Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The European Central Bank kept interest rates unchanged at 2% for the third meeting in a row on Thursday and offered no hints about future moves as it enjoys a rare period of low inflation and steady growth, even in the face of trade turbulence.

The European Central Bank kept interest rates unchanged at 2% for the third meeting in a row on Thursday and offered no hints about future moves as it enjoys a rare period of low inflation and steady growth, even in the face of trade turbulence.

The central bank for the 20 countries that share the euro cut rates by a combined two percentage points in the year to June but has been on the sidelines since. It has made clear it is in no hurry to change policy given inflation is at target, a sweet spot not achieved by the US Federal Reserve, the Bank of England or the Bank of Japan.

Keeping all options on the table, the ECB repeated its longstanding guidance that future decisions would be guided by incoming data and it would not pre-commit to any particular policy path.

"The Governing Council's assessment of the inflation outlook is broadly unchanged," the ECB said in a statement. "The robust labour market, solid private sector balance sheets and the Governing Council's past interest rate cuts remain important sources of resilience."

Speaking at a 1345 GMT news conference, ECB president Christine Lagarde is also expected to repeat that policy is in a "good place" and that policymakers can live with small, temporary deviations from the inflation target.

Lagarde is unlikely to shut the door to further policy easing, however, as ever-shifting US tariffs have yet to fully work their way through the economy, keeping uncertainty elevated and raising the risk that growth and inflation fall too low.

"The outlook is still uncertain, owing particularly to ongoing global trade disputes and geopolitical tensions," the ECB added. "The Governing Council is not pre-committing to a particular rate path."

While some policymakers have repeatedly warned about downside risks, some key data have surprised on the upside in recent weeks, pointing to a more balanced outlook.

Eurozone gross domestic product grew by 0.2% on the quarter, beating the ECB's prediction it would stagnate and a 0.1% growth forecast by economists, as Spain and France both outperformed.

Some early fourth-quarter figures may even point to a pick-up in growth.

Business activity, as measured by a Purchasing Managers' Index survey, is accelerating, while sentiment in Germany, the bloc's biggest economy, is improving and businesses are becoming more optimistic, partly because the fog over tariffs is starting to lift.

But these relatively upbeat reports are balanced out by more sombre data showing that industry continues to suffer and that exports to the United States are down sharply, as well as growing evidence that China is dumping goods it cannot sell in the US on European markets.

The real question then is whether the outlook can remain in such a fine balance given the continued tariff hit, Chinese trade diversion and weak exports.

The strong euro is also weighing on inflation, but the currency has steadied in recent weeks and a hawkish tone from Federal Reserve chair Jerome Powell after Wednesday's rate cut may limit further gains.

Undershooting risk would strengthen the case for a "slightly lower" policy rate, ECB chief economist Philip Lane argued recently, a message that is consistent with market pricing which now puts the chance of one last cut by next June at around 40% to 50%.

But the majority of economists see rates remaining where they are on the premise that uncertainty will fade, households have plenty of savings and Germany is raising spending sharply.

Inflation could still undershoot the ECB's target next year but it is then seen coming back up and policymakers have made it clear that they can tolerate temporary deviations.

The real test of this tolerance is only likely to come in December, when the bank presents fresh projections, including initial estimates for 2028.

Inflation in Tokyo rose at a faster pace, supporting the case for the Bank of Japan to keep raising interest rates gradually and giving the yen a boost.Consumer prices excluding fresh food gained 2.8% in October from a year earlier in the capital, according to the Ministry of Internal Affairs and Communications on Friday, with the main driver being water charges. The median economist estimate in a Bloomberg survey was for a 2.6% increase after the gauge rose 2.5% in September.

The pace of price gains has stayed at or above the BOJ's 2% target for three and a half years, though BOJ Governor Kazuo Ueda maintains that the underlying trend is still some ways from reaching that goal. In the latest month, inflation barring fresh food and energy gained 2.8%, picking up from 2.5% in the previous month. Overall inflation also registered 2.8% growth.The yen rose to 153.84 versus the dollar after the data were released, versus around 154.17 shortly before.

Prime Minister Sanae Takaichi aims to soften the blow of rising prices to consumers and companies with fresh economic measures. The new leader has promised to cut the gasoline tax during the current diet session, bring down electricity and gas costs during the winter, and deliver additional grants for regional governments while raising the ceiling on tax-free earnings.With city-wide subsidies for water having run their course, costs for water were flat in October versus a year earlier. In September, the subsidies led to a decline of 34.6% for those costs. Prices for energy and processed food nudged lower.

While the Tokyo CPI report is a leading indicator for national trends, isolated subsidies affecting only the capital can sometimes distort that dynamic.In other data, industrial production rose 2.2% in September from August, beating the consensus estimate of 1.5% growth, while rising 3.4% from a year earlier. Meanwhile retail sales advanced 0.3% in September versus the prior month and rose 0.5% year on year.The jobless rate held steady at 2.6% and the job-to-applicant ratio stayed at 1.20 in September, meaning there were 120 jobs offered for every 100 applicants.

Unlike in the US, where the central bank faces political pressure to change interest rates, in Japan the BOJ hasn't faced much open pressure on policy. Takaichi, who is known as an advocate of monetary easing, hasn't made any explicit demands on the BOJ since becoming premier, though she drew attention in September 2024 when she declared it would be "stupid" to lift interest rates.The BOJ held its benchmark interest rate unchanged on Thursday. Prior to the decision, BOJ watchers in a Bloomberg survey pushed back their forecast for the next interest rate hike timing. Around half see December as the most likely month when the next hike might come.

Oil prices eased on Friday, heading for a third straight monthly decline, as a stronger dollar capped commodities gains while rising supply from major producers globally offset the impact of Western sanctions on Russian exports.

Brent crude futuresslipped 33 cents, or 0.51%, to $64.67 a barrel by 0027 GMT, while U.S. West Texas Intermediate crudewas at $60.22 a barrel, down 35 cents, or 0.58%.

"A stronger USD weighed on investor appetite across the commodities complex," ANZ analysts said in a note.

The greenback was boosted after Federal Reserve Chair Jerome Powell said on Wednesday a rate cut in December was not guaranteed.

Both Brent and WTI are set to fall about 3% in October as rising supply is expected to exceed demand growth this year, with the Organization of the Petroleum Exporting Countries and major non-OPEC producers ramping up output to gain market share.

More supply will also cushion the impact of Western sanctions disrupting Russian oil exports to its top buyers China and India.

OPEC+ is leaning towards a modest output boost in December, sources familiar with the talks said ahead of the group's meeting on Sunday.

The eight OPEC+ members have boosted output targets by a total of over 2.7 million barrels per day - or about 2.5% of global supply - in a series of monthly increases.

Meanwhile, crude exports from top exporter Saudi Arabia hit a six-month high of 6.407 million barrels per day in August, data from the Joint Organizations Data Initiative (JODI) showed on Wednesday, and are set to climb further.

A U.S. Energy Information Administration (EIA) report also showed record production of 13.6 million bpd last week.

U.S. PresidentDonald Trumpsaid on Thursday that China has agreed to begin the process of purchasing U.S. energy, adding that a very large-scale transaction may take place involving the purchase of oil and gas from Alaska.

However, analysts remained sceptical as to whether the U.S.-China trade deal will boost Chinese demand for U.S. energy.

"Alaska produces only 3% of total US crude oil output (not significant), and we think Chinese purchases of Alaskan LNG likely would be market driven," Barclays analyst Michael McLean said in a note.

The much-awaited meeting between President Donald Trump and Chinese President Xi Jinping on Thursday concluded with significant decisions on trade, soybeans, and resources.The two leaders met at the sidelines of the APEC summit in Busan, South Korea. The first in-person meeting between the two since Trump's second term began in January, for about an hour and 40 minutes.

Trump told reporters aboard Air Force One about the reduction in fentanyl tariffs from 20% to 10%. The reduced fentanyl tariffs will take effect immediately, lowering the levy on Chinese exports to 47% from 57%. Trump still called the subject of fentanyl very "complex" and expressed confidence that Xi would "work hard" to stop the related deaths.

In exchange, Beijing has pledged to step up measures against fentanyl trafficking and restart imports of "tremendous amounts" of U.S. soybeans and other agricultural goods, as per Trump. He also appreciated China's gesture to resume "large quantities" of soybean imports.The President also said that the U.S. and China have reached an agreement on rare earths and critical minerals. Rare earth issue "has been settled," Trump stated, adding that the agreement will be renegotiated annually.

Trump said he had discussed the sale of Nvidia (NASDAQ:NVDA) chips to China with President Xi, adding that it was now up to Beijing to continue talks with the company. "That's really between you and Nvidia," Trump is said to have told the Chinese president.However, he clarified that the discussion did not cover the sale of Nvidia's latest Blackwell chips to China.

When asked about signing the trade deal with China, Trump replied, "pretty soon." He added, "We have not too many major stumbling blocks."Trump also announced plans to visit China in April, adding that Xi is expected to make a return visit to the U.S., though no specific dates were provided. Overall, he called the meeting "amazing" and rated it a "12 out of 10," emphasizing the positive outcomes and agreements reached.

Trump also noted that Taiwan was not part of the talks, but the topic of Ukraine was discussed extensively. He emphasized that the U.S. is willing to work with China toward resolving the conflict.

Xi said China's growth aligns with Trump's vision to "Make America Great Again," emphasizing that "China and the U.S. should be partners and friends," as reported by China Daily.He added that both nations are "fully able to help each other succeed and prosper together" and expressed readiness to work with Trump to "build a solid foundation for China-U.S. relations and create a sound atmosphere for the development of both countries."

Tucked into President Donald Trump's trade deals formalizing higher tariffs on goods from Asia this week are provisions for a global economic frontier the US wants to stay free of protectionism: digital commerce.In deals with Malaysia and Cambodia, and a more preliminary agreement with Thailand, the White House received assurances none will impose digital services taxes or discriminate against American providers of e-commerce, social media, streaming, cloud storage or other types of online services. Those activities count as digital trade when the transactions cross national borders.

While Trump wields tariffs to rebalance US deficits in merchandise trade, his push for a global internet free of import duties and other surcharges is aimed at ensuring the world's largest economy remains the leading net exporter of e-services. That stands in contrast with the prior administration under Joe Biden, which was more sympathetic to European officials' concerns about unfettered access to markets for US tech giants including Alphabet Inc.'s Google, Meta Platforms Inc. and Amazon.com Inc."The Trump administration believes that our deficit in trade in goods has been unfairly imposed, but that our surplus in trade in services has been fairly earned" and wants to "maintain our services surplus, while reducing our goods deficit," said Anupam Chander, a professor of law and technology at Georgetown Law in Washington. "I could understand why other countries would feel that this is itself unfair."

Last year, global exports of digitally delivered services increased to more than $4.77 trillion, a nearly 10% jump from 2023 and more than double the growth in total goods and services trade, according to World Trade Organization and United Nations figures. It's the fastest-growing segment of global goods and services trade that reached about $33 trillion last year.

Supercharging digital trade is artificial intelligence, raising questions for officials concerned about national security, data sovereignty, intellectual property abuse and consumer privacy protections as online services flow unchecked across borders.For some nations, it means a loss of government revenue as items formerly shipped as goods – a book or a movie, for example – are now sent digitally and out of reach of traditional customs duties.As Trump tries to rewire the global trading system, digital commerce has become another battleground for geopolitical fragmentation where Washington and Beijing are jockeying for influence across Africa, Latin America and South Asia.

The new US provisions for Malaysia, Cambodia and Thailand stand out because they call for long-term acceptance of an agreement forged at the WTO calling on all countries to refrain from putting tariffs on digital services.All three Southeast Asian economies agreed to support a permanent extension of the WTO accord known as the "moratorium on customs duties on electronic transmissions."Aside from that initiative and another aimed at protecting fisheries, Washington has abandoned the WTO – the referee of the rules-based trading system for the past 30 years - in favor of Trump's unilateral approach with so-called reciprocal tariffs.

The WTO moratorium has been extended by consensus every two years since 1998, most recently in 2024 when it only was approved in a last-minute deal held up by objections from India. It comes up for renewal again heading into the Geneva-based organization's ministerial meeting in March 2026 in Cameroon."The commitments in the US deals to facilitate the free flow of data are absolutely welcome – especially when set against the trend for localization requirements that we've seen in recent years," said Andrew Wilson, deputy secretary-general for policy at the International Chamber of Commerce. "While country-by-country progress is valuable, the ultimate goal should be to anchor these norms in a new international deal."

Malaysia's accord with Trump included the additional concession that it will refrain from "requiring US social media platforms and cloud service providers to pay into Malaysia's domestic fund."

The latest digital pacts by the US – plus a preliminary one with Vietnam that contains a vague pledge to finalize digital services commitments — follow a framework the US announced in July with Indonesia, whose customs agency had preemptively added a line for digital services in its harmonized tariff schedule, or HTS.That deal specified that "Indonesia has committed to eliminate existing HTS tariff lines on 'intangible products' and suspend related requirements on import declarations," according to the White House document.

Under Trump, the US push for a permanent extension will have to address concerns from Brazil and India, both of which have faced some of the steepest US tariffs. In the past, both have wanted to preserve the option of raising revenue from foreign tech companies and protecting domestic e-commerce companies. Keeping the moratorium renewable also gave them leverage in other areas of trade."That extension looked very shaky after the last ministerial conference," said Simon Evenett, a professor of geopolitics and strategy at IMD Business School in St. Gallen, Switzerland.

Still, he said, while the US uses its leverage to push for a permanent extension of the moratorium, "it's too soon to say this represents broad-based WTO re-engagement — more likely, it's selective engagement on a topic critical to US big tech."Digital services provisions are part of most modern trade agreements, though the US and European Union have different views on the need for openness.Officials in Brussels want safeguards against anti-competitive behavior and stricter data privacy protections — oversight that US officials consider over-regulation. Some European countries have annoyed Washington by imposing taxes on digital services, viewing such moves as domestic fiscal policy that's outside the scope of trade talks. French lawmakers earlier this week voted to double a tax on large technology companies, risking a backlash from Trump.

The US-EU trade framework dated Aug. 21 noted both sides "commit to address unjustified digital trade barriers" and will together pursue a permanent WTO's e-commerce moratorium.Martina Ferracane, an associate professor of international digital trade at Teesside University in the UK, said another temporary extension is likelier than a permanent one because the US administration has "weakened its credibility" to lead a global consensus on the issue.She cited Trump's pledge to put 100% tariffs on films made outside the US as an example of a "threat of non-compliance" with the international ban on tariffs on digital commerce.

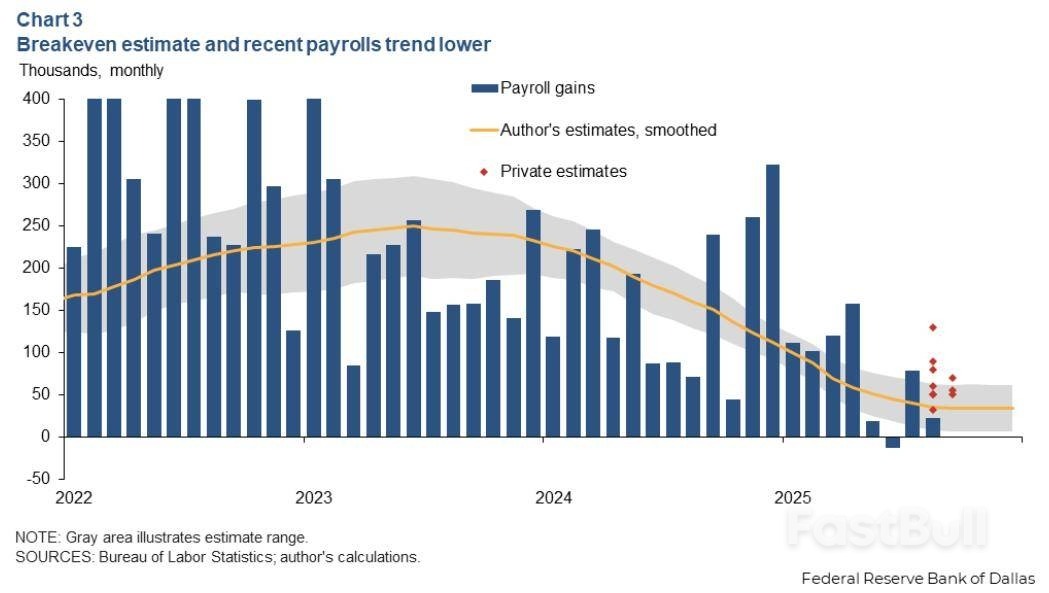

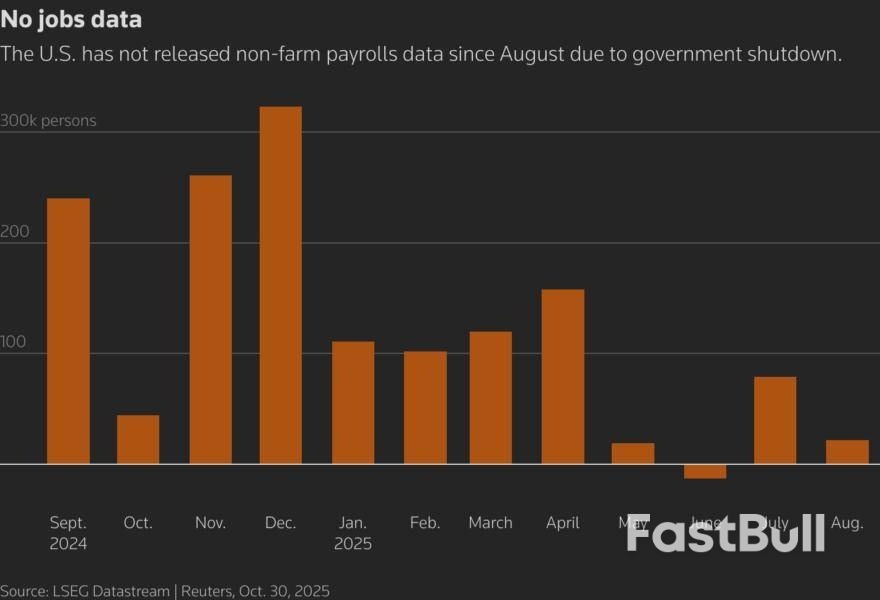

Federal Reserve Chair Jerome Powell surprised many market-watchers on Wednesday when he declared that another interest rate cut in December was not a slam dunk. Perhaps even more surprising was his apparent suggestion that if boosting the labor market is the goal, rate cuts might not be that useful.In the press conference after the central bank lowered its fed funds policy target range by 25 basis points, Powell cited several reasons why a similar move in December is "far from" a done deal. These included "strongly different" views among rate-setters, limited data visibility due to the government shutdown, above-target inflation, and doubts about how quickly the labor market is slowing. He also noted that policy may be close to neutral after 150 basis points of easing.

But perhaps the most telling reason was the most simple: cutting rates won't work. At least, doing so won't address the current problem, which is supporting the softening labor market.

Alluding to this, Powell admitted that the job market is weakening primarily because of shrinking labor supply rather than cooling demand for workers.But lower borrowing costs are designed to boost demand for workers. If the job market's problems are "mostly" a function of labor supply, as Powell said, then cutting interest rates is akin to pushing on a string."So the question then is what does our tool do, which supports demand? Some people argue that this is supply, and we really can't affect it much with our tools. But others argue, as I do, that ... we should use our tools to support the labor market when we see this happening," Powell told reporters.

"It's a complicated situation."

The current U.S. economic picture is indeed complicated.

Job growth has slowed in the U.S. over the past year, but this has been offset by a steep decline in the number of people looking for work. That's a result of the tighter immigration controls, increased deportations, and both young people and retirees leaving the labor force.In the last official monthly jobs report, which was for August, the unemployment rate climbed to a four-year high of 4.3%. But that's only one tenth of a percentage point up on the previous year, and is still ultra-low by historical standards.Powell also said there's no evidence of a worrisome deterioration in the broader labor market, though the recent announcement of some high-profile corporate layoffs may suggest otherwise.

At the same time, economic indicators such as business investment and retail sales still appear fairly healthy. Both are strongly linked to the booming stock market - big companies' rising share price and profits fund their capex, and the asset-owning top 10% continue to drive around half of all U.S. consumer spending.What we appear to see taking shape is a so-called 'K-shaped' economy: the rich are getting richer from the asset price boom, while the rest are struggling.This curious balance is new for the Fed and a tricky one to navigate, especially with the government shutdown reducing visibility even further.

Just as the Fed's blunt interest rate tool doesn't fix supply-side issues in the jobs market, it may not do much to support lower-income households and individuals either, even though ensuring a stronger labor market is the "best thing" the Fed can do for the American people.Cheaper money is also likely to benefit the richest cohorts by inflating asset prices even more, which may also push already lofty valuations to unsustainable levels.Six weeks is a long way off, but a third successive rate cut in December is suddenly in the balance. If the subtext of Powell's press conference is anything to go by, that may be for the best.

The Reserve Bank of Australia will keep its key interest rate unchanged at 3.60% on Tuesday as an inflation spike delays policy easing, according to economists in a Reuters poll who now expect the next and final rate cut in the cycle in 2026.Annual consumer price inflation jumped to 3.2% in the September quarter, above the top of the RBA's 2%–3% target band, driven by higher power and services costs.

The RBA's preferred core measure climbed 1.0% in the quarter, well above its forecast of near 0.6%. Governor Michele Bullock said on Monday even a 0.9% rise would be a "material miss" the board would need to weigh when deciding policy.The stronger-than-expected reading has effectively shut the door on any near-term rate cuts and cast doubt on how quickly the RBA can start easing. Markets have sharply scaled back expectations, now pricing in only one cut by mid-2026.All 34 economists surveyed October 29-30 - after the inflation data - expected the RBA to keep its official cash rate at 3.60% at the conclusion of its two-day meeting on November 4.

"The RBA was cutting because they could. They were normalizing policy because the inflation backdrop was giving them space to move rates away from more restrictive settings. The picture is now different," said Taylor Nugent, senior markets economist at NAB.Unemployment unexpectedly rose to a four-year high of 4.5% in September, but Nugent said inflation was more significant."Q3 inflation data is a pretty clear warning shot that maybe there is a bit more inflation pressure in the economy than they had earlier expected, and so we think they will be on hold for a while. Inflation is a much more important signal than the labour market in terms of the recent data flow."

Just over 90%, or 30 of 33 respondents who had forecasts beyond next week — including major local banks ANZ, CBA, NAB and Westpac — expect the RBA to keep rates unchanged in December.That marks a sharp shift from earlier this month, when three-quarters expected a cut by year-end and almost all predicted rates at 3.10% or lower by end-March 2026. Now, just under half see them falling to 3.35% or below by then.Median forecasts showed one more rate cut by end-June, taking the cash rate to 3.35%. However, economists were divided — 12 predicted rates at 3.35%, six saw them at 3.10%, while 10 expected no change from 3.60%.

However, some economists warned if the labour market weakens further the RBA may be forced to cut rates more than markets anticipate."If the labour market cools more aggressively than expected, then inflation really isn't going to be the problem you need to worry about — it's going to be preserving the gains in the labour market, which has also been a stated aim of the RBA," said Tony Sycamore, market analyst at IG Australia.

"Yes, you can rule out a November rate cut, but it doesn't mean we've seen the end of the easing cycle."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up