Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Federal Reserve Bank of New York President John Williams stated tariffs could increase U.S. inflation by 1.0% to 1.5% within the year, according to his recent speech.

Key Points:

Federal Reserve Bank of New York President John Williams stated tariffs could increase U.S. inflation by 1.0% to 1.5% within the year, according to his recent speech.

Williams’ remarks highlight the persistent impact of tariffs on U.S. inflation without immediate interest rate changes, reflecting on monetary policy expectations and potential market adjustments.

John Williams, President of the New York Fed, stated that tariffs could contribute 1% to 1.5% to U.S. inflation in 2025. Historical trends support this estimation, aligning inflationary impacts with past tariff impositions.

The tariffs are expected to have an immediate impact on costs for U.S. consumers and industries, potentially increasing goods prices. The macroeconomic outlook projects inflation rates within 3.0%–3.5% in 2025. Although having a role in inflation, tariffs are not currently causing a notable inflation rise. Financial markets, including cryptocurrencies, remain largely unchanged by this news. The Federal Reserve maintains a strategy of watching inflation trends closely.

Tariffs' Inflationary Effects and Federal Reserve's Response

Despite the inflationary influences of tariffs, Williams's statements indicate there will be no sudden shifts in Fed policies related to interest rates. Future interest rate moderations are anticipated depending on economic conditions. The absence of major cryptocurrency market movements following the tariff prediction highlights their limited current effect on that sector. Historical patterns indicate similar inflation-pass-through scenarios resulting in transitory price volatility.

Most of the bidders seeking to buy a portion of Starbucks' China operations have submitted offers valuing the business at as much as $5 billion, said two people who have knowledge of the deal discussions.That quotation would make a potential deal one of the most valuable China unit divestments by a global consumer company in recent years.The offers, which have not been reported previously, would let Starbucks push ahead with the sale in a market where it faces sluggish economic growth and stiff competition from local brands.

Starbucks invited around 10 potential buyers to submit non-binding bids by early September, Reuters reported last month.Most of those bids set the value for Starbucks China at about 10 times its expected earnings before interest, taxes, depreciation, and amortisation (EBITDA) of $400 million to $500 million in 2025, said the people.At least one bidder offered an EBITDA multiple in the high teens, said one of the people.The multiple bidders offered for Starbucks China is similar to one of its main rivals Luckin Coffee, which is currently valued at nine times its projected EBITDA for the next 12 months.Luckin has been gaining market share against Starbucks by offering lower-priced products and increasing its presence in smaller Chinese cities.

The people asked to remain unidentified as the information is confidential.

In response to Reuters request for comment, a spokesperson for Starbucks referred to the chain's latest quarterly earnings which saw record-breaking sales growth in international business and the third consecutive quarterly revenue growth in China.The spokesperson declined to comment on the valuation of the China business or the latest status of the bidding process.Starbucks' enterprise value for the global business is 20.6 times its trailing 12-month EBITDA, and is projected to be 19.3 times the forecast of EBITDA for the next 12 months, according to LSEG data.The Seattle-headquartered company has a market value of about $99 billion as of Thursday.

Starbucks has not yet decided how large a stake it is selling in the China business, Reuters reported last month. The two sources said they did not have information on the stake size.In May, the company said it was not considering a full sale of the business. Starbucks CEO Brian Niccol said on the quarterly earnings call in July it would maintain a meaningful stake in the China business.Starbucks' market share in the world's second-largest economy - home to more than a fifth of its cafes - was 14% last year versus 34% in 2019, data from market researcher Euromonitor International showed.

The chain has since taken the rare step of reducing prices for some non-coffee drinks in China and increasing the pace of new and China-centric products.Comparable-store sales in China increased 2% in the quarter ended on June 29 versus zero growth in the previous quarter.Last month, Reuters reported the coffee chain invited interested parties including private equity firms Carlyle , EQT , Hillhouse Investment and Primavera Capital to submit initial bids.

Other potential buyers selected included Bain Capital, KKR & Co ,and technology major Tencent. It is not immediately clear if all of them submitted non-binding offers.Bain, EQT, Tencent, Carlyle and Primavera declined to comment. The others did not respond to a request for comment.It is not immediately clear what the next steps in the sale process are.Typically, the seller would select a smaller group of bidders from the initial round for a final round, when binding offers are expected.

I was favored with an invitation to the Federal Reserve’s Jackson Hole conference in 2007. Entitled Housing, Housing Finance, and Monetary Policy, the sessions illustrated troubling feedback loops between the mortgage markets and the global economy. The clouds I recall gathering over the Grand Tetons were symbolic; a little over a year later, the world was in crisis.

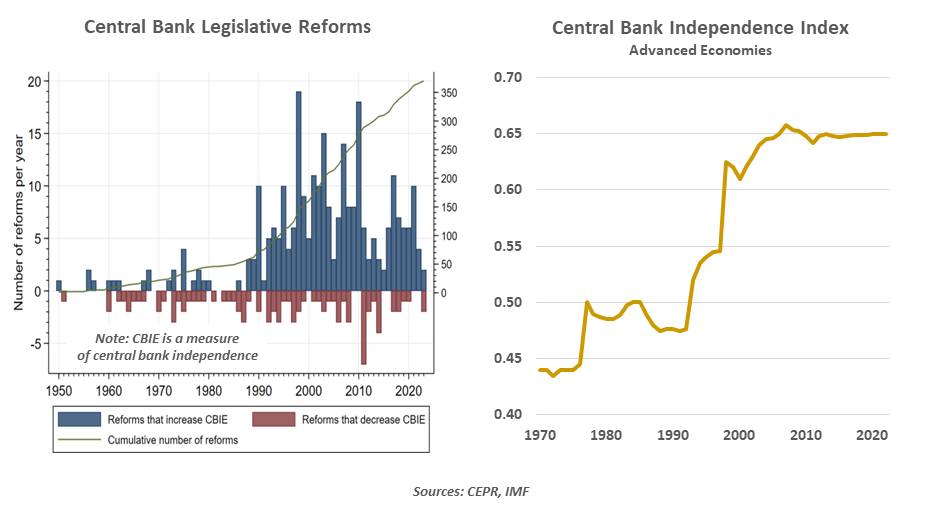

I don’t know what the weather was like in Wyoming this year, but the symbolic clouds that were gathering as the world’s financial dignitaries assembled there were ominous. Presentation topics focused on labor markets and inflation, but the main issue hovering over the event was whether the Fed can remain independent of political influence. Should it lose that battle, the aftershocks could be substantial.Independent central banks are a relatively recent concept. The Federal Reserve didn’t split cleanly from the Treasury Department until 1951; the Bank of England was a branch of the U.K. government until 1997. Debate over the proper degree of partition is still active in many places today.

Those favoring close alignment note the importance of accountability. Political leaders are democratically elected, and feel that their agendas reflect the public’s will. Central banks, in this view, should carry out the course agreed by leaders and their legislatures.To others, however, central banks provide a check on economic policy that is comparable to the role that courts have in adjudicating the law. Governments that accrue large deficits might wish to run the printing presses to finance themselves, leading to inflationary conditions. Creating space for central banks to focus on long-term goals like stable inflation raises the chances of achieving good outcomes. Terms for monetary authorities are long (14 years, in the case of Fed Governors), to immunize them from shifts in political cycles.

There is a substantial body of literature that links distance between governments and their central banks with lower rates of inflation. This, in turn, is positive for economic growth, employment and asset prices. The Fed’s success in fulfilling its mission over the past forty years inspired an increase in the level of central bank independence around the world.Countries that have opted not to follow this approach have been punished by the financial markets. A recent example is Turkey, whose central bank has been directed by a string of individuals close to its president. That country has experienced double digit inflation, a weak currency and capital flight.

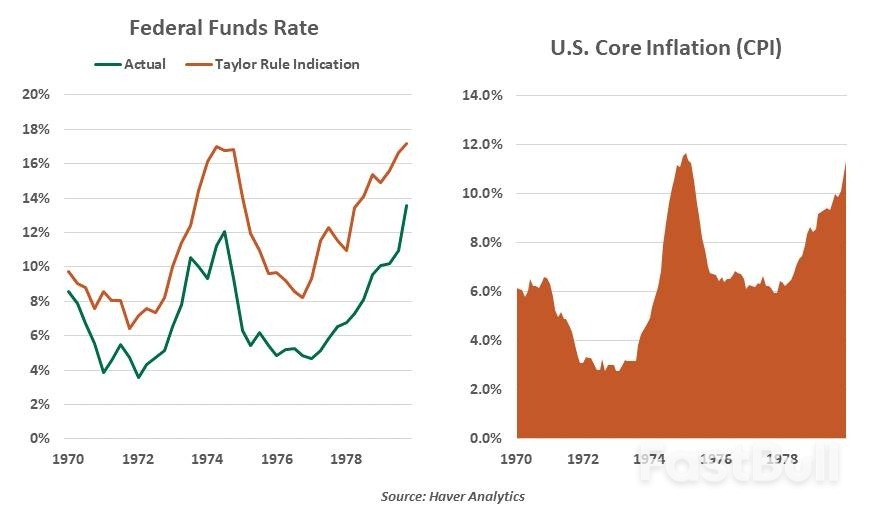

The experience of the 1970s is a cautionary tale for opponents of central bank independence.This evidence hasn’t stopped American leaders from trying to influence monetary policy. As we described last spring, political criticism of the Fed is the rule, not the exception. Most of the time, this has been limited to public statements.The most significant incursion of politics into U.S. monetary policy came during the 1970s, when Richard Nixon appointed his advisor Arthur Burns to head the Fed. Burns kept interest rates lower than they should have been, resulting in substantial inflation at the end of the decade. (The “Taylor Rule” estimation in the chart below provides an estimate of what interest rates should have been, given trends in growth and inflation.) That experience informed a “hands off” posture from the White House that lasted until 2017.

The Fed is an unelected group, but it is not unaccountable. Governors are subject to political approval; they are nominated by the White House and confirmed by the Senate. The Chair provides a monetary report to Congress twice each year, and fields pointed questions from both sides of the aisle. The Fed’s operations are independently audited each year, and they are subject to review by the Government Accountability Office, which is accountable to Congress. The communication surrounding the Fed’s decision-making has expanded substantially over the past forty years; some would say that there is actually too much of it.

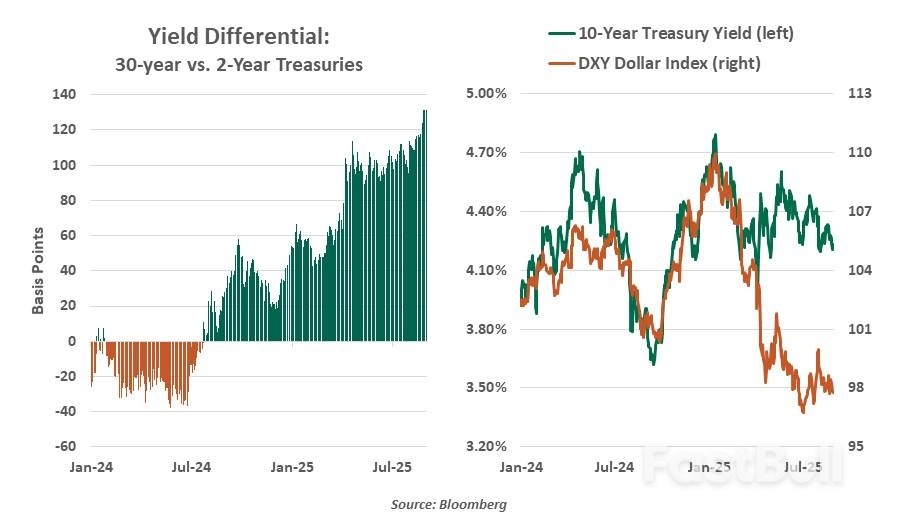

Under both Trump administrations, calls for lower rates and disparagement of Fed officials have been common. Nonetheless, monetary strategy has continued to be guided by fundamentals. Post-pandemic inflation, which remains above the 2% target, has kept policy on the restrictive side. This has increased the ire of the White House, which has called for overnight rates to be 300 basis points lower than they are today.The President has frequently mused about firing current Fed Chairman Jay Powell, whose term at the head of the table concludes next May. This has been seen by most market participants as posturing. But last month, the President took action to terminate Fed Governor Lisa Cook. Cook has sued to retain her position; the matter is now in the hands of the courts. At issue is what “cause” is sufficient to remove a senior official; the termination has no precedent.

The move is part of an effort by the White House to gain control of monetary policy. “We’ll have a majority very shortly,” said the President last week, referring to the makeup of the Fed’s Board of Governors. If Governor Cook loses her appeal to stay, four of the seven members will soon be Trump appointees.There is no assurance that this cohort will vote as a block. Governors Bowman and Waller have made strong statements this year in favor of Fed independence; Waller spent many years as the research director at the Federal Reserve Bank of St. Louis. But if the courts uphold Governor Cook’s dismissal, the Administration could seek grounds to terminate others.

What Would A More Political Fed Do?

A politically motivated majority of Governors could take a number of actions over time that would have been unimaginable before this year. Among them:

These still seem like extreme outcomes, but no possibility should be ruled out. The Project 2025 transition plan, which has influenced the Administration’s approach to a variety of policies, devoted a full chapter to musings on the Federal Reserve. The plan calls for ending the Fed’s maximum employment mandate, preemptively halting any future crisis lending, and exploring a move back to a gold- or other commodity-backed currency system. A lot would have to happen for any of these ideas to become reality. But the potential for personnel changes at the Federal Reserve over time has increased the odds of a tail event.

The reaction of financial markets could provide a check on the Administration’s ambition to control the Fed. A selloff in stocks and bonds could prompt a policy re-evaluation, as it did after the “Liberation Day” tariff announcement in April. Legal challenges are likely along the way; in a decision related to other administrative terminations this year, the Supreme Court gave specific deference to the Federal Reserve. Congress retains the right to reject appointments or proposals that might be viewed as too extreme.The U.S. economy is performing pretty well at the moment. Equity markets have enjoyed another favorable year. Unemployment is very low. Banks are very healthy. One might look at this evidence and wonder why the situation surrounding the Fed is such a big deal.

Borrowing a line from Casablanca, a compromised Fed may not be a problem today, or tomorrow; but it could be soon, and for the rest of our lives. If the Fed’s reputation is diminished, inflation could become unmoored. This would discourage investment, raise costs and damage asset values. The probability of this outcome is low, but rising; and the consequences are vast.A little over a year after my attendance at Jackson Hole, I found myself working at the Federal Reserve Bank of New York, trying to ascertain the extent of the global financial crisis. The courage to do the right thing in the face of immense outside pressure was a hallmark of the Fed’s leadership at that time, and of the institution. I am convinced that we were on the verge of a second Great Depression, which was averted because central banks had the latitude to act without waiting for political endorsement.

I certainly hope that central banks can maintain the respect and space they need to do their jobs. Our economic futures will depend on it.

President Donald Trump will sign an executive order on Friday changing the name of the Department of Defense to the Department of War, reverting to a moniker not used since the 1940s in line with his oft-expressed desire to pump up projections of US military might.

The plans to change the department’s name were described by a White House official on condition of anonymity ahead of the signing. The official said changes would include renaming the Pentagon’s briefing room the “Pentagon War Annex” and modifying the department’s website and signage. The plans were first reported by Fox News Digital.

Trump has long mused about changing the name of the department, even as he boasts about his efforts to end wars abroad and argues that he’s deserving of the Nobel Peace Prize. On social media, Trump repeatedly has referred to Defense Secretary Pete Hegseth as the “Secretary of War” and asked his followers whether he should rename the department.

“We won World War I, we won World War II, we won everything, and it just to me seems much more appropriate,” Trump told reporters in the Oval Office last month. “Defense is too defensive and we want to be defensive but we want to be offensive too if we have to be, so it just sounded to me like a better name.”

Hegseth shared the Fox News Digital report on X, with the new name of his department. He had hinted at the coming change during a speech at Fort Benning on Thursday, saying his job may have “a slightly different title tomorrow, we’ll see.”

Trump and Hegseth have sought to project a more muscular image for the Pentagon, and despite the president’s argument that he’s ended at least seven wars, he’s also launched several military strikes in his second term in the White House. That includes bombing Houthi rebels in Yemen, a strike on Iran’s nuclear program and, most recently, an attack on alleged drug-runners on a motorboat in the Caribbean Sea.

The president has also stoked controversy by enlisting the military to support immigration enforcement and border security, including by deploying the National Guard — and allowing them to carry their service weapons — as part of his takeover of the Washington DC police.

Trump has signaled that his efforts will not stop in the nation’s capital, where he possesses unique authority to oversee the local Guard, but could expand to other cities with Democratic mayors, such as Chicago and New York.

The president has appeared unbothered by the fact that an official name change for the Defense Department would likely require an act of Congress.

“We’re just going to do it, I’m sure Congress will go along, I don’t even think we need that,” he said last month.

The 1947 National Security Act merged the War Department, which dated to 1789, with the Department of the Navy and the Air Force into the National Military Establishment, led by the secretary of defense. The new entity was renamed the Defense Department in a 1949 amendment to the National Security Act.

Trump has charged Hegseth with rebuilding the military, which he says was greatly diminished under former President Joe Biden. His administration has touted strong recruiting numbers evidence that his moves have strong public support.

President Donald Trump signed an executive order Thursday implementing his trade agreement with Japan, under which the US will impose a maximum 15% tariff on most of its products, including automobiles and parts.

The deal was reached in July, but had yet to be formalized as Washington and Tokyo haggled over its terms. The directive prevents the stacking of Trump’s country-specific duties on top of existing levies.

The provisions of the agreement apply retroactively to any products shipped starting Aug. 7, the date which the US president’s tariffs on dozens of trading partners took effect.

Under the agreement, the US will lift certain tariffs on aircraft and aircraft parts as well as generic pharmaceuticals, ingredients and precursor chemicals.

Japan in July agreed to create a $550 billion fund to make investments in the US, though the details have yet to be announced.

The Japanese government has been pressing to secure the agreement for weeks. Its top trade negotiator, Ryosei Akazawa, attended talks in Washington this week over the terms.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up