventory build as API [American Petroleum Institute] indicated … [Wednesday] night, but still up in total (including SPR) 2.4 million barrels vs normal decline of about 2.4 million barrels this time of year,” he added.

In an oil and gas report sent to Rigzone on October 13 by the Macquarie team, Macquarie strategists, including Walt Chancellor, revealed that they were forecasting that U.S. crude inventories would be up by 5.2 million barrels for the week ending October 10.

The EIA’s next weekly petroleum status report is scheduled to be released on October 22. It will include data for the week ending October 17.

In its weekly petroleum status report, the EIA describes itself as the independent statistical and analytical agency within the Department of Energy. Although the White House website highlights that the U.S. government is currently shut down, a banner visible on the EIA website on Wednesday states that the EIA “is continuing normal publication schedules and data collection until further notice”.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up