Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Euro zone inflation unexpectedly ticked up last month, likely solidifying bets that no further European Central Bank rate cuts are coming anytime soon, data from Eurostat showed on Tuesday.

Euro zone inflation unexpectedly ticked up last month, likely solidifying bets that no further European Central Bank rate cuts are coming anytime soon, data from Eurostat showed on Tuesday.

Inflation in the 20 nations sharing the euro accelerated to 2.2% from 2.1% a month earlier, hovering near the ECB's 2% goal for most of this year, as falling energy prices offset still robust domestic price pressures, particularly in services.

Underlying figures, which exclude volatile food and fuel prices held steady at 2.4% on continued quick price growth in services but muted figures for durable goods.

The figures confirm the ECB's own view that inflation is largely defeated and policymakers now have ample time to watch price developments unfold before contemplating any further action.

This is why markets see almost no chance of a cut in the ECB's 2% deposit rate at the bank's last meeting for the year on December 18 and see only a one-in-four chance of any easing next year.

The ECB has cut rates by a combined 2 percentage points in the year to June but has been on the sidelines ever since.

Rate cut talk may get a new lease on life early next year, however, when inflation is set to dip below target on the continued fall in energy costs.

This is seen as a temporary undershooting and the bank tends to look past energy-induced price volatility. But some worry that excessively low figures could weigh on expectations, making low inflation self-perpetuating.

Natural gas prices are now more than 40% lower than a year ago and crude oil (LCOCc1) is down by over 10%, suggesting that plenty of energy deflation is yet to come.

Energy prices were down by 0.5% in November from a year earlier, while services inflation was 3.5% and unprocessed food prices were up 3.3%.

Inflation in non-energy industrial goods, watched to see the impact of Chinese dumping, was 0.6%.

A long list of policymakers have said that the ECB can live with small deviations as long as underlying trends point to a return to target.

Policymaker confidence is held up by relatively upbeat economic data, which suggest that the bloc is weathering exceptionally high uncertainty quite well.

While the economy is not booming, surveys and hard data continue to point to decent expansion near the bloc's potential, which is somewhere in the 1% to 1.5% range.

Growth is also supported by a relatively tight labour market and separate data from Eurostat showed that the jobless rate inched up to 6.4% in October.

Australia's economy grew at a surprisingly softer pace last quarter as households opted to save some of their income gains, clouding the picture on the economy's strength and suggesting markets may have been premature in pricing interest-rate hikes.

Gross domestic product advanced 0.4% in the three months through September, slower than the predicted 0.7%, government data showed Wednesday. The 2.1% annual expansion came in just below a forecast 2.2% gain.

The Australian dollar and government bond yields slipped after the data, erasing an earlier gain as traders trimmed bets on the Reserve Bank turning more hawkish next year. Traders priced a roughly even chance of a rate hike by end-2026, up from about 80% prior to the data.

The market reaction is a relief for Australia's bond market after its worst monthly selloff in more than a year in November, spurred by bets the RBA will hike its policy rate next year amid inflation pressures and a still healthy jobs market. The divergence in policy with the Federal Reserve has seen the yield premium Australian bonds hold over their Treasury counterparts rise to the most in more than three years.

The GDP figures land just under a week before the RBA's final policy decision of the year, when rates are widely expected to stay unchanged at 3.6% after three cuts this year. The RBA expects the economy to grow around its "potential" rate of 2% in 2026, supported by lower borrowing costs, steady household incomes and still-strong population growth.

At the same time, inflation remains uncomfortably elevated and the RBA assesses the labor market as still a bit tight, underscoring the delicate policy balance the rate-setting board must navigate.

The RBA is uncertain about the restrictiveness of monetary policy and whether the economy is running beyond its speed limit. A key question for policymakers is also how much further they can lower borrowing costs, if at all, in an environment of a still-tight labor market and poor productivity growth.

Weak productivity means any pickup in demand risks spilling straight into prices. The RBA has already cut its estimate of the economy's potential growth rate to just 2%, effectively lowering Australia's speed limit. With less room to run, the country can't grow as quickly without reigniting inflation, keeping policymakers wary.

The GDP data showed the household savings ratio climbed to 6.4% from 6% three months earlier, underpinned by higher incomes. Households also shifted away from discretionary spending, down 0.2%, while boosting essential outlays which jumped 1%.

Economic output per person was flat in the third quarter. GDP per capita slid for seven consecutive quarters through 2023 and much of 2024, in a sign of declining living standards.

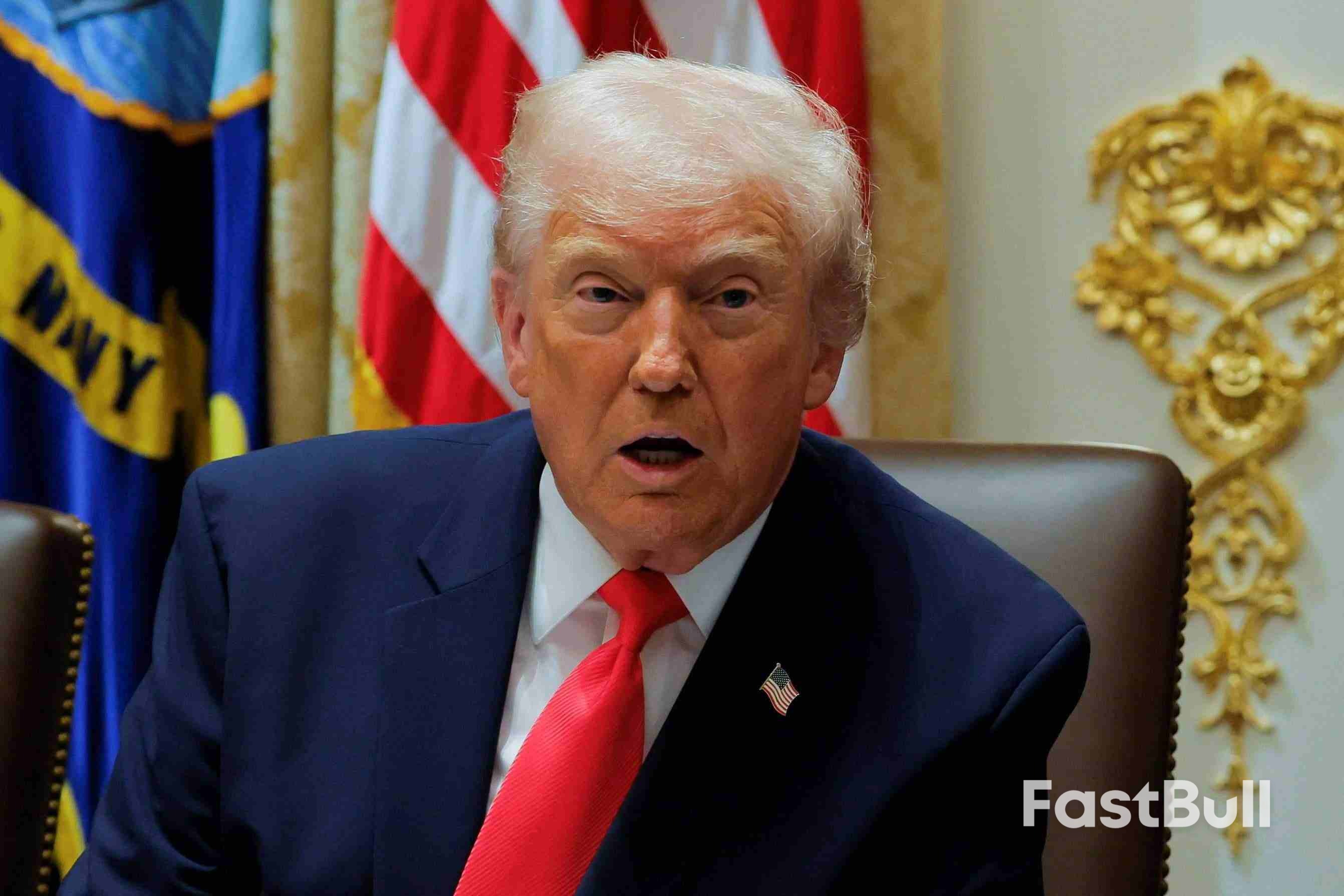

U.S. President Donald Trump said on Tuesday he is terminating all documents, including pardons, that he said his predecessor Joe Biden had signed using an autopen.

The autopen is a device used to replicate a person's signature with precision, typically for high-volume or ceremonial documents. It has been employed by presidents of both major parties to sign letters and proclamations.

Trump and his supporters have made a variety of unfounded claims that Biden's use of the device while president invalidated his actions or suggested that he was not fully aware of these actions. It is not known whether Biden used autopen on pardons.

"Anyone receiving 'Pardons,' 'Commutations,' or any other Legal Document so signed, please be advised that said Document has been fully and completely terminated, and is of no Legal effect," Trump wrote on Truth Social.

Before leaving office in January, Biden issued several pardons, including for family members who he wanted to protect from politically motivated investigations. He also commutated sentences, including for non-violent drug offenders.

Trump, known for his provocative style and dislike for his political opponents, has repeatedly targeted Biden's use of the autopen to sign official documents during his presidency.

Trump has questioned Biden's mental fitness and suggested that aides, not Biden himself, made key decisions. Biden and his former aides have denied these claims, emphasizing the president's active role in governing.

Japan's services sector activity continued its steady growth in November, driven by a faster rise in new orders and increased business confidence, a private-sector survey showed on Wednesday.

The S&P Global final Japan Services Purchasing Managers' Index (PMI) edged up to 53.2 in November from 53.1 in October, staying above the 50.0 line that separates growth from contraction for the eighth consecutive month.

Sub-indexes showed service activity growth was supported by robust domestic demand, with a faster increase in overall new work, despite a continued drop in export sales for the fifth month.

Employment in the service industry grew at its fastest rate since January, as firms showed the highest confidence in their future outlook since then.

Input prices rose at the sharpest pace in six months, although output price inflation eased from October. Higher costs for staff, energy and construction materials were primary contributors to rising expenses, according to the survey.

Japan's broader economic picture showed an improvement, as composite PMI output index rose to 52.0 in November from 51.5 in October, marking growth for the eighth straight month.

"Latest PMI data signalled a further modest expansion of private sector output in Japan, as a solid increase in service sector activity offset a slight reduction in factory output," said Annabel Fiddes, Economics Associate Director at S&P Global Market Intelligence.

"With a new economic stimulus package now approved by Japan's new government - which aims to boost economic growth and help ease the impact of rising costs - it will be important to see if this feeds through to further improvements in demand and output in the months ahead," Fiddes added.

Prime Minister Sanae Takaichi's government last week unveiled a hefty 21.3 trillion yen ($137 billion) stimulus package, after Japan's gross domestic product shrank in the July-September quarter.

Netflix's proposed acquisition of Warner Bros Discovery's studios and streaming unit is expected to reduce streaming costs for consumers by bundling Netflix and HBO Max, according to two people familiar with the proposal.

In recent talks with Warner Bros Discovery, Netflix said the potential combination of its streaming service with HBO Max would benefit consumers by lowering the cost of a bundled offering, the sources familiar with the discussions told Reuters. They requested anonymity to discuss confidential negotiations.

Netflix's argument seeks to address potential regulatory concerns that combining one of the nation's leading subscription video streaming services with a top rival would reduce consumer choice and raise prices, the sources said. The services are not currently offered as a bundle by either company.

Warner Bros Discovery has been exploring a sale of all or part of its business, which includes film and television studios, cable networks such as HBO and CNN, and the HBO Max streaming service.

Reuters reported in October that Netflix was actively exploring a bid for Warner Bros Discovery's studio and streaming business, a tie-up that was seen as potentially reshaping the streaming landscape. Now, by framing the acquisition as pro-consumer, Netflix aims to build a case that the deal should withstand a potential regulatory challenge, according to the sources.

Reuters previously reported that Netflix had submitted a mostly cash offer for the studio and streaming unit.

Other bidders for Warner Bros Discovery - Paramount Skydance and Comcast - also would use HBO Max, together with the Warner Bros film and television library, to bolster their streaming services.

Netflix did not immediately respond to a request for comment, while Warner Bros Discovery declined to comment.

If Netflix's bid is successful, the deal is expected to expand Netflix's movie and television library. But the sources familiar with the matter said the potential combination of the two services is unlikely to radically expand its market share because the vast majority of Netflix customers also subscribe to HBO Max.

The combination of HBO Max and Paramount Skydance's Paramount+ would create a top-tier streaming service in the U.S., capable of challenging Netflix and Walt Disney's Disney+ in terms of volume and breadth of content, wrote Bank of America media analyst Jessica Reif Ehrlich in a recent report.

HBO Max would similarly lift NBCUniversal's Peacock service, which has yet to turn a profit. NBCUniversal is owned by Comcast.

"Comcast risks being left behind as PSKY or NFLX scale (their streaming services), limiting Peacock's reach and weakening NBC's ability to compete in the global media market over time," Ehrlich wrote.

A successful acquisition would give Netflix control over Warner Bros' vast library of content, including the entire HBO catalog, the Warner Bros film archive, and DC Comics properties.

"Netflix is the clear streaming leader in subscribers," Ehrlich wrote, adding: "It still lags other media companies on deep IP libraries that could offer potential use cases for theme parks, experiences, Broadway shows, gaming and merchandising."

To be sure, Netflix faces its own political headwinds, from criticism by the Pentagon over its content to Republican lawmakers warning that a takeover of Warner Bros Discovery could give it too much control and reduce consumer choice. Alphabet's YouTube remains the country's largest streaming platform by viewership.

Rashi Talwar Bhatia says the growing presence of women in India's workforce reminds her of the feminist movement seen in the US in the 1960s.

For the 49-year-old chief investment officer at Ashmore Investment Management India LLP, the trend also presents a long-term investing opportunity. Buying shares of Indian firms that stand to benefit from higher spending by working women is a key theme in Rashi's portfolio. These include instant grocery and food-delivery platforms as well as makers of home appliances and beauty products.

"I have a certain female gaze on my portfolio," Rashi, who helps oversee about $2.3 billion worth of Indian stocks across several of Ashmore's funds, said in an interview in Mumbai last month. "The use of electronic kitchen equipment is going to increase manifold" and spending on "beauty-care products is going to grow massively. Why? Because women have now gotten money in their own hands," she said.

The Ashmore Sicav India Equity Fund, managed by a team including Rashi, has beaten 96% of its peers so far this year, according to data compiled by Bloomberg. Ashmore's investment approach does not involve having individual fund managers for individual funds.

Shares of four companies — food-delivery firm Swiggy Ltd., beauty retailer FSN E-Commerce Ventures Ltd., better known as Nykaa, hair-oil manufacturer Marico Ltd., and Electronics Mart India Ltd. — made up about 10% of the fund's total holdings at the end of October.

India, the world's fastest-growing major economy, is witnessing a consumption boom thanks to rising disposable incomes and growing aspirations of its burgeoning middle class. Female participation in the labor force has climbed to 41.7% in 2023-24 from 23.3% six years ago, according to government data. In comparison, women's global labor force participation rate stood at 48.7% in 2023, as per a report from the International Labour Organization.

"If you ask me, India is going through what the US went through in the 60s," Rashi said. "As you see more women entering the workforce, there will be even more demand."

The US feminist movement in the 1960s marked a crucial period for women's rights and social roles in the country, bringing some key legal and cultural changes that also shaped consumption trends. One of them was the signing of the Equal Pay Act by President John F. Kennedy in 1963, which prohibited discrimination in wages on account of sex.

Still, there's no guarantee of a straight march toward gender parity in India. Many companies still treat diversity goals as a branding exercise, and compliance with rules on child-care facilities, maternity protections or safe-transport guidelines is spotty, particularly outside major cities. A large share of Indian women work in informal or home-based roles that offer few protections and no clear path into the corporate jobs that underpin most of the bullish expectations about female-driven consumption.

Surveys show that families continue to discourage women from working after marriage or childbirth, and employers often reinforce the pattern by favoring men for leadership roles or jobs that require travel. In that sense, Rashi's thesis is as much a bet on cultural change as it is on corporate earnings. If participation plateaus, the investment story loses some of its gloss.

The deeply rooted social norms and traditional gender roles that still place the bulk of caregiving and household responsibilities on women in India are a key reason why the world's most populous nation lags many major global peers in this regard. On average, women spend about eight times more time each day on such activities relative to men, according to a 2022 study published by the Observer Research Foundation.

That's where Rashi sees a big opportunity for food and grocery-delivery firms as well as kitchen-equipment makers.

"I don't think any working woman has the luxury of time at this point to go home after work and crush masalas on a silbatta," she said, referring to a traditional Indian stone tool used to grind spices for cooking. "Quick commerce is a huge boon," said the Mumbai-based Ashmore CIO, who started her career 25 years ago as an automobile analyst with Motilal Oswal Securities Ltd.

India's quick commerce market — where online retailers deliver packages in as little as 10 minutes — is expected to balloon to $100 billion in sales by 2035, from about $6 billion in 2024, according to Bloomberg Intelligence. That would make it nearly a fifth of the country's overall e-commerce sales, up from just 5% in 2024.

That said, the pace and intensity of this growth means there are risks investors should watch out for. In some cases, valuations are getting stretched, posing a risk for stock investors, while in other cases, the breakneck expansion pace is weighing on results.

Higher expansion costs saw online ordering platform Swiggy Ltd. report a loss of 10.9 billion rupees ($121 million) for the quarter ended September, a 74% increase from its loss a year earlier. Its stock, which climbed nearly 17% on its debut last November, is currently trading below the issue price.

One of the Ashmore fund's successful bets is FSN, which runs Nykaa, an online platform that sells makeup and skincare products. Up about 60% in 2025, its shares are among the top performers on the NSE Nifty 200 Index.

At about 7% of total retail in 2024, India's e-commerce penetration remains well below China's 32% and the US' 16% as per Redseer, and underscores that the market is at an early stage in its digital consumption journey, Karan Taurani, an analyst at Elara Securities (India) Pvt., wrote in a Nov. 27 report.

Higher disposable income in the hands of Indian women is sure to play its part in this evolution, and Rashi is counting on her bets to help drive outperformance.

"Today, Indian women are more willing to spend on themselves," Rashi said. "These are decadal changes shifting consumption in a massive way."

A rebound in Ireland's services sector accelerated at its fastest pace in three-and-a-half years in November, with growth driven by increased gains in current activity and new business, a survey showed on Wednesday.

The AIB Ireland Services Business Activity Index climbed to 58.5 in November from 56.7 in October, the fastest rate of growth in the sector since May 2022. PMI readings above 50 indicate growth in activity.

The biggest expansion was in financial services, followed by technology, media and telecoms. Transport, tourism and leisure saw the first increase in activity since February.

New business growth accelerated for the fourth consecutive month, reaching the highest level since April 2022. This was supported by a rise in new export orders, with all four subsectors posting increases for the first time since January.

Jobs were created at the fastest rate since March despite a reduction in staffing levels in TMT for the third time in four months.

The pace of inflation for input costs remains high but has eased from the six-month high posted in September. Service providers increased charges at the fastest rate since January, passing on the higher costs to customers.

The outlook for the next 12 months improved, with expectations reaching the highest level since February, as firms anticipate increased demand and planned business investments.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up