Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The US dollar weakened on Friday, heading for a weekly loss as markets anticipated a dovish tilt at the Federal Reserve following Donald Trump’s interim Fed appointment......

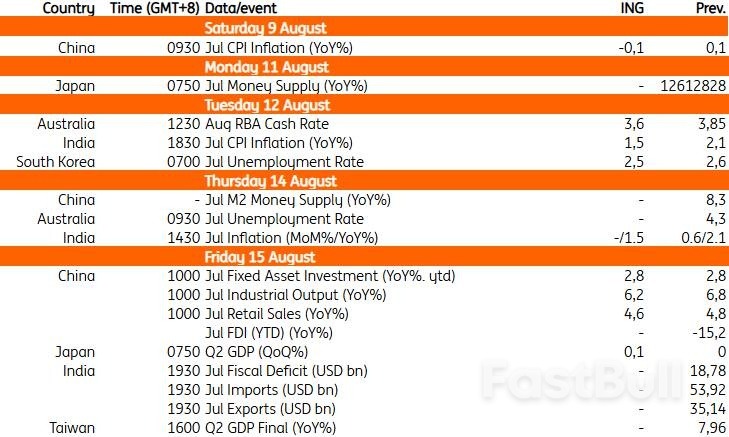

In a surprise move last month, the RBA held the cash rate steady at 3.85%, defying both market consensus and our own expectations. The decision reflected the central bank's desire for more evidence that inflation is tracking sustainably toward its 2.5% target. Since then, both the second-quarter inflation and June employment data undershot expectations. This suggests the RBA's cautious stance in July may give way to a rate cut.

China releases its July inflation data this Saturday. Consumer price index inflation is expected to teeter back into deflation at -0.1% year on year as downward pressures persist. Measures to tackle excessive price competition are unlikely to have an impact in the early going.

The July data dump is scheduled for Friday, showing that economic activity may have continued moderating. Housing prices saw an accelerated downturn in the last few months. With little fresh policy support, this weakness could continue into July. Industrial production comfortably beat forecasts in June, but it’s likely to have slowed to around 6.2% YoY. Retail sales have recovered year to date amid trade-in policies. But it’s possible we could be nearing the peak of policy impact. We expect retail sales to moderate to 4.6% YoY. Finally, fixed asset investment has been on the disappointing side, with private investment sidelined amid continued uncertainty. We expect growth could remain around 2.8% YoY ytd.

South Korea’s jobless rate is expected to decline to 2.5% in July from 2.6% in June. Despite weak hiring in the construction and manufacturing sectors, services related to leisure and eating out are expected to increase. Government cash handouts may have added some temporary jobs in services. Also, the government's job programme continues to support hiring in the social welfare and health sectors.

Japan’s second-quarter GDP release on Friday will be closely monitored. Following a slight contraction of 0.04% quarter-on-quarter, seasonally adjusted, in the first quarter, the economy is expected to recover modestly, producing an estimated 0.1% growth. Exports weakened considerably in the second quarter, and inventory changes are expected to have a negative impact on overall growth. Nevertheless, high-frequency data indicate a recovery in services and private consumption, supporting a moderate upturn in 2Q25. The odds of an October rate hike by the Bank of Japan are likely to be adjusted depending on the data.

The worst may be over for Asia’s central banks that have ramped up efforts defending local currencies after a resurgent dollar and fresh US tariffs fueled pressure across the region.A gauge of Asian currencies is heading for its best week since June as soft US jobs sparked renewed bets on Federal Reserve interest-rate cuts. The dollar-negative story is now “back in play” amid signs of a slowing economy, according to UBS Group AG.The shift offers a welcome reprieve for policymakers who were compelled to return to their interventionist playbook after President Donald Trump announced new import duties, sparking sharp declines in regional currencies. With Bloomberg’s US dollar gauge poised for a weekly drop, investors may still be underpricing the impact of soft economic data and a more dovish Fed outlook.

Intervention was likely “more of a one-off,” said Alex Loo, a macro strategist at Toronto-Dominion Bank in Singapore. “Weaker US activity data in the coming weeks may embolden US dollar bears to re-engage and should ease the pressure off Asian central banks to defend the recent bounce in dollar-Asia pairs.”Traders remain on edge, however, after Trump doubled tariffs on India to 50% through a so-called secondary duty, citing its purchases of Russian oil. Rising crude prices and renewed supply chain disruptions may stoke cost pressures across the region and convince some central banks to delay rate cuts or step back into currency markets to stabilize exchange rates.

“Right now everybody is just anxious about when the next shoe is going to drop,” with intervention likely just to stabilize markets, said Mingze Wu, a currency trader at StoneX in Singapore. “Once Trump settles down, central banks will be more relaxed as well.”The dollar’s recovery toward the end of July pressured Asian currencies to multi-month lows, complicating efforts by regional central banks to maintain stability. As investors moved into safer US assets, the prospect of capital outflows worried policymakers from India to Indonesia, raising the risk of inflation and market volatility.

Bank Indonesia intervened to stabilize the rupiah, while Hong Kong’s de-facto central bank resumed buying local dollars to defend its currency peg. India’s central bank held rates steady on Wednesday, days after state banks were seen supporting the rupee. The Philippine central bank also pledged stronger intervention during bouts of peso weakness to control inflation.With money markets now pricing in a likely US rate cut next month and Trump tapping monetary policy “dove” Stephen Miran for a Fed governor seat, the dollar may ease and offer regional currencies some breathing room.

“We don’t think these disparate decisions or messages from the Reserve Bank of India, BI and Bangko Sentral ng Pilipinas signal a region-wide shift to currency defence,” said Homin Lee, a senior macro strategist at Lombard Odier in Singapore. “A major surge in the dollar could prompt more frequent interventions, but that is not our base-case scenario.”

New import tariffs the US has imposed on a range of trading partners have taken effect, and President Donald Trump is threatening more tariffs could be on the way.

The latest tariffs, which were set at rates of 10-50pc, came into force at 12:01am ET (04:01 GMT) on Thursday.

"BILLIONS OF DOLLARS, LARGELY FROM COUNTRIES THAT HAVE TAKEN ADVANTAGE OF THE UNITED STATES FOR MANY YEARS, LAUGHING ALL THE WAY, WILL START FLOWING INTO THE USA," Trump said on his social media platform shortly before the new tariffs kicked in.

Trump said on Thursday it was up to Russian president Vladimir Putin whether there would be additional tariffs. Last month, Trump said that if Russia failed to make progress on a ceasefire deal with Ukraine by Friay he would put "secondary" tariffs on countries purchasing Russian oil. Trump has already imposed an additional 25pc tariff on imports from India in response to its purchases of Russian oil, and threatened additional secondary tariffs.

"We're going to see what he has to say," Trump said of Putin. "It's going to be up to him. Very disappointed."

The higher tariff rate on India, which is due to take effect on 27 August, would double the tariff on goods imported from India to 50pc. US tariffs on China are currently set at a baseline of 30pc, but they could rise to 54pc on 12 August if the two countries fail to agree on an extension to a temporary trade truce.

Trump also said on Wednesday that he would impose a 100pc tariff on imports of chips and semiconductors, with exceptions for companies that are building or have committed to build production facilities in the US.

| New US tariff rates and effective dates | ||

| Rate | Date | |

| UK | 10% | 5 Apr |

| EU | 15% | 7 Aug |

| Japan | 15% | 7 Aug |

| South Korea | 15% | 7 Aug |

| Indonesia | 19% | 7 Aug |

| Vietnam | 20% | 7 Aug |

| India | 25% | 7 Aug |

| Mexico | 25% | 30 Oct |

| Canada | 35% | 1 Aug |

| China | 54% | 12 Aug |

| Brazil | 50% | 7 Aug |

| Afghanistan | 15% | 7 Aug |

| Algeria | 30% | 7 Aug |

| Angola | 15% | 7 Aug |

| Bangladesh | 20% | 7 Aug |

| Bolivia | 15% | 7 Aug |

| Bosnia and Herzegovina | 30% | 7 Aug |

| Botswana | 15% | 7 Aug |

| Brunei | 25% | 7 Aug |

| Cambodia | 19% | 7 Aug |

| Cameroon | 15% | 7 Aug |

| Chad | 15% | 7 Aug |

| Costa Rica | 15% | 7 Aug |

| Côte d`Ivoire | 15% | 7 Aug |

| Democratic Republic of the Congo | 15% | 7 Aug |

| Ecuador | 15% | 7 Aug |

| Equatorial Guinea | 15% | 7 Aug |

| Falkland Islands | 10% | 7 Aug |

| Fiji | 15% | 7 Aug |

| Ghana | 15% | 7 Aug |

| Guyana | 15% | 7 Aug |

| Iceland | 15% | 7 Aug |

| Iraq | 35% | 7 Aug |

| Israel | 15% | 7 Aug |

| Jordan | 15% | 7 Aug |

| Kazakhstan | 25% | 7 Aug |

| Laos | 40% | 7 Aug |

| Lesotho | 15% | 7 Aug |

| Libya | 30% | 7 Aug |

| Liechtenstein | 15% | 7 Aug |

| Madagascar | 15% | 7 Aug |

| Malawi | 15% | 7 Aug |

| Malaysia | 19% | 7 Aug |

| Mauritius | 15% | 7 Aug |

| Moldova | 25% | 7 Aug |

| Mozambique | 15% | 7 Aug |

| Myanmar (Burma) | 40% | 7 Aug |

| Namibia | 15% | 7 Aug |

| Nauru | 15% | 7 Aug |

| New Zealand | 15% | 7 Aug |

| Nicaragua | 18% | 7 Aug |

| Nigeria | 15% | 7 Aug |

| North Macedonia | 15% | 7 Aug |

| Norway | 15% | 7 Aug |

| Pakistan | 19% | 7 Aug |

| Papua New Guinea | 15% | 7 Aug |

| Philippines | 19% | 7 Aug |

| Serbia | 35% | 7 Aug |

| South Africa | 30% | 7 Aug |

| Sri Lanka | 20% | 7 Aug |

| Switzerland | 39% | 7 Aug |

| Syria | 41% | 7 Aug |

| Taiwan | 20% | 7 Aug |

| Thailand | 19% | 7 Aug |

| Trinidad and Tobago | 15% | 7 Aug |

| Tunisia | 25% | 7 Aug |

| Turkey | 15% | 7 Aug |

| Uganda | 15% | 7 Aug |

| Vanuatu | 15% | 7 Aug |

| Venezuela | 15% | 7 Aug |

| Zambia | 15% | 7 Aug |

| Zimbabwe | 15% | 7 Aug |

Key Points:

US President Donald Trump has nominated Stephen Miran, a pro-cryptocurrency economist, to the Federal Reserve Board of Governors, replacing Adriana Kugler, on August 7, 2025.Miran’s nomination, amidst Trump's dispute with Chair Powell, could influence Fed policies and potentially impact cryptocurrency regulatory discussions.

President Trump's nomination of Stephen Miran aims to fill the vacant seat left by Adriana Kugler on the Federal Reserve Board of Governors. This move introduces a new voice, advocating for streamlined cryptocurrency regulation, into the board's dynamics. Stephen Miran's background spans roles at the US Treasury, Fidelity Investments, and Hudson Bay. This eclectic experience underpins his approach to potential financial policies.Expectations surrounding Miran's potential regulatory influence remain speculative, as no concrete plans have been articulated. Though Miran champions streamlined cryptocurrency regulation, official statements do not confirm direct changes expected for crypto markets.

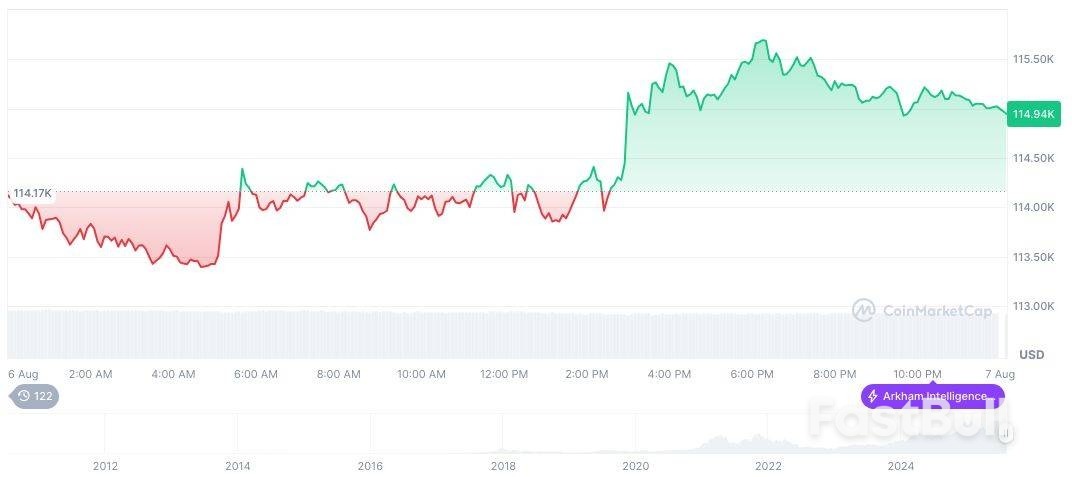

Did you know? During a past Fed board nomination, market debates increased, but they rarely impact digital assets directly without confirmed regulatory changes.Bitcoin (BTC) recently traded at $117,389.27, according to CoinMarketCap. The market cap sits at $2.34 trillion with a 60.19% dominance. Trading volume reached $65.30 billion over 24 hours, marking a 16.95% increase. BTC's value grew by 2.10% in a day and 7.79% over 30 days.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 00:07 UTC on August 8, 2025. Source: CoinMarketCap

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 00:07 UTC on August 8, 2025. Source: CoinMarketCapCoincu analysis suggests that Miran’s experience may lead to potential financial outcomes like increased emphasis on stablecoin regulation, though the absence of new policies suggests limited immediate technological impacts in the crypto scene.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up