Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

EUR/USD stays bullish above 1.17, driven more by dollar weakness than euro strength. Targets sit at 1.1830, 1.19, and 1.20, with support at 1.17. Fed’s Wednesday decision is key.

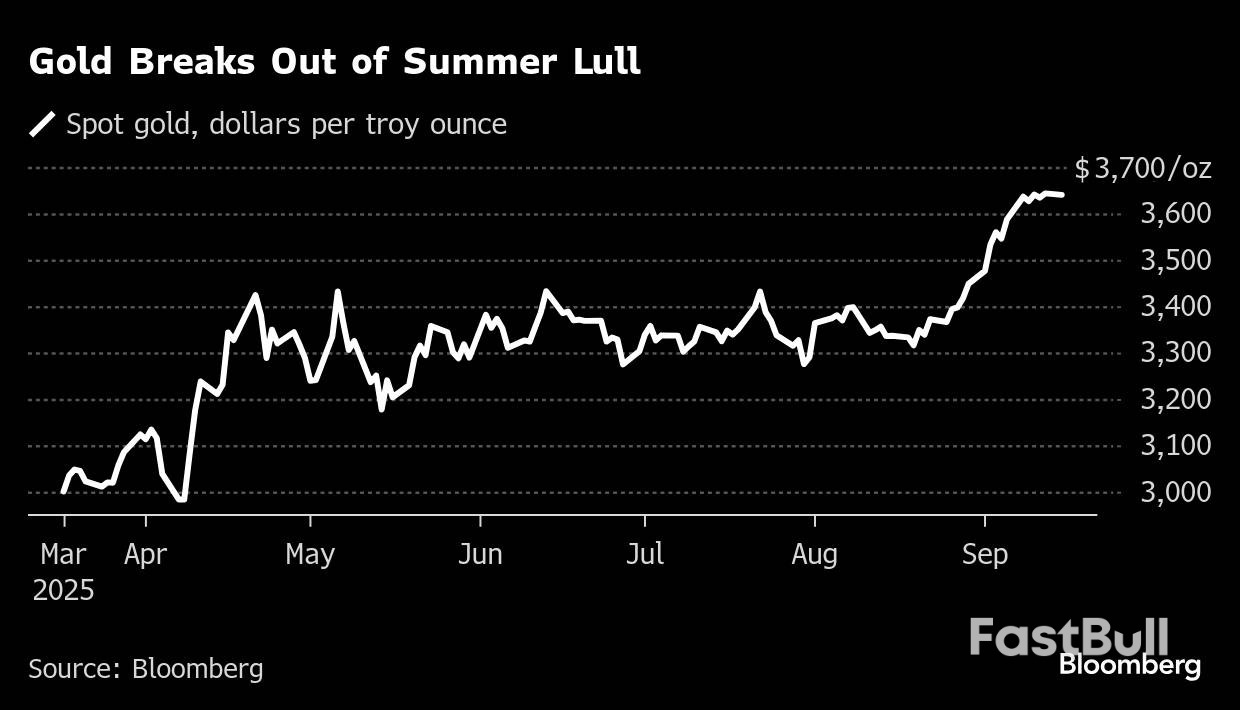

Gold rose near a record high as traders geared up for an anticipated easing of the US Federal Reserve’s monetary policy this week and looked for clues on further rate cuts this year.

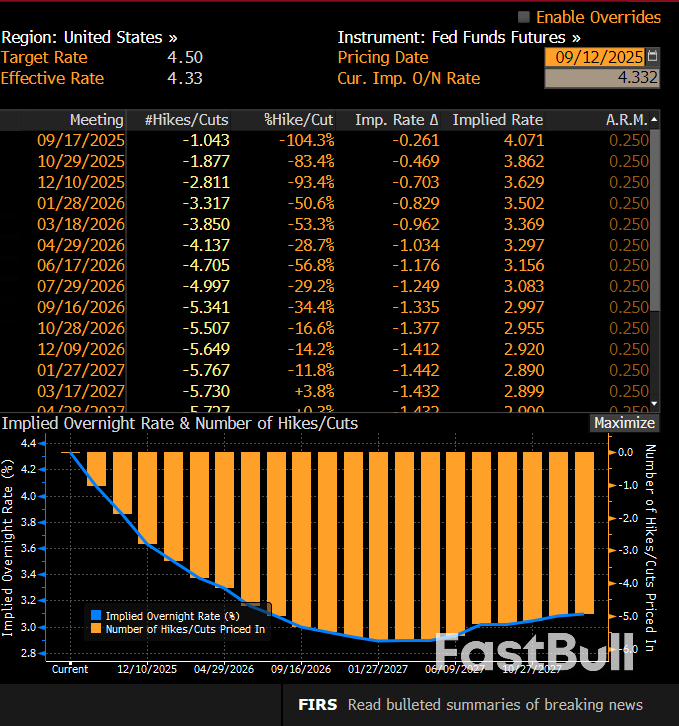

Bullion traded near $3,660 an ounce, after gaining for four consecutive weeks. Investors see a quarter-point cut this week, following signs of labor market weakness. Swaps also price in at least another reduction before the end of the year, with a high probability of a third one.

That expectation has driven Treasury yields to the lowest level in months and weakened the dollar, making bullion more appealing as a store of value that doesn’t bear interest, while also cheaper for buyers in other currencies. Whether the Fed will challenge these bets is a key question for investors this week.

“Macroeconomic numbers are likely to take over from tariff-related headlines,” ANZ Group Holdings’ Daniel Hynes and Soni Kumari said in a note.

Gold has rallied nearly 40% this year and recently broke out from a spell of range-bound trading to surpass an inflation-adjusted record. Persistent uncertainty over geopolitics and President Donald Trump’s trade agenda, along with concerted central bank buying, have supported prices for the haven asset.

Trump’s unprecedented pressure on the Fed — including his attempt to oust Governor Lisa Cook — is the latest catalyst, which Goldman Sachs Group Inc. sees potentially driving gold to near $5,000 an ounce, just 1% of the privately-owned US Treasury market were to flow into bullion.

Gold edged higher to $ an ounce as of 3:50 p.m. London time. The Bloomberg Dollar Spot Index slipped . Silver and platinum rose, while palladium fell. Copper rose 0.9% on the London Metal Exchange to $ a ton.

Meanwhile, Thai authorities are discussing ways to tax gold bought and sold through various online channels and settled in baht, in a bid to stem a currency rally that’s hurting exports and tourism, according to people familiar with the matter.

With the tax, authorities aim to reduce exports of gold and make it more expensive for Thais to own the precious metal, the people said, adding that dollar inflows tied to bullion shipments were among the factors fueling the baht’s rally.

Key points:

Authorities in Sydney approved construction of data centres without requiring measurable plans to cut water use, raising concerns the sector's rapid growth will leave residents competing for the resource.The New South Wales state government, which presides over Australia's biggest city, green-lit all 10 data centre applications it has ruled on since expanding its planning powers in 2021, from owners like Microsoft, Amazonand Blackstone'sAirTrunk, documents reviewed by Reuters show.The centres would bring in a total A$6.6 billion ($4.35 billion) of construction spending, but would ultimately use up to 9.6 gigalitres a year of clean water, or nearly 2% of Sydney's maximum supply, the documents show.

Fewer than half the approved applications gave projections of how much water they would save using alternative sources. State planning law says data centre developers must "demonstrate how the development minimises ... consumption of energy, water ... and material resources" but does not require projections on water usage or savings. Developers need to disclose what alternative water supplies they will use but not how much.The findings show authorities are approving projects with major expected impact on public water demand based on developers' general and non-measurable assurances as they seek a slice of the $200 billion global data centre boom.

The state planning department confirmed the 10 approved data centres collectively projected annual water consumption of 9.6 gigalitres but noted five of those outlined how they expect to cut demand over time. The department did not identify the projects or comment on whether their water reduction plans were measurable."In all cases, Sydney Water provided advice to the Department that it was capable of supplying the data centre with the required water," a department spokesperson told Reuters in an email.

Data centres could account for up to a quarter of Sydney's available water by 2035, or 135 gigalitres, according to Sydney Water projections shared with Reuters. Those projections assume centres achieve goals of using less water to cool the servers, but did not specify what those targets were.Sydney's drinking water is limited to one dam and a desalination plant, making supply increasingly tight as the population and temperatures rise. In 2019, its 5.3 million residents were banned from watering gardens or washing cars with a hose as drought and bushfires ravaged the country.

"There is already a shortfall between supply and demand," said Ian Wright, a former scientist for Sydney Water who is now an associate professor of environmental science at Western Sydney University.As more data centres are built, "their growing thirst in drought times will be very problematic," he added.

The number of data centres, which store computing infrastructure, is growing exponentially as the world increasingly uses AI and cloud computing. But their vast water needs for cooling have prompted the U.S., Europe and others to introduce new rules on water usage.New South Wales enforces no water usage rules for data centres other than the government being "satisfied that the development contains measures designed to minimise the consumption of potable water," according to the documents.

Just three of the 10 approved data centre applications gave a projection of how much the developer hoped to cut reliance on public water using alternative sources like rainwater. The biggest centre cleared for construction, a 320-megawatt AirTrunk facility, was approved after saying it would harvest enough rainwater to cut its potable water consumption by 0.4%, the documents show.An AirTrunk spokesperson said early planning documents referred to peak demand but "subsequent modelling recently tabled to Sydney Water has determined actual usage will be significantly lower".

The company was "working with Sydney Water to transition the site to be nearly entirely serviced by recycled water", the spokesperson added.The most ambitious commitment to cut reliance on town water was 15%, for one of two data centres approved on land held by Amazon, planning documents show.The two centres would collectively need 195.2 megawatts of electricity and take up to 92 megalitres a year of Sydney's drinking water before rainwater harvesting, say the documents, which give a projected reduction in water use for one project but not the other.

Amazon declined to comment on individual properties but said its Australian data centres avoid using water for cooling for 95.5% of the year because their temperature controls rely more on fans than evaporative cooling.Microsoft gave a 12% projected water use reduction for one of the two Sydney data centres it has had approved. Microsoft declined to comment.

Sydney's suburban councils, meanwhile, want to slow what they see as competition for limited water supply, especially when the state wants 377,000 new homes by 2029 to ease a housing shortage."A lot of them have been built without much discussion," said Damien Atkins, a member of Blacktown council where state-approved centres owned by AirTrunk, Amazon and Microsoft are being built."There should be more pushback and I'm just starting to ask those questions now."

In the city's north, Lane Cove council asked the state to return approval powers to local government, citing water usage and other concerns.Neighbouring Ryde council has five centres and another six in various stages of planning. It said those 11 would take nearly 3% of its water supply and has called for a moratorium on approvals.On a small vegetable farm near where Amazon, Microsoft, AirTrunk and others are building centres, Meg Sun said her family's business had to turn off the sprinklers in the 2019 drought but still bought enough water from Sydney Water to drip-feed the crops.

She worries what might happen if water demand is worsened by data centres' needs in the next drought."We can't even run the business then, because we do rely on water," she said.

Australia is confident its wide-ranging security agreement with the US and UK will push ahead despite a Pentagon review, people familiar with the matter said, with Canberra recently announcing at least $9 billion in related defense investments.

The Trump administration’s review of the so-called Aukus agreement, which was revealed in June, is focused mainly on reinforcing the pact rather than unraveling it, according to the people familiar, who asked not to be identified discussing internal deliberations.

Australia’s announcement over the weekend — that it will spend $8 billion on a related defense hub to build naval ships and service submarines and $1.1 billion on an underwater drone program — underscore Canberra’s commitment to the endeavor, and particularly its willingness to boost defense spending.

President Donald Trump and Defense Secretary Pete Hegseth have put global allies on notice that Washington expects them to spend more on their own defense, rather than rely on the security guarantees that crystallized in Europe and the Pacific after World War II.

Australian Prime Minister Anthony Albanese has publicly highlighted the rise in defense spending, including the weekend’s defense hub announcement.

“Today’s investment is another way we’re delivering record defense funding to bolster Australia’s capabilities,” he said at a briefing Sunday. “We pay our way and we contribute to our alliance each and every day.”

As well, Australia and the UK signed a 50-year defense treaty in July to underpin the construction of nuclear-powered submarines.

That ramp-up comes ahead of a possible meeting between Albanese and Trump later this month at the UN General Assembly meeting in New York — their first since the American president returned to office in January.

Aukus, signed in 2021 by then-President Joe Biden, at its core is aimed at checking China’s military advance in the Indo-Pacific region.

But a key component of the agreement would see the US help develop Australia’s nuclear-powered submarine fleet — including the sale of at least three, and potentially five, advanced Virginia-class vessels. The transfer would start in 2032 and 2035 with two subs from the existing fleet, and a third newly built sub would be sold to Australia in fiscal year 2038.

That’s proved a controversial wrinkle given the US currently lacks the shipbuilding capacity to meet its own submarine demand, much less that of its allies.

Separate to that attempt to buy nuclear-powered submarines from the US, and eventually build them in Australia by the 2040s, the nation is in the middle of a military spending spree, which the government has repeatedly called “the largest peacetime increase in defense spending in Australia’s history.”

Australia, like other US allies and partners, has found its relationship with Washington tested during Trump’s second term, especially with Albanese needing to show some independence by pushing back publicly on Washington’s spending demand, according to one person familiar with the government’s thinking. While that may play well domestically, it’s unsettled parts of Australia’s defense community.

Albanese has also sought to walk a fine line between the US and China, its largest export market. And Australia’s decision to recognize Palestine has drawn criticism from within Trump’s camp.

Despite those tensions, US–Australia cooperation in the military and intelligence spheres continues to run smoothly, said the people.

Defense Minister Richard Marles told Sky News on Sunday that he had received “positive sentiment” from Hegseth and US Secretary of State Marco Rubio about the future of Aukus.

“I’ve had numerous conversations with American counterparts,” he said. “I’m really confident about the proceeding of Aukus under the Trump administration.”

The Pentagon declined to comment on the status of the review or the path forward for Aukus.

A US State Department spokesman said in a written response to questions that it’s coordinating with the Defense Department on the Aukus review, and that “we remain committed to working with Australia to strengthen and advance the alliance.”

Australia sits beyond the range of China’s short- and medium-range conventional missiles, making it a relatively safe rear-area hub compared with Japan or Guam in case of a conflict over Taiwan. Its northern coast also provides access to the Indo-Pacific sea lanes that would be critical for sustaining US and allied operations around the island.

The US already rotates Marines through Darwin and uses Australian facilities for training, surveillance, and refueling. In a Taiwan contingency, Australia could serve as a logistical hub for fuel, ammunition, repairs and troop rotations.

The defense hub, in Henderson, Western Australia, will serve as the base for US and UK nuclear-powered submarines, which are scheduled to begin forward operations there from 2027. Albanese’s government said this will help strengthen the country’s defense industries’ experience with nuclear-powered submarines.

“Henderson is very much an Aukus precinct,” Marles said alongside Albanese on Sunday. “I’ve got no doubt this decision will be welcomed in the United States, as it will be welcomed in the United Kingdom, because it is another step forward down the Aukus path.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up