Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China once stood at the center of global supply chains. Yet its role in U.S. trade has been shrinking fast. A decade ago, nearly 90% of supplier volume came from China, Hong Kong, and Korea.

China once stood at the center of global supply chains. Yet its role in U.S. trade has been shrinking fast. A decade ago, nearly 90% of supplier volume came from China, Hong Kong, and Korea. Today that share sits closer to 50%. Trump's first tariff push triggered the shift, and companies have kept moving ever since. Now trade flows look different, and the numbers tell a clear story.

Chinese exports to the U.S. dropped almost 29% in November alone. This marked the eighth straight month of double-digit declines. Even a recent trade truce has not reversed the fall. U.S. tariffs remain much higher on Chinese goods than on many other countries, so firms keep routing shipments through third markets. As a result, China sells less directly to America, even while selling more to Southeast Asia and Europe.

Trump's tariff strategy pushed companies to search for new manufacturing hubs. They found them in Vietnam, Indonesia, Thailand, India, and Malaysia. Together these countries now take a growing share of work once done in China. Wells Fargo data shows supplier diversification nearly doubled after the first tariff wave. Today the shift has reached a tipping point.

China's exports to South Asia have jumped sharply. For example, exports to Indonesia rose over 29% this year, while shipments to Vietnam and India also surged. But this growth masks the broader trend: more goods now move through Asia before reaching the U.S. Meanwhile, Vietnam's shipments to America are up 23%, and Thailand's rose more than 9%. Each increase shows how global trade routes keep reshaping as firms avoid U.S. tariffs tied to China. These corridors may become a permanent part of the new trade landscape.

The tariff fight has not only shifted trade. It has strained U.S. corporate finances. Companies rushed to front-load inventories early in 2025 before Trump's tariff expansion took effect. Now that stockpile is nearly gone. As new shipments face higher levies, cash flow tightens.

Many importers can no longer negotiate better prices because their industries run on thin margins. Retail, apparel, and generic pharmaceuticals face the hardest squeeze. As a result, firms seek new financing tools to manage rising costs. Banks such as HSBC report a sharp jump in demand for trade finance. With tariffs rising from an average of 1.5% to double digits, cash has become king. Companies now rethink payment terms and supply chain strategies as they brace for more volatility.

China is adjusting too—quickly and strategically. Though exports to the U.S. keep falling, China's overall outbound shipments grew nearly 6% in November. Strong demand from ASEAN nations and Europe now offsets American weakness. China also increased shipments of critical minerals such as rare earths, signaling its intent to stay central to global industry.

However, domestic challenges remain. Factory activity shrank for the eighth straight month. Imports rose only slightly, showing weak consumer demand at home. Policymakers are preparing new stimulus measures to stabilize growth around 5%. They may ease rates, widen fiscal deficits, and support struggling sectors like housing. Moreover, officials aim to boost household spending, especially as the yuan strengthens. A stronger currency lowers import costs and could help shift China away from its heavy export dependence—a long-term goal Beijing now treats as urgent.

Markets across Asia reflect these shifting currents. Investors are parsing every hint from China's trade data and every move by the Trump administration. In recent days, China's stronger-than-expected export numbers lifted mainland markets. Yet Hong Kong's Hang Seng slipped, showing uneven confidence. Japan's revised GDP figures added further uncertainty, while Australia awaited a steady hand from its central bank.

U.S. markets, however, appear calmer. Major indexes posted gains as investors weighed both domestic and global data. Still, the trade story looms over every outlook. China's slowdown in U.S.-bound shipments, the rise of new manufacturing hubs, and Trump's tariff path all shape business expectations. Global supply chains no longer revolve around one country, and companies know the map will keep changing.

In this new environment, China and the U.S. remain tied together—but through a trade web that looks far less direct than before. The next moves from Washington and Beijing will decide whether this transformation accelerates or stabilizes. For now, the world adapts, one container at a time.

A Russian liquefied natural gas export facility delivered its first shipment to China since being sanctioned by the US in January, the latest sign of increased energy cooperation between Beijing and Moscow.

The Valera vessel, which loaded a shipment from Gazprom PJSC's Portovaya facility on the Baltic Sea in October, arrived at the Beihei import terminal in southern China on Monday, ship data compiled by Bloomberg shows. Both Valera and Portovaya were sanctioned by Joe Biden's administration to thwart Russia's plans to boost LNG exports.

China, which doesn't recognize the unilateral sanctions, has increasingly bought blacklisted Russian gas over the last few months, ratcheting up energy ties between the two countries. Beijing has also ignored a broader push by US President Donald Trump to halt sales of Russian oil, which will likely be a key part of trade negotiations between Washington and New Delhi this week.

Russia has two relatively small LNG export facilities on the Baltic Sea, with the Novatek PJSC-led Vysotsk plant also blacklisted by the US. Another sanctioned Russian plant, the Arctic LNG 2 site in Siberia, started delivering fuel to Beihai in late August.

In mid-October, satellite images showed a tanker that loaded at Portovaya transferring fuel into another vessel registered to a Hong Kong-based company near Malaysia. That ship, known as CCH Gas, has been sending out false location signals, and was spotted by satellites near China last month. It isn't clear where it is currently located.

Markets are betting overwhelmingly that Fed policymakers will cut interest rates this week for a third straight meeting. Yet the bond market's reaction to those moves has been highly unusual.

Treasury yields are climbing even as the central bank lowers rates. By some measures, a disconnect like this hasn't been seen since the 1990s.

What the divergence indicates is a matter of heated debate. Opinions are all over the place, from the bullish (a sign of confidence that recession will be averted) to the more neutral (a return to pre-2008 market norms) to the favorite narrative of so-called bond vigilantes (investors are losing confidence the US will rein in the constantly swelling national debt).

But one thing is clear: The bond market isn't buying Donald Trump's idea that faster rate cuts will send bond yields sliding down and, in turn, slash the rates on mortgages, credit cards and other types of loans.

With Trump soon able to replace Chair Jerome Powell with his own nominee, there's also the risk that the Fed squanders its credibility by caving to political pressure to ease policy more aggressively — which could backfire by fanning already elevated inflation and pushing yields higher.

"Trump 2.0 is all about getting long-term yields down," said Steven Barrow, head of G10 strategy at Standard Bank in London. "Putting a political figure at the Fed will not get bond yields down."

The Fed started pulling its benchmark rate down in September 2024 and has since cut it by 1.5 percentage points. Traders see another quarter point cut Wednesday and are pricing in two more such moves next year, which would bring its rate to around 3%.

Yet Treasury yields haven't come down at all. Ten-year yields have risen nearly half a percentage point to 4.1% since the Fed started easing policy and 30-year yields are up over 0.8 percentage point. —Ye Xie and Michael MacKenzie

Fed Chair Jerome Powell is expected to push through another quarter-point interest-rate cut this week despite unease among fellow policymakers that inflation remains too high. Elsewhere, central bank decisions from Australia to Switzerland to Brazil will draw attention from investors.

Bitcoin is testing a key Fibonacci retracement support level, raising concerns of a potential drop to $76,000 if the level breaks, according to analysts monitoring market conditions.

The implications are significant for Bitcoin and related large-cap cryptocurrencies due to correlation, potentially affecting broader market conditions and investor sentiment.

Bitcoin is currently trading near a key Fibonacci retracement support as analysts warn of potential declines. Traders closely watch this technical level, which they say could lead to BTC nearing its April 2025 lows around $76,000 if it breaks down.

Key market figures include Bitcoin spot and derivatives traders on major platforms like Binance and CME. Daan Crypto Trades specifically highlights the 0.382 Fibonacci retracement zone as crucial, with a potential breakdown towards $76,000 if it fails.

The immediate concern is heightened selling pressure if Bitcoin loses its support level, further propelled by low weekend trading volumes. Market watchers note this could trigger a cascade of liquidations due to significant leveraged positions. Concerns extend to ETF outflows and reduced institutional demand, which are crucial factors influencing whether the current Fibonacci support will hold or break, potentially impacting broader market sentiment and risk appetites.

Daan Crypto Trades, Crypto Derivatives Trader, Twitter/X – "The 0.382 Fibonacci retracement zone is the line bulls must defend, and a breakdown could send BTC back to April levels near $76,000": source

Besides Bitcoin, assets like Ethereum and Chainlink could experience correlated impacts due to market sentiment. Analysts observe support in the $83–84k band, with risks rising if Bitcoin falls below the 0.382 Fibonacci level. With the potential for accelerated bearish momentum, tracking on-chain metrics offers insights. Historical trends indicate that failure to maintain key support levels often results in swift moves to subsequent Fibonacci bands, intensified by leverage and liquidity dynamics.

In recent months, Federal Reserve officials have repeatedly referred to monetary policy as restrictive. In September, Jerome Powell said policy was "clearly restrictive," and in November, New York Fed President John Williams stated "I still view the current monetary policy level as moderately tight..."

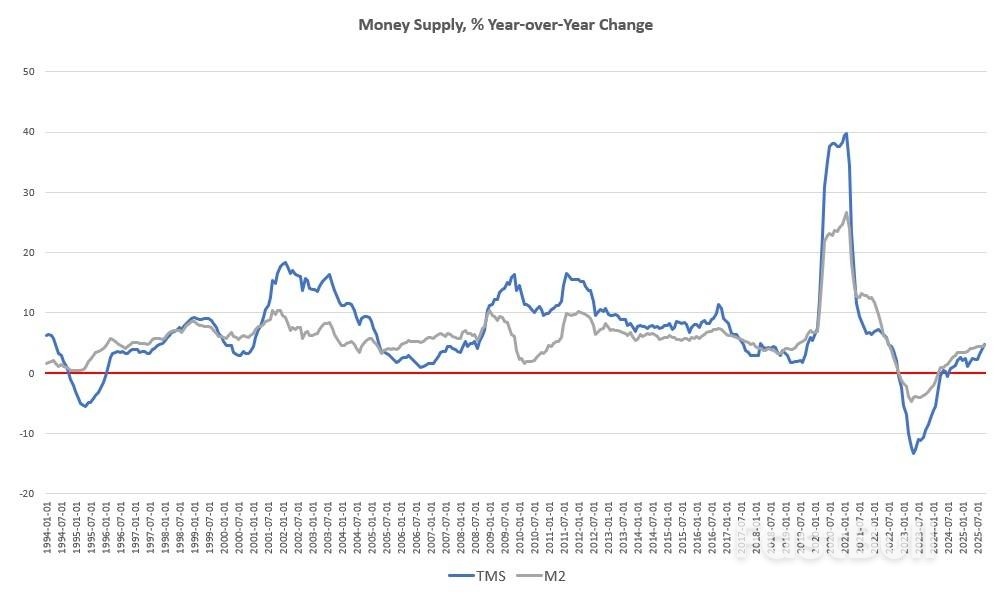

Well, it may be that current policy is "restrictive" compared to, say, the policies of Bernanke and Yellen. But recent data on the money supply suggests that the money supply in recent months is finding plenty of room to increase rapidly, in spite of what Fed officials say.

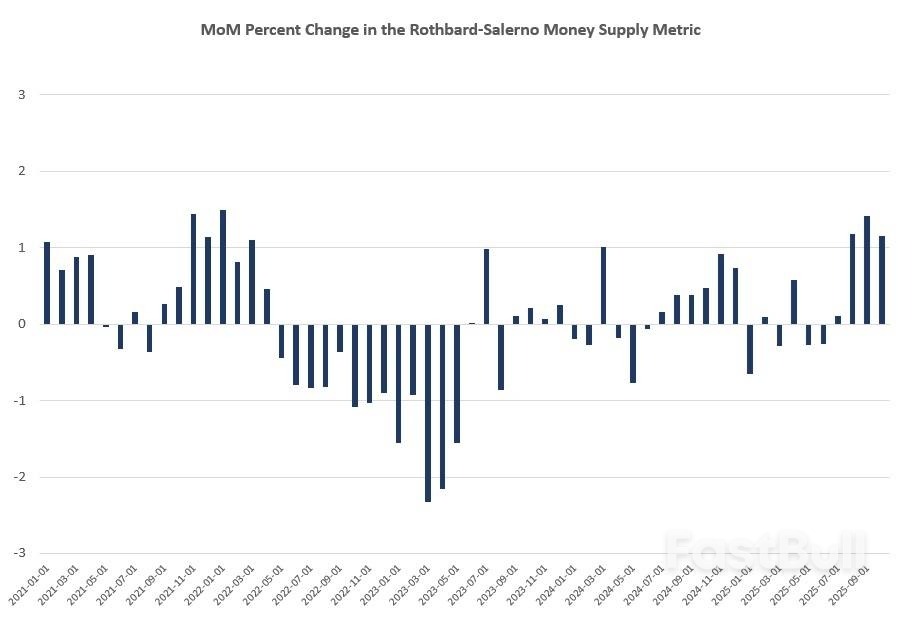

For example, the money supply has increased every month for the past four months, and as some of the highest rates we've seen in years. Moreover, when measured year-over-year, the money supply has accelerated over the past three months and is now at the highest rate of growth seen in 40 months—or since July of 2022.

While the money supply largely flatlined through much of the mid-2025, growth has clearly accelerated since August of this year.

During October, year-over-year growth in the money supply was at 4.76 percent. That's up from September year-over-year increase of 4.06 percent. Money supply growth is also up sizably compared to October of last year when year-over-year growth was 1.27 percent.

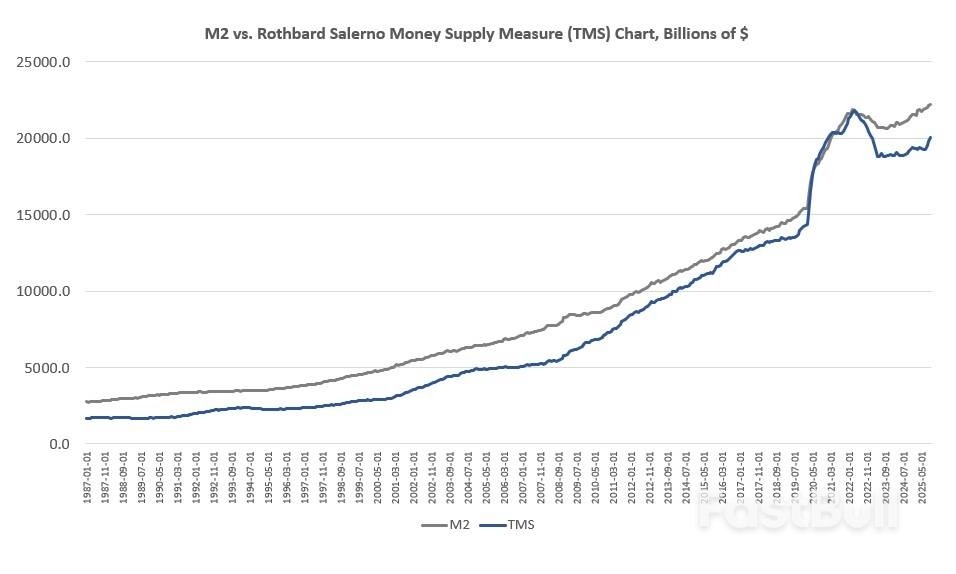

In October, the total money supply again rose above $20 trillion for the first time since January of 2023, and grew by half a trillion dollars from August to October.

In month-to-month growth, August, September, and October all posted some of the largest growth rates we've seen since 2022, rising 1.18 percent, 1.4 percent, and 1.14 percent, respectively. topping off four months of growth.

The money supply metric used here—the "true," or Rothbard-Salerno, money supply measure (TMS)—is the metric developed by Murray Rothbard and Joseph Salerno, and is designed to provide a better measure of money supply fluctuations than M2. (The Mises Institute now offers regular updates on this metric and its growth.)

Historically, M2 growth rates have often followed a similar course to TMS growth rates, but M2 has even outpaced TMS growth in eleven of the last twelve months. In October, the M2 growth rate, year over year, was 4.63 percent. That's up from September's growth rate of 4.47 percent. October's growth rate was also up from October 2024's rate of 2.97 percent.

Although year-over-year and month-to-month growth rates moderated during the summer—and even fell substantially during 2023 and early 2024, money-supply totals are again rapidly heading upward. M2 is now at the highest level it's ever been, topping $22.2 trillion. TMS has not yet returned to its 2022 peak, but is now at a 34-month high.

Since 2009, the TMS money supply is now up by more than 200 percent. (M2 has grown by nearly 160 percent in that period.) Out of the current money supply of $20 trillion, nearly 29 percent of that has been created since January 2020. Since 2009, in the wake of the global financial crisis, more than $13 trillion of the current money supply has been created. In other words, more than two-thirds of the total existing money supply have been created since the Great Recession.

Given current economic conditions, it is surprising to see such robust growth in the money supply.

Given current stagnating economic conditions, it is surprising to see such robust growth in the money supply. Private commercial banks play a large role in growing the money supply in response to loose Fed policy. When economic conditions are expansive, and as employment grows, lending also grows, further loosening monetary conditions.

In recent months, however, economic indicators continue to point to both worsening employment conditions and rising delinquencies. For example, US layoffs in October surged to a two-month high. Meanwhile, Bloomberg reports that " Mom-and-Pop Business Bankruptcies Hit a Record as Debts Rise." The latest price-sector jobs numbers show more job losses.

This all applies downward pressure on money supply growth. However, in an effort to further pump asset prices and somehow counter our growing economic stagnation, the Fed lowered the target federal funds rate in September and throughout much of this year has slowed its efforts to reduce the Fed's balance sheet—also known as "quantitative tightening."

This return to accommodative monetary policy—which belies Fed claims of "restrictive" policy—has surely done its part in returning the money supply to growth levels we haven't seen in years.

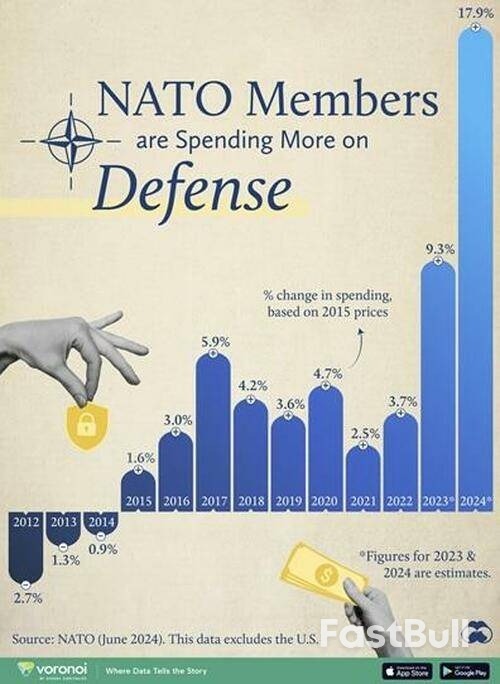

European members of NATO have been warned by Washington that they must assume greater responsibility for the alliance's intelligence operations and missile production - which will require significantly more defense spending by 2027, Reuters has reported.

Reuters in its exclusive Friday report said that the United States "wants Europe to take over the majority of NATO's conventional defense capabilities, from intelligence to missiles, by 2027, Pentagon officials told diplomats in Washington this week, a tight deadline that struck some European officials as unrealistic."

"The message, recounted by five sources familiar with the discussion, including a U.S. official, was conveyed at a meeting in Washington this week of Pentagon staff overseeing NATO policy and several European delegations," the report continued.

The directive was coupled with a warning behind the scenes, reportedly involving Pentagon officials cautioning representatives from several European nations that the US may scale back its role in certain NATO defense efforts if this target and deadline is not met.

US Army/NATO file image

US Army/NATO file imageIt was noted in the report that some European officials consider the 2027 goal unrealistic, saying that rapidly substituting American military support would demand far greater investment than current plans and NATO member approved defense budgets allow.

This generally reflects the Trump administration's long verbalized dissatisfaction with with Europe's progress on shouldering more of NATO's collective defense burden.

But the Reuters report also underscored that European officials were not offered tangible metrics whereby failure or success would be assessed:

Conventional defense capabilities include non-nuclear assets from troops to weapons and the officials did not explain how the U.S. would measure Europe's progress toward shouldering most of the burden.

It was also not clear if the 2027 deadline represented the Trump administration position or only the views of some Pentagon officials. There are significant disagreements in Washington over the military role the U.S. should play in Europe.

One NATO official was cited as saying "Allies have recognized the need to invest more in defense and shift the burden on conventional defense" from the US to Europe.

As we described previously the Trump administration's new National Security Strategy really hits out hard at Europe, stating saying "it is far from obvious whether certain European countries will have economies and militaries strong enough to remain reliable allies" to the United States.

The document further highlights that this current reality of European weakness could have certain negative implications for potential for heightened Western escalation with Russia:

"Managing European relations with Russia will require significant U.S. diplomatic engagement, both to reestablish conditions of strategic stability across the Eurasian landmass, and to mitigate the risk of conflict between Russia and European states," the document reads.

Most analysts see the language in the document as opening the door for greater Washington meddling in European affairs.

Source: Visual Capitalist

Source: Visual Capitalist"Washington is no longer pretending it won't meddle in Europe's internal affairs" Pawel Zerka, a senior policy fellow at the European Council on Foreign Relations, observed.

"It now frames such interference as an act of benevolence ('we want Europe to remain European') and a matter of US strategic necessity. The priority? 'Cultivating resistance to Europe's current trajectory within European nations'," he concludes.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up