Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

European shares gained as investors awaited eurozone inflation and U.S. jobs data. Spanish inflation rose, dimming ECB rate-cut hopes. Oil fell on OPEC+ concerns, gold hit records, and corporate shifts dominated headlines.

Dollar bears suffered last week after a string of data questioned whether the Federal Reserve was right to cut rates earlier this month. Perhaps the standout number was the upward revision to the second-quarter GDP figure, which showed much stronger US consumption than previously believed. This, combined with another low jobless claims figure, was enough to shake out a few late-dollar short positions. There also remain the continued gains in US equities, with a sense that global passive equity funds, following benchmarks, will have to pour more money into the US.

This week is all about US jobs data. Now that the Fed has firmly swung behind the risk of a weaker jobs market being greater than the risk of inflation, employment data will have to come in on the weak side to maintain both expectations for Fed easing and a weaker dollar. That data unfolds over Tuesday (JOLTS job openings), Thursday (weekly jobless claims) and Friday (the September payroll report). Regarding payrolls, there is probably more focus on the unemployment rate now that Fed Chair Jerome Powell has said that it may just take a +0-50k job increase each month to keep the unemployment rate steady. Our team actually think there is a slight upside risk (dollar bullish) to Friday's jobs figures.

One additional event risk this week is a US government shutdown on Tuesday evening. That's probably a mild dollar negative if it happens, but it would look unlikely to last long if it did occur.DXY will probably tread water today near 98 and make its first decent move of the week on tomorrow's JOLTS release.

While Germany continues its soul-searching on the future path for growth and France remains mired in budget uncertainty, Spain is doing very well. Spain's sovereign debt received a one-notch upgrade to A from A- from Fitch on Friday evening. The ratings agency cited better growth prospects for the country as it revised those growth forecasts higher. Spain's news serves as a reminder of the north-south divide in the eurozone and why government bonds in the eurozone area have remained resilient in the face of the news out of France.

Still on the subject of Spain, the country is one of the first to release September CPI data today, as is Belgium. Both headline and core inflation are expected to pick up. The news should be a precursor to the French and German CPI numbers tomorrow, and then the full eurozone release on Wednesday. We and consensus see the eurozone flash CPI rising to 2.2% year-on-year from 2.0%, with some looking for 2.3%. A higher number could further rein in expectations of one final European Central Bank cut and help the euro.

There are also plenty of ECB speakers this week. Today, we'll hear from Germany's Joachim Nagel at 11:00am CET and Chief Economist Philip Lane at 2:00pm CET.EUR/USD looks to have put in a short-term low near 1.1650, but will require some softer US jobs data to break back above the 1.1790/1800 area this week.

Sterling has been underperforming since around the middle of September, with plenty of focus on whether the UK is 'going bust' or will require an IMF bail-out – neither of which is likely. At the heart of that story is weak UK growth and parlous public finances, which leave the UK Labour government with very little room for manoeuvre. Not helping that story last week was an interview given by Prime Minister Keir Starmer's main rival, Andy Burnham, that the government should ignore the bond market. With that in mind, there will be a lot of focus on the Labour Party conference, which kicks off in Liverpool today. Any signs that the government will cede ground to the left wing of the party by, say, withdrawing the two-child cap on benefits, would be taken poorly by Gilts and sterling.

If sterling can survive that party conference unscathed, then presumably more rhetoric from Bank of England hawks later in the week – including Governor Andrew Bailey – could provide sterling with a little more support.So far, support has held at 1.3300 for cable. And US jobs data will help determine whether we end the week over 1.35.

This week, attention should return to local data in Central and Eastern Europe. Tomorrow, Poland's inflation figures for September will be released. We expect headline inflation to jump from 2.9% to 3.0%, driven by a shallower decline in gasoline prices compared to August. Core inflation is estimated to have eased further, while food and energy inflation remained broadly stable. More pronounced declines in headline inflation are expected in November and December.

On Wednesday, we will receive PMI figures across the region, where we could see some slight improvement in sentiment. On Friday, Turkey's inflation figures for September will be released. We expect a further decline from 33.0% to 32.2% but month-on-month, we will see some acceleration from 2.0% to 2.4%. Risks are on the upside, given continuing pricing pressures in food, with adverse weather conditions and the start of the school season pushing education inflation higher.

In the Czech Republic, general elections will be held on Friday and Saturday, suggesting an opposition victory, but the latest polls show a closer race than expected. In recent days, the market has priced in a higher fiscal premium, with government bonds underperforming their CEE peers. However, we do not expect a significant widening of the fiscal deficit in any scenario, and the long end of the curve seems too high, although we may see more pressure here this week.

EUR/CZK seems untouched for now, and historically, FX has not reacted much to elections in the Czech Republic, which should also be the case this time. In general, conditions in the CEE region are turning positive for FX again. Market rates rebounded significantly last week, and EUR/USD is heading up again. We should also see some rebound in the CEE region this week.

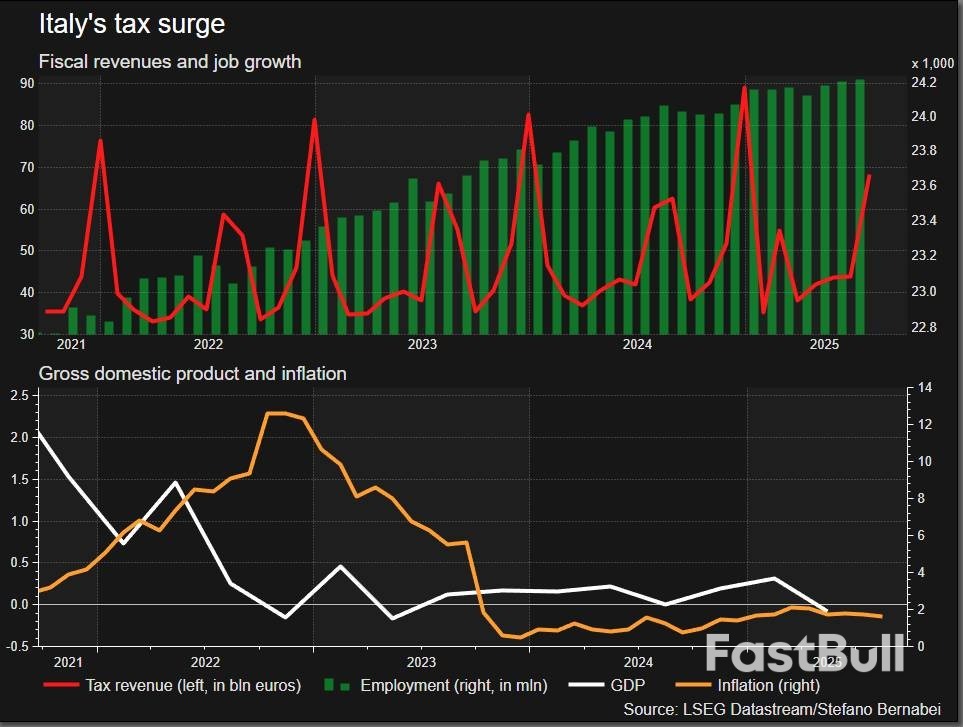

Italy's tax take is rising faster than expected thanks to job growth and inflation, putting the budget deficit on track to dip below the European Union ceiling of 3% of gross domestic product in 2025, a year ahead of schedule.

Tax revenues rose by more than 16 billion euros ($18.76 billion) between January and July, 5% higher than in the same period last year and outpacing the expectations of the Italian Treasury, which in April forecast a 0.8% increase for the full year.

The government had estimated a deficit of 3.3% of GDP in 2025, but the extra taxes mean the fiscal gap will probably be significantly lower.

Prime Minister Giorgia Meloni and her right-wing allies are claiming credit for the stronger numbers, yet economists say the upswing has been caused by phenomena not necessarily tied to the government, which took office in late 2022.

Tax evasion reforms introduced over the years are bearing fruit, analysts say, although much of the heavy lifting is down to inflation-driven fiscal drag and the creation of some 2 million new jobs over the past four years that have boosted tax receipts.

"Job growth boosts both tax revenue and GDP, but tax revenues grow faster than GDP since employment is taxed much more heavily than other kinds of income," said Marco Leonardi, economics professor at Milan's Statale University.

Meloni frequently points to the job growth as an achievement of her government, but never mentions the fiscal drag - a simple economic phenomenon where inflation and nominal pay growth raise the proportion of taxes paid on income.

Leonardi estimated that the state had collected an extra 25 billion euros from 2021 to 2024 thanks to this effect, with more cash piling up this year, outpacing limited tax cuts introduced by Meloni so far.

Consumer prices in Italy rose by 19% between 2020 and this year. Wages have risen in nominal terms in recent years too but by less than inflation, leaving ordinary Italians feeling worse off. Italian salaries adjusted for inflation are below the level of 1990, data by the OECD and Italy's national statistics bureau ISTAT show.

"The government says it has passed billions of euros of tax cuts, but the impact on our pay packet seems minimal or inexistent. Meanwhile, prices remain high," said Veronica D'Amato, an office worker from Rome.

In Germany, by contrast, the government shifts income‑tax brackets each year to offset fully the impact of inflation.

France has seen no tax windfall this year, partly as a result of more modest employment and consumer price growth than Italy, and faces a 2025 budget deficit of at least 5.4% of GDP.

Italy's sturdier accounts are also a reflection of new rules introduced progressively since 2011 that have narrowed the scope to evade taxes, with successive governments pushing traceable digital payments and tightening controls.

Tools now in place include expanded e‑invoicing, real‑time VAT reporting, penalties for retailers that refuse card payments, and heavy use of data matching across state systems.

"In my field, the level of evasion has definitely declined in the last 20 years," said Martina Di Egidio, a Rome architect.

She cited a national digital platform introduced around a decade ago where all applications for building work must be uploaded as one measure that curbed evasion.

Giacomo Ricotti, head of the Bank of Italy's tax department, told parliament last week that tax evasion fell from 97 billion euros in 2017 to around 72 billion in 2021, the most recent data available.

Fitch ratings cited "rising tax compliance" among the factors behind its decision on September 19 to upgrade Italy's credit rating.

Yet Italy's long-running fight against tax fraud is still far from won, with critics pointing the finger at Meloni for some setbacks.

Soon after taking office, she partially softened past crack-downs on evasion by raising a limit on cash payments to 5,000 euros from 1,000 and offering numerous tax amnesties allowing people to settle their disputes.

The European Commission says that in Italy the VAT compliance gap, which measures estimated losses from fraud and evasion, widened by roughly four percentage points, opens new tab in 2023 from 2022, reversing a tightening between 2020 and 2022.

Brussels linked the higher compliance observed during the pandemic to home renovation incentives that taxpayers could access by declaring work. Meloni has almost entirely phased out these programmes, given their massive costs for state coffers.

The government says its strategy is focused on targeted tax audits to avoid hitting honest taxpayers and on pre-emptive agreements with companies on their future tax bills. Meanwhile, the co-ruling League party is piling pressure on Meloni to adopt a further, large-scale tax amnesty.

Italy's tax burden remains stuck above 42% of GDP, higher than the EU average of 40% -- a statistic that opposition parties say belies repeated claims by the coalition that it is slashing taxes.

With national elections due in 2027, Meloni is looking to cut income taxes for those earning between 28,000 and 60,000 euros a year, politicians said.

"It's time to give an important signal for a reduction of the tax burden on the middle class," said junior Treasury Minister Federico Freni.

Bitcoin steadied above $112,000 on Monday, easing concerns after a turbulent week that rattled crypto investors. The world’s largest cryptocurrency briefly touched $112,293 in early trading, its highest level since last Thursday’s sharp price pullback, before settling near $111,835.

Despite the recent swings, researchers at crypto investment firm XWIN Research Japan maintain that the broader bull market remains alive. In a Sunday note on CryptoQuant, XWIN argued that on-chain indicators show “resilience beneath the surface,” pointing to data from long-term holders and Bitcoin’s Market Value to Realized Value (MVRV) ratio.

The MVRV, which compares Bitcoin’s market price to the average purchase price of all coins, currently stands at about 2. XWIN highlighted that this level historically signals neither panic selling nor excessive optimism.

“Investors are still sitting on healthy gains, yet the market has cooled from overheated conditions,” the report said, adding that previous cycles often entered their strongest expansion phases after similar periods of consolidation.

XWIN also noted that profit-taking by long-term holders has slowed, effectively tightening supply and potentially setting the stage for renewed upward pressure. “This cycle has not reached its terminal stage,” the firm wrote.

“The recent consolidation could mark the groundwork for the next major leg upward—suggesting the bull market is alive and well.”

Bitcoin’s latest rebound follows two significant liquidation events that erased more than $4 billion in leveraged positions over the past week. Data from CoinGlass show that on Monday, September 22, roughly $3 billion in crypto longs were wiped out when BTC briefly dropped 3% below $112,000.

A second wave on Thursday triggered another $1 billion in liquidations as prices slid to $109,000. Bitcoin accounted for $726 million of the losses during the first event, while Ether led the second with $413 million in liquidated long positions.

Even with these sharp shakeouts, the crypto market mood is showing signs of recovery. The Crypto Fear & Greed Index climbed back to a neutral reading of 50 on Monday, up from 37 a day earlier.. That rebound follows a stretch of “Fear” not seen since mid-April, when BTC briefly sank toward $80,000.

For now, traders are watching whether Bitcoin can maintain its footing above $112,000, with analysts like XWIN suggesting that the recent turbulence may be a pause rather than an end to the current bull cycle.

The pharmaceutical group GSK has announced the surprise departure of its chief executive, Emma Walmsley, after eight years in the top job.Walmsley, who has run the FTSE 100 company since 2017, will step down from the board at the end of this year, and remain at the business until her notice period ends on 30 September 2026.She said in a statement: “2026 is a pivotal year for GSK to define its path for the decade ahead, and I believe the right moment for new leadership.

“As CEO, you hope to leave the company you love stronger than you found it and prepare for seamless succession. I’m proud to have done both – and to have created Haleon, a new world-leader in consumer health.“Today, GSK is a biopharma innovator, with far stronger momentum and prospects than nine years ago.”Luke Miels, who is now chief commercial officer and has been at GSK since 2017, has been appointed as her successor.Walmsley oversaw much change at GSK in her eight-year tenure, including the separation of the group’s consumer healthcare business Haleon, its biggest corporate restructure in two decades.

Walmsley is one of the highest-paid chief executives in London, with a £10.6m total package last year, down from £12.7m in 2023 as a result of lower bonuses. Her fixed pay was little changed at £1.6m.The company’s chair, Sir Jonathan Symonds, thanked Walmsley for her “outstanding leadership in delivering a strategic transformation of GSK, including the successful demerger of Haleon”.He said: “GSK today is necessarily very different to the company she was appointed to nine years ago and has a bright and ambitious future. The company is performing to a new, more competitive standard, with performance anchored in a stronger portfolio balanced across specialty medicines and vaccines.”

GSK, which is headquartered in London, employs more than 65,000 people across the world. It is one of the largest companies listed on the London Stock Exchange, with a market capitalisation of £60bn.Her departure comes at a difficult time in the pharmaceutical industry, as Donald Trump has threatened to impose new tariffs this week on branded drugs, as well as trucks and kitchen cabinets.

Busy week of economic news and reports from both sides of the Atlantic. Here’s how the cable might get tossed around.

The US Federal Reserve needs to maintain a restrictive stance of monetary policy to get inflation down to its 2% target, Cleveland Fed president Beth Hammack told CNBC's Squawk Box Europe on Monday.

"It's a challenging time for monetary policy. We are being challenged on both sides of our mandate," she said, referring to inflation and maximum employment.

"When I balance those two sides of our mandate, I think we really need to maintain a restrictive stance of policy so that we can get inflation back down to our goal," she said.

Hammack, among the most hawkish Fed policymakers, and not a voter on policy this year, said she expected inflation to remain above target for the next one to two years.

"When I start seeing pressure in the services side, things like insurance that feeds into our super core inflation that, to me, says that maybe this isn't just coming from the tariff impacts, and it's something we need to be more attentive to," Hammack added.

Last week, Hammack had said that the Fed needed to be "very cautious" in removing restrictive monetary policy with inflation still above the central bank's 2% target and remaining persistent.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up