Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

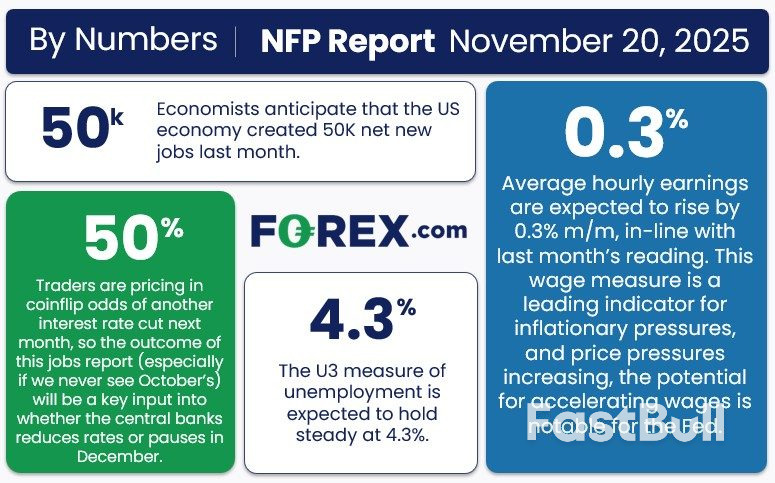

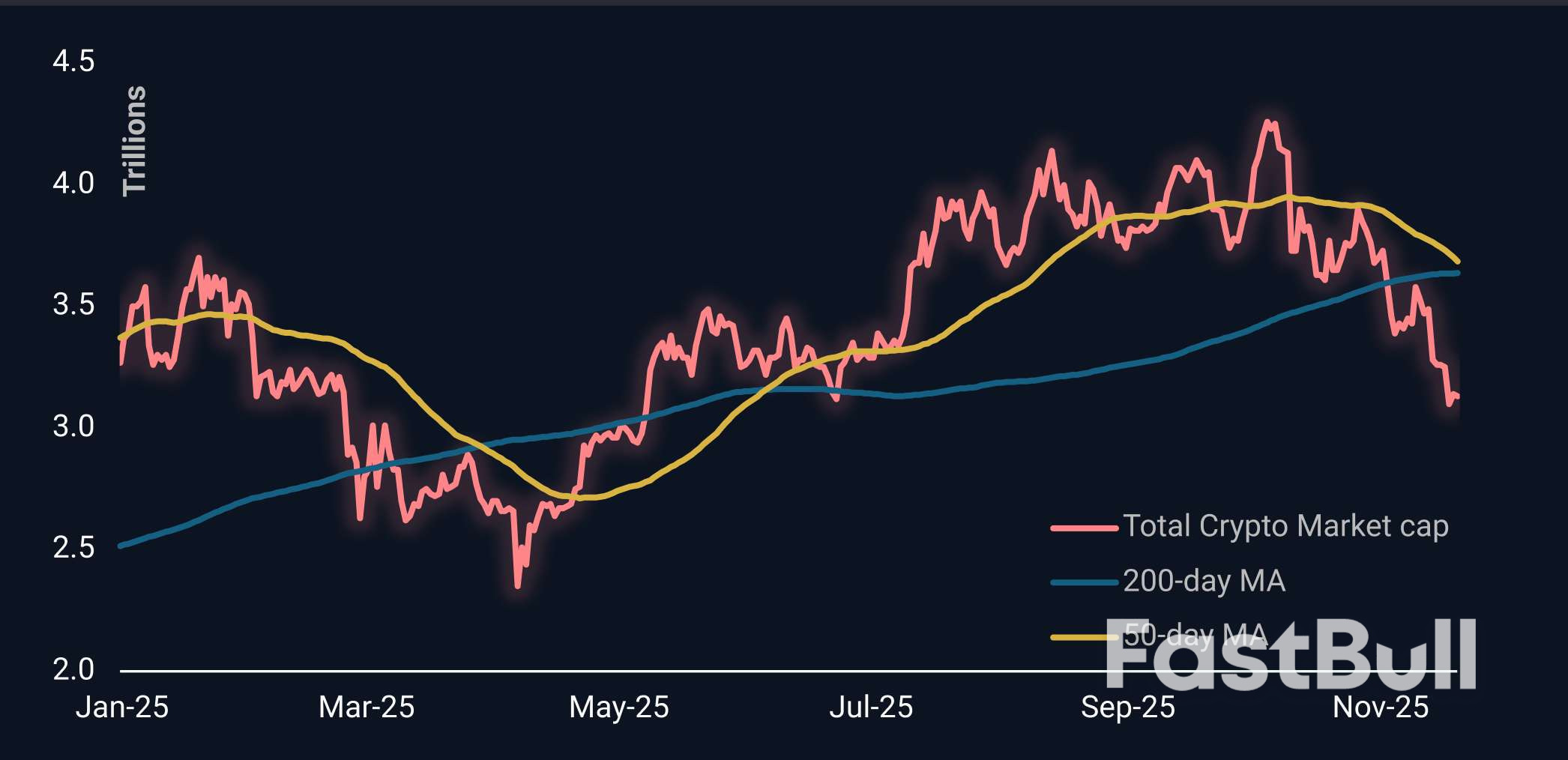

Cleveland Fed warns against further rate cuts.Inflation projected above 2% target until 2026.Possible impact on crypto markets and economic activity.

Cleveland Fed President Beth Hammack voiced concern at the Economic Club of New York regarding potential inflation risks if the Federal Reserve continues to implement rate cuts.

Hammack's remarks could signal higher rates persisting, impacting expectations in financial and cryptocurrency markets, with possible increased volatility in Bitcoin and Ethereum.

Cleveland Fed President Beth Hammack recently warned that more rate cuts could prolong elevated inflation risks in the U.S. economy. Her remarks highlighted concerns following the Fed's recent quarter-point rate reduction.

Beth Hammack opposes further loosening of monetary policy, citing projections of high inflation continuing through 2026. Her stance contradicts prior market expectations of further rate reductions in the coming year. She stated, "I remain concerned about high inflation and believe policy should be leaning against it."

The market anticipates a higher-for-longer interest rate environment, likely increasing market volatility and uncertainty as the Federal Open Market Committee's meeting approaches. Investors are wary of a potential economic slowdown.

Hammack's warning could influence crypto markets, especially Bitcoin and Ethereum, as tighter monetary policies often impact liquidity and asset prices. Historically, hawkish policy leads to DeFi TVL outflows.

Institutional investors may adopt caution, impacting flows into both crypto and traditional markets. Many are now re-evaluating their positions ahead of expected policy shifts.

Insights suggest potential for financial and regulatory impacts, with a history of hawkish pivots leading to sell-offs in crypto. Past policy shifts have resulted in price corrections in major assets like Bitcoin and Ethereum.

Mexican President Claudia Sheinbaum has again sought to stand up to President Donald Trump, on Tuesday repeating her rejection of any possibility of US military intervention against cartels on sovereign Mexican soil.

Trump has recently floated openness toward the possibility, and also Colombia, in exchanges with reporters related to the military build-up off Venezuela. "It's not going to happen," Sheinbaum said, according to The Associated Press. "He (Trump) has suggested it on various occasions, or he has said, 'we offer you a United States military intervention in Mexico, whatever you need to fight the criminal groups.'"

Trump had been asked asked on Monday if he would seek the Mexican government's permission before launching any potential strikes and responded that he "wouldn't answer that question." He added that he has been "speaking" with Mexico and that they "know how I stand."

That exchange had started as follows:

Speaking to reporters in the Oval Office, Trump answered a question about potentially striking Mexico or sending American troops or other personnel into the country by saying it would be "OK with me."

"Would I launch strikes in Mexico to stop drugs? OK with me, whatever we have to do to stop drugs. Mexico is — look, I looked at Mexico City over the weekend. There's some big problems over there," Trump said after he was asked whether he was considering such action.

The military campaign ongoing in the southern Caribbean and off Latin America is called "Operation Southern Spear," per a prior announcement from Pentagon chief Pete Hegseth.

"We've stopped the waterways, but we know every route. We know every route, we know the addresses of every drug lord," Trump had additionally explained.

"We know their address, we know their front door. We know everything about every one of them. They're killing our people. That's like a war. Would I do it? I'd be proud to."

The question of US military action south of the border is not a completely 'new' one; however, Operation Southern Spear marks the first time in history that the Pentagon has parked this many US naval assets, including a carrier group, just off Latin America. It's making leaders in the region very nervous, to say the least.

The Trump administration's mammoth fiscal legislation will boost economic growth next year, but the impact will be partially undercut by Federal Reserve interest rates kept higher than they would be otherwise, a former top Fed researcher concluded in a new analysis.

The federal deficit, meanwhile, will be even larger than the gain in gross domestic product.

John Roberts, former deputy associate director of the Fed's research division and now a special advisor to Evercore ISI, wrote in an analysis of the Trump legislation known as the "One Big Beautiful Bill" that the arrival of perhaps $100 billion in extra refunds early next year will help lift economic growth by about four-tenths of a percentage point in the first half of the year.

The legislation exempted some overtime and tipped income from taxes and included other tax breaks.

The GDP impact will fade fast, however, and for the full year growth will be about 0.32 percentage points higher than it would have been otherwise, Roberts found using the Fed's internally developed and publicly available FRB/US model of the economy. Next year's deficit, meanwhile, will grow by eight-tenths of a percentage point as a result of the tax cuts and higher spending on defense and border protection.

The slowing impact on growth is partly due to the nature of consumer behavior - the extra money is likely to be spent quickly by the households who intend to spend it at all - and partly due to the Federal Reserve reducing its benchmark policy rate less than it would otherwise due to faster economic growth that leads to slightly higher inflation and a slightly lower unemployment rate.

"The model suggests that rates should be roughly a quarter point higher at the end of 2026 than would have been appropriate in the absence of One BBB stimulus – so for instance, one cut if two would otherwise have been warranted," Roberts wrote. "In response to the stronger economy, interest rates are higher and those higher interest ratesdampen the increase in GDP" by about half.

Roberts' findings illustrate the type of considerations the Fed will be debating at the December 9-10 meeting, with the implications of changed tax policy factoring into the outlook for next year. Officials already are divided over whether further rate cuts are needed now, while President Donald Trump continued to demand lower rates.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up