Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

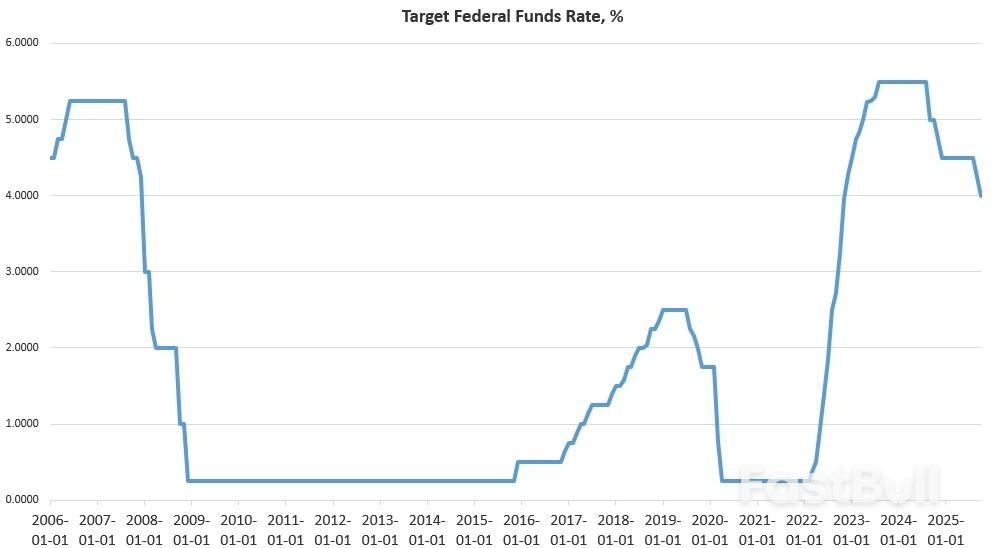

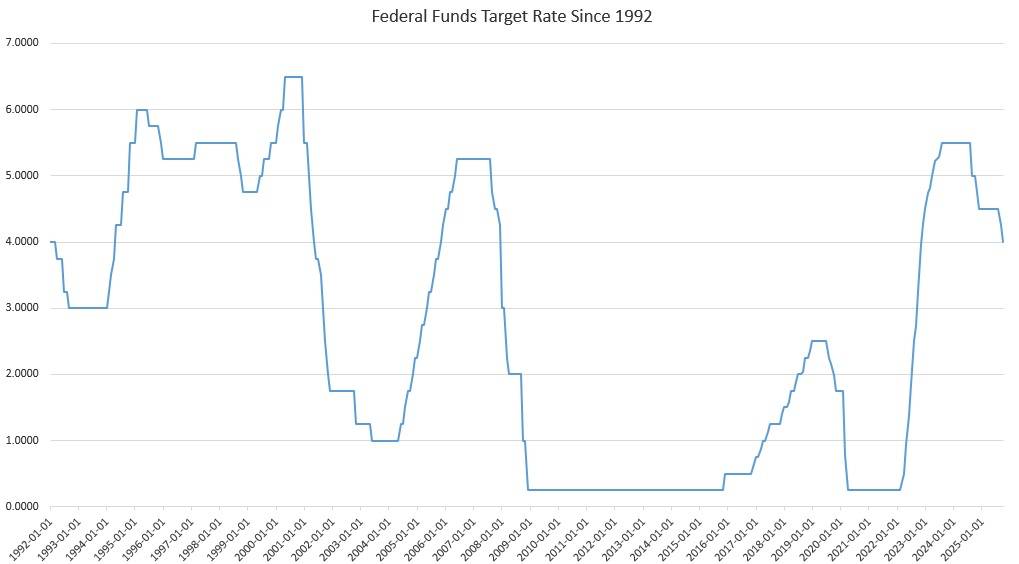

The Federal Reserve's Federal Open Market Committee (FOMC) on Wednesday voted to again reduce the target policy interest rate by 25 basis points, down to an upper bound of 4.0 percent.

The Federal Reserve's Federal Open Market Committee (FOMC) on Wednesday voted to again reduce the target policy interest rate by 25 basis points, down to an upper bound of 4.0 percent. The FOMC has now cut the policy rate (i.e., the federal funds rate) five times since September 2024, totaling a reduction in 150 basis points over 13 months.

Fed Chairman Jerome Powell also announced on Wednesday that the Fed plans to end quantitative easing as of December 1. That is, the Fed will cease allowing reductions in its balance sheet and will switch to maintaining its balance sheet at current levels. Moreover, the Fed will reconfigure its balance sheet to increase its focus on Treasurys and reduce its holdings of mortgage-backed securities.

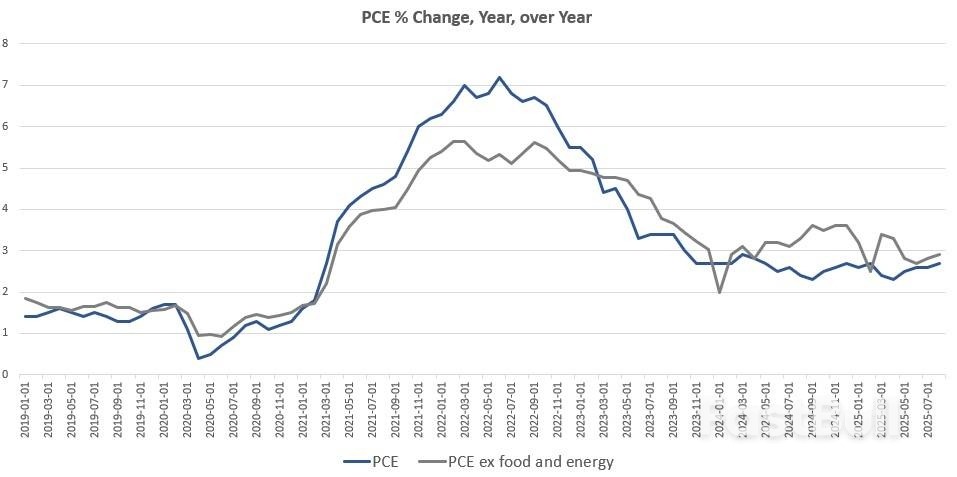

The Fed has embraced these further efforts at monetary easing even though official price-inflation rates continue to show that price inflation remains far from the Fed's claimed two-percent goal. Apparently, the Fed has shifted its focus from price inflation to economic stimulus. After all, the FOMC's policy changes, as well as Powell's comments during the following press conference, paint a picture of a Fed that has all but completely abandoned any alleged commitment to a two-percent price-inflation target. The Fed is now preoccupied with the lackluster employment situation and providing ever more monetary stimulus.

With this new cut to the target policy interest rate, the FOMC continues its current cycle of monetary easing that has been in place since last fall. In spite of Fed claims that the US economy is robust, the 150-bp reduction is a clear sign that the Fed regards the US economy as incapable of standing on its own without continued monetary stimulus to maintain weakening bubble spending and investment.

In recent decades, a 150-bp-point drop in the target rate—with no intervening rate hikes— has always been followed by (or coincided with) a recession. This was certainly the case in 2001, 2008, and in 2020.

As is expected, the Fed maintains that the economy is "expanding" in Wednesday's FOMC statement, although the committee's brief summary of economic conditions does admit of a slowing employment situation:

Available indicators suggest that economic activity has been expanding at a moderate pace. Job gains have slowed this year, and the unemployment rate has edged up but remained low through August; more recent indicators are consistent with these developments. Inflation has moved up since earlier in the year and remains somewhat elevated.

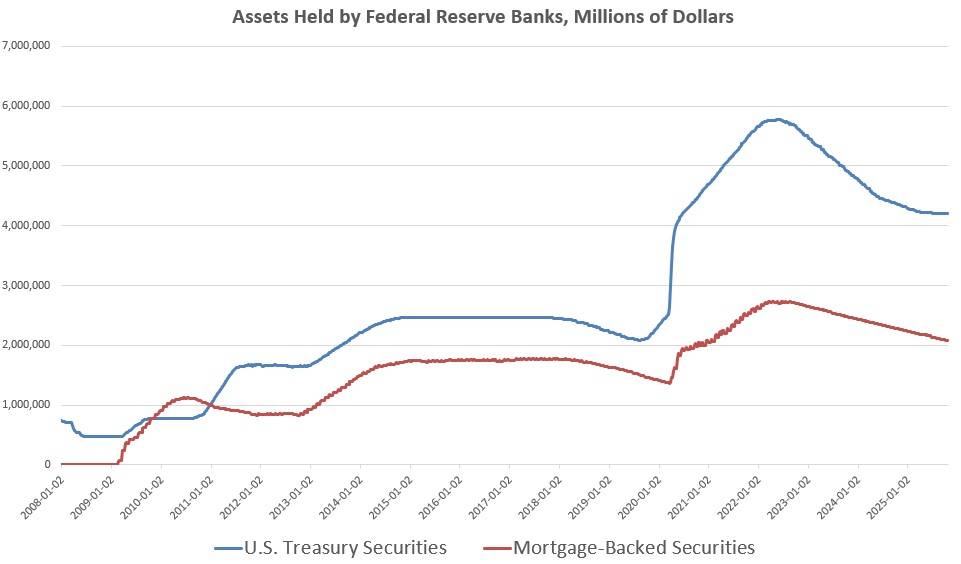

Further evidence of the Fed's commitment to loosening economic conditions can be found in the FOMC's new announcement that "quantitative tightening" will cease on December 1. In the current context "quantitative tightening" is the Fed's slow but ongoing reduction in its balance sheet, where the Fed has amassed trillions of dollars in mortgage-backed securities and government Treasurys. Since 2008, the Fed has purchased these assets in an effort to reduce interest rates for Treasurys—by raising demand—and to create more liquidity for housing markets.

The total size of the portfolio peaked in mid 2022 at $5.7 trillion in Treasury debt and $2.7 trillion in mortgage securities. In recent years, however, the Fed has very slowly reduced the size of its portfolio, mostly by allowing assets to mature without replacing them. Since mid 2022, the portfolio has been reduced by a total of $2.2 trillion, with $1.5 trillion of that being Treasurys, and $651 billion being mortgage securities. This is not surprising because the Fed has always been committed to manufacturing demand for Treasurys to help reduce Treasury yields, and thus reduce interest paid on federal debt.

These assets were purchased with newly created dollars, so increases in the portfolio have resulted in adding trillions of dollars to the total money supply. Thus, the creation of the Fed's massive asset hoard has long been an important component of quantitative easing. In contrast, when the Fed allows the size of the portfolio to shrink, this is a type of quantitative tightening, or "QT" and has a deflationary effect.

According to Powell, this will end in December at which time the Fed will presumably no longer allow the size of the portfolio to further decrease as assets mature and "roll off." Instead, Powell noted the Fed will end QT by purchasing new assets to replace the older maturing assets. 1

Notably, Powell also stated that the Fed will work to increase the proportion of Treasurys in the portfolio, in relation to mortgage securities (i.e., agency securities). This is an extension of the Fed's existing policy—begun earlier this year—of reducing its stock of mortgage securities at a faster rate than it has been reducing its stock of Treasurys.

The FOMC statement maintains that the "unemployment rate has edged up but remained low," but during the press conference, Powell clarified that "job creation ... is pretty close to zero" and so many FOMC members concluded "that it was appropriate for us to react by supporting demand with our rates." Powell also admitted that the no hire, no fire economy persists, and he stated "available evidence suggests that both layoffs and hiring remain low, and that both households' perceptions of job availability and firms' perceptions of hiring difficulty continue to decline." Prompted by questions, Powell admitted that there had a been a number of major layoff announcements earlier in the week and stated "we're here to — by lowering rates at the margin that will support demand, and that will support more hiring. And that's why we do it."

Powell also stated that a large part of the employment story is a declining supply of labor, which has helped keep the labor situation seemingly stable. He noted that this is due to falling labor-force participation (for whatever reason) and also by the fact that "the supply of workers has dropped very, very sharply due to mainly immigration." Powell doesn't use the word "deportations" but that is clearly a factor in what he is describing here. In other words, there is very little hiring going on, but since the labor force has declined so much, a lack of hiring has prevented any significant surge in the unemployment rate.

After all, if the supply of labor falls at the same rate as the supply of jobs, the unemployment rate will not change. But, even here, Powell admits that "demand for workers has gone down a little more than supply." This explains why the unemployment rate rose in August, even as the administration ramped up deportations. One can only guess what the unemployment rate would be of the supply of workers had continued to increase due to immigration or any other factor.

It is important to remember that all this talk of creating monetary stimulus in the face of a declining job market is happening while the official price-inflation number is nowhere near the Fed's supposed two-percent target. Indeed, in the most recent CPI report, core price inflation was 3 percent, has been above three percent for three months. Core CPI year-over-year inflation has only dipped below 2 percent during three months of the past 53 months.

Last September, when the Fed began the current easing cycle, and lowered the target rate by 50 basis points, Powell claimed that price-inflation was rapidly returning to the two-percent target. Either his data was way off, or he was simply lying. Even measured by the PCE (the Fed's preferred price-inflation measure), price-inflation is certainly not near two percent. The August PCE measure (the most recent available number) was up 2.7 percent, year over year, while the core PCE increase for August was 2.9 percent.

Yet, Powell has invented a way of waving this inconvenient data aside. In his remarks on Wednesday, Powell apparently invented a new inflation measure which can be described as "price inflation minus the effects of tariffs." Or, as Powell puts it:

inflation away from tariffs is actually not so far from our 2 percent goal. We estimate, people have different estimates of what that is, but it might be five or six tenths, and so if it's 2.8, then core PCE, not including tariffs, might be 2.3 or 2.4, in that range, something like that. So that's not so far from your goal.

Powell doesn't offer any actual numbers or explanation of how he came up with this "price-inflation ex tariff" number. It's apparently something the Fed is simply speculating about.

This new "measure" however, is nothing more than a political ploy used to explain away rising prices, so the Fed can claim that price inflation is really close to two percent, even if the federal government's own official numbers say otherwise. The Fed might as well go back to claiming that price inflation is "transitory" because of "Putin's price hike."

Tariffs don't cause inflation in the technical sense, of course, but in an environment of monetary inflation, tariffs do often contribute to upward pressure on prices of imports and import-dependent goods. So, what Powell is doing here is simply inventing a new number that excludes some higher prices from the CPI and PCE in order to create a narrative in which the Fed has steered price inflation back to two percent.

On the other hand, given the weakening job market, it could be that the Fed is betting on a worsening economy to get price-inflation back below two percent. A slowing economy, accompanied by a rapid slowdown in demand, would allow the Fed to continue to inflate the money supply without apparent inflation above the two percent target. This would only produce an illusion of success, of course, since monetary inflation combined with weakening demand simply robs ordinary people of the benefits of deflation—which are badly needed during times of economic bust—while still inflating new bubbles and creating new malinvestments.

Hundreds of thousands of ultra-Orthodox Israelis, known as the Haredim, gathered in Jerusalem on Thursday for a mass rally against the arrests of yeshiva students accused of evading military service.The rally is described by Israeli media as a 'rare show of unity' between the divided Haredi factions, who are often in opposition regarding politics and state relations. The demonstration, named "Cry of the Torah," was endorsed by nearly all ultra-Orthodox leaders, who instructed followers to attend and maintain order.

Source: Flash90

Source: Flash90Only the Jerusalem Faction, led by Rabbi Azriel Auerbach, refused to participate, accusing organizers of failing to demand the full reinstatement of the long-standing Torato Omanuto exemption system that allows Torah students to defer military service.The exemption is central to the ultra-Orthodox Jewish way of life, allowing yeshiva students to dedicate their time solely to the study of the Torah instead of army duty, a principle many Haredim see as vital to preserving their religious identity. Torah study is viewed by the ultra-Orthodox as a form of spiritual service to the nation, equal in importance to military duty.

"After it was not made clear to me that the purpose of the rally is to publicly declare that the ultra-Orthodox community demands the reinstatement of the Torato Omanuto arrangement … I cannot instruct participation in this rally," Auerbach said in a public letter.Organizers said the gathering was not against the draft exemption law itself but against the arrests of students labeled as deserters. "The debate over the law is still ongoing, and it belongs in the Knesset," a source explained. "But following the arrests and persecution against us, it was decided to protest nonetheless."

The event featured no speeches or a central stage. Instead, rabbis stood separately in different locations while crowds recited psalms and prayers."Some will stand on balconies overlooking the streets where the rally is taking place, and others will stay in their cars," one organizer said, adding that coordinating a central platform for such large numbers was "impossible."An official notice instructed women to pray separately, stating that "women of Israel from the city of Jerusalem who wish to take part in the event will gather in a designated area," while others were asked to "join the prayers from wherever they are."

The protest was convened after Lithuanian leaders, Rabbis Dov Landau and Moshe Hillel Hirsch, called for action following the arrest of several yeshiva students. Their decision prompted Shas and Agudat Yisrael leaders to join, forming a unified coordinating committee across factions.

Police prepared for potential disturbances by hardline followers of Rabbi Zvi Friedman, whose group disrupted a Supreme Court hearing a day earlier. "We expect that the police will use full force against them so they don't turn our prayer rally into a violent event," a source warned.A counter-protest was organized nearby by the "Coalition of Service Organizations and Families of Reservists," including bereaved families and wounded soldiers.Prominent ultra-Orthodox leaders have repeatedly urged their followers to ignore military recruitment orders following the Israeli High Court's ruling that yeshiva students must be drafted into military service amid Israel's enlistment crisis in the army.

The legislation was introduced in 2024 amid mounting losses in Gaza, aiming to replenish dwindling manpower as the Israeli army struggled to sustain operations while facing an unprecedented shortage of recruits.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up