Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Find out how much money you need to buy a stock or start investing in 2025. Understand minimum amounts, fees, and simple ways to invest with little money.

Many beginners wonder how much money do you need to start investing and whether small amounts can really make a difference. The truth is, modern brokers and fractional shares have lowered the entry barrier, allowing anyone to buy stocks with just a few dollars. This guide explains how much you actually need, what affects that amount, and how to invest smartly in 2025.

Understanding how much money you need to begin investing is not a one-size-fits-all answer. It depends on several financial, technical, and personal factors that shape your investment capacity and goals. Below are the main elements that determine your starting point.

Every stock has a different market value. Some blue-chip companies like Apple or Microsoft trade above $150 per share, while smaller or newer firms may trade under $10. If your broker only allows full-share purchases, you will need at least the price of one whole share to begin. However, many modern platforms now offer fractional shares, letting you start with just a few dollars.

Example: If Apple trades at $170, buying 0.1 share costs only $17, making stock ownership more accessible than ever.

Your choice of brokerage directly affects how much money you need to start trading stocks. Traditional brokers such as Fidelity or Charles Schwab may require higher minimum deposits, often between $100 and $500, while online and app-based brokers like Robinhood, SoFi, or Public often have no account minimums and let you invest as little as $1.

When deciding where to open an account, prioritize low or zero commissions, ease of use, and strong regulation by agencies such as the SEC, FCA, or ASIC.

Different account types influence your initial deposit and investment flexibility.

Each has unique benefits, tax rules, and risk profiles, all of which affect how much money you need to start investing effectively.

Even though most brokers advertise zero-commission trading, there can still be small costs such as:

While each fee may seem minor, they can add up over time. Understanding the full cost structure helps you estimate your true investment amount.

How much you start with depends on how you plan to invest.

Your time horizon and risk tolerance determine not just how much you invest initially, but how consistently you grow it.

Your own budget plays a critical role. Before investing, make sure you have an emergency fund that covers three to six months of expenses and have managed any high-interest debts. The amount you invest should never compromise your daily financial stability.

Even $20 to $50 monthly contributions can compound significantly over years, proving that starting small is better than waiting for the “right amount.”

The good news is that there is no universal minimum to start investing anymore. It largely depends on your broker, stock choice, and whether fractional shares are available. Here is what beginners should know in 2025.

In the past, you needed hundreds of dollars to buy your first stock. Today, fractional trading means you can start with as little as $1. Traditional full-share models require you to buy at least one share at its full price, for example Tesla at $250, while fractional share models allow you to buy a small percentage of that share, such as $10 worth of Tesla. This makes it easier for anyone, regardless of income, to begin investing early.

This directly addresses the question of how much money you need to start investing in a modern context.

Depending on your comfort and platform, these benchmarks help gauge where to begin.

The key is not the amount but the habit. Consistent investing, even in small amounts, often beats waiting for the perfect time.

While buying stocks is inexpensive today, maintaining an account can include:

Understanding these factors ensures you know how much money you need to start trading stocks realistically—not just the purchase price of shares.

Different brokers have different entry requirements. Comparing minimum deposits and features helps you choose the most suitable one.

Choose a platform that matches your investing style—low-cost, secure, and easy to navigate.

Even if you can start with just $1, the real minimum investment is your consistency and willingness to learn. Compounding works best when you stay invested, reinvest dividends, and gradually increase your contributions.

As Warren Buffett said, “The best investment you can make is in yourself.” Start small, stay steady, and your results will grow faster than you expect.

There is no fixed rule for how much money you need to start investing—modern brokers let you begin with almost any amount. The real focus should be on habits, diversification, and learning. Start now, invest consistently, and scale gradually.

You don’t need a large sum to begin investing. Thanks to fractional shares, zero-commission brokers, and automated plans, anyone can start buying stocks with minimal funds. The key is to follow simple, practical steps and stay consistent.

Fractional investing lets you buy part of a share instead of the whole stock. This means you can invest in major companies like Apple (AAPL), Tesla (TSLA), or Nvidia (NVDA) with as little as $10. Most brokers such as Robinhood and Fidelity support this feature, allowing beginners to start learning without needing a large deposit.

Set up an automatic plan to invest a fixed amount—like $20 or $50 per month. This method, known as Dollar-Cost Averaging (DCA), helps reduce timing risks and builds discipline. Over time, small consistent contributions can grow through compounding.

Choose platforms with no account minimums and transparent fees. For U.S. investors, Robinhood, SoFi Invest, or Fidelity are great options; global users can explore eToro or Interactive Brokers. Always check for regulation and safety before funding your account—these details matter as much as how much money you need to start investing.

If buying individual stocks feels risky, start with low-cost ETFs. Funds tracking the S&P 500 or Nasdaq 100 give instant diversification and can be purchased for $10–$20 per trade. This spreads risk and helps new investors participate in broader market growth.

Many brokers offer demo accounts or educational tools. Use them to understand market basics and test trades without risk. This preparation helps you decide how much money you need to start trading stocks confidently when you switch to real investing.

Successful investing isn’t about starting big—it’s about staying steady. Reinvest dividends, review your progress quarterly, and increase contributions as your income grows. Whether it’s $10 or $1,000, the habit you build today shapes your future wealth.

Yes. With fractional shares, $100 can buy parts of major stocks like Apple or Tesla. It’s a solid way to start small and build experience.

Yes. £1000 is enough to open an account on Freetrade or eToro and create a basic diversified portfolio.

You’ll own a small fractional share. It’s low risk and helps you learn how markets and prices move.

There is no fixed rule for how much money you need to start investing. What matters most is consistency, patience, and the willingness to start now rather than waiting. Thanks to modern brokers and technology, anyone can begin investing with minimal funds and build wealth steadily over time.

Consumer price inflation rose 2.2% in the eurozone on an annual basis in September, data confirmed earlier Friday, offering the European Central Bank few reasons to further ease monetary policy.

The eurozone’s consumer price index (CPI) rose by 2.2% annually last month, up from 2.0% in September, confirming the flash release seen earlier this month.

Month-on-month, the reading gained 0.1% last month after posting a similar gain of 0.1% in August.

Stripping out more volatile items like food and fuel, the "core" number rose to 2.4% in the twelve months to September, increasing from 2.3% in the prior month.

The ECB has cut interest rates by two percentage points in the year to June but has been on hold ever since, arguing that inflation was now sufficiently close to its 2% target and there was no urgency in adjusting rates further.

It is widely expected to keep rates unchanged at its next meeting at the end of the month.

The ECB should keep interest rates steady as long as inflation is close to 2% and should not try to overengineer policy in case of small deviations from its target, Austrian central bank chief Martin Kocher said on Thursday.

While inflation has hovered around 2% for months, projections show it dipping to 1.7% next year before a rebound in subsequent years, raising concerns among some policymakers about undershooting.

"For me, this is close to the target. We should not overreact in either direction," Kocher, one of the newest members of the ECB’s rate-setting Governing Council, told a conference. "If you’re slightly above the target, overreaction is not advisable, in my view."

His colleague Primoz Dolenc, Slovenia’s acting central bank, added that the ECB should now hold interest rates steady unless new shocks hit.

"If there are no new economic shocks, I think that leaving the monetary policy stance as is would be the right thing to do going forward," Dolenc said. "It’s a stance that neither fuels inflationary pressures nor restricts economic growth."

Understanding how old do you have to be to buy stocks is the first step toward building financial independence. Most countries set a legal minimum age for opening a brokerage account, but young investors can still start early through custodial or educational investment options. This guide explains the legal requirements, available account types, and smart ways to begin investing before turning 18.

Understanding the legal age to buy or trade stocks is the first step toward responsible investing. Many young people are eager to begin building wealth early, but before opening a brokerage account, it’s essential to know the age limits and legal rules that apply in different countries.

Each country sets its own age requirement for investing in the stock market. In most regions, individuals must be 18 years old to legally buy, trade, or own stocks in their name. However, there are some exceptions and specific account types that allow minors to participate under parental supervision.

| Country | Legal Age to Buy Stocks | Minor Investment Options | Notes / Regulatory Authority |

|---|---|---|---|

| United States | 18 years | Custodial Accounts (UGMA/UTMA) | Governed by SEC and state laws; minors can invest under a guardian’s management. |

| United Kingdom | 18 years | Junior ISA, Child Trust Fund | FCA oversees market activity; parents can invest on behalf of children. |

| Canada | 18 or 19 (depending on province) | Informal trust or RESP accounts | Regulated by IIROC; minors can invest via parent/guardian accounts. |

| Australia | 18 years | Minor trading accounts under adult supervision | Overseen by ASIC; parents manage investments until the child turns 18. |

| New Zealand | 18 years | Joint or custodial accounts | FMA governs stock trading; minors may hold assets jointly with a parent. |

This overview helps answer a common question — how old do you have to be to buy stocks — and shows that while most countries require investors to reach legal adulthood, minors still have ways to start learning and investing early.

Minors are legally considered incapable of entering binding financial contracts, including opening a brokerage or trading account. Stock investing involves signing agreements with brokers, assuming liability, and managing real financial risk — responsibilities that the law reserves for adults.

This limitation is designed to protect young investors from impulsive trading, fraud, or financial mismanagement. Instead, young people interested in investing can do so through supervised or educational accounts until they reach the minimum age allowed by their country.

If you’re wondering how old do you have to be to trade stocks or open an online trading platform, the answer is generally 18, though parental or custodial structures make earlier exposure possible.

In the United States, minors can still invest legally through custodial accounts, such as UGMA (Uniform Gifts to Minors Act) or UTMA (Uniform Transfers to Minors Act).

These accounts are opened by an adult — typically a parent or guardian — who manages the assets until the minor reaches the age of majority (usually 18 or 21, depending on the state). The assets legally belong to the child, but the custodian controls investment decisions until the handover age.

Custodial accounts are one of the safest and most educational ways for teens to gain early exposure to investing. They allow young investors to buy stocks, track performance, and learn about market trends, while still having a responsible adult manage the financial side.

This setup helps bridge the gap between curiosity and capability — making it an ideal solution for those asking how old do you have to invest in stocks or how old do you have to be to purchase stocks safely.

Buying your first stock isn’t just clicking “Buy”. It’s choosing the right broker, understanding orders, and managing risk. Whether you’ve just reached the legal investing age (e.g., how old do you have to be to buy stocks) or you’re returning to markets, follow the steps below to build a disciplined process.

If you’re wondering how old do you have to be to trade stocks, most regions require 18 (some 19–21). Minors use custodial/guardian accounts until reaching majority.

Diversified ETFs can be a simpler first step than single-stock selection.

Knowing how old do you have to be to purchase stocks gets you through the door; mastering process and risk management keeps you in the game.

Even if you’re under 18 and can’t open a standard brokerage account, there are still smart ways to start learning and participating in investing early. Understanding these options can prepare you for financial independence and help you develop long-term habits.

Before you reach the legal age to invest directly, you can explore several structured ways to begin. Each option offers different levels of control, responsibility, and risk exposure while giving minors access to real market learning.

A custodial account—such as a UGMA or UTMA—allows a parent or guardian to manage investments on your behalf until you reach adulthood. It’s one of the most practical answers to the question “how old do you have to be to buy stocks”, since minors can’t trade independently but can legally own assets under supervision.

For young investors starting small, fractional shares and ETFs provide affordable exposure to the stock market. Even if you’re too young to buy individual shares, these tools—available on many modern apps—let you invest in diversified assets once you meet the minimum age or through a guardian account.

If you’re not ready or eligible to invest real money, practice with virtual trading platforms. These simulators teach you how old do you have to be to trade stocks isn’t the main limitation—it’s about understanding market psychology, price movement, and risk. Building this skill early gives you a strong advantage once you begin real investing.

No, you generally cannot buy stocks directly at 16 because minors under 18 cannot legally open a brokerage account in most countries. However, you can invest through a custodial account managed by a parent or guardian, which allows you to own assets until you reach the legal age. This is often how young investors get early exposure to the market while learning how old do you have to be to buy stocks in practice.

In the UK, individuals under 18 cannot open a standard investment account, but they can use a Junior ISA (Individual Savings Account) or a child trust fund. Parents or guardians manage these accounts, and the funds legally belong to the child once they turn 18. This makes it one of the most common ways to start investing early in the UK.

Yes — investing $100 is absolutely worth it, especially for beginners. With fractional shares and commission-free trading platforms, you can start small, diversify your holdings, and learn how markets work. What matters most isn’t the amount but building consistent investing habits that grow over time.

Knowing how old do you have to be to buy stocks helps you plan your investment journey wisely. Whether you’re a teen exploring custodial accounts or an adult opening your first brokerage account, understanding age rules, account options, and investing tools ensures a confident start in building long-term wealth.

Key points:

International investors have shown renewed interest in Germany at this week's IMF meetings in Washington, but Europe's fragmented regulatory framework is holding them back, the head of the Association of German Banks told Reuters."Many are holding back because Europe is still a patchwork of different national regulations," Heiner Herkenhoff said in an interview on the sidelines of the International Monetary Fund gathering. "We urgently need to address this."He called for a unified and liquid capital market in Europe. "Unfortunately, we've been working on that for far too long already," Herkenhoff said.

International investors are showing more interest in Germany following the new government's announcement of a 500 billion euro ($585 billion) infrastructure fund to modernise the country.

"There is momentum that we should seize," Herkenhoff said.

Reviving growth in Europe's largest economy is Chancellor Friedrich Merz's top priority after two years of economic contraction. The government says Germany needs to attract more private capital to complement the surge in public spending, making it crucial to improve Germany's appeal to investors.

The number of foreign investments in Germany fell in 2024 for the third year in a row.

Finance Minister Lars Klingbeil met around 50 investors on Thursday in Washington at an event hosted by the British bank Barclays. Amid heightened global uncertainty and rising U.S. protectionism, Berlin is seeking to position Germany as a safe, predictable destination for investors.Investments in climate protection, renewable energy, defence and artificial intelligence are particularly in demand, Herkenhoff said.Securitisations, in which loans are bundled together and then sold, could also help attract investors. However, Herkenhoff said the most recent proposals from the European Commission in this area were complex.

"It is also important that capital requirements are not further tightened - otherwise demand would drop significantly," Herkenhoff said.

Bitcoin dropped below $106,000 in early European hours Friday, with nearly $1.2 billion in crypto positions wiped out over the past 24 hours.Data shows that most of the damage came from long positions, reflecting how aggressively traders had positioned for a bounce earlier in the week.According to CoinGlass, almost 79% of total liquidations were long trades, affecting more than 307,000 accounts. The largest single hit was a $20.4 million ETH-USD long on Hyperliquid, a decentralized derivatives exchange that has quietly become one of the main engines of leveraged trading in crypto.

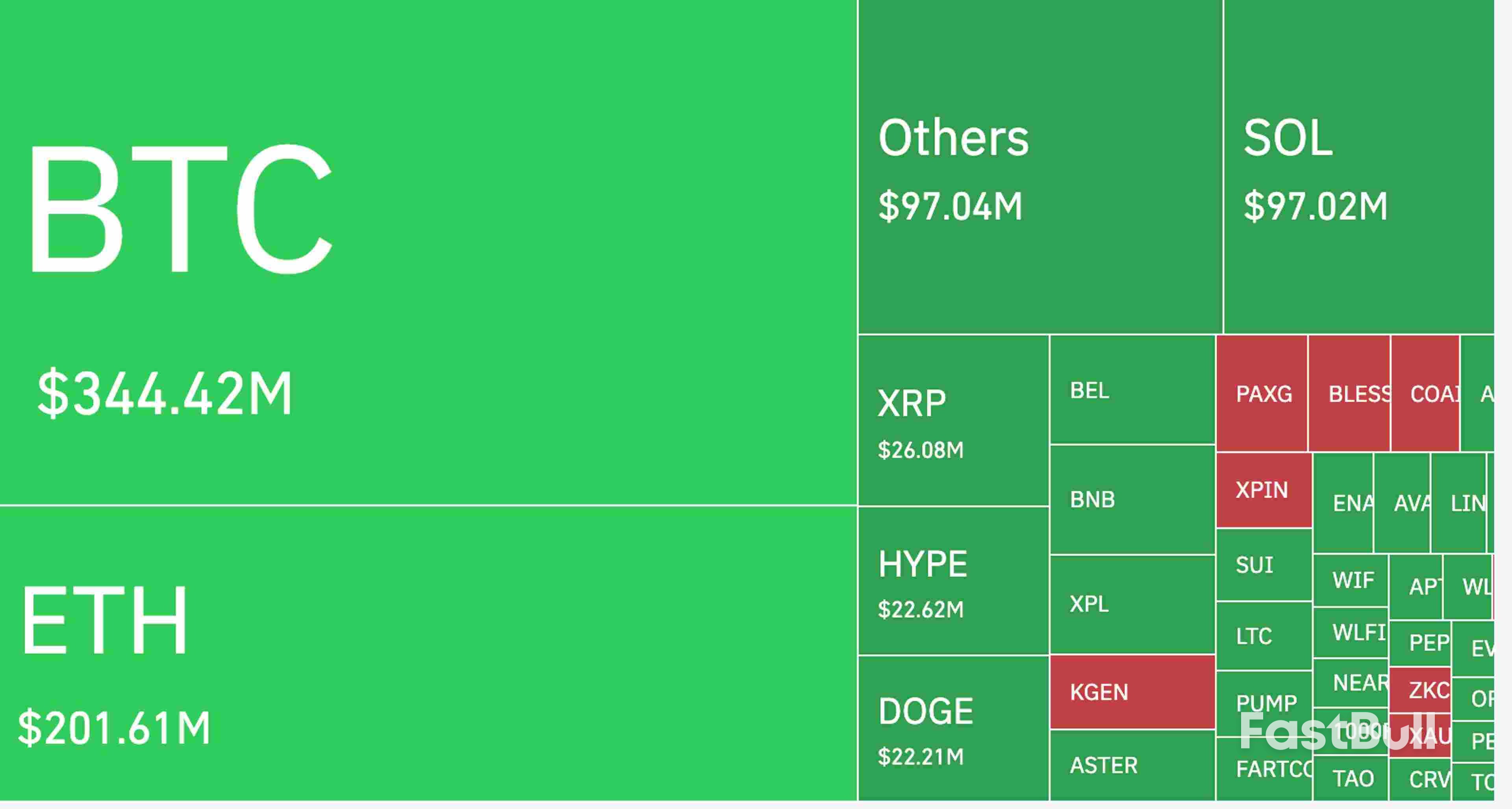

(CoinGlass)

Bitcoin accounted for roughly $344 million in losses, followed by Ether at $201 million, and Solana SOL$180.48 at $97 million. XRP, DOGE$0.1823 and other high-beta tokens each saw tens of millions more cleared from open interest.

Across exchanges, Hyperliquid saw the most activity at $391 million, followed by Bybit at $300 million, Binance at $259 million, and OKX at $99 million. That mix shows how on-chain venues are now sitting side by side with traditional trading platforms during major market resets.Liquidations occur when traders using borrowed money to amplify positions can no longer meet margin requirements. In simple terms, if the market moves too far against a leveraged bet, the position is forcibly closed to prevent further losses.

These events can turn into cascading sell-offs when large clusters of stop orders trigger at once, creating what traders call a “liquidation loop.”Such loops are often tracked through liquidation heatmaps and open interest data, which can show where large concentrations of leverage sit in the market. When price approaches these zones, traders watch closely for potential squeeze or unwind events that can define the next directional move.

Bitcoin’s decline began late Thursday as prices slipped through the $107,000 level, setting off a chain of forced closures that rippled through derivatives markets.The move comes against a tense macro backdrop. Renewed friction between the U.S. and China has dented risk appetite, while a stronger yen and weaker gold prices have added to the uncertainty. Bitcoin has now given back most of its early-week gains, while ether trades just below $3,900, down about 4% on the day.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up