Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Shanghai Futures Exchange: Adjusts Price Limits, Margin Ratios For Some Silver Futures Contracts

Turkish Foreign Minister: We Hope Solution Can Be Found To Avoid Conflict And Isolation Of Iran

Turkish Foreign Minister: Spoke With USA Envoy Witkoff On Thursday, Will Continue Speaking To USA Officials On Iran

Iran's Araqchi Says Tehran Welcomes Talks With Regional Countries That Aims At Bringing Stability And Peace

Istanbul - Iran's Foreign Minister Araqchi Says Tehran 'Is Prepared For Resumption Of Talks With The US'

Istanbul - Iran's Foreign Minister Araqchi: Talks With His Turkish Counterpart Fidan Was Very 'Good And Useful'

Turkish Foreign Minister: Turkey Closely Following Integration Agreement Between Damascus-Sdf In Syria

Turkish Foreign Minister: Turkey Calling On US, Iran To Come To Negotiating Table To Resolve Issues

Turkish Foreign Minister: Turkey Opposes Foreign Intervention On Iran, We Tell Our Counterparts This

Turkish Foreign Minister: Iran's Peace And Stability Important For US, Turkey Saddened By Deaths During Protests

Chevron: Continue To Engage With The USA And Venezuelan Governments To Advance Shared Energy Goals

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)A:--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)A:--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)A:--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)A:--

F: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)A:--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)A:--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)A:--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)A:--

F: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)--

F: --

P: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Hong Kong's economy surged past 2025 forecasts with robust trade-driven growth, anticipating continued 2026 momentum.

Hong Kong’s economy posted a robust 3.8% year-on-year expansion in the fourth quarter of 2025, according to official advance estimates. This marks the city's 12th consecutive quarter of growth, driven by strong regional trade, a recovery in tourism, and vigorous activity in the financial services sector.

The fourth-quarter performance represents an acceleration from previous periods. The economy grew by a revised 3.7% in the third quarter, 3.1% in the second, and 3.0% in the first quarter of 2025. On a seasonally adjusted quarterly basis, GDP expanded by 1.0% in the final three months of the year, up from 0.7% in the third quarter.

For the entirety of 2025, Hong Kong's real GDP grew by 3.5%. This figure not only surpassed the government's own forecast of 3.2% but also marked a significant increase from the 2.5% growth recorded in 2024.

The momentum was underpinned by strong performance across several key economic pillars:

• Private Consumption: Expenditure rose by 2.5% in the fourth quarter, slightly ahead of the 2.4% increase in Q3. For the full year, private consumption grew by 1.6%.

• Goods Exports: Total exports surged by 15.5% in Q4, a notable jump from the 12% rise in the previous quarter. This brought full-year export growth to 12%.

• Goods Imports: Imports expanded by 18.4% in Q4, up from 11.7% in Q3, resulting in 12.6% growth for the full year.

Looking ahead, the government anticipates that the Hong Kong economy will maintain its positive trajectory into 2026. A government spokesperson stated that the city is "expected to maintain good momentum."

Several factors are expected to support this continued growth. A moderate but sustained expansion of the global economy, combined with strong international demand for electronics enabled by artificial intelligence, is projected to bolster Hong Kong's export performance.

Furthermore, improving sentiment among consumers and businesses, alongside the possibility of interest rate cuts in the United States, is expected to stimulate local consumption and investment.

Despite the optimistic forecast, officials cautioned that external uncertainties persist, particularly amid escalating geopolitical tensions that could pose risks to the outlook.

On Wednesday, after the close of the regular trading session, Microsoft (MSFT) released its quarterly earnings report, which exceeded analysts' expectations:

→ Earnings per share: actual $4.14, forecast $3.90;

→ Gross revenue: actual $81.2bn, forecast $80.3bn;

→ Operating profit: up 21%.

Despite the strong results, MSFT shares suffered a dramatic sell-off of around 10% by the close of yesterday's trading. According to media reports, this was the largest one-day drop in Microsoft's share price on record, with the company losing roughly $360bn in market capitalisation.

Market participants were most likely disappointed by the following factors:

→ A sharp rise in capital expenditure: capex surged by 66% to $37.5bn as Microsoft continued to invest heavily in data centres and AI infrastructure, while the timing of meaningful returns on these investments remains uncertain.

→ Slowing growth in the cloud computing segment.

When analysing the MSFT chart on 15 January, we identified a key ascending channel reflecting the stock's long-term price structure. At that time, we suggested that the market might find a temporary balance ahead of the earnings release.

Since then, although volatility persisted, the price showed an ability to recover from 22 January onwards, indicating that buyers were attempting to wrest control from sellers.

Yesterday's record decline significantly altered the picture, but two factors are worth noting:

1 → The price fell below the 1 May low, entering the area of a broad bullish gap located above the psychological $400 level.

2 → In 2026, the market has been forming a descending channel (shown in red), with the price now reaching its lower boundary.

It is reasonable to assume that these two factors could act as support. The structure of yesterday's candle supports this view: the session closed well above the low, and trading volumes were the highest in several years. This suggests active buying interest, with the price rebounding from around $422 to $433.

As a result, it is possible that the initial emotional reaction may fade and MSFT shares will avoid a further acceleration of the downtrend. However, a meaningful shift back to a bullish market structure would require strong fundamental catalysts.

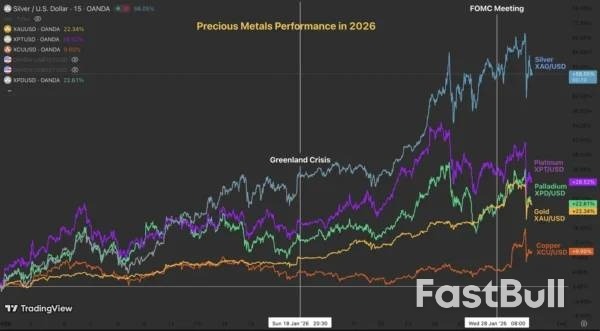

If 2025 was volatile for metals, 2026 is starting with even greater intensity.

The global order is fracturing as historic allies clash and new conflicts appear imminent.

For metal maximalists, this confirms a long-held thesis. Decades of high deficits create predictable capital flows and supply shortages, which are now driving prices to daily records.

As geopolitical tensions rise, investors are rushing to commodities to hedge against supply shortages and inflation, a classic play.

But today's flows feel different.

It is almost impossible to predict tops in such extreme, unidirectional trends. Some periods can be more favorable for squeezes. Some others are more favorable for rangebound conditions and selloffs.

And such periods tend to change at the beginning of the New Year, at the start of Quarters, Months, or even after FOMC meetings.

As the US President announced he will officially announce his decision on the Fed Chair next week, Markets are looking back at yesterday's Federal Reserve decision.

Higher rates for longer will be the way to go for the Fed until anything cracks, as the US Labor Market bounced back and the US economy is shining – Can't justify many cuts with that.

Today marked a brutal stalling in rallies throughout the Metals asset class.

Gold was trading 6% higher than the day before the FOMC, only to give up those gains in a 10% flash crash.

Similar flows occurred in Copper, Silver, Palladium, and Platinum, all dropping by 9% to 11%.

By the way, Copper spiked to new record highs in yesterday's evening session, reaching $6.52 per lb, but still lacking a more fundamental foundation to persistently elevated prices.

In the meantime, let's dive right into intraday timeframe analysis for Gold (XAU/USD), Silver (XAG/USD) and Copper (XCU/USD) to spot where the session dynamic takes the price action. Is the trend challenged?

This morning's action could pose a significant test to the 30% yearly run in the Bullion.

The current fundamentals are heavily backing the recent rise, particularly as it is far less extreme than the one seen in Silver for example.

Still, when profit-taking occurs so suddenly, traders can look around, question the current state of the Market and reassess if the trend can still hold.

Since the flash, prices have rebounded – Hence look at these two levels:

Resistance Levels:

Support Levels:

Evolving in a steep upward channel, Silver is testing its upper bound in high volatility consolidation.

Prices have maintained within a $107 to $120 range since Monday, hence trades will look for breakouts either to the upside or downside for future action.

Similarly as in Gold, look for a candle close above or below with high volumes to get confirmation.

A break lower could go test the Upward channel lower bounds, currently around $92.

Resistance Levels:

Support Levels:

The recent moves are not particularly indicative of a trend-end but recent up and down action may precede doubts to the sustainability of the recent moves.

Copper spiked by 10% during overnight trading, corrects by a similar amount and is now holding tight at its January 14 record range ($6.00 to $6.10 Major Pivot).

Higher Timeframe Levels to watch for Copper (XCU/USD):

Resistance Levels:

Support Levels:

Watch out for positioning and fast-paced moves!

January is already coming to an end and it has historically been the best month for Gold, Silver and Platinum. Keep a close eye to see if the rally holds the colder February ahead.

Safe Trades!

China is set to cut its import tariff on whisky in half, a significant move that provides a major boost to the British whisky industry. The tariff will be lowered from 10% to 5%, with the new rate taking effect on February 2.

This decision comes directly after high-level talks between British Prime Minister Keir Starmer and Chinese President Xi Jinping, aimed at repairing diplomatic ties and strengthening economic cooperation.

The reduction is expected to deliver substantial financial benefits for UK-based exporters. According to the British Prime Minister's office, the deal is valued at approximately £250 million ($344.13 million) over the next five years.

The UK is the dominant player in China's whisky market. Customs data from 2025 shows that China imported $445.5 million worth of whisky, with a staggering 84% of that total originating from the United Kingdom. This market share underscores why the tariff adjustment is a critical win for the Scotch whisky sector.

The tariff change marks a reversal of a recent effective rate hike. While Beijing had previously set a provisional tariff of 5% on whisky in 2017, this provision was removed for 2025, causing the rate to revert to 10%. The new policy reinstates the lower 5% tariff.

The agreement was a key outcome of discussions between Starmer and Xi in Beijing. Beyond whisky tariffs, the two leaders also committed to pursuing greater cooperation in the broader fields of trade, investment, and technology.

The Spanish economy finished 2025 with significant momentum, posting 0.8% quarter-on-quarter growth in the final three months. This performance marked an acceleration from the 0.6% expansion seen in the third quarter and outpaced consensus forecasts by 0.2 percentage points.

While a minor downward revision to first-quarter data adjusted the full-year growth for 2025 to 2.6%, the key takeaway is clear: Spain entered 2026 on solid footing, powered by strong domestic demand.

The drivers behind the strong Q4 performance followed a familiar pattern. Household consumption was a major contributor, rising by a robust 1.0% for the third consecutive quarter. Investment also expanded by 1.7%, bolstered by a 2.7% surge in intellectual property investment.

However, the picture was not uniformly positive. Government consumption remained largely flat, and net exports continued to be a drag on growth, reflecting a difficult global economic environment.

From a production standpoint, all major sectors grew, but their trends diverged. Manufacturing output slowed for the second quarter in a row, expanding by just 0.1%. According to S&P Global PMI data, this weakness stems from declining output and shrinking order books amid intense competitive pressure. This trend contrasts with yesterday's more optimistic economic sentiment indicators, which appear to overlook the sharp drop in reported export orders.

In contrast, the services sector continued its robust expansion, although signs of a slowdown in tourism are becoming more visible. After several years of standout performance, growth in the tourism sector is expected to normalize.

The economic forces that shaped late 2025 will continue to guide Spain’s outlook in 2026. Growth is expected to normalize as several key drivers moderate.

• Government Consumption: With no new budget in place, government spending is expected to make a limited contribution.

• Private Consumption: After several quarters of strong growth, consumer spending is forecast to gradually return to a more normal pace.

• Net Exports: External demand is likely to remain subdued, partly due to a stronger euro. The real effective exchange rate of the euro has climbed 6.1% since January 2025, weighing on exports.

With other growth engines moderating, investment will become the critical factor for Spain's economy in 2026. Much of the country's recent growth has been quantitative, driven by an expanding labor force through migration. The government's plan to grant legal status to approximately 500,000 people—about 2% of the current legal labor force—continues this strategy. While this move offers social and labor market benefits, its macroeconomic impact may be more limited than previous labor supply expansions.

Meanwhile, a decline in productivity per hour worked in Q4 2025 highlights an urgent need for productivity-enhancing investments to foster more sustainable, structural growth.

A major source of potential upside comes from the EU Recovery and Resilience Facility (RRF). Spain has roughly €20 billion in RRF grants to disburse by the end of 2026, equivalent to about 6% of its annual investment spending. Favorable conditions for private investment also exist, with capacity utilization rising to 79.8% in Q4 2025. While the effects of these investments may not be immediate, they could initiate a gradual shift toward higher-quality, more productive growth, helping Spain continue to outperform its eurozone peers.

Reflecting these dynamics, our 2026 growth forecast has been revised upward to 2.4%, though this is primarily due to the strong carry-over from Q4 2025 rather than a change in the underlying quarterly growth profile.

Inflation data from January also points toward normalization. At 2.5% year-on-year, the figure was slightly higher than expected but still represented a 0.5 percentage point drop from December 2025. This decrease was driven by a 0.7% month-on-month fall in prices, largely due to a more moderate rise in electricity costs compared to the previous year. This data reinforces the broader trend of both the Spanish economy and its inflation profile returning to a more stable pattern.

AUDUSD extended rally for nearly two weeks and hit three-year high on Thursday (0.7093), before easing.

Weakening US dollar and Aussie tracking strong rise in precious metals, were mainly behind the latest rally (up over 6% since the move started on Jan 19).

Bulls broke and established above psychological 0.70 level, but faced strong headwinds on approach to 0.7100 resistance, as daily studies are overbought and overstretched 14-d momentum turned south.

Thursday's red daily candle with long upper shadow adds to signals of upside rejection and warning of pullback, as the US dollar jumps after steep fall in past four days.

Loss of initial supports at 0.70 zone (psychological / near Fibo 23.6% of 0.6667/0.7093) unmasks 0.6930 (Fibo 38.2%), with stronger acceleration lower to find solid ground at 0.6900/0.6880 zone (round-figure / 50% retracement) and mark a healthy correction before larger bulls regain control.

Caution on potential loss of 0.6880 handle, which may trigger deeper pullback and sideline bulls.

Res: 0.7015; 0.7093; 0.7157; 0.7207Sup: 0.6968; 0.6930; 0.6880; 0.6830

The US Dollar started a major decline below 158.00 against the Japanese Yen. USD/JPY settled below 157.00 to enter a bearish zone.

Looking at the 4-hour chart, the pair traded below a key bullish trend line with support at 158.00 to start the recent downtrend. It settled below 156.50, the 200 simple moving average (green, 4-hour), and the 100 simple moving average (red, 4-hour).

Finally, the pair dived below 153.50 and tested 152.00. A low was formed at 152.09, and the pair is now consolidating losses. Immediate resistance sits near 153.75.

The first key hurdle could be 154.00. The next stop for the bulls might be 154.80, where they could face hurdles. A close above 154.80 could open the doors for more gains. In the stated case, the bulls could aim for a move toward 156.50 and the 200 simple moving average (green, 4-hour).

If there is a fresh decline, the pair might find support near 152.40. The first major area for the bulls might be near 152.00. The main support sits at 150.00, below which the pair could accelerate lower. The next support could be 146.50.

Looking at EUR/USD, the pair extended gains and traded above 1.2000 before the bears appeared and pushed the pair to 1.1950.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up