Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Goldman Sachs on Monday reduced its forecast for aluminium prices this year after its economists downgraded global growth forecasts including for the U.S. and China following the Trump administration's move to sharply increase tariffs.

"We now expect the aluminium price to fall to a monthly average low of $2,000 (per metric ton) in Q3 2025," the bank said in a note.

Goldman expects prices to rebound to $2,300 per metric ton (/t) by December 2025, compared to its earlier forecast of $2,650/t. London Metals Exchange (LME) aluminium was trading at around $2,392/t as of 1300 GMT on Monday.

U.S. President Donald Trump has imposed or floated plans for a series of global tariffs since his return to office, including 25% tariffs on steel, aluminium and auto parts alongside major tariffs on Mexico, Canada and China.

Aluminium, a lightweight and corrosion-resistant metal, plays a critical role across industries including transportation, packaging, and electronics.

Trump said on Sunday that he would be announcing the tariff rate on imported semiconductors this week.

Goldman also forecast a global aluminium market surplus of 580,000 tons in 2025, versus its previous forecast of a 76,000 tons deficit.

It attributed this to a downward revision to its global total aluminium demand growth forecast to 1.1% year-on-year in 2025 and 2.3% in 2026, as the bank expects a hit from weaker global GDP growth. Previously it had expected demand growth of 2.6% this year and 2.4% in 2026.

Goldman said it still expects aluminium prices to go up after 2025, but not as much as it estimated before, as the extra supply built up during 2025–2026 will help soften the rise.

According to the note, aluminium prices will be at $2,720/t by December 2026, instead of $3,100 forecast previously, and average around $2,800 per ton in 2027, when Goldman sees the market entering a 722,000 tons deficit.

(Reporting by Anjana Anil and Brijesh Patel in Bengaluru; Editing by Kirsten Donovan and Andrea Ricci)

Oil demand growth was revised down to 1.3 million barrels per day, with the growth a "minor adjustment" that is mainly based on the expected impact of tariffs on the market, the Vienna-based body said in its report on Monday. Demand is expected to grow by 40,000 barrels per day, it said.

Demand in countries outside the Organisation for Economic Co-operation and Development (OECD) is projected to increase by nearly 1.25 million barrels per day, mainly to be supported by demand from China, the world's second-largest economy and largest consumer of energy, it said.

For 2026, Opec slightly revised its global demand growth forecast to about 1.3 million bpd. Demand in the OECD is expected to grow by about 100,000 bpd, while non-OECD countries will log an increase of 1.2 million bpd.

"In the OECD, oil demand is expected to be pressured by the likely impact of the new US tariffs on imports," Opec said. "In the non-OECD, despite having been burdened with considerable tariffs by the US, China is expected to drive oil demand, supported by strong mobility and industrial activity."

Opec's projections run counter to the US's view on the market: the world's largest economy and second-largest consumer of energy foresees "very strong" long-term growth in oil and gas demand, US Energy Secretary Chris Wright said in Abu Dhabi last week, without specifying a time period for the forecast.

Opec also downgraded its projections for global economic growth, forecasting a 3 per cent expansion this year and 3.1 per cent in 2026.

Oil, much like the stock markets, bore the brunt of Mr Trump's tariffs in their immediate aftermath of their announcement. Prices had plunged to their lowest levels in more than three years on April 4, as China hit back against the US tariffs with its own additional levies on American goods.

They plunged further on Wednesday after Mr Trump increased tariffs on China, nearing levels seen during the tail-end of the worst of the Covid pandemic four years ago, intensifying the market mayhem.

Prices have since rebounded. Brent, the benchmark for two-thirds of the world's oil, was up 1.22 per cent at $65.55 a barrel as of 4.20pm UAE time on Monday. West Texas Intermediate, the gauge that tracks US crude, added 1.32 per cent to $62.31. However, analysts have downgraded their projections for oil in 2025, citing vital factors such as soft demand, uncertainty from Opec supply and a decline in US shale stash.

The Swiss lender UBS reduced its Brent price forecasts by $12 a barrel to $68, while WTI has been lowered to $64 per barrel. Goldman Sachs, the fifth-largest US bank by assets, expects Brent and WTI to edge down and average $63 and $59 a barrel, respectively, for the remainder of 2025, then fall further to $58 and $55 in 2026.

"US tariffs and the trade war between the US and China will likely weigh on economic growth this year and are likely to result in oil demand growing at a slower speed this year," Giovanni Staunovo, a strategist at UBS, wrote in a note on Monday.

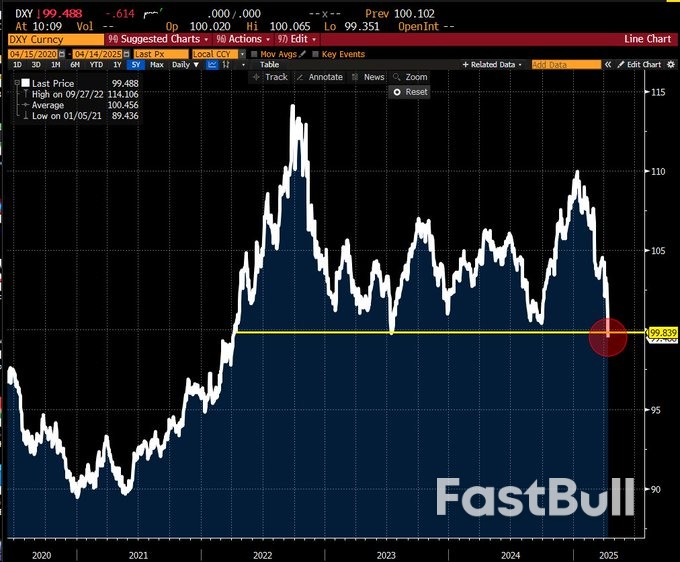

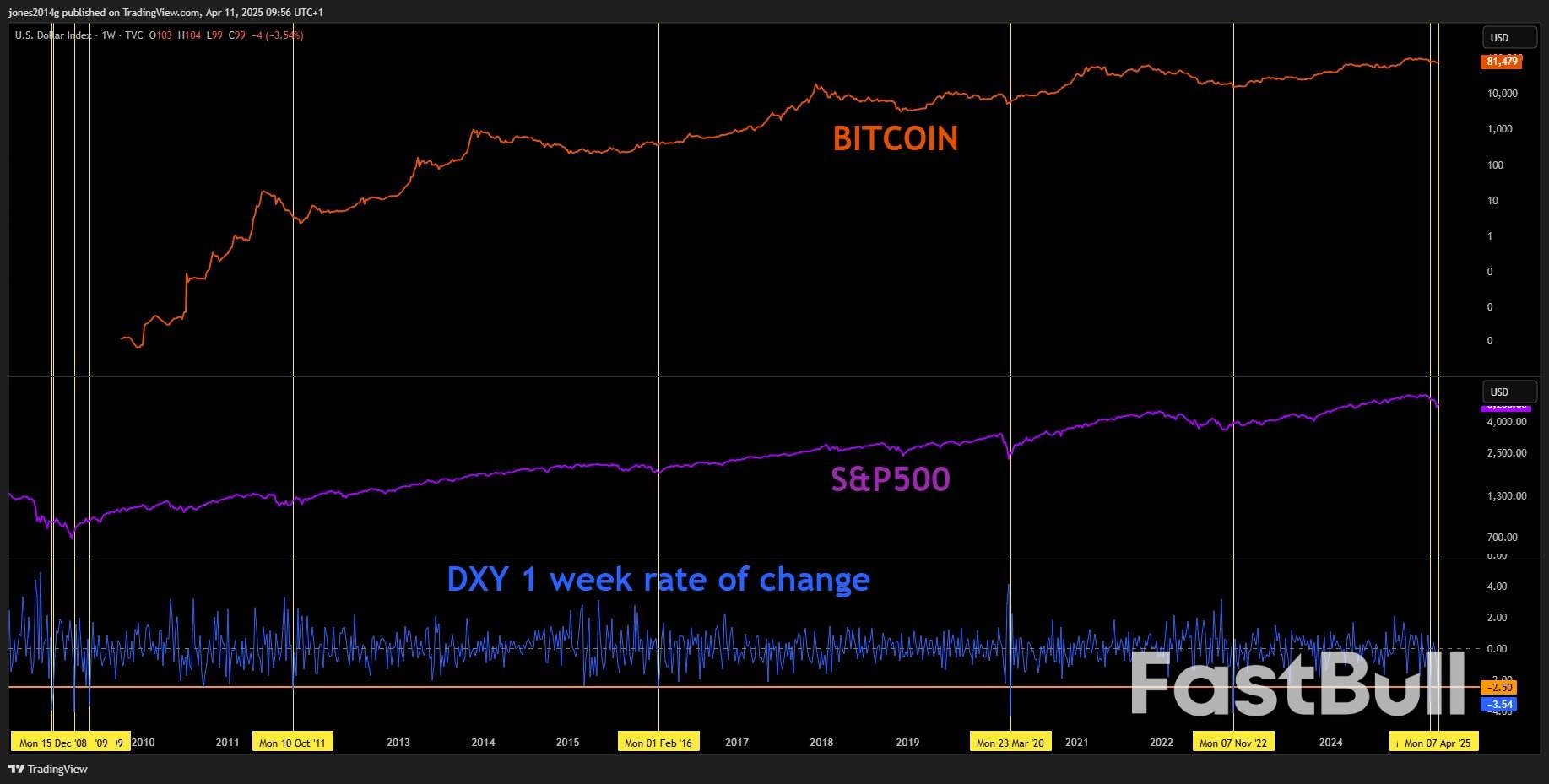

While far from constant, Bitcoin’s relationship with dollar strength tends to show that gains occur after major DXY losses — albeit with a delay of several months.

While far from constant, Bitcoin’s relationship with dollar strength tends to show that gains occur after major DXY losses — albeit with a delay of several months.

Above: EUR/CNY at 10-minute intervals with US 10 and 30-year yields, and GB 10 and 30-year yields. Click the image for more detailed inspection.

Above: EUR/CNY at 10-minute intervals with US 10 and 30-year yields, and GB 10 and 30-year yields. Click the image for more detailed inspection. Above: EUR/CNY, USD/CNY, USD/CNY at hourly intervals with US 10 and 30-year yields. Click the image for more detailed inspection.

Above: EUR/CNY, USD/CNY, USD/CNY at hourly intervals with US 10 and 30-year yields. Click the image for more detailed inspection.WASHINGTON (April 14): U.S. President Donald Trump on Sunday said he would be announcing the tariff rate on imported semiconductors over the next week, adding that there would be flexibility with some companies in the sector.

The president's pledge means that the exclusion of smartphones and computers from his reciprocal tariffs on China likely will be short-lived as Trump looks to reset trade in the semiconductor sector.

"We wanted to uncomplicate it from a lot of other companies, because we want to make our chips and semiconductors and other things in our country," Trump told reporters aboard Air Force One as he traveled back to Washington from his estate in West Palm Beach.

Trump declined to say whether some products such as smartphones might still end up being exempted, but added: "You have to show a certain flexibility. Nobody should be so rigid."

Earlier in the day, Trump announced a national security trade probe into the semiconductor sector.

"We are taking a look at Semiconductors and the WHOLE ELECTRONICS SUPPLY CHAIN in the upcoming National Security Tariff Investigations," he posted on social media.

The White House had announced the exclusions from steep reciprocal tariffs on Friday, creating some hope that the tech industry might escape being ensnared in the escalating conflict between the two nations and that everyday consumer products such as phones and laptops would remain affordable.

However, Trump's commerce secretary, Howard Lutnick, earlier on Sunday made clear that critical technology products from China would face separate new duties along with semiconductors within the next two months.

Trump's back-and-forth on tariffs last week triggered the wildest swings on Wall Street since the COVID pandemic of 2020. The benchmark Standard & Poor's 500 index is down more than 10% since Trump took office on January 20.

Lutnick said Trump would enact "a special focus-type of tariff" on smartphones, computers and other electronics products in a month or two, alongside sectoral tariffs targeting semiconductors and pharmaceuticals. The new duties would fall outside Trump's so-called reciprocal tariffs, under which levies on Chinese imports climbed to 125% last week, he said.

"He's saying they're exempt from the reciprocal tariffs, but they're included in the semiconductor tariffs, which are coming in probably a month or two," Lutnick said in an interview on ABC's "This Week," predicting the levies would bring production of those products to the United States.

Beijing increased its own tariffs on U.S. imports to 125% on Friday in response. On Sunday, before Lutnick's comments, China said it was evaluating the impact of the exclusions for the technology products implemented late on Friday.

"The bell on a tiger's neck can only be untied by the person who tied it," China's Ministry of Commerce said.

Billionaire investor Bill Ackman, who endorsed Trump's run for president but who has criticized the tariffs, on Sunday called on him to pause the broad and steep reciprocal tariffs on China for three months, as Trump did for most countries last week.

If Trump paused Chinese tariffs for 90 days and cut them to 10% temporarily, "he would achieve the same objective in causing U.S. businesses to relocate their supply chains from China without the disruption and risk," Ackman wrote on X.

Sven Henrich, founder and lead market strategist for NorthmanTrader, was harshly critical of how the tariff issue was being handled on Sunday.

"Sentiment check: The biggest rally of the year would come on the day Lutnick gets fired," Henrich wrote on X. "I suggest the administration figures out who controls the message, whatever it is, as it changes every day. U.S. business can't plan or invest with the constant back and forth."

U.S. Senator Elizabeth Warren, a Democrat, criticized the latest revision to Trump's tariff plan, which economists have warned could dent economic growth and fuel inflation.

"There is no tariff policy - only chaos and corruption," Warren said on ABC's "This Week," speaking before Trump's latest post on social media.

In a notice to shippers late on Friday, the U.S. Customs and Border Protection agency published a list of tariff codes excluded from the import taxes. It featured 20 product categories, including computers, laptops, disc drives, semiconductor devices, memory chips and flat panel displays.

In an interview on NBC's "Meet the Press," White House trade adviser Peter Navarro said the U.S. has opened an invitation to China to negotiate, but he criticized China's connection to the lethal fentanyl supply chain and did not include it on a list of seven entities - the United Kingdom, the European Union, India, Japan, South Korea, Indonesia and Israel - with which he said the administration was in talks.

Trade Representative Jamieson Greer said on CBS's "Face the Nation" that there were no plans yet for Trump to speak to Chinese President Xi Jinping on tariffs, accusing China of creating trade friction by responding with levies of its own. But he expressed hopes for some non-Chinese deals.

"My goal is to get meaningful deals before 90 days, and I think we're going to be there with several countries in the next few weeks," Greer said.

Ray Dalio, the billionaire founder of the world's biggest hedge fund, told NBC's "Meet the Press" that he was worried about the United States sliding into recession, or worse, as a result of the tariffs.

"Right now we are at a decision-making point and very close to a recession," Dalio said on Sunday. "And I'm worried about something worse than a recession if this isn't handled well."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up