Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

On Nov. 3, Fed Governor Lisa Cook made her first public remarks about the economy since the Trump firestorm began in late August.

Federal Reserve Governor Lisa Cook said the ongoing risks for both inflation and the labor market create a teachable moment for how the Fed must proceed carefully when it comes to future interest rate cuts.

Cook — who previously taught at Michigan State University as a professor of economics and international relations — noted that it's a moment that she might tap into one day if she ever returns to the classroom.

And she cleverly noted that going back to teaching isn't something she wants to do too soon.

Cook, of course, has been in the hot seat since President Donald Trump moved in the middle of the night to fire her from the Federal Reserve in late August. Cook sued Trump, challenging his authority to fire a Fed governor. Attorney Abbe David Lowell, who is representing Cook, has said Trump's action was "illegal."

On Oct. 1, the U.S. Supreme Court rejected Trump's efforts to immediately remove Cook based on the Trump administration's ongoing allegations that she misrepresented information about occupancy on two mortgages she obtained in 2021, including one for an Ann Arbor home.

The Supreme Court will hear oral arguments on the case in January, a case that could set a major economic precedent when it comes to the central bank's ability to act independently from the president.

If Trump can fire Cook, what other power does a president have over other seated Fed governors? No other president has ever fired a Fed governor in the Fed's nearly 112-year history.

On Monday, Nov. 3, Cook made her first public remarks since the Trump firestorm when she gave a presentation on the economic outlook and took some limited questions at an afternoon event held by The Brookings Institution in Washington, D.C.

Cook declined to speak specifically on the topic that made her one of the most recognizable names among Fed governors. She did, though, make a few not-so-subtle remarks during a question-and-answer period.

"With respect to Fed independence," she said at one point, "I'm not going to say much but I support it."

She also expressed gratitude for the many people, including some she said were in the audience Monday, who offered her words of support.

And she gave an indication that her life has changed, saying that she's no longer able to easily go out into the community and talk directly with business owners and consumers about what they're experiencing in the economy.

In the past, Cook said, she might have slipped into a diner in Virginia to listen to conversations and understand what's going on but noted that she cannot do that anymore.

"What I want is the mortar between the bricks," Cook said.

Cook said she studies the economic data before casting her vote about whether interest rates should be reduced or raised. She tries to gather some information on her own beforehand on what people seem to be experiencing in their prospective corners of the economy.

The Federal Reserve banks across the country, she said, fill in many of those gaps by offering much research through conversations with businesses, nonprofits and others.

Eight times a year, each Federal Reserve Bank publishes a Beige Book after conducting interviews with regional business leaders and others to gather on-the-ground, real-time economic insight.

Cook voted in favor of the quarter-point rate cut announced Oct. 29, moving the target range for the federal funds rate to 3.75% to 4%.

Two Fed governors voted against the latest rate cut: Stephen Miran, who preferred a more aggressive move and wanted to lower the target range for the federal funds by a half percentage point, and Jeffrey Schmid, who preferred no change at the October meeting.

The October rate cut was the second step by the Fed in 2025 to reduce short term interest rates. On Sept.17, the Fed cut short-term rates by a quarter point to a target range of at 4% to 4.25%. The Fed board's decision wasn't unanimous in September, either.

The next Federal Reserve meeting is Dec. 9 and Dec. 10. More questions are being raised about what the Fed might do next.

"Every meeting, including December's, is a live meeting," Cook said.

Keeping rates too high can contribute to higher levels of unemployment; keeping rates too low can fuel inflation. The Fed remains at a crossroads.

"Looking ahead, policy is not on a predetermined path," Cook said in her prepared remarks. "We are at a moment when risks to both sides of the dual mandate are elevated."

Right now, Cook said, the labor market is showing some signs of a slowdown but there is no reason for alarm.

"The latest available indicators," she said in her remarks, "suggest that the labor market remains solid, though gradually cooling."

Yet, she noted that past experience shows the employment picture can shift suddenly and the labor market can "deteriorate very quickly."

It's a risk that the Fed must take into account when deciding how long to keep interest rates at a higher level. Rates would be kept higher in order to put a lid on inflation. The Fed has a dual mandate to promote maximum employment and price stability.

Opting to cut rates could mean that some are more worried about job market risks ahead than the threat of higher inflation.

In her speech, Cook acknowledged that it was a challenging time to offer an economic outlook due to the government shutdown.

Federal agencies that provide key economic numbers aren't producing much of the necessary data. Those agencies include the Bureau of Labor Statistics, the Census Bureau and the Bureau of Economic Analysis.

"The longer the shutdown lasts, the more data could be disrupted," she said.

Inflation could remain elevated for the next year, Cook says

When it comes to inflation, she said, much uncertainty remains about how much higher tariffs will contribute to higher prices, and inflation, down the line.

Many firms, Cook said in her speech, have not raised prices as they run down their inventories. Others say they are waiting until tariff uncertainty is resolved before hitting consumers with price increases.

"As such, I expect inflation to remain elevated for the next year," Cook said. "Nonetheless, the effect of tariffs on prices, in theory, should represent a one-time increase."

Not everyone is doing well in this economy. Cook pointed out that "there appear to be worsening outcomes for vulnerable and low-to-middle-income households."

In the labor market, she said, youth and Black unemployment rates, both of which tend to be more cyclical than total unemployment, have steadily risen since this spring through the latest readings in August.

"The deteriorating labor market experienced by these two vulnerable groups mirrors other emerging strains in some households' financial health and balance sheets," she said.

Cook said the current economic conditions are "sometimes called a 'two-speed' economy, when the well-off are doing well, while LMI (low-to-middle-income) and vulnerable households are not."

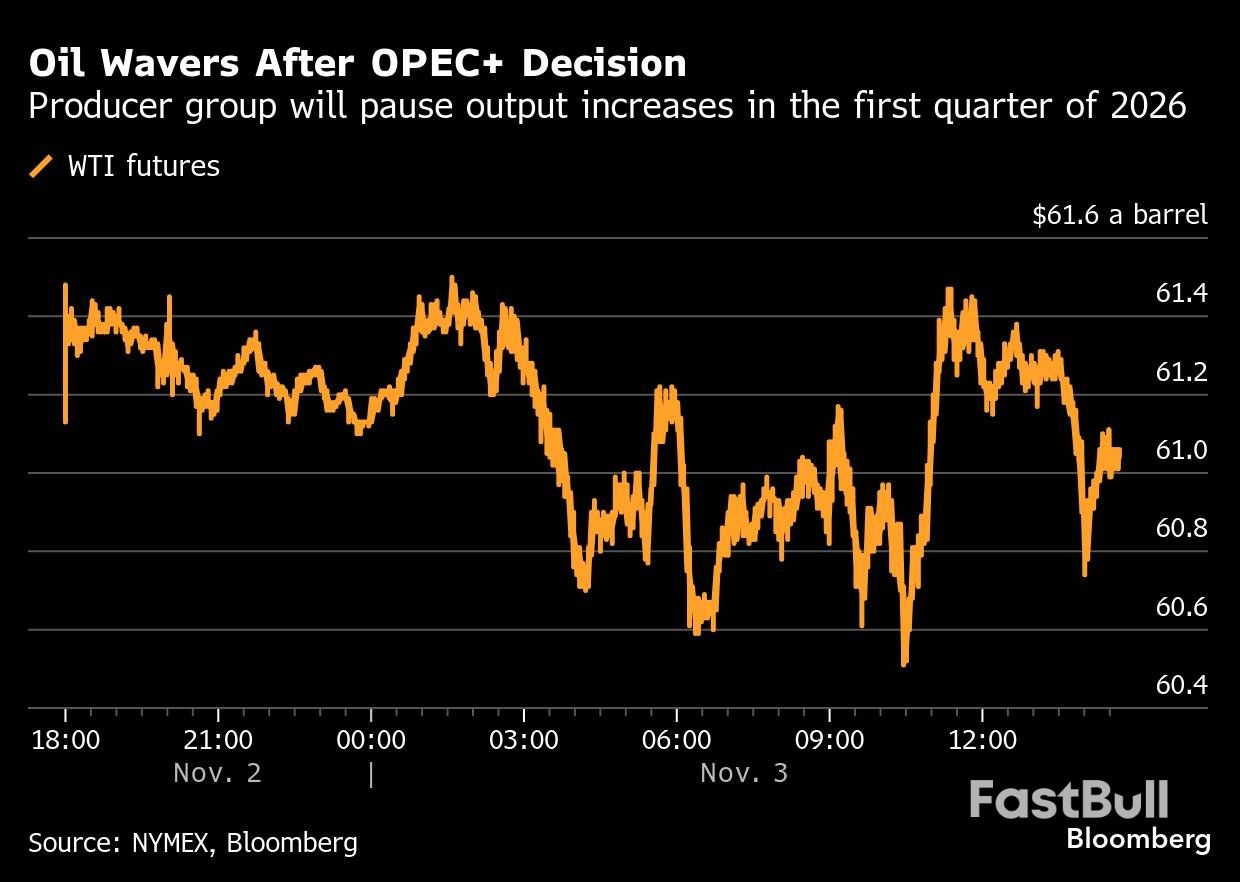

Oil was little changed Monday as traders weighed the OPEC+ alliance's plan to pause its output revival next quarter on anticipation demand will slow, while the market is seen headed for oversupply.

West Texas Intermediate rose about 0.1% to settle above $61 a barrel after fluctuating between small gains and losses through the day, extending a string of marginal increases. The Organization of the Petroleum Exporting Countries and its partners said the decision on Sunday to halt production hikes from January reflects an expectation for a seasonal slowdown. The move comes against a backdrop of widespread forecasts for excess supplies next year that could weigh down prices.

The US benchmark has slumped about 9% over the past three months as OPEC+ ramped up output in an apparent effort to regain market share, while producers outside the group also increased production. Prices recently bounced from a five-month low after tighter US sanctions on two major Russian oil producers over the war in Ukraine raised some questions about supply from Moscow.

"The decision to halt quota hikes during 1Q does not materially change our production forecasts but still sends an important signal," Morgan Stanley analysts including Martijn Rats and Charlotte Firkins wrote. "The group is still adjusting supply in response to market conditions."

The eight key members of OPEC+ are left with roughly 1.2 million barrels a day of their current supply tranche still to restore. Actual output increases have fallen short of advertised volumes, as some members offset earlier overproduction and others struggle to pump more.

Following the OPEC+ move, Morgan Stanley raised its near-term price forecast for Brent while also maintaining a warning for a "substantial surplus." The United Arab Emirates, meanwhile, on Monday added to the chorus of producers who have come out to downplay glut concerns.

Traders will also be monitoring disruptions to flows after a Ukrainian drone attack in the Black Sea left a tanker ablaze and damaged loading facilities in the port city of Tuapse. Oil intake at the refinery at Tuapse halted after the attack, according to a person familiar with the matter.

At the same time, top energy producers warned at the Adipec conference in Abu Dhabi that supply will be hit by the latest set of sanctions on Russia. The restrictions are serious and dampening supply, said BP Plc boss Murray Auchincloss.

San Francisco Federal Reserve President Mary Daly on Monday said she supported the U.S. central bank's interest rate cut last week, and will want to sift through incoming data to assess if another reduction in borrowing costs is warranted at the December 9-10 meeting.

"I thought it was appropriate to take another bit off the policy rate," she said at the Forum Club of the Palm Beaches in Florida, noting that the U.S. economy has been resilient, and that while inflation is running above the Fed's 2% target, the labor market has also softened. As for next month's policy decision, Daly said she will "keep an open mind."

The Fed's quarter-percentage-point rate reduction at its October 28-29 meeting was the second such cut of the year, and brought its benchmark policy rate to the 3.75%-4.00% range. Several policymakers since the meeting have said they thought the rate cut was not needed; a couple of officials, however, have said they already feel that another rate cut will be needed at the Federal Open Market Committee meeting in December.

Daly said by the time of that meeting she will want to assess if the 50 basis points of rate cuts so far this year have delivered enough insurance against further softening in the labor market, or if more support might still be needed.

Data including state-based unemployment insurance claims suggests the labor market is not on a "precipice," she said, adding that inflation is running at around 3%. Despite the absence of official economic statistics during the ongoing federal government shutdown, she said, the central bank has access to a lot of data, including from surveys and conversations with businesses and communities that will help inform views about appropriate policy.

"Oftentimes, before a meeting of the FOMC, the views are widely different," she said. "But then, by the time you get to the meeting, so much more information has been given that it's easier to see a convergence around at least a couple of ways to go."

Interest rates are in a good place to deal with persistently elevated inflation, Federal Reserve Governor Lisa Cook said Monday in her first public remarks since President Donald Trump said he had fired her.

Cook, appointed by former President Joe Biden and the first Black woman to serve as a Fed governor, is the first central bank official to ever be subject to a firing attempt. In a letter announcing her removal, Trump cited allegations of mortgage fraud, which still haven't been taken to court. Cook sued Trump shortly afterwards, in what has become a landmark case on presidential power and Fed independence that will be decided next year by the Supreme Court.

The court ruled that Cook can remain in her role for now, and has scheduled oral arguments in January. Cook said Monday she is "beyond grateful" for the support she's received in her legal battle with the Trump administration, but didn't comment further on the topic.

Cook has voted to lower interest rates in the past two Fed meetings, but hadn't commented publicly on the economy since before Trump said in August that he fired her. Fed officials routinely participate in public events to lay out their views on the economy in the spirit of transparency and helping investors understand the direction of monetary policy.

In prepared remarks for an event in Washington, DC, Cook offered a balanced perspective on the US economy, detailing the twin threat to the central bank's dual mandate of stable prices and full employment.

She pointed to signs of strain in the labor market, such as rising Black unemployment, but suggested there's more urgency to finish the job on inflation than to lower rates further to prevent mass layoffs.

"Let me be clear. I am committed to reaching our 2% inflation target," she said. "I see the current policy rate as remaining modestly restrictive, which is appropriate given that inflation remains somewhat above our 2% target."

Cook's latest comments come at a time when Fed policymakers are divided on how Trump's economic policies might impact prices, employment and economic growth.

There were "strongly differing views" among officials at last week's rate-setting meeting, when the Fed lowered rates for the second time in a row, Chair Jerome Powell said in a post-meeting news conference. Two Fed officials cast dissenting votes, but for opposing reasons: Fed Governor Stephen Miran voted in favor a larger, half-point cut; while Kansas City Fed President Jeffrey Schmid preferred to hold borrowing costs steady.

That was the first time since 2019 there were dissents calling for both easier and tighter policy.

On one side, Fed officials argue that any inflation spurred by Trump's aggressive tariff strategy will likely prove to be a one-off price increase and that the US labor market is at serious risk of falling off a cliff if the Fed doesn't continue to lower rates. Most of the officials in this camp are Trump appointees.

Powell has characterized the notion of limited tariff inflation as "reasonable." Cook herself said "the effect of tariffs on prices, in theory, should represent a one-time increase."

The other side of the Fed debate argues that the risk of higher inflation is greater, especially when considering that inflation has remained above the Fed's 2% target for more than four years. In a Friday statement explaining his dissent, Schmid said he has heard "widespread concern over continued cost increases and inflation" from people in his district.

"Rising healthcare costs and insurance premiums are top of mind," he said.

The suspension of government data because of the government shutdown, which is nearing the longest on record, has made the Fed's job of judging the economy even more difficult.

Cook didn't provide a full-throated call for rate cuts in her latest remarks, but said she is attentive to the risks around the labor market. She also didn't sound overly concerned with inflation, stating that her "assessment is that inflation is on track to continue on its trend toward our target of 2% once the tariff effects are behind us."

"We are at a moment when risks to both sides of the dual mandate are elevated," Cook said. "Every meeting, including December's, is a live meeting."

At the end of Monday's event, Cook said she believes public service "is worth the scrutiny."

"I've been motivated to do public service, given my family's history, for example, in the civil rights movement and my participation in it myself," she said. "And then I had to learn to have a thick skin if I thought the principle was worth pursuing."

"This too shall pass," Cook added.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up