Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

As artificial intelligence (AI) becomes a fixture in education and work, nurturing digital agility will be essential for students to thrive in a constantly shifting technological world.

As artificial intelligence (AI) becomes a fixture in education and work, nurturing digital agility will be essential for students to thrive in a constantly shifting technological world.“It’s not about learning how to use a computer or virtual reality sets, because we realised these are going to change all the time. The ability for students to accept and be comfortable with the digital space, that, we feel, is very important to what we as educators need to cultivate,” said BK Gan, president and chief executive officer of Taylor’s Schools.The fundamental idea is to blend academic achievements through the development of digital agile capabilities by giving students an appropriate environment to challenge their minds and prevent cognitive outsourcing. Cognitive outsourcing is the action of handing over information collection and processing to others, and in this case, devices.

“It is critical that our kids in the classrooms do not outsource their thinking because the technology is now available for them to do that. We want to make sure that they are able to use it as a tool for entrepreneurial reasons.“Do you remember your house phone number? If you don’t, that’s cognitive outsourcing of your memory. Let’s say you want to drive somewhere. If you’ve been there before, do you remember the roads? People will most likely use Google Maps. Everything has been outsourced nowadays,” said Gan.To get students on track, computer science classes are made compulsory in the curriculum until Year 9, and students are tasked with coding on an application called Swift. Each child that graduates will carry the knowledge and ability to properly code an app.

James Abela, director of digital learning and entrepreneurship at Garden International School (GIS), shared that the AI chatbot on the GIS webpage was developed by students themselves. GIS is a subsidiary of the Taylor’s Education Group (TEG).These classes are also injected into the syllabus starting from kindergarten years, where educators will start from teaching children about computational thinking through hands-on activities involving small robots. This helps students develop problem solving abilities, but rather than calling it a ‘subject’, it is masked as a play activity for younger kids.

The essence of combining gamification of learning with technology and AI carries onto the primary and secondary school years, as well for the students to become more involved and attentive in class.Abela himself has previously written a book on how gamification of learning was able to help students stay engaged with their education throughout the pandemic lockdown. With AI and technology, the concept becomes much easier to implement.“It starts with the kindergarten kids to build their foundation, so they can think in a very logical way and look at new things in the digital space without fear, because we know that things will move very fast in the digital age,” said Abela.

“Learning through doing is so much more powerful than learning through a lecture, and that is why computing has become so powerful, because it is directly relevant and it encourages resilience.”He shares that the schools have spent at least a quarter of a million ringgit to invest in the proper technology to make the current curriculum a reality.One example of Taylor’s Schools initiatives is the 1:1 Apple programme, where the school’s partnership with the smartphone company provides students with an iPad as a technological tool for learning. The programme has been adopted since 2012 to reflect a student’s regular use of technology to cultivate skills in using technological tools efficiently and effectively.

This also helps keep up to date when rolling out new software for students to be kept in the loop of current technological developments.Taylor’s is cognisant of their students’ privacy, using Gemini as their chosen AI tool due to their agreement with Google to not use personal data in their AI training.

Educators can also be empowered by the usage of AI and technology by creating a classroom environment that can be catered to each and every student to realise their full potential.This allows students to experiment with a variety of options to express themselves and unlock new pathways to discover the most optimal learning methods for each child. With new technologies being introduced to the classroom, this becomes increasingly easier to implement.“If we want to truly personalise lessons, we can fully differentiate the task. The students have a choice to do a video, a podcast, to write it, or in some cases, maybe an art piece. It’s still the same task in the end,” said Abela.

“What matters is the quality of students’ thinking. The devices enable them to express themselves and give them options to learn in many different ways.”Additionally, using AI and tech in the classroom allows for teachers to be more in tune with the learning progress of the students. Abela shared how students who struggle with certain classes can privately receive support through their devices and software. This is also important as it reduces the embarrassment from peers from being singled out.The examination procedure, however, does not allow the use of AI to ensure that students do not exploit the technology by bypassing the critical thinking process, and must instead rely on their own cultivated knowledge to pass their tests.

This is part of Taylor’s Schools’ responsibility to cultivate an ethical usage of AI and foster a sense of responsibility when using their digital skills.Abela shares an example where some of their students have made an exercising game, or “exergame”, where the gamification for fitness was applied as a responsible use of technology to make people healthier.“We don’t want to be simply teaching prompt engineering, because AI is already getting better at understanding people. What we need to do is look at the sources underneath,” he says.“You need to have curated content so that the students actually know what good, quality, trusted knowledge is. [Some people don’t use] AI because they know it can’t be trusted in terms of content, so in their younger years, we need to teach the children what is data and trusted sources.”

Taylor’s School continues to be cautious of the excessive use of AI by implementing a traffic light system in regards to students’ usage of AI in their learning. A green signifies that using AI will have no effect on their education, a yellow indicates that the use of AI may harm the learning progress, and red would mean that the use of AI will result in stunted learning.Educators also receive training for half a day every with levels of training to familiarise themselves and keep up with the evolving landscape of technology, be it anything from basics to to subject specifics. This is conducted throughout Taylor’s Schools with an estimated 1,500 garden teachers being trained across its operating regions.

Daily Light Crude Oil Futures

Daily Light Crude Oil FuturesPrecious metals have been clubbed like a bay seal this morning with Gold down 4%...

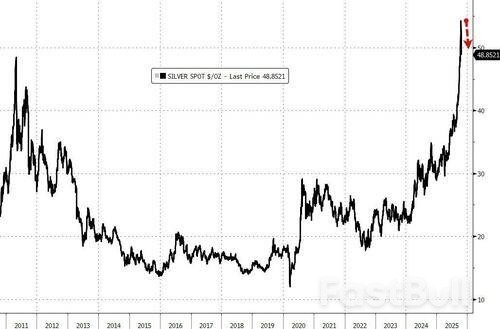

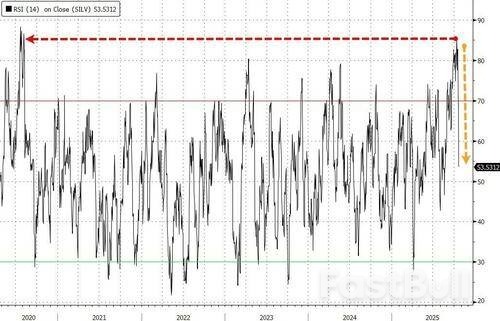

Silver is doing even worse, down almost7%...

A little context is useful...

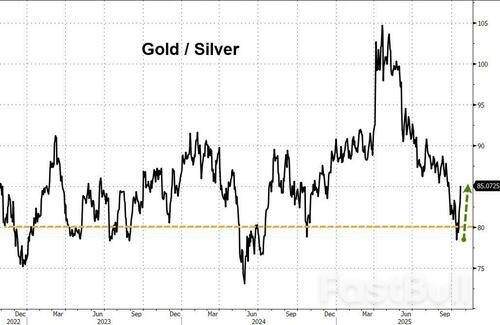

Meanwhile, we note that silver's dramatic underperformance came at critical support levels against gold (at the 80x ratio that has been significant for years)...

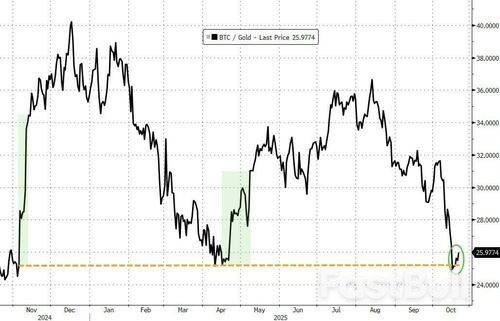

Additionally, relative to crypto, gold had got back to a key resistance level (that acted as serious support for the BTC/Gold ratio twice before - the election and liberation day)...

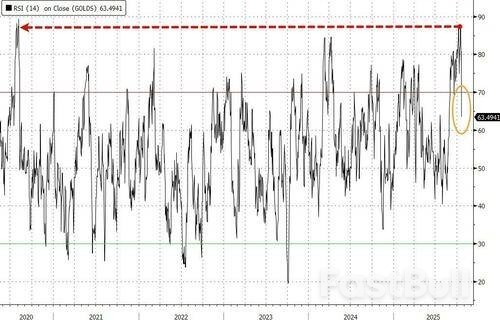

On the 'bright' side, this decline has dragged gold and silver back from perilously overbought levels...

UBS traders say that the next level to watch is the Oct. 15 low at 4165, before 4095/4100 which held on dips on Oct. 14; then it is the 4060 level which briefly capped the advance on Oct. 8/9.

It is no longer clear that Turkey provides a counterweight to Iran in the Middle East. Ankara has ambitions of its own.

Under the guise of leading a moderate Sunni axis and assisting the West against Iran’s radical Shia bloc, President Recep Tayyip Erdoğan’s Turkey is advancing a far more ambitious vision: the restoration of Turkey’s regional hegemony.Ankara’s economic and diplomatic ties with the West, including its NATO membership, are tactical tools to attain regional hegemony rather than genuine commitments to shared interests with the United States. Turkey’s ultimate objective is to reclaim the influence once enjoyed by the Ottoman Empire, which ruled vast swaths of Asia, Europe, and Africa for over six centuries. It follows that these ambitions threaten US, Western, and Israeli interests alike.

The close relationship between Turkey and Syria’s new president, Ahmed al-Shara, signals a dangerous realignment. Despite Western hopes that the collapse of the Iran-led axis in Syria would stabilize the region, the “Erdoğan-Shara axis” risks replacing one radical bloc with another.

Analysts such as Dr. Hay Eytan Cohen Yanarocak warn that Turkey is now the de facto powerbroker in Syria, directing events via its proxies. Turkish-led “joint operations commands” now reportedly coordinate activity across Syria, Jordan, Iraq, and Lebanon. While this may weaken Iran’s footprint, it empowers Ankara’s Islamist ambitions rather than promoting peacebuilding in Syria.Israel and Syria are now publicly admitting to pushing forward a peace agreement under the auspices of the United States. Yet given Erdoğan’s strong influence in Syria, these ambitions may face hardships—or worse, come to fruition under an innocent guise that would later entail heavy costs.

Even as Turkey seeks to curb Iranian and Russian influence, its hardly an ally for either Israel or the West. At an Organization of Islamic Cooperation (OIC) summit in June, Erdoğan openly backed Iran, a country recognized by the US as a State Sponsor of Terrorism, declaring, “We are optimistic that victory will be Iran’s,” while accusing Israel of igniting the region. His statements reveal both solidarity with sanctioned adversaries and claims to regional leadership over the Islamic world.

Meanwhile, Erdoğan continues to whitewash Hamas, recently describing it as a “resistance movement,” not a terrorist group, in an interview with Fox News. The Turkish president significantly escalated his rhetoric since the beginning of the Gaza war, accusing Israeli prime minister Benjamin Netanyahu of committing “genocide” in Gaza, “no less than what Hitler did.” He proudly leads massive rallies around the country, even going as far as threatening to “invade” Israel last year, “just as we entered Karabakh, just as we entered Libya.”

Indeed, Turkey has been hosting and harboring Hamas leaders on its soil for years, providing them with financial networks in defiance of US sanctions. Turkey’s ties with Hamas are longstanding and deep—politically, financially, and operationally. Hamas has established real estate companies, investment funds, and sham NGOs in Turkey, an enterprise whose scale has turned Turkey into a major Hamas financial hub, overseeing assets worth more than half a billion dollars.Hamas operatives have also received training in Turkey, returning with funds and directives to escalate attacks against Israel. Inter alia, this was proven in documents seized by the IDF in the Gaza Strip, exposing Hamas’ “Shadow Unit”—an undercover squad that left Gaza to Iran via Turkey for guidance and sponsorship in 2019. Ankara justifies its support through euphemisms that attempt to distinguish Hamas as a political, rather than a terrorist entity.

Meanwhile, Ankara has been building the largest military around the Mediterranean, expanding defense exports to $7.1 billion in 2024, and gaining combat experience in Syria, Libya, and the Caucasus. Though lacking stealth aircraft and a long-range ballistic missile arsenal, Turkey seeks to fill these gaps through US arms purchases.

Erdoğan’s threats go beyond Israel. In 2022, he threatened to launch ballistic missiles at Greece. Turkey still illegally occupies Northern Cyprus, a move firmly condemned by the European Union, of which Cyprus is part. During a July 2024 visit to the territory, Erdoğan declared his intention to establish a military base there.

The West’s hope that Turkey will counterbalance Iran’s Shia axis misreads Ankara’s intentions. As recent Iran-Turkey defense dialogues demonstrate, the two share growing military and intelligence cooperation despite sectarian differences. In 2025, Tehran’s defense minister hailed Turkey as a partner in facing “the challenges before the Islamic world.”Finally, Turkey’s nuclear ambitions should keep the West alert. Though Turkey lacks an independent nuclear arsenal, it hosts 50 US-controlled warheads and is now signaling a civilian nuclear drive that could evolve militarily. In September 2025, Ankara announced plans for domestic reactor development and nationwide bunker construction, including nuclear shelters.

Under Erdoğan, Turkish society has undergone systematic Islamization, a reverse of Atatürk’s secular legacy. The government cultivates a conservative Sunni extremist ideology, mirroring Iran’s revolutionary model.

Turkey courts Western engagement through trade, defense procurement, joint military exercises with the United States, and a rhetoric of partnership—as illustrated in Erdoğan’s latest visit to Washington to meet President Trump. Yet this dual-track strategy—appearing as a NATO ally while empowering jihadist actors—mirrors Iran’s former guise as a stabilizer against ISIS.Turkey’s assertive foreign policy, Islamist orientation, and cooperation with US-designated terror groups have increasingly rendered it an unreliable ally and emerging revisionist power. Its neo-Ottoman aspirations pose a strategic challenge that Washington, NATO, and Jerusalem can no longer afford to ignore.

It is now unavoidable to ramp up demands on Erdoğan before any further strengthening of the Turkish-Western alliance—if not reevaluate Turkey’s role in the West’s security architecture altogether. The West currently underestimates Turkey’s ambitions, focuses on short-sighted moves while ignoring its destabilizing and aggressive military moves and ties with radical terrorist groups.The logic of “the lesser evil”—choosing Turkey over Iran—has run its course. It is of the essence to shift from accommodation to vigilance with Turkey, scrutinizing its role in keeping regional stability and participation in the global security burden sharing, and its status as a legitimate Western partner. Until it changes its course, Ankara has now established itself as a strategic competitor, rather than a partner, to the US international security interests.

Gold prices fell over 3% on Tuesday, as the dollar firmed and investors booked profits after expectations of U.S. interest rate cuts and sustained safe-haven demand drove the yellow metal to a fresh record high in the previous session.

Spot goldwas down 3.5% at $4,203.89 per ounce, as of 09:05 a.m. ET (1305 GMT), its steepest fall since November 2020.

U.S. gold futuresfor December delivery fell 3.3% to $4,217.80 per ounce.

Prices scaled an all-time peak of $4,381.21 on Monday and have gained over 60% this year, bolstered by geopolitical and economic uncertainty, rate cut bets and sustained central bank buying.

"Gold dips were being bought as recently as yesterday, but the sharp jump in volatility at the highs over the past week is flashing caution and may encourage at least short-term profit-taking," said Tai Wong, an independent metals trader.

The dollar indexrose 0.4%, making bullion more expensive for holders of other currencies.

Wall Street looked poised for a calm start, with futures trimming earlier losses as investors assess a wave of largely positive earnings from corporate giants.

"Better risk appetite in the general marketplace early this week is bearish for the safe-haven metals," said Jim Wyckoff, senior analyst at Kitco Metals, in a note.

Traders now await the U.S. consumer price index (CPI) data, delayed due to the ongoing U.S. shutdown, due on Friday. September's figures are expected to show a 3.1% year-on-year rise. Markets expect that the Federal Reserve will cut interest rates by 25 basis points at its meeting next week.

Gold, a non-yielding asset, tends to benefit in a low-interest rate environment.

Investors are also awaiting U.S. President Donald Trump's upcoming meeting with Chinese President Xi Jinping next week.

Spot silverdropped 5.2% to $49.68 per ounce.

"Silver is stumbling badly today and has dragged the entire complex lower," said Wong.

"It appears we have a short-term top at $54 and while sentiment wobbles under $50, silver is likely to trade sideways with substantial volatility as long as gold remains relatively firm."

Elsewhere, platinumshed 4.3% to $1,568.25 and palladiumlost 5.8% to $1,410.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up