Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

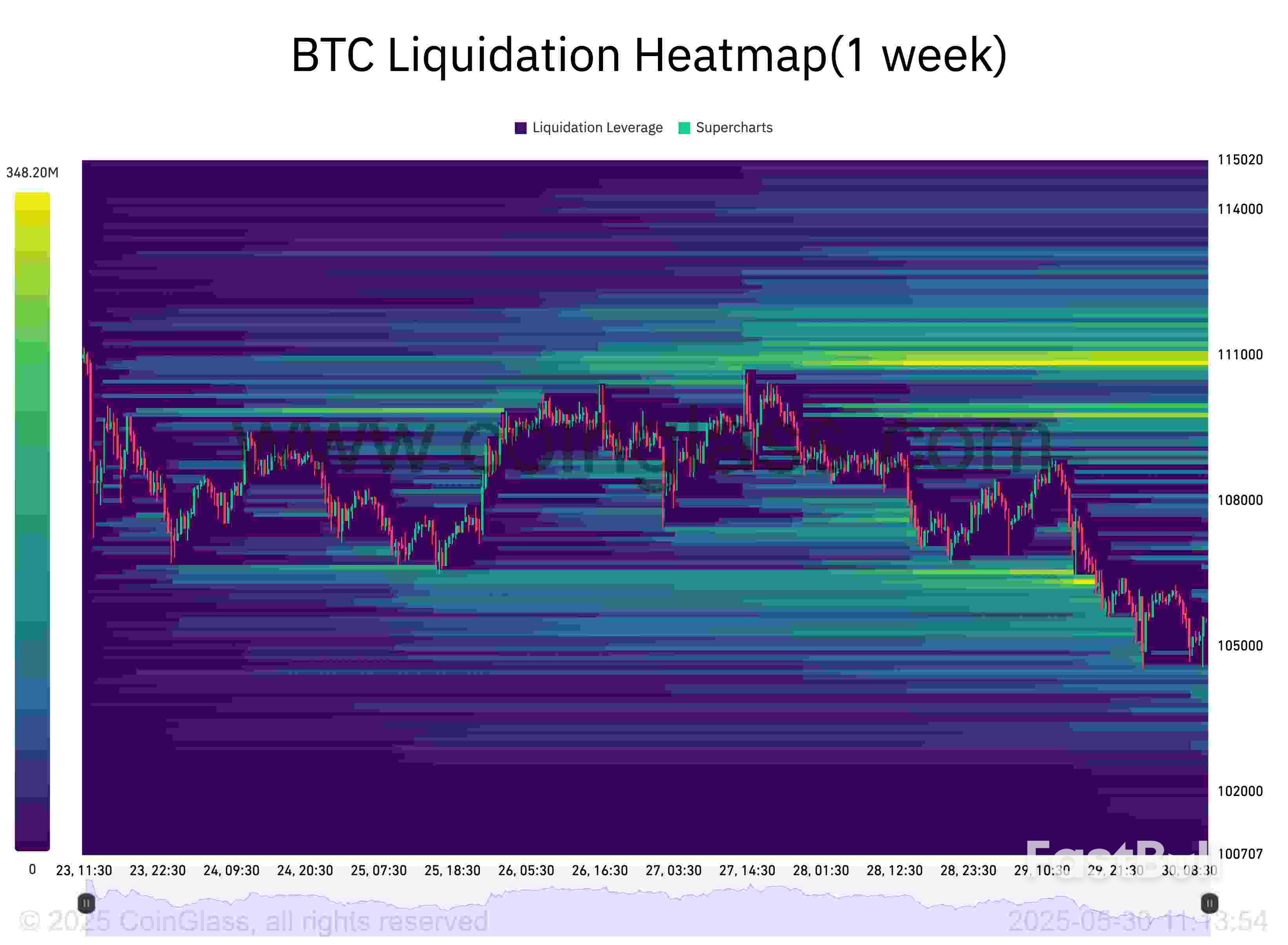

Bitcoin has dropped 10% since its latest all-time highs — how much lower could BTC price action go before setting a local bottom?

Source: Roman/X

Source: Roman/X

BTC/USD chart with 111-day, 200-day SMA, short-term holder cost basis. Source: Glassnode

BTC/USD chart with 111-day, 200-day SMA, short-term holder cost basis. Source: GlassnodeHOUSTON, May 30 (Reuters) - Oil prices fell on Friday and headed for a second consecutive weekly loss, as investors weigh a potentially larger OPEC+ output hike for July, and uncertainty spreads around U.S. tariff policy after the latest courtroom twist.

Brent crude futures fell by 21 cents, or 0.33%, to $63.94 a barrel by 1451 GMT. U.S. West Texas Intermediate crude fell by 34 cents, or 0.56%, to $60.60 a barrel.

The Brent July futures contract is due to expire on Friday. The more liquid August contract was trading 43 cents lower, or 0.71%, at $59.77 a barrel.

At these levels, the front-month benchmark contracts were headed for weekly losses over 1%.

Price moves dipped into negative territory after Reuters reported that OPEC+ may discuss an increase in July output larger than the 411,000 barrels per day (bpd) that the group had made for May and June.

"The oil price would probably only come under greater pressure if the oil-producing countries were to increase their production even more than in previous months or give indications that there will be similarly high production increases in the following months," Commerzbank analysts said earlier on Friday in a note, published before the news.

Senior Analyst Phil Flynn with Price Futures Group said an online post on Truth Social by U.S. President Donald Trump that seemed to threaten more changes in tariff levels for Chinese imports also put pressure on crude prices.

"Trump's Truth Social message on China failing to observe a truce on tariffs also combined with the Reuters headline to push prices down," Flynn said.

The potential OPEC+ output hike comes as the global surplus has widened to 2.2 million bpd, likely necessitating a price adjustment to prompt a supply-side response and restore balance, said JPMorgan analysts in a note, adding that they expect prices to remain within the current range before easing into the high $50s by year-end.

Trump's tariffs were expected to remain in effect after a federal appeals court temporarily reinstated them on Thursday, reversing a trade court's decision a day earlier to put an immediate block on the sweeping duties.

Oil prices were down more than 1% on Thursday.

Oil prices have lost more than 10% since Trump announced his "Liberation Day" tariffs on April 2.

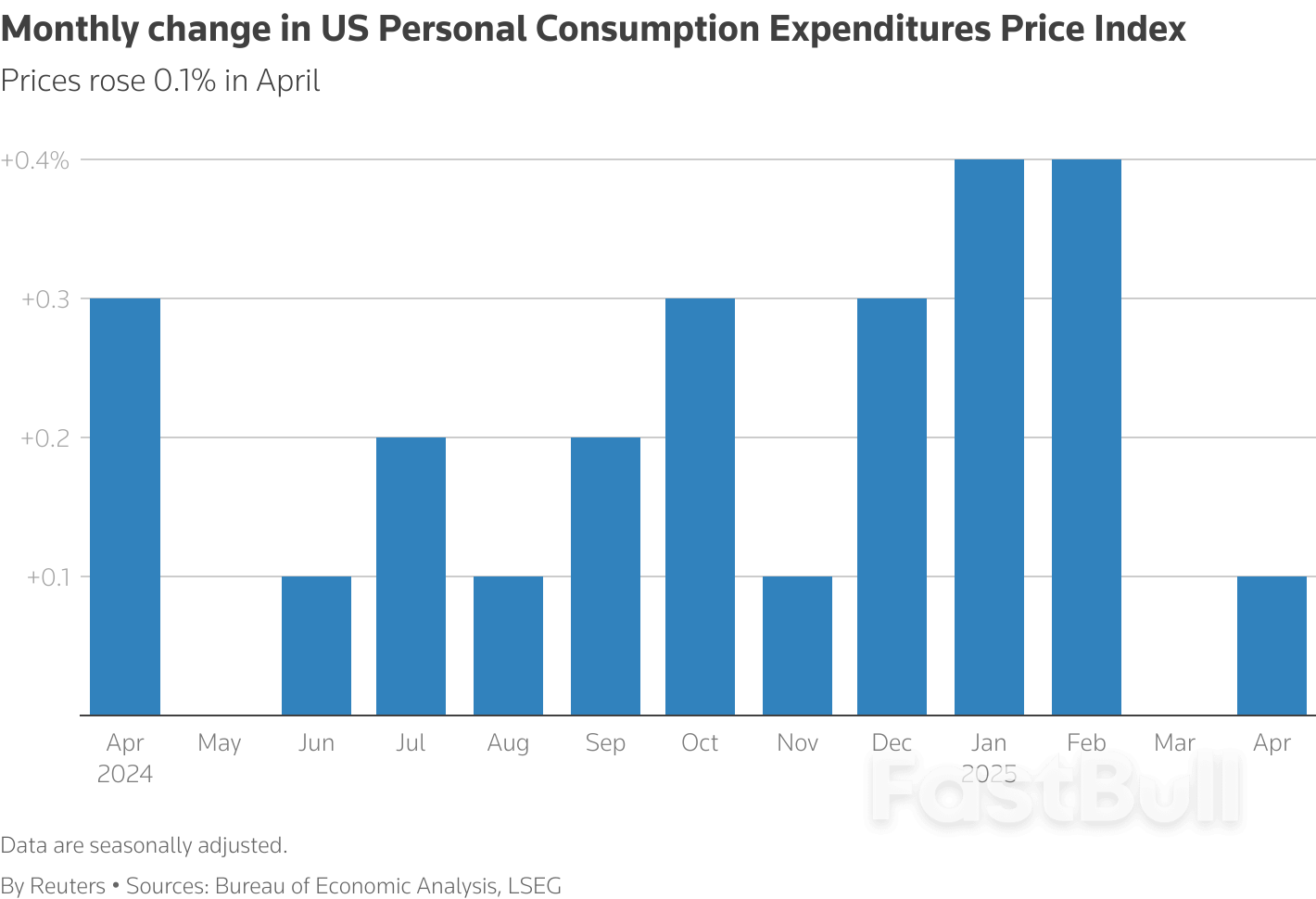

Also pressuring prices, U.S. consumer spending slowed in April, according to data published on Friday.

Federal Reserve policymakers wary of cutting interest rates in the face of President Donald Trump's aggressive tariffs will likely stick to their wait-and-see stance amid fresh data Friday showing muted inflation last month and evidence of increased consumer caution.

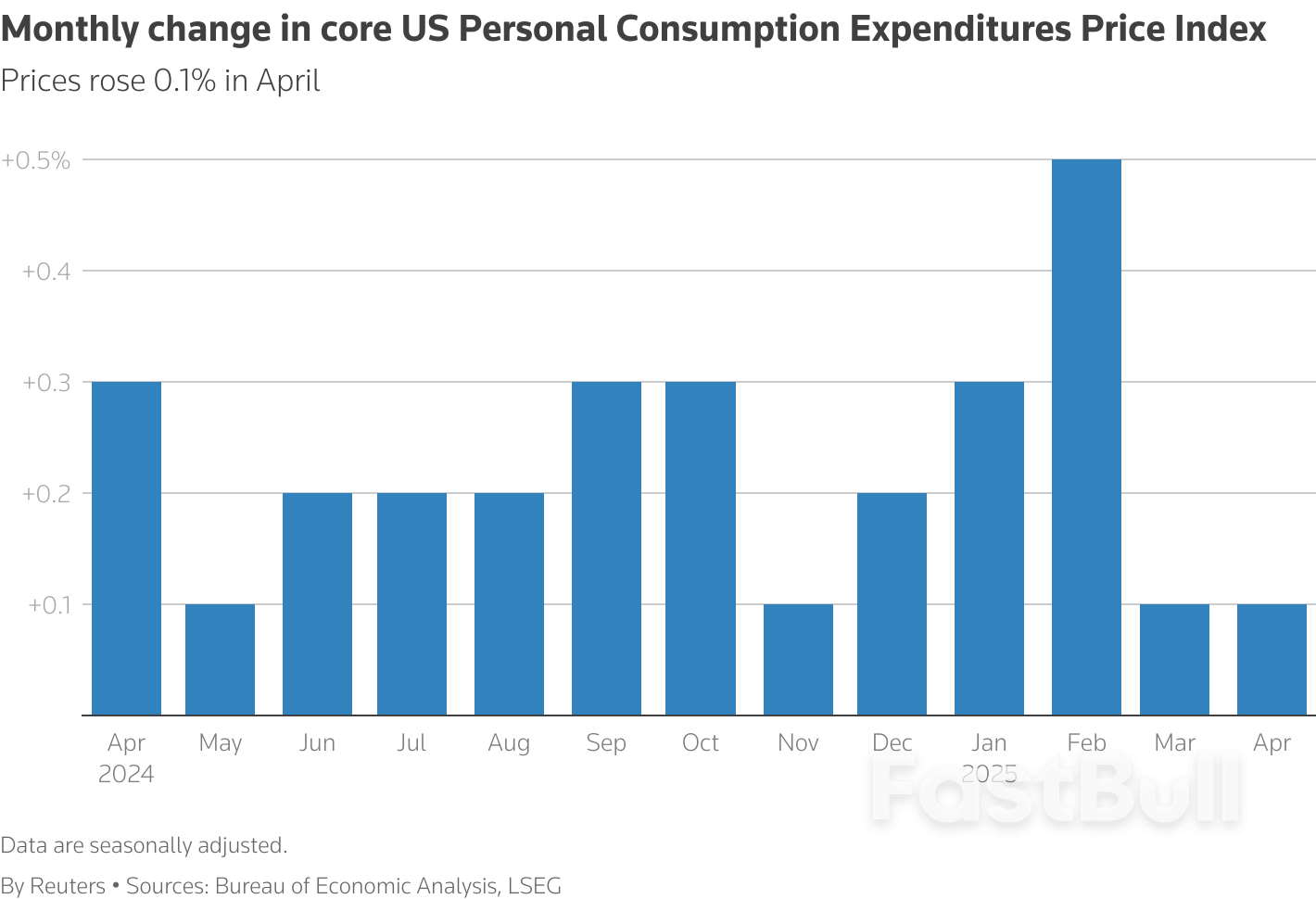

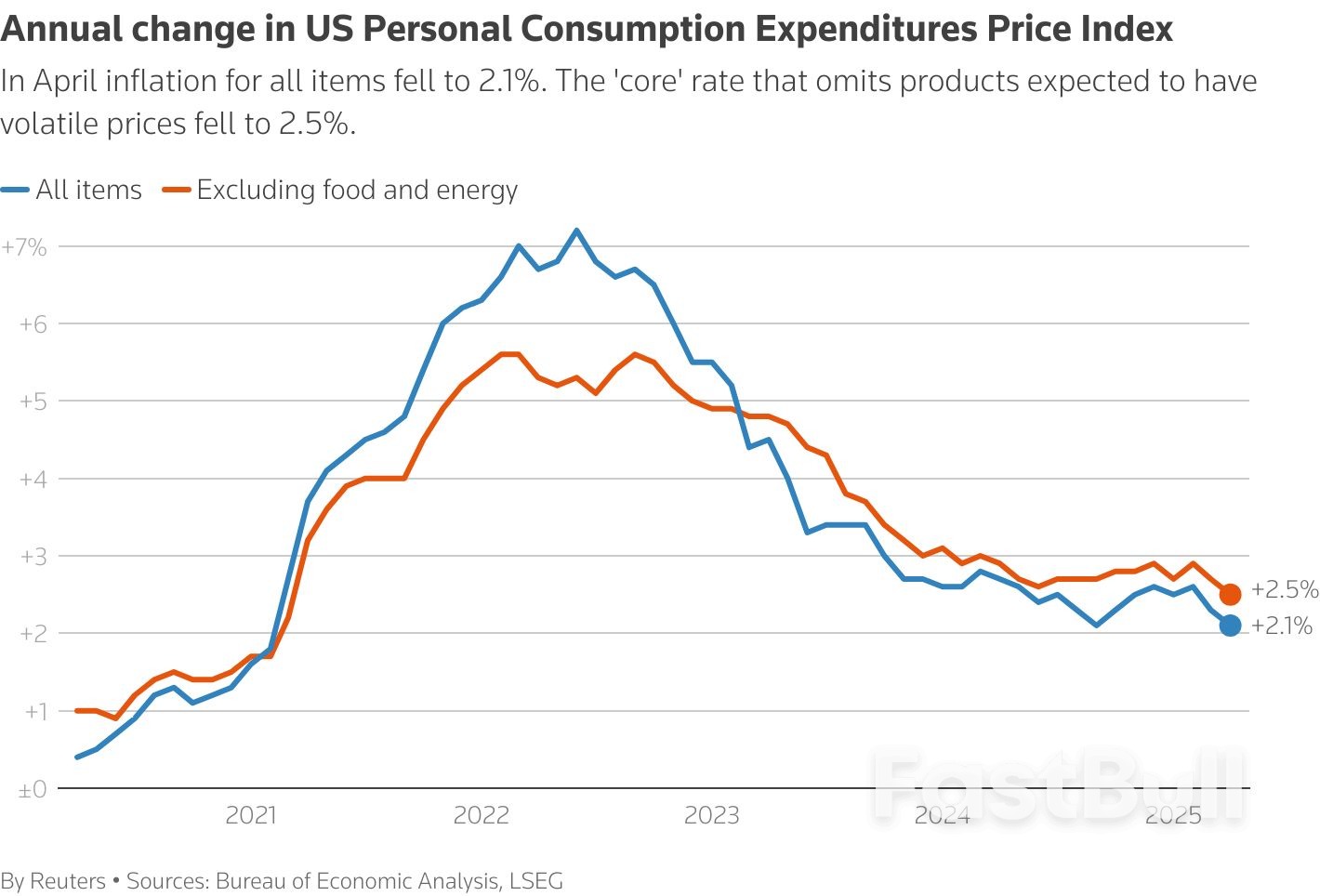

April's 2.1% year-over year increase in the Personal Consumption Expenditure price index, down from 2.3% in March, puts inflation within a stone's throw of the Fed's 2% target.But analysts don't see that trend continuing, with businesses expected to pass on to consumers at least some of their rising costs from higher import levies. Already goods prices are firming, the report showed.

"The Fed will welcome the favorable inflation reading in this report, but they are likely to interpret it as the calm before the storm," said Olu Sonola, who heads U.S. economic research at Fitch Ratings. The central bank will continue to wait for the storm, unless consumer spending buckles and the unemployment rate rises rapidly, Sonula added.

Consumer spending growth slowed to 0.2% last month, the Commerce Department also said on Friday, and the personal saving rate jumped to 4.9% from 4.3%. Analysts saw both as signs of renewed consumer caution amid uncertainty over tariff policy that continues to change on a near-daily basis.

For the Fed, wrote III Capital Management's Karim Basta, there's "nothing to do but wait."

The Fed has kept short-term borrowing costs in the 4.25%-4.50% range since last December. Since their last meeting, in May, policymakers have repeatedly voiced concerns that tariffs could reverse progress on inflation.

"As long as inflation is printing above target and there's some uncertainty about how quickly it can come back down to 2%, well, then inflation is going to be my focus because the labor market's in solid shape," San Francisco Fed President Mary Daly told Reuters late Thursday, adding that rates need to stay moderately restrictive to keep that pressure on prices.

Dallas Fed President Lorie Logan late Thursday similarly said it could be "quite some time" before it's clear if Trump's policies pose bigger risks to employment or to inflation; for now, she said, the risks are in rough balance, leaving the Fed on hold.

Traders after the data continued to bet that by September the Fed will begin cutting rates gradually, bringing the policy rate down to 3.75%-4.0% by year's end.

The best week for the dollar in three months isn’t enough to reverse its broader declines as US trade and policy uncertainty weighs on sentiment.

A gauge of dollar strength is on track for its longest monthly losing streak in five years despite being up 0.4% so far this week. Investors were focused on a proposed US measure that would hit companies from countries deemed to have “discriminatory” tax policies.

“If the bill as presently written takes effect, it would deter foreign investment in US assets at a time when the country faces increasing reliance on foreign capital to finance its ballooning debt,” wrote Elias Haddad, a strategist at Brown Brothers Harriman & Co. in a note. “Clearly, this is not good for the dollar.”

Concern that President Donald Trump’s erratic trade policies will undermine the economy are adding to the greenback’s weakness and eroding its appeal as a traditional haven bet. A court battle is underway over the legality of Trump’s sweeping tariffs — though the US administration insists they’re here to stay.

The Bloomberg Dollar Spot Index pared earlier gains to trade up 0.1% on Friday as reports showed US consumers hitting the brakes on spending in April while goods imports plummeted by a record as companies adjusted to higher tariffs. US consumer sentiment rebounded in late May, according to the University of Michigan.

The latest data is “still insufficient for the Federal Reserve to seriously consider its cuts,” said Yusuke Miyairi, a foreign-exchange strategist at Nomura. “Choppy price action in the dollar continues, owing to the market following back-and-forth tariff headlines.”

Earlier in the week, stronger-than-expected economic data lifted the dollar amid a global bond rally. But on Thursday, the greenback weakened after weak jobs results.

Meanwhile, a gauge of emerging-market currencies is on track for its first weekly loss since mid-April as investors scale back on risk following recent gains. The South African rand slumped more than 1% against the dollar on Friday.

While currencies including the rand and Mexico’s peso have strengthened more than 4% against the greenback since Trump unveiled his comprehensive list of tariffs, traders are taking some profits amid renewed global trade noise.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up