Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

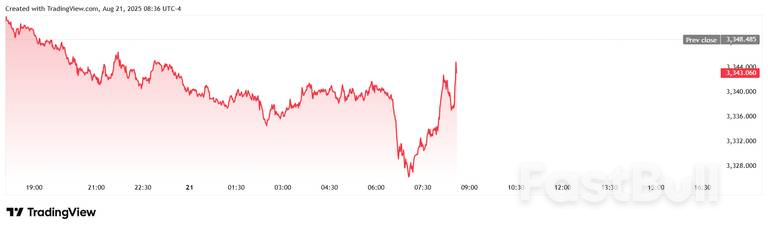

Gold hovers near $3,340 and silver around $37.80 as Fed minutes and strong dollar cap upside. Traders await Powell’s Jackson Hole speech, with metals stuck between hawkish policy and geopolitical uncertainty.

Russian President Vladimir Putin is prepared to meet Ukrainian President Volodymyr Zelenskiy but all issues must be worked through first and there's a question about Zelenskiy's authority to sign a peace deal, Putin's foreign minister said on Thursday.

Putin and U.S. President Donald Trump met on Friday in Alaska for the first Russia-U.S. summit in more than four years and the two leaders discussed how to end the deadliest war in Europe since World War Two.

After his summit talks in Alaska, Trump said on Monday he had begun arranging, opens new tab a meeting between the Russian and Ukrainian leaders, to be followed by a trilateral summit with the U.S. president.

Asked by reporters if Putin was willing to meet Zelenskiy, Foreign Minister Sergei Lavrov said: "Our president has repeatedly said that he is ready to meet, including with Mr. Zelenskiy".

Lavrov, though, added a caveat: "With the understanding that all issues that require consideration at the highest level will be well worked out, and experts and ministers will prepare appropriate recommendations.

"And, of course, with the understanding that when and if - hopefully, when - it comes to signing future agreements, the issue of the legitimacy of the person who signs these agreements from the Ukrainian side will be resolved," Lavrov said.

Putin has repeatedly raised doubts about Zelenskiy's legitimacy as his term in office was due to expire in May 2024 but the war means no new presidential election has yet been held. Kyiv says Zelenskiy remains the legitimate president.

Russian officials say they are worried that if Zelenskiy signs the deal then a future leader of Ukraine could contest it on the basis that Zelenskiy's term had technically expired.

Zelenskiy said this week Kyiv would like a "strong reaction" from Washington if Putin were not willing to sit down for a bilateral meeting with him.

European leaders say they are sceptical that Putin is really interested in peace, but are searching for a credible way to ensure Ukraine's security as part of a potential peace deal with minimal U.S. involvement.

Lavrov said it was clear that neither Ukraine nor European leaders wanted peace. He accused the so-called "coalition of the willing" - which includes major European powers such as Britain, France, Germany and Italy - of trying to undermine the progress made in Alaska.

"They are not interested in a sustainable, fair, long-term settlement," Lavrov said of Ukraine. He said the Europeans were interested in achieving the strategic defeat of Russia.

"European countries followed Mr. Zelenskiy to Washington and tried to advance their agenda there, which aims to ensure that security guarantees are based on the logic of isolating Russia," Lavrov said, referring to Monday's gathering of Trump, Zelenskiy and the leaders of major European powers at the White House.

Lavrov said the best option for a security guarantee for Ukraine would be based on discussions that took place between Moscow and Kyiv in Istanbul in 2022.

Under a draft of that document which Reuters has seen, Ukraine was asked to agree to permanent neutrality in return for international security guarantees from the five permanent members of the U.N. Security Council: Britain, China, France, Russia and the United States.

Any attempts to depart from the failed Istanbul discussions would be hopeless, Lavrov said.

At the time, Kyiv rejected that proposal on the grounds that Moscow would have held effective veto power over any military response to come to its aid.

South Korea is set to unveil about $150 billion in US investment plans by private companies during a summit between President Lee Jae Myung and US President Donald Trump, the Hankyoreh newspaper reported Thursday.The pledge is likely to include both ongoing and future projects and will be separate from the $350 billion South Korea agreed to invest in the US as part of a trade agreement struck last month.

While the $150 billion package will be highlighted at the summit, officials don’t expect further discussion of the $350 billion investment fund, which was a centerpiece of last month’s trade agreement, the newspaper said, citing unidentified government officials.The trade agreement between the two countries reached in July capped US tariffs on imports of Korean goods at 15%, one of the most favorable rates.

Lee is set to meet Trump on Aug. 25, a high-stakes trip that’s also expected to cover security issues.The scale of US-bound investments to be announced on the occasion of the South Korea-US summit has not yet been determined, South Korea’s industry ministry said in a statement late Wednesday. The government did not offer an immediate comment when reached by Bloomberg News.

Several Korean companies already have existing US investment plans, including Samsung Electronics Co.’s multibillion-dollar semiconductor plant in Texas and Hyundai Motor Group’s $21 billion pledge for vehicle and steel facilities. Last year, Hanwha Ocean Co. and Hanwha Systems Co. acquired Philly Shipyard for $100 million and parent Hanwha Group is preparing detailed investment plans tied to shipbuilding cooperation in the US, the report added.Leaders of South Korean conglomerates, including Samsung’s Jay Y. Lee, Hyundai Motor’s Euisun Chung, SK’s Chey Tae-won and LG’s Koo Kwang-mo, will join the delegation for the US trip, Yonhap News reported last week. Hanwha Group’s Kim Dong-kwan and HD Hyundai’s Chung Ki-sun and Hanjin Group’s Walter Cho may also join, according to Yonhap

South Korea has previously said that the country’s $350 billion investment pledge as part of the US trade deal is largely structured as loan guarantees rather than direct capital injections and the actual equity commitment would remain below 5%.

Gold prices rose sharply following the release of worse-than-expected labor market data after the number of Americans filing new claims for unemployment benefits was well above economists’ forecasts.

Initial claims for state unemployment benefits came in at seasonally adjusted 235,000 for the week ending August 16, the Labor Department announced on Thursday. The number was higher than expectations, as consensus estimates forecasted a reading of 225,000 claims. The previous week’s figure was unrevised at 224,000.

Spot gold rose back toward session highs following the 8:30 am EDT data, and last traded at $3,343.07 per ounce for a loss of 0.16% on the session.

Meanwhile, the four-week moving average for new claims – often viewed as a more reliable measure of the labor market since it flattens week-to-week volatility – came in at 226,250 following the previous week's unrevised average of 221,750.

Continuing jobless claims, which represent the number of people already receiving benefits, were at 1.972 million during the week ending August 9, higher than the expected 1.960 million reading and the previous week’s downwardly revised 1.942 million level.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up