Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Google’s strong earnings show AI is boosting, not cannibalizing, its search business. Gemini adoption, solid ad revenue, and rising AI demand eased fears, pushing Alphabet’s stock higher and reinforcing its central role in AI.

Unprofitable Air India Ltd. is seeking at least 100 billion rupees ($1.1 billion) in financial support from its owners Tata Sons Pvt. and Singapore Airlines Ltd., said people familiar with the matter, as the airline grapples with the aftermath of a deadly plane crash among other challenges.The request includes funds for overhauling Air India's systems and services as well as developing in-house engineering and maintenance departments, some of the people said, requesting not to be identified as the information is not public.

The ailing carrier is far from a goal of breaking even operationally by end of March next year after facing multiple setbacks. The appeal for more funding underscores the challenges of operating in the India's aviation market where many carriers have exited after burning cash. Sector leader Interglobe Aviation Ltd., which operates the IndiGo fleet, is the only profitable domestic carrier with over 64% market share.The carrier is 74.9% owned by the Tata Group, with the rest held by SIA. Any financial support would be proportional to ownership, the people said, adding that the owners would decide if the funding will be an interest-free loan or via equity.

Spokespersons for Tata Sons, Air India and SIA did not respond to emailed queries seeking comments on the financial support sought by the carrier.Air India's pursuit of profitability was already tottering in early June as it had to fly longer hours for its non-stop west-bound flights from India after an armed border conflict in May with Pakistan led to airspace curbs.The financial math worsened after one of its Boeing 787 Dreamliner headed for London crashed immediately after take off from Ahmedabad on June 12, killing all but one on board. Safety concerns following the tragedy led to a system-wide audit by India's aviation regulator. Air India also slashed international flights on widebody jets by 15% starting June through August, which curbed revenue as well.

SIA is closely involved in key functions such as engineering, operations and airport services at the airline after the Ahmedabad crash, the people said.AI Engineering Services Ltd. - a government-owned entity and formerly a subsidiary of Air India - does maintenance work for the airline. The financial support will help Air India scale up its own engineering and maintenance capabilities by building hangars at key airports in the country, the people said.

Airport services at six key airports are done through Air India-Singapore Airport Terminal Services - an equal joint venture between Air India and SATS, the people said, adding that ground services at other airports were also being looked into.

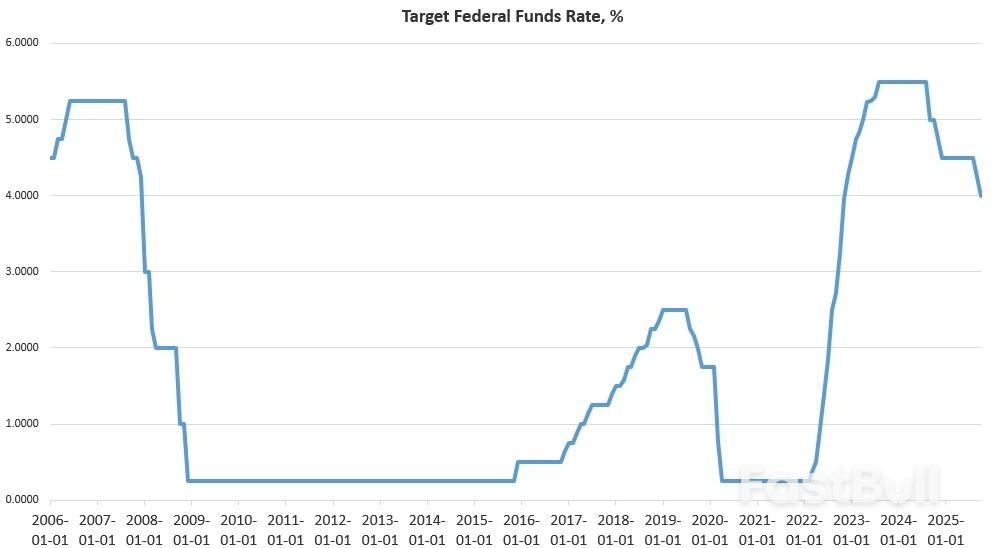

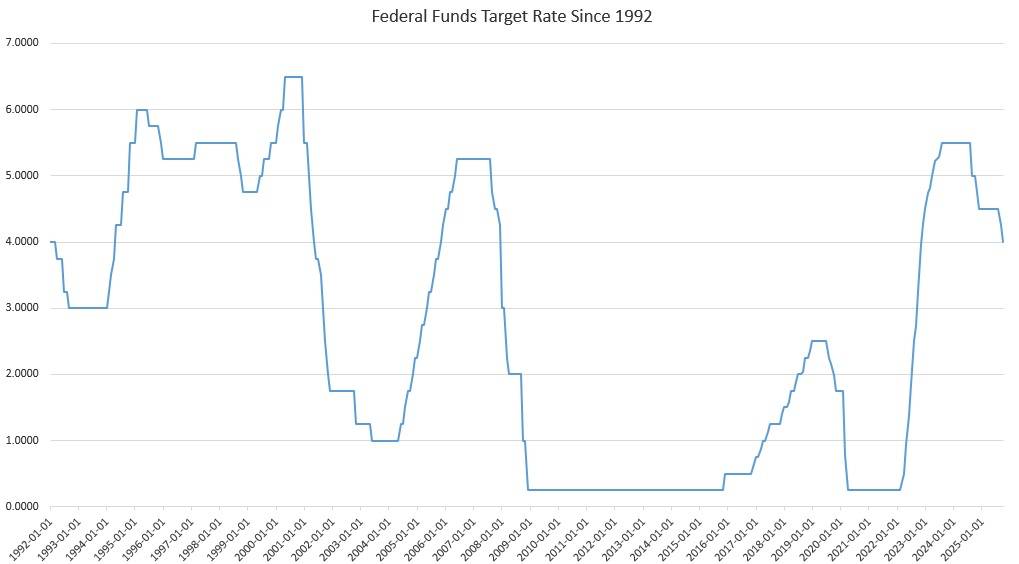

The Federal Reserve's Federal Open Market Committee (FOMC) on Wednesday voted to again reduce the target policy interest rate by 25 basis points, down to an upper bound of 4.0 percent. The FOMC has now cut the policy rate (i.e., the federal funds rate) five times since September 2024, totaling a reduction in 150 basis points over 13 months.

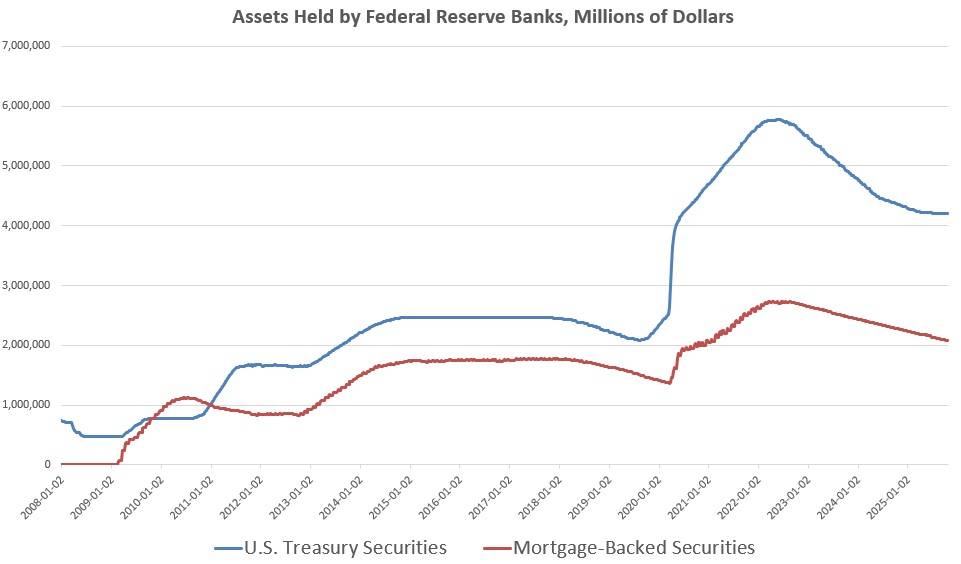

Fed Chairman Jerome Powell also announced on Wednesday that the Fed plans to end quantitative easing as of December 1. That is, the Fed will cease allowing reductions in its balance sheet and will switch to maintaining its balance sheet at current levels. Moreover, the Fed will reconfigure its balance sheet to increase its focus on Treasurys and reduce its holdings of mortgage-backed securities.

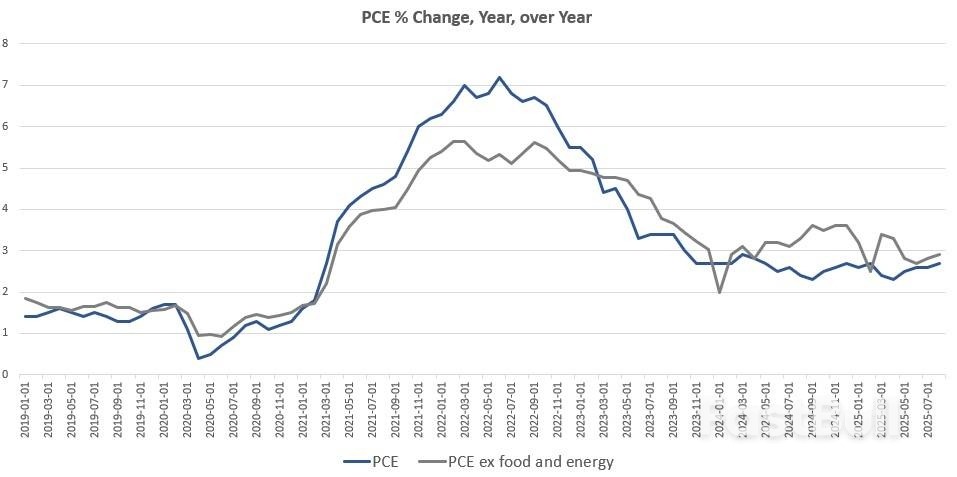

The Fed has embraced these further efforts at monetary easing even though official price-inflation rates continue to show that price inflation remains far from the Fed's claimed two-percent goal. Apparently, the Fed has shifted its focus from price inflation to economic stimulus. After all, the FOMC's policy changes, as well as Powell's comments during the following press conference, paint a picture of a Fed that has all but completely abandoned any alleged commitment to a two-percent price-inflation target. The Fed is now preoccupied with the lackluster employment situation and providing ever more monetary stimulus.

With this new cut to the target policy interest rate, the FOMC continues its current cycle of monetary easing that has been in place since last fall. In spite of Fed claims that the US economy is robust, the 150-bp reduction is a clear sign that the Fed regards the US economy as incapable of standing on its own without continued monetary stimulus to maintain weakening bubble spending and investment.

In recent decades, a 150-bp-point drop in the target rate—with no intervening rate hikes— has always been followed by (or coincided with) a recession. This was certainly the case in 2001, 2008, and in 2020.

As is expected, the Fed maintains that the economy is "expanding" in Wednesday's FOMC statement, although the committee's brief summary of economic conditions does admit of a slowing employment situation:

Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up but remained low through August; more recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated.

Further evidence of the Fed's commitment to loosening economic conditions can be found in the FOMC's new announcement that "quantitative tightening" will cease on December 1. In the current context "quantitative tightening" is the Fed's slow but ongoing reduction in its balance sheet, where the Fed has amassed trillions of dollars in mortgage-backed securities and government Treasurys. Since 2008, the Fed has purchased these assets in an effort to reduce interest rates for Treasurys—by raising demand—and to create more liquidity for housing markets.

The total size of the portfolio peaked in mid 2022 at $5.7 trillion in Treasury debt and $2.7 trillion in mortgage securities. In recent years, however, the Fed has very slowly reduced the size of its portfolio, mostly by allowing assets to mature without replacing them. Since mid 2022, the portfolio has been reduced by a total of $2.2 trillion, with $1.5 trillion of that being Treasurys, and $651 billion being mortgage securities. This is not surprising because the Fed has always been committed to manufacturing demand for Treasurys to help reduce Treasury yields, and thus reduce interest paid on federal debt.

These assets were purchased with newly created dollars, so increases in the portfolio have resulted in adding trillions of dollars to the total money supply. Thus, the creation of the Fed's massive asset hoard has long been an important component of quantitative easing. In contrast, when the Fed allows the size of the portfolio to shrink, this is a type of quantitative tightening, or "QT" and has a deflationary effect.

According to Powell, this will end in December at which time the Fed will presumably no longer allow the size of the portfolio to further decrease as assets mature and "roll off." Instead, Powell noted the Fed will end QT by purchasing new assets to replace the older maturing assets. 1

Notably, Powell also stated that the Fed will work to increase the proportion of Treasurys in the portfolio, in relation to mortgage securities (i.e., agency securities). This is an extension of the Fed's existing policy—begun earlier this year—of reducing its stock of mortgage securities at a faster rate than it has been reducing its stock of Treasurys.

The FOMC statement maintains that the "unemployment rate has edged up but remained low," but during the press conference, Powell clarified that "job creation ... is pretty close to zero" and so many FOMC members concluded "that it was appropriate for us to react by supporting demand with our rates." Powell also admitted that the no hire, no fire economy persists, and he stated "available evidence suggests that both layoffs and hiring remain low, and that both households' perceptions of job availability and firms' perceptions of hiring difficulty continue to decline." Prompted by questions, Powell admitted that there had a been a number of major layoff announcements earlier in the week and stated "we're here to — by lowering rates at the margin that will support demand, and that will support more hiring. And that's why we do it."

Powell also stated that a large part of the employment story is a declining supply of labor, which has helped keep the labor situation seemingly stable. He noted that this is due to falling labor-force participation (for whatever reason) and also by the fact that "the supply of workers has dropped very, very sharply due to mainly immigration." Powell doesn't use the word "deportations" but that is clearly a factor in what he is describing here. In other words, there is very little hiring going on, but since the labor force has declined so much, a lack of hiring has prevented any significant surge in the unemployment rate.

After all, if the supply of labor falls at the same rate as the supply of jobs, the unemployment rate will not change. But, even here, Powell admits that "demand for workers has gone down a little more than supply." This explains why the unemployment rate rose in August, even as the administration ramped up deportations. One can only guess what the unemployment rate would be of the supply of workers had continued to increase due to immigration or any other factor.

It is important to remember that all this talk of creating monetary stimulus in the face of a declining job market is happening while the official price-inflation number is nowhere near the Fed's supposed two-percent target. Indeed, in the most recent CPI report, core price inflation was 3 percent, has been above three percent for three months. Core CPI year-over-year inflation has only dipped below 2 percent during three months of the past 53 months.

Last September, when the Fed began the current easing cycle, and lowered the target rate by 50 basis points, Powell claimed that price-inflation was rapidly returning to the two-percent target. Either his data was way off, or he was simply lying. Even measured by the PCE (the Fed's preferred price-inflation measure), price-inflation is certainly not near two percent. The August PCE measure (the most recent available number) was up 2.7 percent, year over year, while the core PCE increase for August was 2.9 percent.

Yet, Powell has invented a way of waving this inconvenient data aside. In his remarks on Wednesday, Powell apparently invented a new inflation measure which can be described as "price inflation minus the effects of tariffs." Or, as Powell puts it:

inflation away from tariffs is actually not so far from our 2 percent goal. We estimate, people have different estimates of what that is, but it might be five or six tenths, and so if it's 2.8, then core PCE, not including tariffs, might be 2.3 or 2.4, in that range, something like that. So that's not so far from your goal.

Powell doesn't offer any actual numbers or explanation of how he came up with this "price-inflation ex tariff" number. It's apparently something the Fed is simply speculating about.

This new "measure" however, is nothing more than a political ploy used to explain away rising prices, so the Fed can claim that price inflation is really close to two percent, even if the federal government's own official numbers say otherwise. The Fed might as well go back to claiming that price inflation is "transitory" because of "Putin's price hike."

Tariffs don't cause inflation in the technical sense, of course, but in an environment of monetary inflation, tariffs do often contribute to upward pressure on prices of imports and import-dependent goods. So, what Powell is doing here is simply inventing a new number that excludes some higher prices from the CPI and PCE in order to create a narrative in which the Fed has steered price inflation back to two percent.

On the other hand, given the weakening job market, it could be that the Fed is betting on a worsening economy to get price-inflation back below two percent. A slowing economy, accompanied by a rapid slowdown in demand, would allow the Fed to continue to inflate the money supply without apparent inflation above the two percent target. This would only produce an illusion of success, of course, since monetary inflation combined with weakening demand simply robs ordinary people of the benefits of deflation—which are badly needed during times of economic bust—while still inflating new bubbles and creating new malinvestments.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up