Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Extravagant displays of opulence and adulation greeted U.S. President Donald Trump at every stage of his four-day swing through the Gulf, which wrapped up on Friday. His itineraries in Saudi Arabia, Qatar and the United Arab Emirates appeared tailor-made for a real-estate-developer-turned-president, who can be susceptible to flattery, transactional in his foreign policy dealings and is attracted to extreme wealth.

Extravagant displays of opulence and adulation greeted U.S. President Donald Trump at every stage of his four-day swing through the Gulf, which wrapped up on Friday. His itineraries in Saudi Arabia, Qatar and the United Arab Emirates appeared tailor-made for a real-estate-developer-turned-president, who can be susceptible to flattery, transactional in his foreign policy dealings and is attracted to extreme wealth.

To the extent those displays were designed to curry favor with Trump, they very well might have worked. While the Gulf states announced trillions in potential investments in the U.S. during his visit, they also got plenty in return.

On Thursday, the U.S. agreed to partner with the UAE to build a massive artificial intelligence campus in that Gulf state. In a surprise move on Tuesday, Trump agreed to lift sanctions on Syria at the request of Saudi Crown Prince Mohammed bin Salman, even as some of Trump's own advisers recommended against rapprochement with Syria, whose new president was once an al-Qaeda commander.

"Oh, what I do for the crown prince!" the president gushed to the crowd at the investment conference in Riyadh where he announced the decision.

Trump's regional swing could serve as a template for other host nations looking for a way to the president's heart, analysts said. The treatment Trump received throughout the week seemed almost a global extension of what regularly plays out in Washington, where Cabinet members are quick to praise Trump's acumen and vision, and often outline the administration's accomplishments in superlative terms.

"They played their hand well," Laura Blumenfield, Middle East analyst at John Hopkins University's School of International Studies in Washington said of the Gulf state leaders. "The choreography of Trump's royal tour was impressive."

Trump left the Middle East without securing a ceasefire or renewal of humanitarian aid for Gaza, however. Democrats and good government watchdogs raised concerns about Trump's decision-making being swayed by the regal spectacle and whether his diplomatic efforts could be used to further his family's extensive business operations in the Arabian Peninsula.

"It feels like Trump is being played by some of these leaders with the ostentatious, ceremonial pomp," said Brett Bruen, a former foreign policy adviser to Democratic President Barack Obama and president of the Global Situation Room consultancy.

"A lot of this raises questions whether Trump is taking personal prizes or really advancing U.S interests in the region," he added.

The Trump administration has repeatedly said it is committed to transparency and that it complies with all ethics laws to avoid conflicts of interests.

"Countries in the Middle East are 'pulling out all the stops' because America is strong again," said Taylor Rogers, a White House spokesman. "Foreign leaders know President Trump is the dealmaker-in-chief whose peace through strength policies have restored America’s dominance."

The pomp and pageantry began before Trump even touched down in Saudi Arabia on Tuesday for the first stop of his trip. As Air Force One descended toward Riyadh, Saudi F-15 fighter jets appeared close alongside to escort the presidential plane. After the president walked down a lavender carpet, his motorcade was escorted to the Royal Court on a road lined by mounted Arabian horses.

Not to be outdone, Qatar gave Air Force One a fighter jet escort of its own as it descended into Doha on Wednesday. And instead of mere horses, the Qataris added camels into the mix, as well as Tesla Cybertrucks, which have become popular among some Trump supporters due to their affiliation with Tesla CEO Elon Musk, a close Trump adviser. A traditional dhow sailboat with an American flag sail bobbed in the nearby bay.

In Qatar's elaborate royal court, the Emiri Diwan, Trump gushed at the quality of the marble. Trump's own style tends heavily toward the white stone and gold leafing, elements that feature heavily at his Mar-a-Lago estate in Florida and which he has added to the White House since taking office.

The emir had previously offered Trump a luxury Boeing 747-8 plane to replace Air Force One, a gift that is raising constitutional questions and ethical concerns even from some fellow Republicans. And on Thursday, he offered Trump a series of personal compliments, albeit ones related to diplomacy rather than style.

"We are very excited," the emir said. "I know that you are a man of peace. I know that you want to bring peace to this region."

Trump, throughout the trip, was quick to offer compliments in return. "I like him a lot. I like him too much," Trump said of bin Salman, without mentioning the leader's alleged role in ordering the murder of U.S.-based Saudi journalist Jamal Khashoggi in 2018. Bin Salman has denied involvement in the killing and former President Joe Biden's administration determined that he had immunity from a lawsuit filed against him in the U.S.

UAE President Mohammed bin Zayed al Nahyan, Trump said later in the week, is a "magnificent man."

Upon landing in Abu Dhabi on Thursday for the last stop of his trip, Trump toured the massive, ornate Sheikh Zayed Grand Mosque with the emirate's crown prince. Trump marveled at its beauty and what he called "an incredible culture."

At the Qasr al Watan royal palace that evening, Sheikh Mohamed presented Trump with a final gift on his trip: the Order of Zayed.

The baroque pendant necklace, the country's highest civilian honor, is made of pure gold.

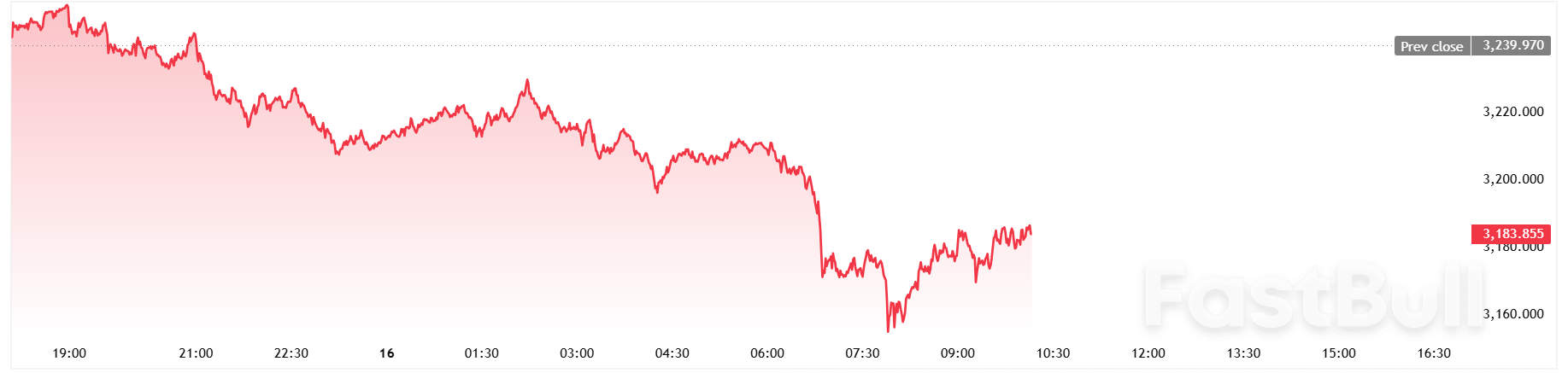

Daily E-mini Nasdaq 100 Index Futures

Daily E-mini Nasdaq 100 Index Futures Daily Adobe Inc

Daily Adobe Inc

Daily Applied Materials, Inc.

Daily Applied Materials, Inc.

The London Metal Exchange is discussing imposing curbs on big positions that would outlaw the sort of outsized bets that have rocked the markets in recent months.

The LME, which hosts global benchmark prices for key industrial metals such as aluminum, copper and nickel, has been discussing the appropriate level for position limits in informal conversations with market participants, according to people familiar with the matter. It has suggested it could seek to prevent traders from taking positions in the nearby month’s contracts larger than the total inventory, the people said, asking not to be named as the talks are private.

The conversations come as responsibility for setting position limits in UK commodity markets is due to be transfered from the Financial Conduct Authority to individual exchanges from July 2026, according to a policy statement from the regulator earlier this year. The LME is likely to make a formal proposal on position limits to the market at some point before then, the people said.

At the same time, the LME has been rocked in recent months by the arrival of some of the world’s largest energy traders. They have made an aggressive push into metals markets after making tens of billions of dollars in profits in oil and gas trading in the wake of Russia’s full-scale invasion of Ukraine.

Vitol Group, Gunvor Group and Mercuria Energy Group Ltd. have all in recent months had positions on the LME that exceeded the total available inventory. Most recently, Mercuria built up a huge position in aluminum in a bet that any easing of sanctions against Moscow would tighten the market, Bloomberg reported this week.

While the LME has been in contact with each of the trading houses about their positions, there’s no rule to prevent traders amassing large bets in the market — indeed, it has been a feature of trading on the exchange for almost all of its 148-year history.

The FCA imposed position limits on UK commodity markets for the first time in 2018, but it set them at such high levels as to be largely irrelevant.

The position limit for aluminum in the nearby month’s contracts, for example, is equivalent to 1.19 million tons — more than four times currently available inventories. In nickel, the overall position limit of nearly 500,000 tons is far larger than the vast position built up by Chinese nickel company Tsingshan Holding Group Co. that triggered a short squeeze that almost destroyed the exchange in 2022.

The LME hasn’t yet decided where to set position limits, the people said, and any overly restrictive policy may have unintended consequences. A crucial question will be how to define the total inventory, the people said: the exchange currently publishes data on “on-warrant” stocks, “canceled” stocks that are in the LME system but have been requested for delivery, and “off-warrant” stocks that are outside the system but could be delivered.

An LME spokesperson said on Friday that the exchange is working on its implementation plan in response to the FCA’s final rules and guidance on reforming the commodity derivatives regulatory framework. “We will keep the market informed as we work towards the roll-out of the new framework on 6 July 2026.”

Former Federal Reserve Chair Ben S. Bernanke urged the US central bank to provide the public a fuller explanation of its interest-rate decisions and a much richer examination of potential forecast scenarios.

“The publication of selected alternative scenarios and their implications could facilitate a subtle but important shift in the Fed’s communications strategy,” Bernanke said Friday in the text of a speech for a conference at the Fed’s headquarters in Washington.

That, he added, would allow policymakers “to provide policy guidance that is more explicitly contingent on how the economy evolves.”

Under Bernanke, the Fed tried and failed in 2012 to introduce a consensus forecast of economic conditions and interest rates. On Friday, Bernanke referred to that effort as “a terrific mess.”

But the central bank could release the Fed staff’s forecast, which is viewed as important by policymakers, and use that as a starting point for discussing alternative forecasts, he said.

“There really is a movement toward treating uncertainty in the forecast more seriously,” Bernanke said. “The only way to do that is to have a true forecast and the ability to construct alternative scenarios.”

The Fed, he said, might also release a summary of commentary from policymakers on what represents a “meaningful projection,” even if that falls short of a consensus.

“It doesn’t have to be 100% consensus,” he said, as it’s nearly impossible to have 19 people in perfect agreement. “But is it just a reasonable description of what the committee thinks? That’s a criteria that I think can be operationalized, and that’s important.”

The former chair criticized the Fed for providing relatively little context and explanation following its rate decisions.

Almost all other major central banks, he said in his prepared remarks, release “timely, detailed background information bearing on the policy decision.”

The former chair spoke at an event dedicated to the central bank’s ongoing review of its longer-run strategy — or framework — for implementing monetary policy. The framework serves as a guide for policymakers as they aim to meet the broad goals assigned by Congress to foster stable prices and maximize employment.

The Fed first published its Statement on Longer-Run Goals and Monetary Policy Strategy in 2012 when Bernanke was chair. It included the central bank’s first public declaration of an explicit inflation goal, which it set at 2%.

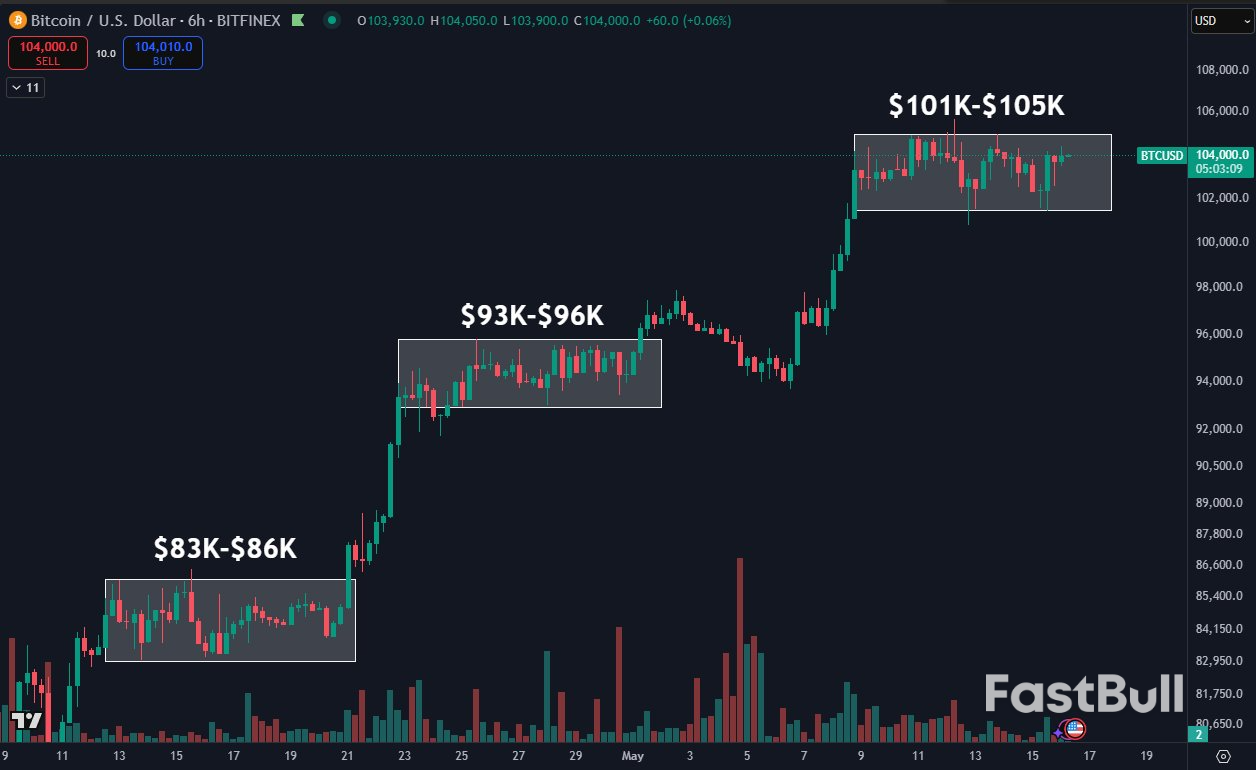

BTC/USD 6-hour chart. Source: Daan Crypto Trades/X

BTC/USD 6-hour chart. Source: Daan Crypto Trades/X

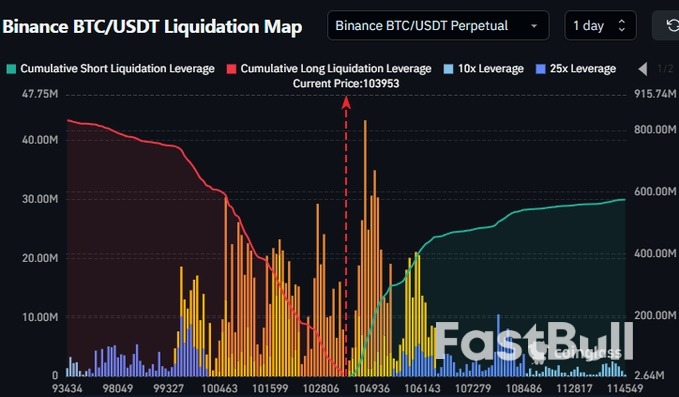

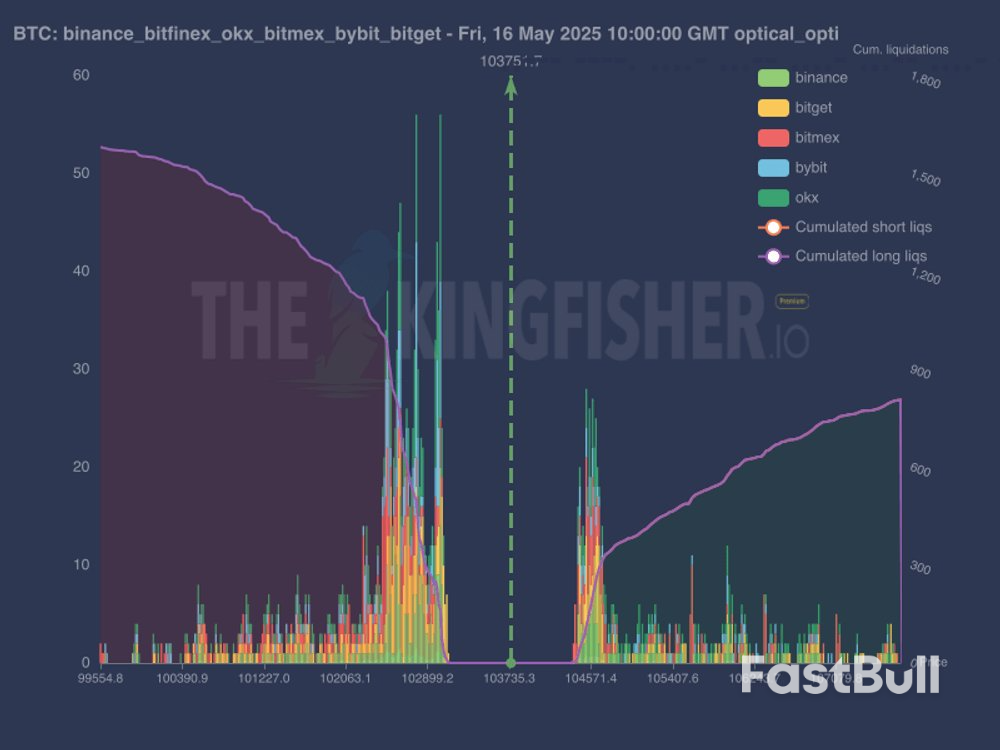

Bitcoin exchange order book liquidity data. Source: TheKingfisher/X

Bitcoin exchange order book liquidity data. Source: TheKingfisher/X BTC/USDT 1-week chart with MACD data. Source: Crypto Caesar/X

BTC/USDT 1-week chart with MACD data. Source: Crypto Caesar/X BTC/USDT 4-hour chart. Source: Kevin Svenson/X

BTC/USDT 4-hour chart. Source: Kevin Svenson/XThe trade war between the United States and the rest of the world reached a boiling point in April after President Trump unveiled reciprocal tariffs that were far greater than what anyone was expecting and as he flagged a new round of sectoral tariffs. The response by other countries varied, with many, like Australia, Japan and the United Kingdom, deciding not to retaliate. But others, such as the European Union and China, have not held back in responding with some counter measures.

China’s response has been the most aggressive, likely taking the White House by surprise. As expected, though, the tit-for-tat retaliation only infuriated Trump, escalating into a full-blown trade conflict. Prior to the weekend talks between US and Chinese officials aimed at diffusing the situation, Chinese businesses were staring at a staggering 145% tax on their exports to the US, while American imports were being charged a somewhat lower 125% rate.

All this suggests that a truce was inevitable. Reports on who initiated the talks vary, depending on the source. But most likely, both sides were seeking an urgent de-escalation, as such punitive tariffs can only be harmful to the world’s two largest economies. Hopes were high heading into the weekend meetings in Switzerland as Trump had hinted that he was willing to lower tariffs on China to 80%.

In a huge relief for investors, the outcome was far better than expected, as both sides agreed to slash each other’s tariffs by 115%, bringing the rate on Chinese imports to 30% and the rate on US goods entering China to 10%. Not forgetting the sectoral tariffs on steel and cars, this leaves the average level of levies between the two countries still above what it was prior to the start of the trade war in February.

More concerning for investors and other decision makers, especially business leaders and central bank policymakers, is that the temporary reprieve does little in removing the uncertainty. Reaching an initial trade deal was probably the easy part. Agreeing on a comprehensive trade pact that resolves differences on key areas such as intellectual property rights, the illegal flow of fentanyl and US access to Chinese markets will be much more difficult.

This leaves markets exposed and vulnerable to any potential setbacks during the 90-day pause, while failure to reach a more permanent agreement risks reviving fears about a US and global recession.

The easing trade tensions have helped the US dollar recover significant lost ground. The dollar index surged towards its 50-day moving average (MA) the day after the Sino-US deal was announced, extending its rebound from April’s three-year low of 97.92 to more than 4%. However, the 50-day MA has proven to be a tough obstacle to overcome, and the greenback has since retreated somewhat, casting doubt about its outlook even if trade frictions continue to de-escalate.

Apart from the ongoing risk that Trump could re-impose some of the suspended tariffs at any point, there is also huge uncertainty about what will happen to inflation. For now, US inflation appears to be gradually declining, putting the Fed in a strong position to resume its rate cuts at some point in the second half of the year.

However, the Trump administration has repeatedly indicated that the 10% baseline tariffs that were introduced on April 2 are here to stay. The 25% duties on specific sectors are also not likely to be abolished completely, even if there are some further exemptions in the future. Plus, tariffs on additional industries are possible.

This makes it difficult for the Fed to feel confident about inflation maintaining its current downward path as there’s bound to be some impact from the higher tariffs on US prices even in the best cast scenario. Investors currently foresee just two rate cuts this year, with a full 25-basis-point reduction not fully priced in until September.

A long pause seems more justifiable now that exorbitant tariff levels have been scaled back and no longer pose a threat to the economy. But then why is the dollar’s rebound looking shaky?

It’s likely that investors still see a significant risk of stagflation, as the uncertainty about Trump’s policies will probably hold back business and consumer spending to some extent, suppressing growth while costs go up. It’s also the case that the supply chain landscape will go through an inevitable transformation, as many businesses will be forced either way to shift some or all of their production to the US, pushing up costs.

Investors should not be fooled into thinking that America’s quest to decouple from China will stop when Washington and Beijing finalise their deal, which itself may not bring an end to the broader economic war.

One reason why Trump is coming down hard on China in his second term is because of the failure of the Phase I agreement signed in January 2020 during his first term. The Chinese did not live up to their commitment of buying more US goods, so the White House will be wary not to repeat the same mistake and will seek better safeguards for enforcement of the deal.

Hence, the stakes are a lot higher this time, meaning a resolution of the trade dispute may take a lot longer than anticipated. This explains why many investors are maintaining a substantial degree of caution until there is a more convincing breakthrough in the negotiations.

Nevertheless, some optimism in the short term is warranted, as all the signs suggest the Trump administration wants to avoid another stock market meltdown and is determined to get more preliminary deals across the finish line. It’s also highly likely that the existing 90-day delays on reciprocal tariffs will be extended, while the evidence from the latest announcements on the chip and pharmaceutical sectors is that the White House is toning down its stance amid outcry from industry leaders.

For the dollar, a break above the 50-day MA is vital if the recovery is to gain any traction, with the next critical barrier likely to be found around 103.35, followed by the 200-day MA. Though, the 200-day may be too bullish a target at the moment as downside risks persist.

Trump’s constant flip-flopping on trade and undermining of America’s democratic institutions is harming the dollar’s position as the world’s reserve currency. This may limit the dollar’s advances even if there is a further cooling in trade tensions.

But in the event that there is a re-escalation in the trade war and Fed rate cut expectations are ratcheted up, there is scope for the dollar index to slide all the way down to the 94.60 region towards 2021 lows.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up