Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks BOC Monetary Policy Report

BOC Monetary Policy Report U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)--

F: --

P: --

Russia CPI YoY (Nov)

Russia CPI YoY (Nov)--

F: --

P: --

U.S. Federal Funds Rate Projections-Longer Run (Q4)

U.S. Federal Funds Rate Projections-Longer Run (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Federal Funds Rate Projections-Current (Q4)

U.S. Federal Funds Rate Projections-Current (Q4)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

U.S. Federal Funds Rate Projections-1st Year (Q4)

U.S. Federal Funds Rate Projections-1st Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-3rd Year (Q4)

U.S. Federal Funds Rate Projections-3rd Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Nov)

U.K. 3-Month RICS House Price Balance (Nov)--

F: --

P: --

Australia Employment (Nov)

Australia Employment (Nov)--

F: --

P: --

Australia Full-time Employment (SA) (Nov)

Australia Full-time Employment (SA) (Nov)--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Nov)

Australia Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Australia Unemployment Rate (SA) (Nov)

Australia Unemployment Rate (SA) (Nov)--

F: --

P: --

Turkey Retail Sales YoY (Oct)

Turkey Retail Sales YoY (Oct)--

F: --

P: --

Italy Quarterly Unemployment Rate (SA) (Q3)

Italy Quarterly Unemployment Rate (SA) (Q3)--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report South Africa Gold Production YoY (Oct)

South Africa Gold Production YoY (Oct)--

F: --

P: --

South Africa Mining Output YoY (Oct)

South Africa Mining Output YoY (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Federal Reserve is widely expected to hold interest rates steady next week, with investors focused on new central bank projections that will show how much weight policymakers are putting on recent soft data and how much risk they attach to unresolved trade and budget issues and an intensifying conflict in the Middle East.

The Federal Reserve is widely expected to hold interest rates steady next week, with investors focused on new central bank projections that will show how much weight policymakers are putting on recent soft data and how much risk they attach to unresolved trade and budget issues and an intensifying conflict in the Middle East.

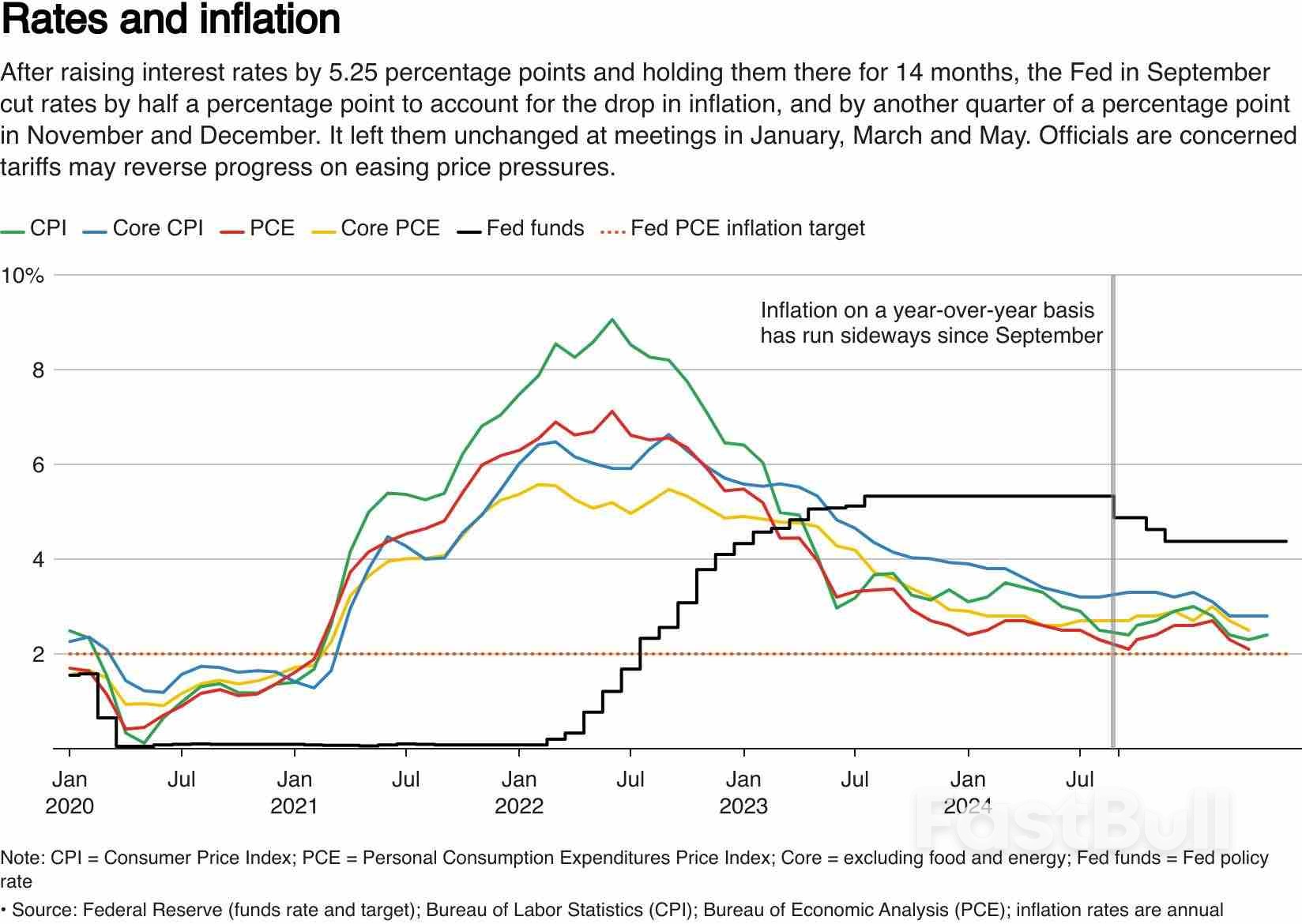

Recent inflation data had eased concern that the tariffs imposed by President Donald Trump would translate quickly into higher prices, while the latest monthly employment report showed slowing job growth - a combination that, all things equal, would put the Fed closer to resuming its rate cuts.

Trump has demanded the U.S. central bank lower its benchmark overnight interest rate immediately by a full percentage point, a dramatic step that would amount to an all-in bet by the Fed that inflation will fall to its 2% target and stay there regardless of what the administration does and even with dramatically looser financial conditions.

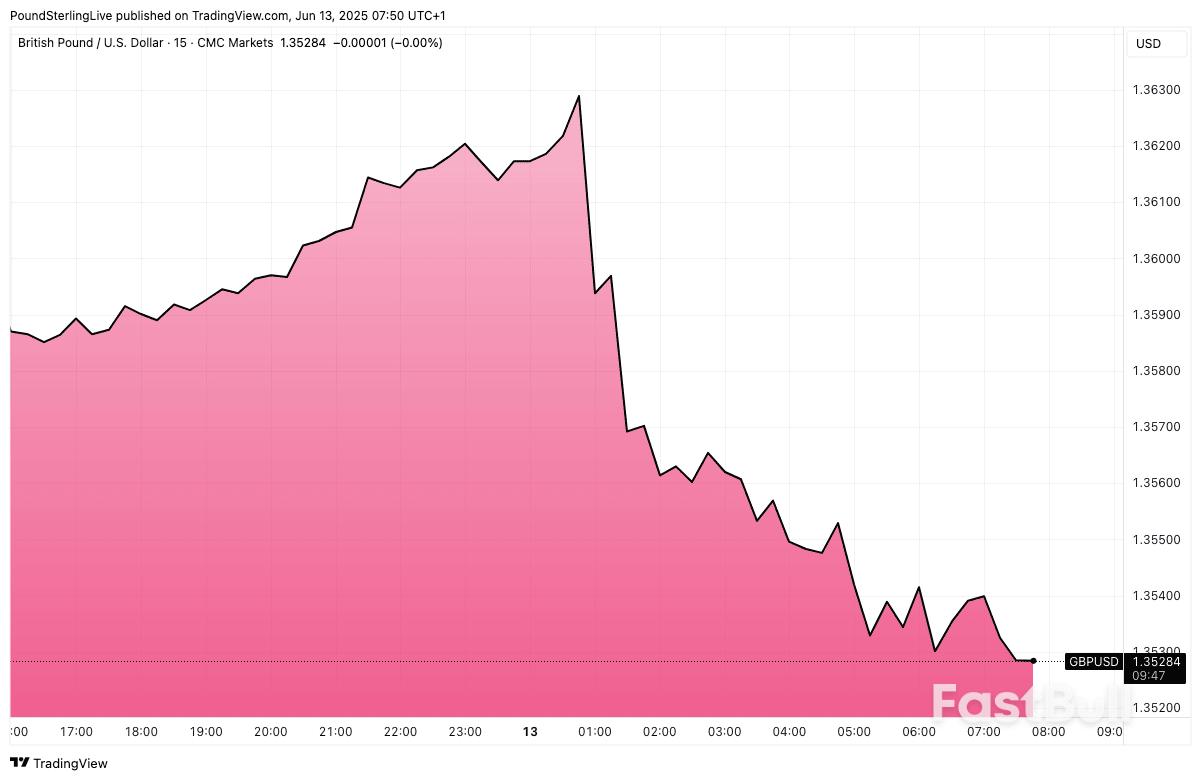

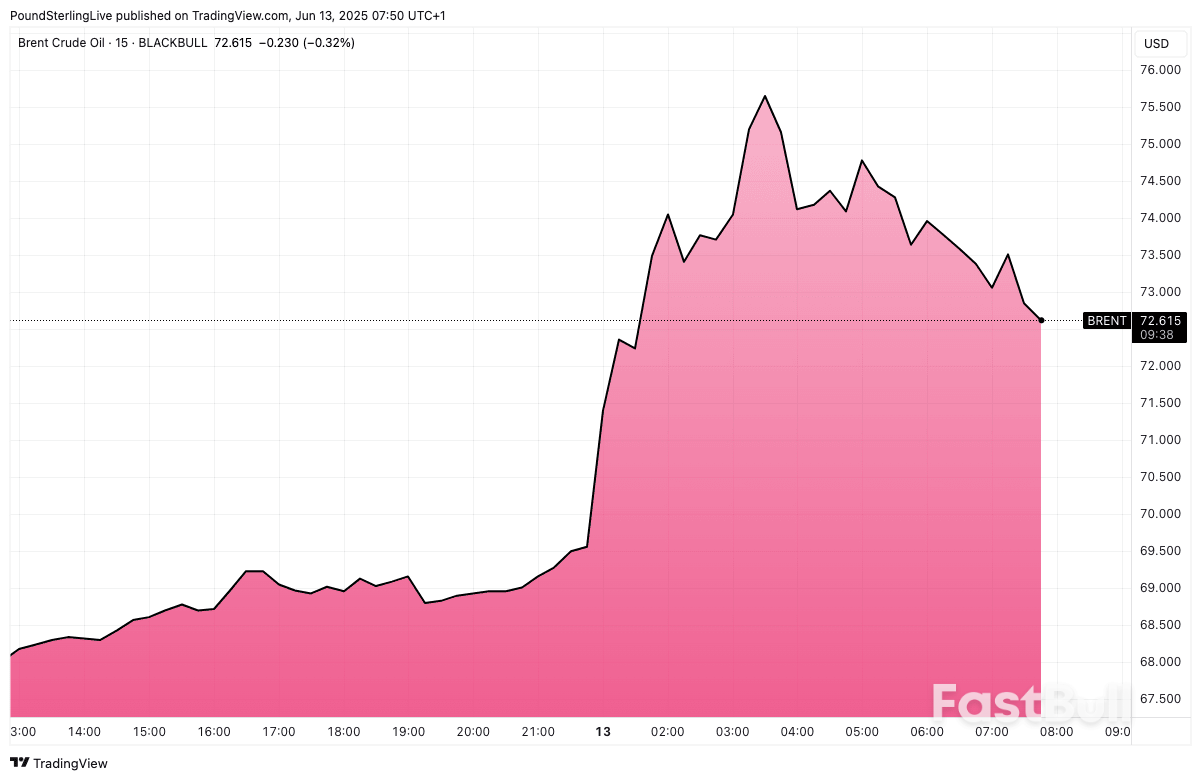

The risks of that approach were highlighted overnight when an Israeli attack on Iran sent spot oil prices up nearly 9%, potentially upending a four-month run of falling energy prices that have helped keep overall inflation more moderate than expected. Iran is a major oil producer, and a broader conflict in the region could disrupt both production and shipping.

Though the price of oil figures less prominently in U.S. inflation than it did during the oil shocks of the 1970s, big swings in commodity prices or developing geopolitical risks can make Fed officials more cautious in their decisions - as Russia's invasion of Ukraine did in early 2022 when it prompted the U.S. central bank to start a cycle of interest rate hikes with a quarter-percentage-point increase, smaller than many officials had favored before the war began.

Trump's push to rewrite the rules of global trade also remains a work in progress, with potentially inflationary results. Since the Fed's last policy meeting in May, the administration delayed until next month a threatened round of global tariffs that central bank officials worry could lead to both higher prices and slower growth if implemented; trade tensions between the U.S. and China have eased but not been resolved; and the terms of a massive budget and tax bill under consideration in Congress are far from settled.

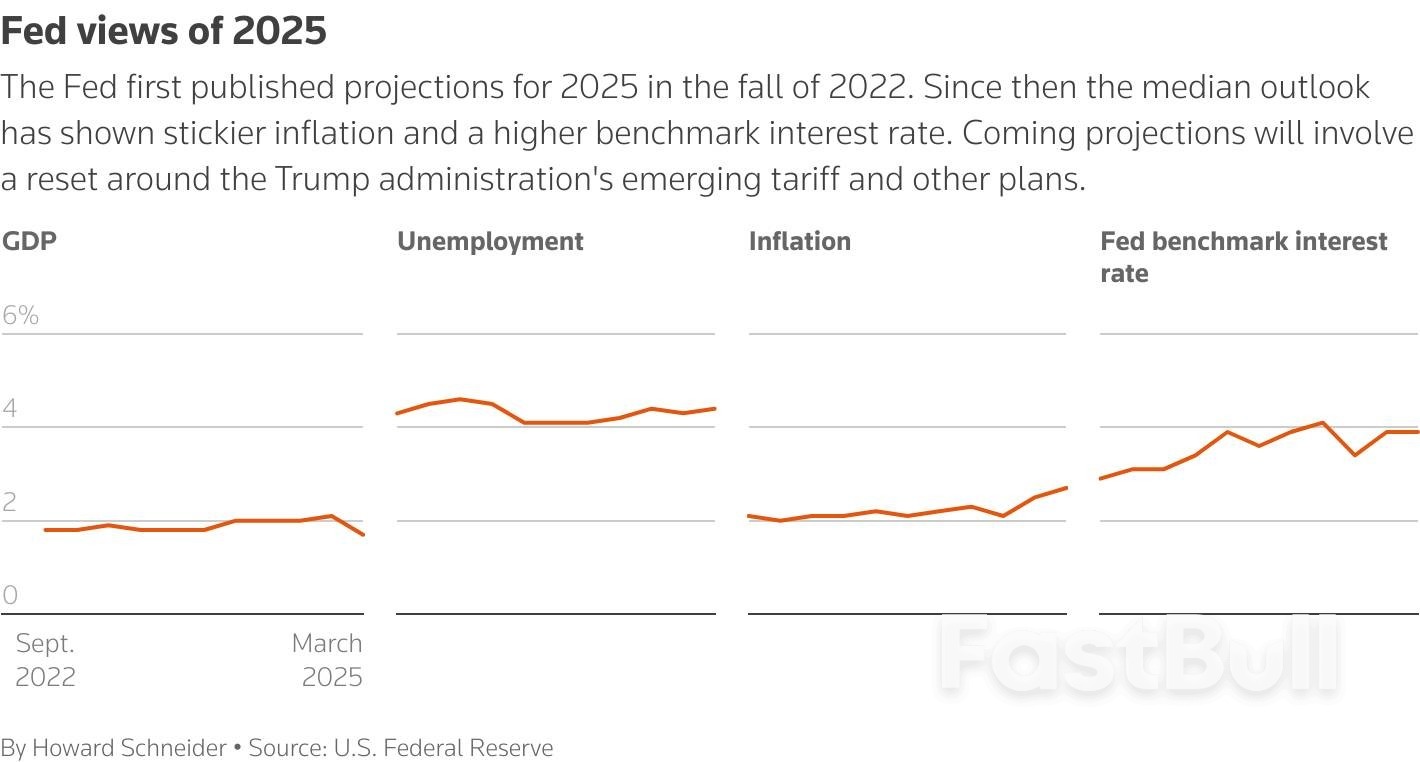

When Fed officials issued their last set of quarterly projections in March, anticipating two quarter-percentage-point rate cuts this year, Fed Chair Jerome Powell noted the role that inertia can play in moments when the outlook is so unclear that "you just say 'maybe I'll stay where I am,'" a sentiment that may last as long as the tariff debate remains unresolved.

"Recent Fed commentary has reinforced a wait-and-see approach, with officials signaling little urgency to adjust policy amid increased uncertainty around the economic outlook," Gregory Daco, chief economist at EY-Parthenon, wrote in the run-up to the Fed's June 17-18 meeting. Daco said he anticipates the median rate projection among the Fed's 19 policymakers to still show two rate cuts in 2025, with an overall tone of "cautious patience" and "little in the way of forward guidance" given the uncertainty weighing on households and businesses.

That view aligns roughly with what investors in contracts tied to the Fed's policy rate currently expect, though pricing shifted towards a possible third rate cut this week after data showed consumer and producer prices both increased less than expected in May. While year-over-year inflation measured by the Fed's preferred Personal Consumption Expenditures Price Index is around half a percentage point above the central bank's target, recent data show it running close to 2% for the past three months once the more volatile food and energy components are excluded.

The unemployment rate, meanwhile, has remained at 4.2% for the past three months.

The Fed's policy rate was set in the current 4.25%-4.50% range in December when the U.S. central bank cut it by a quarter of a percentage point in what officials at the time expected would be a steady series of reductions in borrowing costs spurred by slowing inflation. The trade policy Trump pursued after he returned to office on January 20, however, raised the risk of higher inflation and slower growth, an outcome that would put the Fed in the uncomfortable position of having to choose whether to focus on keeping inflation at its 2% target or supporting the economy and sustaining low unemployment.

The risk of that worst-of-both-worlds outcome has eased since the early spring, when Trump's "Liberation Day" slate of global tariffs caused a market backlash and led to widespread forecasts of a U.S. recession before the president backed down.

In its most recent analysis, Goldman Sachs analysts lowered the odds of a recession to around 30% and said they now see a bit less inflation and slightly higher growth this year.

Yet that analysis did not prompt a shift in the investment bank's Fed rate outlook, which currently expects higher inflation numbers over the summer to sideline the central bank until December.

The Fed itself may see its median rate projection fall to a single quarter-percentage-point cut this year if only due to the passage of time, noted Tim Duy, chief U.S. economist at SGH Macro Advisors.

With three fewer months in the year to make changes in policy and so many major issues outstanding, "if the Fed retained two cuts ... it would have more confidence in those two cuts than in March," Duy wrote. "But ... participants have less confidence in rate cuts since 'Liberation Day,' and that should be reflected" in the new projections.

It would only take two officials to change their outlooks for the Fed's projected rate reductions to shift more toward next year.

There's another scenario, one in which the weak pass-through from tariffs to inflation is due to weakening demand as consumers pay more for imported goods by cutting back on services, a dynamic that may already be developing.

The retail sales report for May, which is due to be released next week ahead of the Fed meeting, may provide insight into that issue. But Citi economists say they think weakening demand will keep inflation down, lead to rising unemployment, and prompt the central bank to cut rates faster than expected, beginning in September and continuing at each meeting from there into 2026.

"Tariffs may eventually boost some goods prices, but the broad-based slowing in core services inflation will make this a one-time price increase," the Citi analysts wrote. "Markets have yet to internalize that softer demand will lead to cooler inflation but also to rising unemployment ... The path to Fed rate cuts is becoming increasingly clear."

Daily E-mini S&P 500 Index

Daily E-mini S&P 500 Index Daily Chevron Corp.

Daily Chevron Corp. Daily Northrop Grumman Corp.

Daily Northrop Grumman Corp. Daily United Airlines Holdings Inc

Daily United Airlines Holdings IncGoldman Sachs has updated its oil price forecast to include a higher geopolitical risk premium following Israel’s attack on Iran, while maintaining its view that Middle East oil supply will not face disruptions.

The U.S. bank continues to project Brent crude prices will drop to $59 per barrel and West Texas Intermediate (WTI) to $55 per barrel in the fourth quarter of 2024. Looking further ahead, Goldman Sachs forecasts Brent at $56 per barrel and WTI at $52 per barrel in 2026.

Goldman Sachs analysts noted that "the potential of further escalation in the Middle East implies that the short-term risks to our price forecast are now skewed to the upside on net."

The bank’s forecast is based on expectations of robust supply growth outside of U.S. shale production. While acknowledging increased short-term upside risks due to Middle East tensions, Goldman Sachs still sees medium-term downside risks stemming from potential OPEC+ supply increases and ongoing uncertainty in global trade conditions.

A court in Bamako is due to decide if Mali’s military government can take over operations at Barrick’s Loulo-Gounkoto complex. The hearing is set for Monday after being postponed five times — likely a reflection of the sensitivities of the case and its wider implications.

While the junta running the West African nation has aggressively renegotiated revenue-sharing terms with all major mines, it’s only the Canadian company that’s on the verge of losing control of its asset — at least temporarily.

The government escalated its standoff with Barrick last month, asking a judge to appoint an interim administrator to manage the site that produced 723,000 ounces of gold in 2024. It wants to restart operations at the mine that were suspended in January following the Malian authorities’ move to block bullion exports.

A key question is whether the government wants to seize Loulo-Gounkoto or is trying to force Barrick into a settlement.

For its part, the Toronto-based firm — which has initiated international arbitration proceedings against Mali — says it’s already agreed several accords, only for the government to backtrack.

The high-stakes brinkmanship over such a significant asset is being monitored closely in neighboring nations, where rulers are devising plans to generate better returns from their minerals.

Burkina Faso (also run by the military) has nationalized some smaller mines and junta-led Guinea has revoked a slew of permits. Ivory Coast is revising legislation governing the sector, while Senegal is reviewing oil and gas contracts.

Meanwhile, the mine that last year was the No. 2 contributor in Barrick’s portfolio — spanning from Nevada to Papua New Guinea — is stranded at a time of record gold prices.

Its travails may be a warning to Western firms mulling investment in the coup-prone region.

Key stories and opinion:Barrick Says Mali’s Bid to Take Over Gold Mine Lacks Legal Basis Guinea Takes Endeavour Gold Permits in Latest Round of Removals Barrick CEO Vows to Defend Rights as Mali Junta Seeks More Money Mali Junta Leader Gets Backing to Serve as President Until 2030What’s Driving the Coups Across Sub-Saharan Africa?: QuickTake

China plans to remove tariffs on imports from almost all African countries to further cement close relations with the continent as it deals with the fallout of US President Donald Trump’s trade wars. The 53 African nations that have diplomatic ties with China — Eswatini has allied with Taiwan — will be accorded “zero-tariff treatment for 100% tariff lines,” according to a letter issued to foreign ministers. South Africa sees scope to ease its dispute with Washington over agricultural trade tariffs and regulations.

The International Monetary Fund is seeking more clarity on a $7 billion fiscal hole discovered under Senegal’s previous administration before it can discuss a fresh program with the new government. The Washington-based lender is awaiting a final audit outcome following an earlier review that found former President Macky Sall’s administration misreported debt and budget-deficit data. Separately, the IMF wants to see the ZiG “fully becoming a national currency” as it weighs whether to place Zimbabwe on a staff-monitored program.

East African finance chiefs increased planned spending to a record to sustain economic growth and mitigate the effects of geopolitical risks and cuts in foreign aid. Kenya, Rwanda, Tanzania and Uganda plan to boost expenditure by a combined $5.5 billion in the 12 months through June 2026 compared with the year before, despite rising debt payments and limited room to lift taxes. Kenyan police used teargas to disperse protesters in the capital, Nairobi, ahead of Treasury Secretary John Mbadi’s speech. Also, columnist Justice Malala looks at how democracy is dimming in the region.

A World Bank-linked climate fund has backed South African plans to cut its reliance on coal, unlocking up to $2.6 billion in financing and giving its energy transition an unexpected boost. The decision rescues support that looked to be in peril after the government asked in September to alter an agreement originally endorsed in 2022, and after the US halted other projects. Meanwhile, diplomats in Washington working to repair frayed relations with Trump are confronting an additional headache: South Africa’s embassy was inundated by storm water and raw sewage, leaving it partially inoperable.

In one of Mali’s oldest towns, poverty and climate change are eroding the resolve of residents to safeguard a slice of the planet’s architectural heritage. Djenné’s iconic mud buildings were designated a World Heritage Site in 1988, meaning they can’t be destroyed or modified. But in recent years, extreme rains have made the buildings harder to maintain, while political turmoil and safety fears have diminished the town’s appeal to tourists. Some local people say the UNESCO designation is a burden they’re struggling to bear.

African students are increasingly applying to MBA programs in the US. But the Trump administration’s anti-international-student stance could soon put a stop to this. In 2019, African students averaged just 4% of total international applications to two-year MBA programs in America and by last year the share ballooned to 27%. Nearly a quarter of programs report that the largest source of foreign applicants came from either Nigeria or Ghana.

Iran announced it will continue its nuclear activities following airstrikes by Israel, a move confirmed by Iran's state television. The airstrikes have heightened tensions in the region, drawing international attention.

This development underscores the continuing geopolitical tensions between Iran and Israel, potentially impacting global diplomacy and markets.

Iran's commitment to its nuclear program remains steadfast. This declaration comes despite Israeli airstrikes targeting Iranian facilities, as reported by ChainCatcher news. The Atomic Energy Organization of Iran (AEOI), led by Mohammad Eslami, plays a crucial role in managing these activities, often emphasizing Iran's right to pursue nuclear advancements.

The geopolitical landscape faces uncertainty as regional and global actors weigh responses. The E3, consisting of France, Germany, and the UK, maintain focus on possible repercussions, including sanctions that may disrupt traditional financial pathways. The Iranian military has issued warnings of retaliation against Israel and the United States, adding to the crisis's complexity.

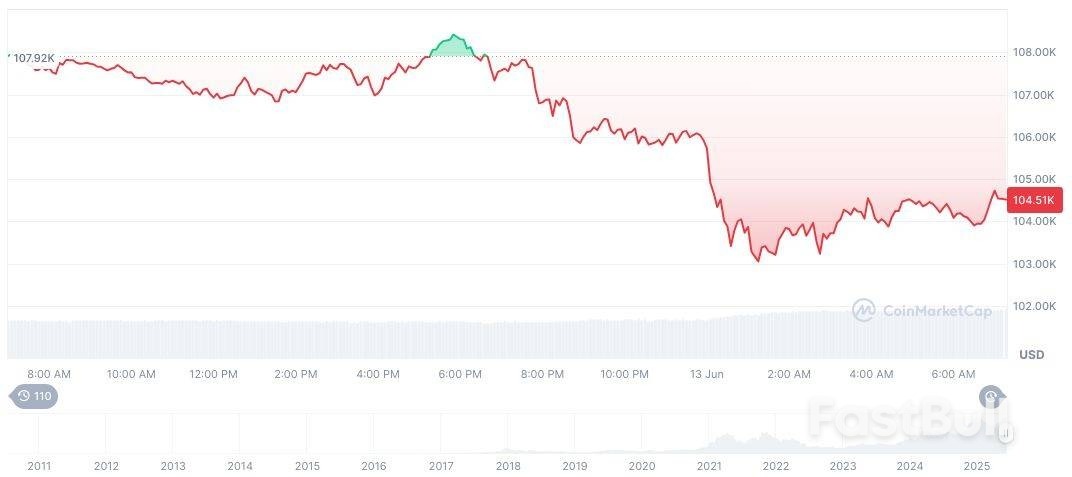

Market and community reactions reflect anxiety over potential broader conflicts. Crypto markets, historically volatile during geopolitical crises, show no direct impact according to the latest data. However, stakeholders remain cautious, closely watching for any shifts that may disrupt financial stability or investor sentiment.

Did you know? During previous Iran-Israel tensions, Bitcoin trading volumes often spiked as investors sought safe-haven assets, highlighting geopolitical impacts on crypto markets.

According to CoinMarketCap, Bitcoin (BTC) trades at $105,029.34 with a market cap of $2.09 trillion, maintaining dominance at 63.86%. Data reflects a 2.17% dip over 24 hours but a 1.22% increase over the past week. The 24-hour trading volume of $72.05 billion represents a 36.31% change, showcasing significant market activity.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 12:44 UTC on June 13, 2025. Source: CoinMarketCap

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 12:44 UTC on June 13, 2025. Source: CoinMarketCapWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up