Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold (XAU/USD) remains resilient above the $4,200 level, supported by dovish Fed expectations, persistent geopolitical risks, and a weaker U.S. dollar. With markets pricing in two additional Fed rate cuts this year, investors continue to favor gold as a safe-haven asset amid rising uncertainty.

Insurance IPO activity in 2025 has shown stark regional contrasts. While the U.S. has seen a surge in activity as tech-driven insurers capture investors' attention, activity in the UK and Europe has been subdued amid liquidity shortages and valuation hurdles.In the U.S., Neptune Insurance's $3.1 billion debut, Slide Insurance's $2.6 billion listing and HCI Group's Exzeo Group, which is targeting a valuation of up to $2 billion in its U.S. IPO, are among examples that have shown heightened investor appetite for profitable business in the insurance space.

Cristiano Dalla Bona, co-head of U.S. equity capital markets at Mergermarket, said this latest wave of U.S. insurance IPOs is differentiated by "the breadth of business models coming to market, with a focus on insurtech offerings".Dalla Bona highlighted that while some insurance platforms carry significant underwriting exposure, others – particularly MGA and broker-driven businesses – are asset-light.He noted: "The broker model is especially attractive because it doesn't require holding underwriting risk, operates with light capital intensity and remains a deeply fragmented sector, offering ample opportunities for growth through consolidation."

The U.S. market benefits from a deep, insurance-savvy investor base in New York, a regulatory environment supportive of public offerings and a valuation premium that has grown in the aftermath of the COVID-19 pandemic.

By contrast, IPO activity across Europe and London remains subdued in 2025.The London Stock Exchange saw only nine new listings in the first half of this year, none of which were in the insurance space.Market uncertainty, geopolitical tensions and macroeconomic challenges have dampened investor appetite and delayed many IPO plans. Some hoped-for European insurance IPO activity failed to materialise.Inigo, once considered a strong IPO candidate, opted for acquisition rather than going public. Similarly, Centerbridge Partners-led Canopius withdrew its IPO plans earlier this year.

Aspen Insurance, closely linked to the London market, chose to list in New York instead, seeking higher valuations and more favorable conditions in the U.S. market, and has since agreed to be acquired by Sompo in a $3.5 billion deal pending regulatory approvals.Despite these headwinds, analysts remain cautiously optimistic about a likely rebound in activity in Europe in the months to come, fuelled by regulatory reforms and renewed M&A activity. Nevertheless, the environment remains risk-averse and focused on profitability and resilience.

Erickson Davis, head of European equities, KBW, said: “In general, across sector, EU and UK IPO activity has been subdued versus US activity levels.” He pointed to liquidity differentials: “Liquidity profiles of listing venues is a major factor in this, particularly in insurance where there is often an international business mix or distribution profile to the company which enables more flexibility in an IPO listing decision.”This dynamic is evident in insurer valuations. More liquid U.S.-listed stocks which have offered a way to play a hard market have been easier investments for global fund managers than less liquid UK or EU alternatives. Davis added: "We find the relative valuation multiples on several UK and EU-listed insurers too cheap to ignore, particularly as capital return dynamics play out.”

The post-pandemic era has also shifted valuation premiums. “It’s also noteworthy that in the post-COVID era, a valuation premium for U.S.-listed insurers has emerged. This is most pronounced in the reinsurance space when looking at Bermudians vs Lloyd’s stocks,” Davis said.London’s challenges are heightened by Brexit-related market access issues and macroeconomic headwinds, according to Lukas Muehlbauer, research associate and Europe director, IPOx.

“(The) UK’s new listing rules to simplify requirements and attract more companies are a step in the right direction,” Muehlbauer, said. He added that “sizeable European IPO candidates have opted for sales rather than listings”.U.S. mortgage insurer Radian's $1.7 billion acquisition of UK-based Inigo is one such example, which “removed another potential IPO candidate from an already thin roster of prospective London floats”, according to Muehlbauer.

Against that backdrop, Allianz CEO Oliver Bäte acknowledged the pull of deeper U.S. markets. “For Europe's largest insurer, it would currently be a rational decision to move to the New York Stock Exchange,” he said at the Bundesbank's Financial Center Conference in Frankfurt in September.A 2024 report by former European Central Bank president Mario Draghi on European competitiveness shed light on these structural challenges, emphasizing that “capital markets in Europe remain fragmented”.

This fragmentation leads to “higher compliance costs and inefficiencies,” which weigh heavily on companies seeking to list in Europe, the report stated.Draghi and Bäte’s observations underscore the tough structural situation for European insurers, who face weaker liquidity and limited capital market support compared to their U.S. peers.Elaborating on the scope of dual listings, Fitch senior director Gerald Glombicki said: "There’s not many companies that do that because it’s pretty expensive and there’s a lot of regulatory burdens to it, and some who do, don't get the benefit of being dual listed.”

Meanwhile, IPOx’s Muehlbauer highlighted the limitations in crossing markets. “Some European insurers may look at a U.S. dual listing to reach a larger pool of investors, yet they may also have to factor in higher underwriting fees on average and greater litigation exposure in the U.S., so it isn’t an automatic choice," he said.

Amid a backdrop of slowing growth and rising trade tensions, China’s leaders gathered in Beijing to sketch out policies for the next five years. Problem is, it’s hard enough to navigate the next five days right now as US President Donald Trump ratchets up the tariff pressure.

Speaking from Air Force One on Sunday, Trump listed rare earths, fentanyl and soybeans as the US’s top issues with China just before the two sides return to the negotiating table and as a fragile trade truce nears expiration. Days earlier, the US leader threatened a 100% tariff on Chinese shipments after Beijing vowed to exert broad controls on the minerals.

While President Xi Jinping and his officials have become accustomed to dealing with Trump’s threats, shrugging off the first trade war and keeping the export engines humming through the second take so far, the tariff uncertainty can only complicate their planning.

Chang Shu, Eric Zhu and David Qu of Bloomberg Economics expect a more balanced approach among growth, equity, and security, reflecting a deeper understanding of how these goals reinforce each other.

“This trinity of priorities could mark a shift from the growth-at-all-costs model in the older plans and the heavier emphasis on equity and security in the past two,” they wrote. As for trade, Beijing “will likely signal a shift from a long-held mercantilist approach to a more two-way opening with diversified global engagement.”

But that’s not to say growth — which came in at the weakest pace in a year during the third quarter — will no longer be a priority.

Standard Chartered’s China economists Shuang Ding and Hunter Chan say recent deliberations in policy circles indicate that average growth of 4.7-4.8% is desired for 2026-30, to pave way for a doubling of 2020 GDP by 2035.

To pull that off, Beijing will aim to boost productivity amid an aging population and technology restrictions from the West, they say. Specific policy proposals over the period could center around:

The authorities may see the next five years as a good window to promote the use of Renminbi in international trade and investment, they said.

Macquarie’s China economist Larry Hu expects a three-prong approach will underpin policy in the next five years:

“To achieve the growth target, Beijing will have no choice but to boost domestic demand,” Hu said. “For investors, it's the single most important thing to watch, although the timing is less determined by the 5-Year Plan made in Beijing, and more by policies made in Washington.”

After being delayed by the US government shutdown, the Bureau of Labor Statistics will release of the September consumer price index on Friday. The data, originally slated for Oct. 15, will give Federal Reserve officials a critical piece of information on inflation ahead of their policy meeting the following week.

Elsewhere, inflation data from Japan to the UK, purchasing manager indexes from major economies, and the first summary of a meeting by Swiss central bank officials will be among the highlights.

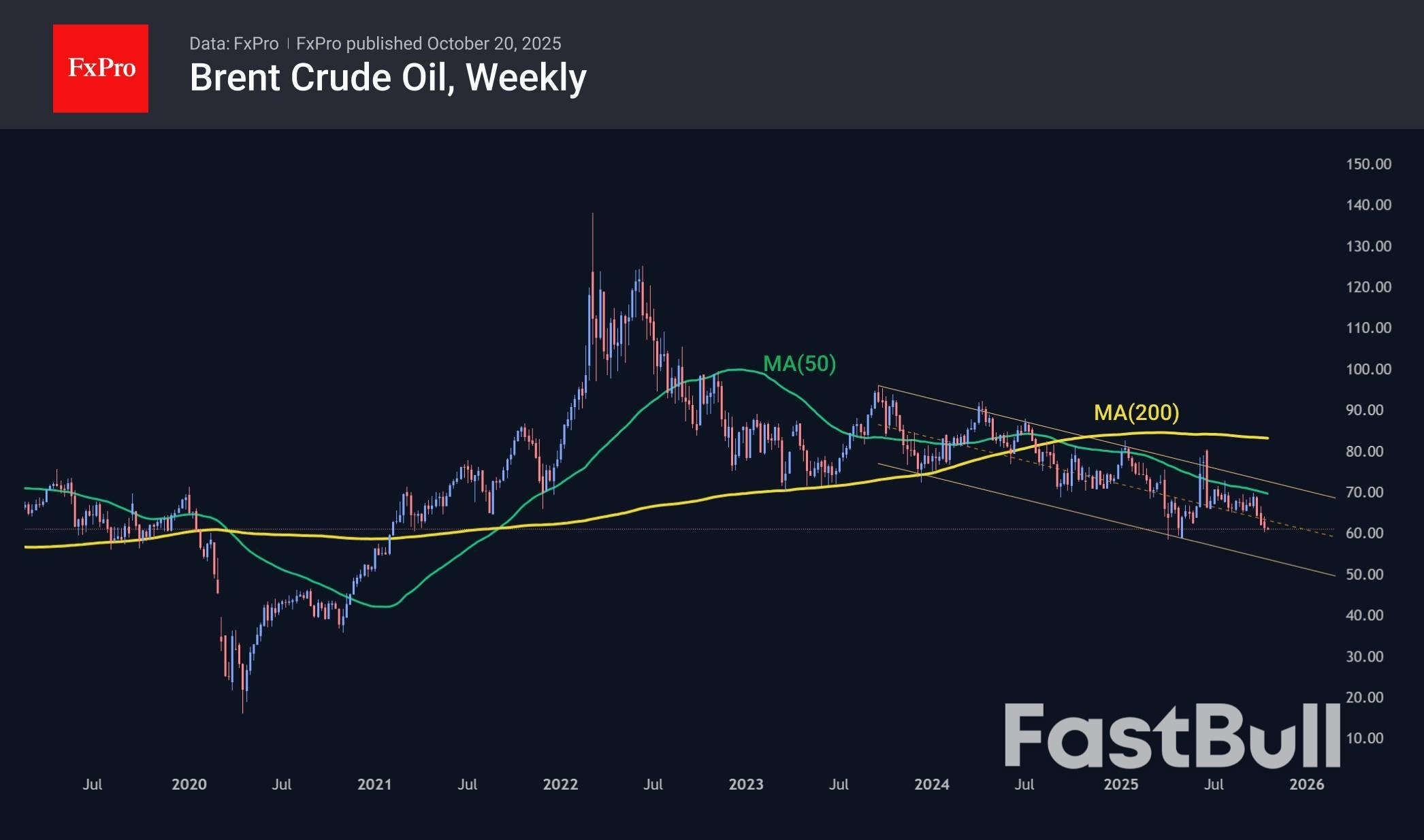

Crude oil prices fell 0.7% on Monday after three consecutive weeks of decline. Global production is growing while global economic growth is slowing, putting pressure on prices. In addition, the risk premium on signing the gas agreement and intensifying efforts to resolve the Ukrainian conflict has begun to decline. At the same time, oil prices are far from oversold, leaving room for further decline in the coming months.

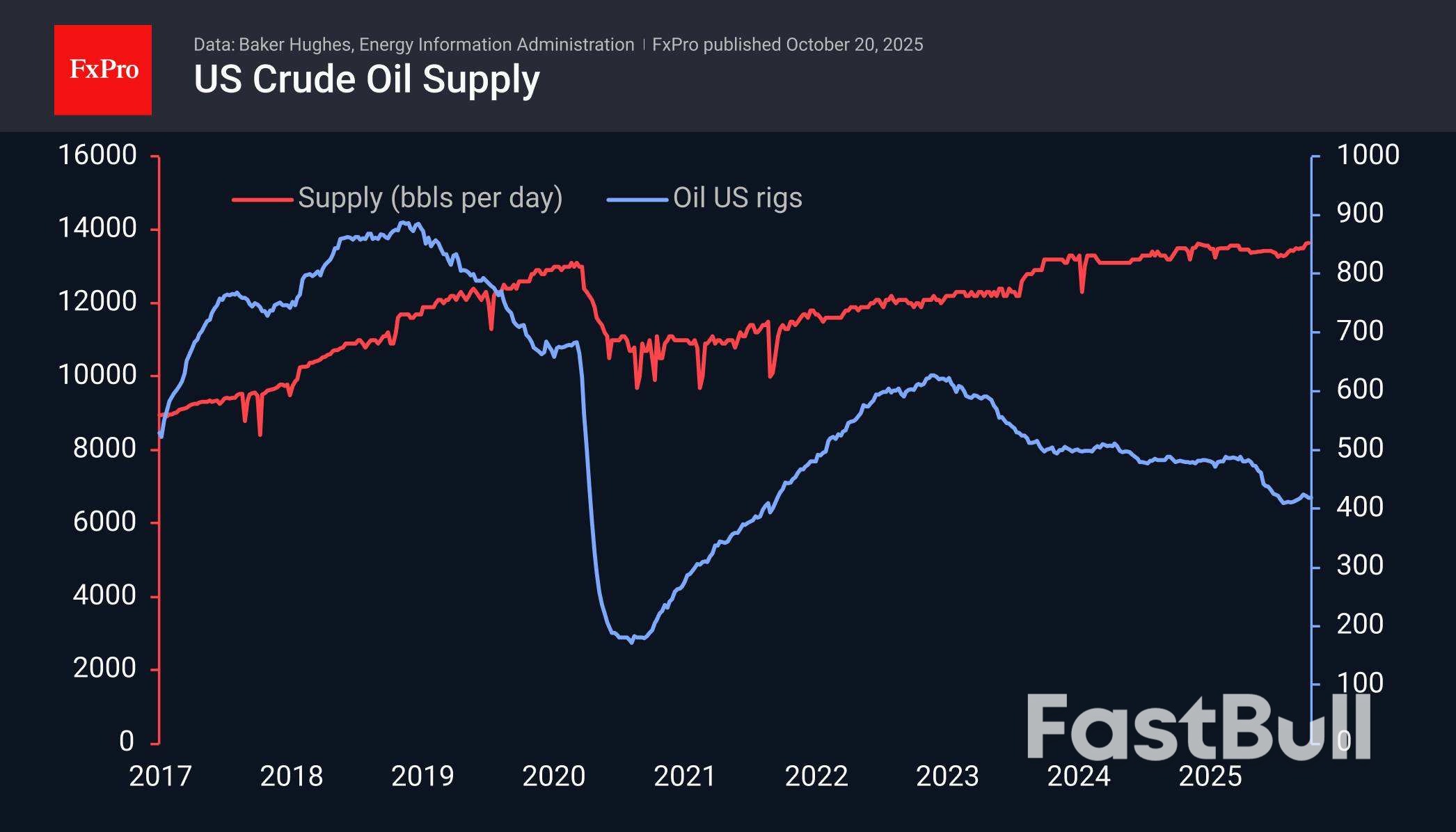

Baker Hughes reported on Friday that 418 oil rigs are operating in the US, the same as a week earlier, undermining the recovery trend seen since August. However, America is increasing production efficiency, extracting more oil from each well.

Bloomberg noted that there are now nearly 1.2 billion barrels of oil at sea, a record since the peak in 2020, when US production was at historic highs and Saudi Arabia and Russia were fighting for market share, boasting of their potential.

The current situation strongly resonates with what happened more than five years ago. The latest weekly data showed a record high in daily production in the US, with supplies of 13.64 million barrels per day.

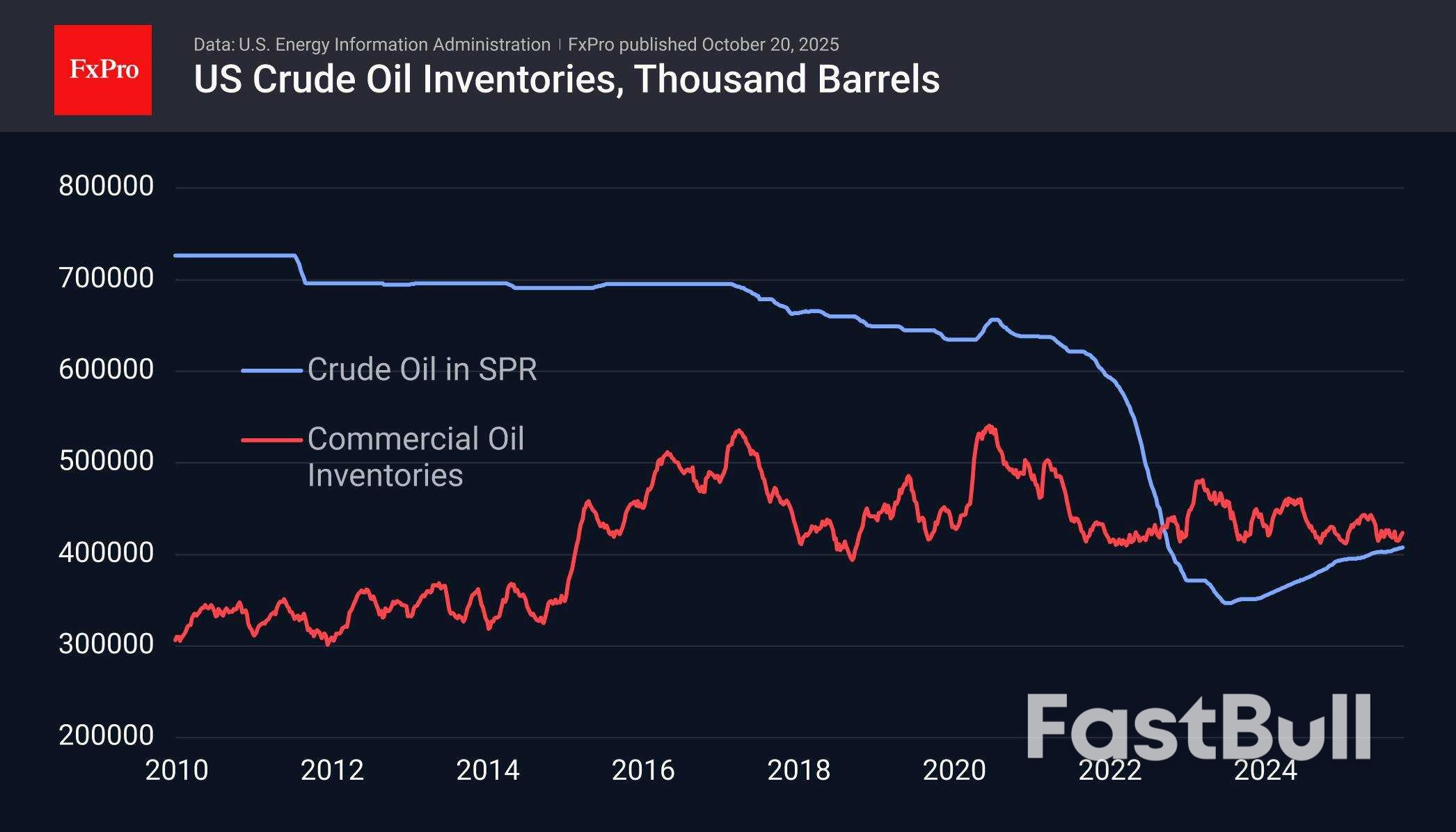

Inventory figures are a stabilising factor. Commercial inventories in the US are at the lower end of the range for the last decade, but they were about the same in January 2020, and six months later, this figure set a new record. However, without a collapse in consumption, such rapid growth should not be expected. The US government may also move to more actively rebuild the strategic petroleum reserve sold off in 2022.

The price of oil has been in a downward channel for just over three years, and at the end of September, it accelerated its decline as it approached the 50-week moving average and the upper limit of the range. The lower limit of this range is now close to $53 per barrel of Brent, with a decline towards the end of the year closer to $50.50 against the current $61.00.

The main scenario for oil is a decline towards $50 in the next 2-4 months. At the same time, the potential for an increase in US inventories is a potential stabilising factor. We assume that the situation with inventories is roughly similar worldwide, excluding the abundance of oil at sea.

The stock market plays a central role in the global economy, allowing investors and companies to trade ownership and raise capital. This article explains how the stock market works, what drives prices, and how investors can participate responsibly.

The stock market is a network of exchanges where shares of publicly listed companies are bought and sold. When investors purchase a company’s stock, they acquire partial ownership and a claim on its future profits. Prices move constantly as buyers and sellers react to news, earnings reports, and economic data.

Major exchanges include the New York Stock Exchange (NYSE) and the Nasdaq. Each operates under strict regulations to ensure transparency, fair pricing, and investor protection. The market serves two core purposes: helping companies raise capital and giving investors opportunities to grow wealth.

When a company goes public through an Initial Public Offering (IPO), it sells shares directly to investors for the first time. The funds raised help finance expansion, research, or debt repayment.

After the IPO, shares trade on the secondary market between investors. Prices fluctuate based on supply and demand—when more investors want to buy than sell, prices rise, and vice versa.

Stock prices reflect investors’ collective expectations about a company’s future performance. Several factors influence these movements:

In the short term, markets can be volatile. But over time, stock prices tend to follow corporate fundamentals and economic trends.

Investors can earn returns in two main ways:

Long-term investors often focus on compounding growth by reinvesting dividends and holding through market cycles. Short-term traders, in contrast, aim to profit from daily price movements.

All investments carry risk. Market downturns, poor corporate performance, or global crises can reduce portfolio value. To manage risk:

Modern investors also use index funds and ETFs to gain broad exposure while minimizing fees and individual stock risk.

The stock market functions as a global exchange connecting companies seeking capital with investors pursuing growth. Prices move based on fundamentals, sentiment, and macroeconomic forces. Understanding these mechanisms helps investors participate more confidently and make informed, disciplined decisions for the long term.

In the German Bundestag, Friedrich Merz appealed to the EU to integrate the fragmented European capital market more deeply and reduce bureaucratic hurdles. His vision for the next step: a kind of Wall Street for Europe.German Chancellor Friedrich Merz used his government statement on Thursday to take a strategic look at what he called the “fragmented and over-bureaucratized” European stock and capital market landscape. His stated goal: the completion of the Capital Markets Union.“We need a kind of European Stock Exchange, so that successful companies like BionTech from Germany don’t have to go to the New York Stock Exchange,” Merz said. “Our companies need a sufficiently broad and deep capital market to fund themselves faster and more efficiently.”

The Chancellor linked this call to a strong appeal to the European Commission for consistent de-bureaucratization of the fragmented European capital market. Only in this way, he stressed, will the value created from German and European research truly remain in Europe. Only then can societal wealth grow via the capital market, Merz argued.The debate is fueled by the growing trend of European innovative companies raising capital on U.S. exchanges. Recent examples include Linde, Birkenstock Holding, and BioNTech – firms that chose Wall Street listings over domestic options.

This discussion fits into a broader financial context: the integration of European financial and capital markets. A far-reaching harmonization of financial hubs and access to capital would not be a mistake. Currently, there are around 15 securities exchanges in the Eurozone. The two largest operators – Euronext N.V. and Deutsche Börse AG – together handle about 80 percent of the annual €8 trillion equity trading volume.

Merz’ initiative stands not only for institutional reform but also as an attempt to free Europe’s financial markets from self-imposed regulatory constraints.The Chancellor emphasized the importance of better financing for innovative startups in high-tech future industries. Experience shows, however, that these companies tend to rely on venture capital – and they have no difficulty listing on international exchanges like Frankfurt or London.

The real question for Brussels and Berlin is whether focusing on a new financial hub alone is enough to prevent visible capital flows from Europe to the United States.Germany alone lost around €64.5 billion last year due to capital flight – a symptom of deeper issues: an overbearing regulatory framework from Brussels and EU capitals, excessive fiscal burdens, and an escalating energy cost crisis.

These are fundamental economic imbalances that cannot be resolved simply by creating a European mega-exchange. They are homegrown design flaws – at the heart of today’s economic crisis.In reality, the debate over the Capital Markets Union is about something else entirely: the European Commission’s strategic goal to consolidate member state debt under its roof. This would give Brussels greater financial clout through regular EU bond issuances. More centralization in Brussels, less national oversight – the dream of the Brussels power center.

The EU is gradually moving toward a paradigm shift in debt financing. Originally, the Commission was strictly prohibited from financing itself via market issuances. That red line has long been crossed.The COVID lockdowns provided a lever to launch NextGenerationEU, an unprecedented €800 billion debt program. This money largely financed national deficits, with the Commission acting as a market borrower, backed by the European Central Bank.

It is no secret that Brussels wants to expand this model. The Ukraine conflict serves as a convenient pretext to issue new joint debt under the media-amplified threat of Russian aggression. Chancellor Merz has already indicated this spring that EU-wide borrowing for defense purposes is not off the table – but only for “absolute exceptional cases.”

Merz deliberately avoided the term “Eurobonds,” just like Ursula von der Leyen, who in her State of the Union speech on September 10 circumnavigated the term, instead proposing a common European budget for “European goods.”The signal is clear: we are in a transitional phase where old debt rules are being gradually loosened, and the centralization of debt issuance in Brussels is systematically advanced.

This aligns seamlessly with thinking about a shared European exchange – potentially hosted by Euroclear in Brussels, the central player in the safekeeping and settlement of Eurozone securities. A serious move would also consider relocating the European Central Bank to Brussels for fast debt issuance.The EU’s response to the looming debt crisis is obvious: a much higher degree of centralization. Activating capital that can be leveraged to expand debt becomes strategic; the exchange consolidation is just a secondary concern.

This also ties into the debate over using frozen Russian assets at Euroclear. The goal: collateralize a portfolio worth around €200 billion, largely expired European sovereign bonds, to finance reparations loans to Ukraine. Brussels is searching for credit collateral, regardless of origin.

In 2025, global markets experienced a notable decline that raised concerns among investors. This article explores the main reasons behind the stock market drop—from economic pressures to investor sentiment shifts—and examines what these developments could mean for the future.

The first quarter of 2025 saw sharp declines across major indices. The S&P 500 dropped nearly 8%, the Nasdaq lost around 10%, and the Dow Jones slipped by 6%. These movements reflected a combination of macroeconomic uncertainty, rising rates, and profit-taking after a strong 2024 rally.

Analysts noted that while the drop was significant, it resembled a market correction rather than a long-term crash. The pullback was fueled by valuation adjustments and investor caution toward sectors with stretched earnings multiples.

Central banks continued tightening monetary policy to combat persistent inflation. Higher borrowing costs reduced corporate profits and made equities less appealing compared to bonds. Growth stocks, particularly in technology, were hit hardest as future earnings were discounted more aggressively.

Global manufacturing and consumer spending data began to soften. Economists warned of potential stagflation, where growth slows while prices remain high. This combination eroded confidence and led investors to rebalance toward defensive sectors like healthcare and utilities.

Several major companies reported weaker-than-expected earnings. Profit margins compressed due to higher input costs and sluggish demand. Disappointing forecasts from technology and retail firms triggered broad-based selling across related sectors.

Ongoing geopolitical tensions, trade disputes, and policy changes amplified volatility. Energy prices spiked after new supply disruptions, while investor sentiment turned risk-averse amid uncertainty around global alliances and fiscal debates.

After two years of strong gains in AI, semiconductor, and fintech stocks, valuations reached unsustainable levels. Institutional investors began rotating into lower-risk assets, sparking a wave of profit-taking that accelerated the overall market decline.

Investor behavior shifted rapidly during the selloff. Volatility indexes such as the VIX surged, and trading volumes spiked as hedge funds unwound leveraged positions. At the same time, demand for safe-haven assets like gold, Treasury bonds, and the U.S. dollar increased sharply.

Despite short-term losses, many analysts viewed the correction as a healthy reset. The market had grown overly concentrated in high-valuation stocks, and a pullback was seen as necessary for long-term stability.

Investors who maintain perspective and avoid panic selling are more likely to benefit when market sentiment eventually improves.

The stock market’s decline in 2025 was driven by a mix of rising interest rates, slowing growth, and valuation corrections after years of strong gains. While unsettling, the drop reflected a natural adjustment to shifting economic conditions rather than a systemic failure. Understanding these dynamics helps investors make informed decisions and prepare for the market’s eventual recovery.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up