Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Fed Vice Chair Jefferson flagged rising risks from both inflation and a weakening job market. He backed September’s rate cut citing labor softness but offered no clear guidance, stressing policy depends on incoming data.

OPEC+ is to discuss fast tracking its latest round of supply hikes in three monthly instalments of about 500,000 barrels a day to recoup market share.

This comes after the cartel announced earlier this month that they were adding a much smaller amount than that - about 137,000 barrels a day - leaving a question mark about how fast the rest will be returned.

So, now, Bloomberg reports that, according to a delegate, Saudi Arabia and its partners will review the expedited return of the remainder of a 1.66 million barrel-a-day supply tranche when they meet on Oct. 5.

The result is further pressure on the price of oil...

...testing the lows of its recent channel (ironically extending losses after similar rumors hit crude prices yesterday).

The IEA already forecast that the oil market is headed for a record supply-demand surplus next year.

Finally, we note that Saudi Crown Prince Mohammed bin Salman is heading to Washington in November to meet with President Donald Trump, who has called for lower oil prices.

Federal Reserve Bank of New York President John Williams downplayed the effect of tariffs on the risk of inflation, adding that price rises are less of a headache for policymakers than before.

Central bankers have seen a “re-balancing of the risks, from one where inflation was the big risk to one where employment and inflation — the risks to them — have moved closer together,” Williams said Monday, per Bloomberg. “It made sense to move interest rates down a little bit to take a little bit of the restrictiveness out of there.”

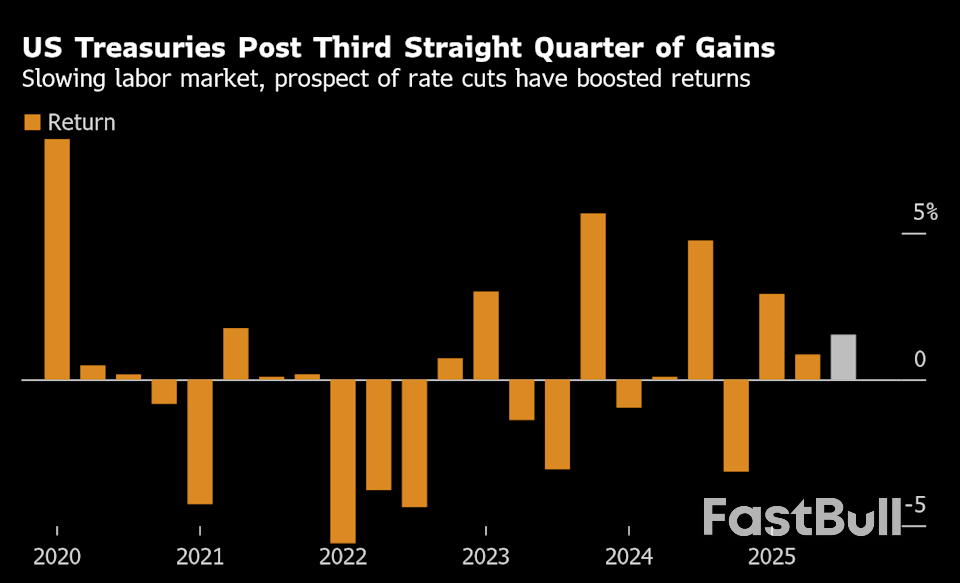

The Federal Reserve cut interest rates for the first time in 2025 earlier in September, as policymakers tried to steady a slowing job market while facing intense political pressure to lower rates from President Donald Trump. The decision brought the federal funds rate down to a range of 4%-4.25%.

Williams didn’t indicate whether he would support another rate cut at the Fed’s October meeting. He said tariffs have only had a “relatively modest or moderate” effect on inflation, pushing up some prices on imports.

“The tariff effects have been smaller than most people thought, and there doesn’t seem to be any signs of inflationary pressures building,” he added.

His comments struck a different tone to those of Cleveland Federal Reserve President Beth Hammack earlier in the day, underlining the split in opinion among central bankers about the best path forward for policy. Hammack said it's a “challenging time” for central bankers as they try to balance fighting inflation with protecting jobs.

“On the inflation side right now, I continue to be worried about where we are from an inflation perspective,” Hammack said in a Monday interview on CNBC, adding that she doesn’t expect prices to retreat to the Fed’s target of 2% inflation until the end of 2027 or early 2028. However, she added that that the labor market looks “reasonably healthy.”

While the number of Americans filing new applications for unemployment benefits tumbled again last week, fears remain over the state of the jobs market. Rising layoffs have been cited by officials as a potential problem area, and Fed Chair Jerome Powell warned that companies are not hiring is “a way of passing on tariff costs.”

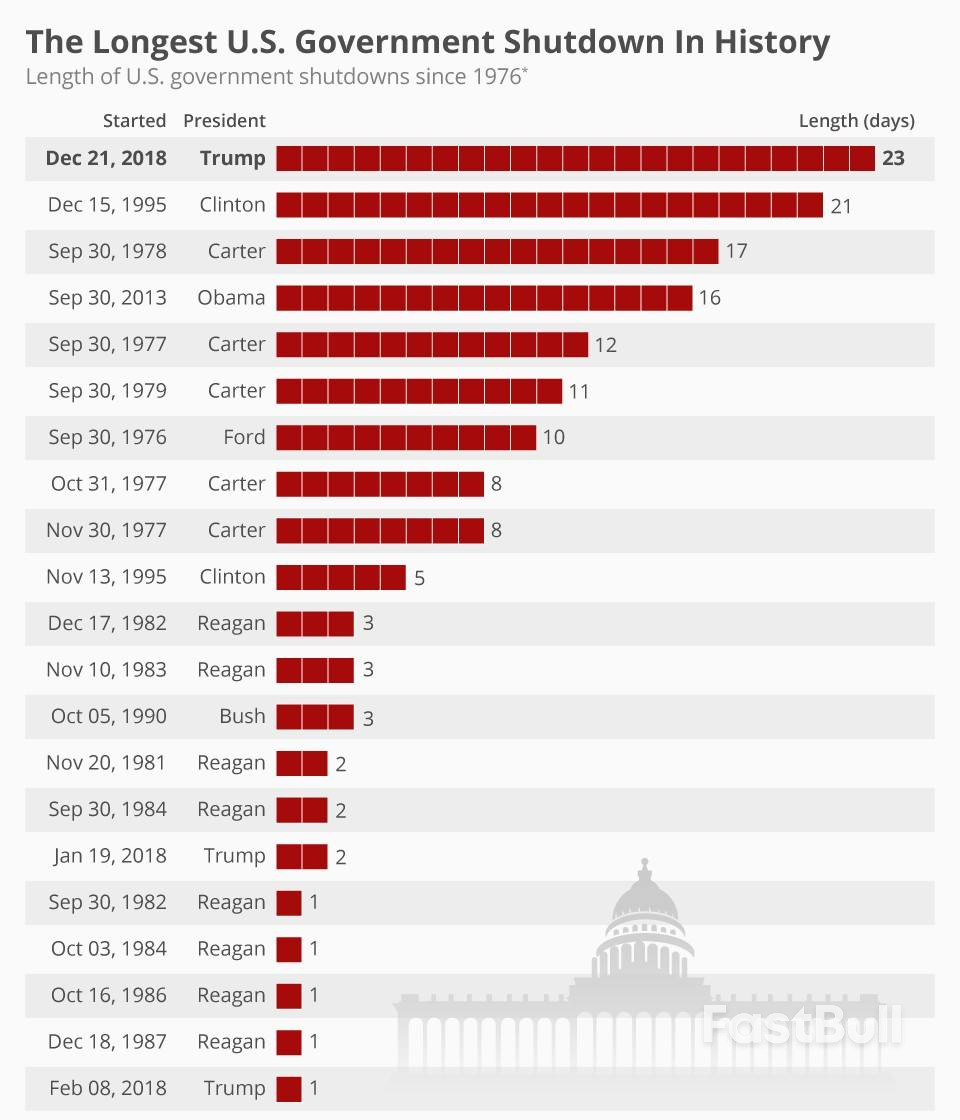

Nonetheless, the better-than-expected data prompted investors to pare back expectations for more rate cuts. September’s nonfarm payrolls report is set for Friday, but risks being delayed by an impending federal government shutdown this week.

Bank of Japan board members debated the feasibility of raising interest rates in the near term with some suggesting the time for such a move may be approaching, a summary of opinions at the central bank's September policy meeting showed on Tuesday.Many opinions at the meeting called for vigilance to mounting inflationary pressure, the summary showed, adding to signs of a hawkish shift on the board that heightens the chance of a rate increase in October.

"Judging solely from the perspective of Japan's economic conditions, it may be time to consider raising the policy interest rate again, given that it has been more than six months since the last rate hike," one opinion was quoted as saying.With uncertainty over U.S. tariffs and other external headwinds receding, the BOJ has scope to raise Japan's real interest rate that remains low by global standards, another opinion said, according to the summary.

At the September 18-19 meeting, the BOJ kept interest rates steady at 0.5%, but two of the nine board members dissented and instead unsuccessfully called for a hike to 0.75%.The last time it raised rates was in January. Since then, the BOJ has signalled a pause to scrutinise the impact of U.S. tariffs on Japan's export-reliant economy.The dissent by board members Hajime Takata and Naoki Tamura was seen by markets as a prelude to a near-term increase in borrowing costs. In a speech on Monday, dovish member Asahi Noguchi said the need for a rate hike was increasing "more than ever."

Markets are now pricing in roughly a 60% chance of a rate hike at the BOJ's next meeting on October 29-30. Investors are focusing on the BOJ's "tankan" quarterly business survey, due on Wednesday, and Governor Kazuo Ueda's speech on Friday, for clues on the timing of the next rate hike.If economic and price developments do not deviate much from the anticipated path, the BOJ should raise rates at "somewhat regular intervals," a third opinion said, adding the tankan and corporate first-half earnings reports may help to decide on whether a hike would be appropriate.

Of the opinions on monetary policy, five suggested resuming rate hikes in the foreseeable future in a sign of broadening calls within the board for a near-term increase.Some, however, called for caution. One member said it would not be too late to raise rates after assessing "a little more hard data" as Japan's domestic demand tends to be vulnerable to external shocks, the summary showed."A rate hike at this point, which would come as a surprise to the market, should be avoided," another opinion showed.

On the price outlook, many pointed to inflationary pressure with one saying firms are continuing to increase prices even as rises in import costs dissipate, the summary showed."There seems to be a higher likelihood the cost pass-through to food prices will continue, taking into account data and anecdotal information," another opinion showed.The BOJ's summary, released several market days after each policy meeting, does not identify the names of the members who made the comments.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up