Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

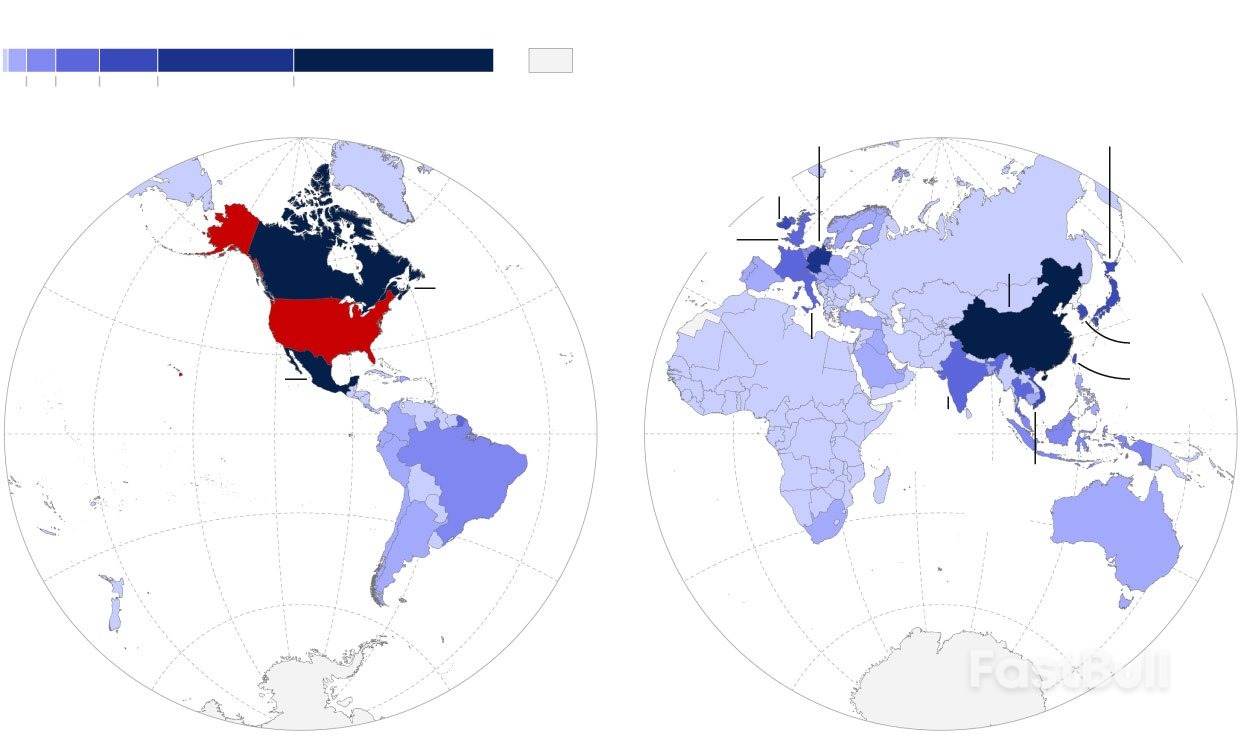

A sizable majority of Europeans would back retaliatory tariffs against the U.S. over new levies on goods produced in the EU.

More than two thirds of those polled in Germany, Europe’s economic powerhouse, are in favor of countering America’s actions in the brewing trade war.

The mood is similar, if not worse, in several other major economies on the Old Continent where an even larger share of people would like to see an appropriate response. Italians are the least belligerent in that context but over half of them would still support European countermeasures.

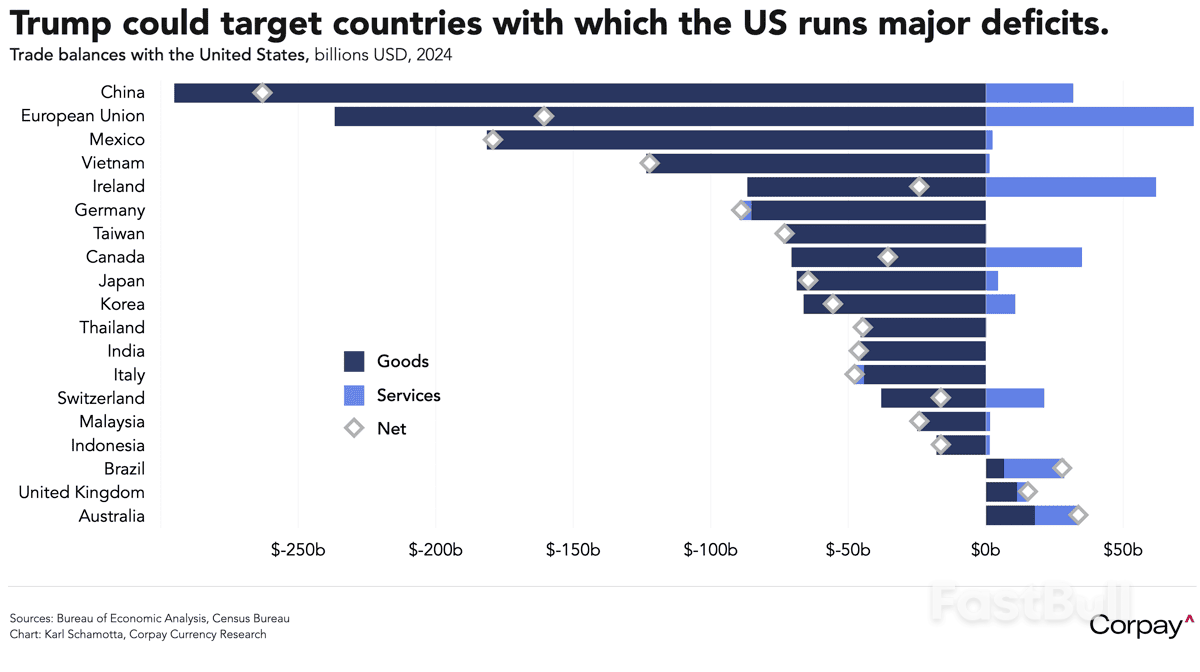

Most citizens of seven countries in Western Europe, EU member states and Britain, are largely supportive of retaliating against U.S. tariffs on the products they are making. The finding came ahead of an expected announcement, part of President Donald Trump’s policy of imposing “reciprocal tariffs” on nations that America has trade deficits with.

At 79%, Danes are the most eager backers of adopting countermeasures, according to the Yougov Eurotrack survey conducted in March. Swedes are second with 73% of them declaring support for potential EU response.

Exactly 70% of the respondents in Spain are in favor of Europe slapping higher tariffs on U.S. goods. Italians are least supportive with a total of 45% either unsure about or opposing a European retaliation, reflecting Italian Prime minister Giorgia Meloni’s recent call to avoid impulsive moves.

France and Germany, Europe’s leading political powers, are ranking in the middle, both with 68% of their citizens hoping for an adequate EU reaction. In the United Kingdom, no longer a member of the European Union, 71% support retaliatory tariffs.

With new US tariffs set to come into force tomorrow, most Western Europeans support imposing retaliatory tariffs on US goods.EU nations and the U.K. brace for tariff impact on their economies.

Between 60 and 76% of those polled in EU countries expect U.S. tariffs to seriously affect the European Union’s economy, with people in Germany, France, Italy, and Spain being the most worried about the potential effects for the EU as a whole.

Germans fear their national economy will be hit the hardest, given the large size of its automotive industry set to suffer the most under Trump’s 25% tax on imported cars. Some 75% of the participants in the poll there believe they are going to see a significant impact.

YouGov noted that the majority of Brits (60%) also anticipate a substantial impact on business in the U.K., while respondents in Denmark are the least likely to feel this way. Still, every second Dane is uneasy about the prospects for the Danish economy.

Germans are the most likely to think the US placing tariffs on EU goods would have a lot/fair amount of impact on their national economy.Europeans disagree with Trump’s reasons for ‘Liberation Day’

Commenting on his plans for broad-based “reciprocal tariffs” in February, the U.S. president accused the European Union of being “very unfair to us” in terms of trade relations. He and members of his administration have been referring to April 2 as “Liberation Day.”

The poll suggests, however, that Europeans largely disagree with Washington’s reading of the current state of affairs, with 40% (in Italy) to 67% (in Denmark) opposing Trump’s claims. Only between 7% and 18% of the EU respondents think he has good reasons.

Britons are displaying similar attitudes – over half of them, or 55% of the surveyed, are convinced that the United Kingdom has been fair enough in its trade dealings with the United States. Only around 6% tend to agree with Donald Trump’s remarks.

After imposing tariffs on steel and aluminum imports, the U.S. head of state unveiled last Wednesday a 25% tariff on “all cars that are not made in the United States,” which should take effect alongside the reciprocal tariffs expected this week.

The European Commission, the EU’s executive arm, indicated on Thursday it’s going to wait for the April 2 announcement from Washington before countering. Quoted by Euronews, its spokesperson for economic security, Olof Gill, stated that if necessary, Brussels will deliver a “well calibrated” response.

“Our objective is a negotiated solution. But of course, if need be, we will protect our interests, our people and our companies,” the Commission’s President Ursula von der Leyen said in a speech to the European Parliament, insisting the EU has a “strong plan to retaliate” while emphasizing the confrontation is “in no one’s interest.”

Between promises of emancipation and technical challenges, its ascent raises questions: can it truly dethrone the giants of traditional finance? Far from clichés, let’s dive into an uncompromising analysis.

Bitcoin is based on a peer-to-peer network, without a conductor. Banks, on the other hand, function like centralized cathedrals, where each stone depends on a higher authority.

This structural divergence explains why Bitcoin is appealing: it replaces trust in institutions with irrefutable mathematics.

In 2021, El Salvador adopted Bitcoin as legal tender, despite criticism. The result? An economy less dependent on the dollar, but exposed to volatility.

Meanwhile, traditional banks, protected by state safety nets, withstand storms. Bitcoin offers risky freedom; banks, a corseted stability.

Bitcoin handles 7 transactions per second, compared to thousands for Visa. Solutions like Lightning Network are trying to bridge this gap, but the road remains long.

Banks, despite their heaviness, master the art of massive flows. An advantage that could erode if blockchain technology matures.

Bitcoin promises a bank account on a smartphone. Yet, 3 billion people still lack internet access. In sub-Saharan Africa, only 48% of adults own a mobile phone. Without digital infrastructure, the dream of inclusion remains a mirage.

Cross-border transfers via Bitcoin cost a few cents, compared to an average of 6% via traditional banks. But this saving masks a problem: the volatility of BTC can cancel out gains in just a few hours. Stablecoins attempt to address this, but their peg to traditional currencies perpetuates dependency on the current system.

Start your crypto adventure safely with Coinhouse This link uses an affiliate program.

The Bitcoin blockchain has never been hacked. But digital wallets, on the other hand, are vulnerable. In the first quarter of 2025, losses related to cryptocurrency platform hacks reached $1.63 billion.

Banks spend billions on cybersecurity, yet experience regular data breaches. In 2022, 74% of financial institutions reported an increase in attacks. Bitcoin eliminates intermediaries, but not human errors.

20% of bitcoins are locked in inaccessible wallets. A simple misplaced USB key, and fortunes evaporate. Banks, with their recovery procedures, offer a psychological security that Bitcoin cannot match.

Bitcoin is limited to 21 million units. A scarcity that attracts investors but poses a problem: how to manage an economy without monetary adjustment? Central banks use inflation as a tool; Bitcoin imposes a rigor incompatible with crises.

In 2024, 60% of BTC holders consider it as “digital gold.” Few use it to buy a coffee.

As long as it remains a speculative asset, its role as a daily currency will remain marginal. Banks, despite their flaws, retain the monopoly on everyday exchanges.

BlackRock and JPMorgan are integrating Bitcoin into their portfolios, but as an investment product, not as a currency. A hybrid adoption that reinforces the current system more than it dismantles it.

The EU adopted MiCA in 2023 to regulate cryptos. The United States oscillates between repression and innovation.

Without a clear framework, Bitcoin will never supplant banks. But excessive regulation could jeopardize its decentralized essence. Bitcoin will not kill banks. It forces them to evolve. Meanwhile, the tax framework is evolving. Here are the essential dates to remember regarding crypto and taxes in 2025.

Designed to keep transactions confidential and identities hidden, these specialized cryptocurrencies sparked interest and controversy from day one. However, in 2025, with evolving regulations, innovative technology, and changing user priorities, the relevance of privacy coins feels increasingly uncertain. Are they still useful? Or are they becoming relics in a more transparent crypto ecosystem? Let’s take a closer look at their history, current trends, and what the future may hold.

To understand where privacy coins stand today, it’s essential to revisit their origins and the reasons they captured attention in the first place.

Privacy coins are a type of cryptocurrency designed to prioritize user anonymity and the confidentiality of transactions. Unlike Bitcoin and Ethereum, where transactions are publicly recorded on the blockchain, privacy coins hide transaction details—including amounts, sender addresses, and recipient addresses.

Privacy technologies such as ring signatures, zk-SNARKs, and stealth addresses make this level of confidentiality possible. For example, Monero uses ring signatures to obscure the origin of funds, while Zcash employs zk-SNARKs to prove transactions occurred without revealing specific details. In short, these coins aim to protect user identities in an increasingly monitored digital world.

The rise of privacy coins was driven by a growing demand for financial privacy. In the early days of crypto, Bitcoin was mistakenly thought of as an anonymous way to send value. When users realized Bitcoin transactions could be traced, privacy coins emerged to fill the gap.

These coins appealed to individuals seeking to safeguard their financial activities—whether to protect personal information or avoid surveillance. They also resonated with libertarians and privacy advocates who saw them as a tool for resisting government control and protecting freedom.

However, with anonymity came controversy. Privacy coins became heavily associated with illegal activities, such as money laundering and transactions on darknet markets. While many users employed these coins for lawful purposes, their misuse by bad actors attracted the attention of global regulators.

From the start, privacy coins faced intense scrutiny from governments and financial institutions. Nations like Japan and South Korea banned their use entirely, citing concerns about tax evasion and criminal activity. Some exchanges in the US and Europe delisted privacy coins due to increasing compliance demands.

Regulators’ primary concern has always been the inability to trace transactions. Transparent blockchains like Bitcoin allow law enforcement to track illicit financial flows when necessary, but privacy coins make this nearly impossible. Over the years, this regulatory pressure has made it harder for privacy coins to gain mainstream traction.

Various technologies can bring privacy to blockchain and crypto.

Various technologies can bring privacy to blockchain and crypto.Fast forward to the present day, and privacy coins still exist, but the landscape around them has shifted dramatically. Several key trends define their status today.

As cryptocurrency adoption has gone mainstream, the demand for privacy coins has seen mixed results. On one hand, some industries and regions still rely on them. Privacy advocates, journalists, and political dissidents in authoritarian countries use these coins to protect themselves. On the other hand, stricter regulations and penalties have discouraged usage in developed economies.

Interestingly, privacy coins have made a small comeback within niche sectors. For instance, in the gaming industry or among decentralized communities valuing privacy, these coins have carved out specific use cases. However, their overall market share remains small compared to more broadly adopted assets like Bitcoin and Ethereum.

Technological innovation has kept privacy coins competitive despite decreasing popularity. In 2025, advancements like zk-STARKs (an evolution of zk-SNARKs) and adaptive anonymity protocols have improved the efficiency and security of privacy features. These upgrades make transactions even harder to trace while reducing computational costs.

Moreover, some privacy concepts have migrated to mainstream blockchains, creating hybrid solutions. For example, Ethereum's layer-2 solutions now include optional privacy features, making it easier for users to toggle between transparent and private transactions. This integration raises questions about whether standalone privacy coins can maintain relevance in the long run.

Regulators haven’t let up in their efforts to control or eliminate privacy coins. Compliance requirements have reached new levels of intensity. Most centralized exchanges outright refuse to list privacy coins due to Know Your Customer (KYC) and Anti-Money Laundering (AML) laws. Some countries, like the US and EU nations, have imposed severe penalties for their misuse.

Still, enforcement isn’t universal. Nations with looser regulatory oversight or a history of favoring cryptocurrency innovation—such as certain parts of Asia and Africa, remain havens for privacy coin activity.

So, what lies ahead for privacy coins? Several possibilities may shape their trajectory beyond 2025.

There’s little doubt that privacy coins will remain a regulatory target. Governments are wary of their capacity to enable untraceable transactions, and this concern will likely lead to stricter enforcement. Over time, some privacy coins may migrate underground, appealing exclusively to users willing to take legal risks. Others could attempt to adapt by incorporating semi-compliant features—but at the cost of losing their appeal to hardcore privacy advocates.

Instead of withering away completely, privacy-focused technology could integrate into broader crypto ecosystems. Already, major blockchains like Ethereum are experimenting with privacy solutions that offer the best of both worlds: transparency when required and privacy when desired. If this trend continues, standalone privacy coins could lose relevance as these features become standard on larger platforms.

Decentralized finance (DeFi) is also an area ripe for privacy innovation. Users of DeFi platforms might begin demanding more anonymity features, and privacy coins that integrate with DeFi protocols could see renewed interest.

The question of survival depends largely on whether these coins can adapt. If innovation stagnates or regulations become unbearable, they may fade into obscurity. However, as long as there’s demand for privacy in financial transactions, they’ll likely retain a small but dedicated user base. Their future may reside not in the mainstream but in specialized markets where privacy is non-negotiable.

Privacy coins occupy a unique, controversial space in the cryptocurrency world. While they’ve lost some of their early momentum due to regulatory crackdowns and technological competition, they remain valuable to those who prioritize financial privacy. The evolution of anonymity technology, combined with the steady push for compliance, will determine their survival in the years to come.

For avid crypto enthusiasts or those concerned with personal privacy, the next few years will be critical. Will privacy coins adapt or disappear? Only time will tell. One thing is clear: as the conversation around privacy, transparency, and control evolves, so too will the tools we use to navigate the crypto space.

Donald Trump declared the "Liberation Day" tariffs aiming to bolster U.S. industries. The policy affects over 25 countries, triggering market volatility. Trump's history of influencing markets continues, with crypto sectors responding swiftly.

Bitcoin's value rose by 2.3% to $66,500, while Ethereum gained 3.1%, reflecting confident market reactions to tariffs. Markets also saw significant trading volume, with heightened activity on exchanges and derivatives markets.

GameStop's $1.5 billion investment to "buy the dip" underscores institutional confidence in Bitcoin's potential amidst tariff-induced turbulence. Social media suggests bullish sentiment, with retail traders viewing this as a buying opportunity.

Financial markets are navigating this volatility, with historical trends suggesting that similar economic measures previously led to significant Bitcoin appreciation. Experts propose Bitcoin's future price could ascend significantly, indicating strategic interest across sectors.

Fred Krueger, Mathematician and Author, emphasized the role of Bitcoin in today's market dynamics: "Bitcoin is a portable digital gold, especially in the face of tariffs."

Despite the absence of immediate regulatory responses, the market's enthusiasm remains cautious yet optimistic. Investors eye digital assets for safeguarding wealth, anticipating advantages if geopolitical tensions escalate further.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up