Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

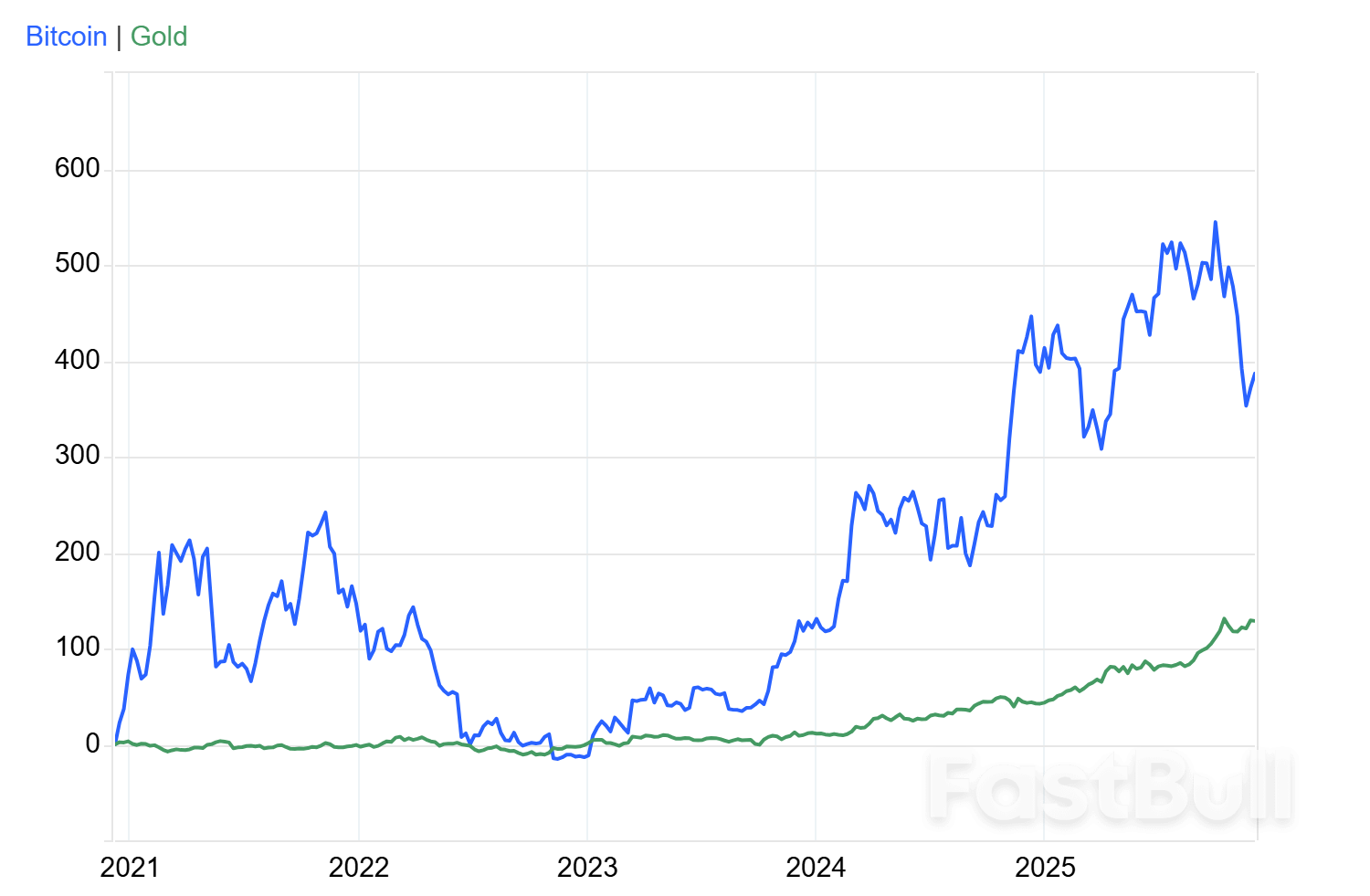

Bitcoin’s sharp reversal and a surge in investor fears have forced even the market’s strongest champions to confront a bruising December downturn.

A suburban Chicago police officer who was detained during a high-profile federal immigration enforcement surge in the area has returned to duty, his police department said in a statement on Tuesday.

Radule Bojovic, an officer with the Hanover Park Police Department, was arrested by U.S. Immigration and Customs Enforcement agents during "Operation Midway Blitz," a months-long deportation campaign launched by the administration of U.S. President Donald Trump in the Chicago area in September.

The Department of Homeland Security, which oversees ICE, announced Bojovic's arrest with much fanfare in a press release on October 16, saying he had overstayed a tourist visa after arriving in the U.S. from Montenegro.

But the Hanover Park Police Department quickly responded with a statement saying Bojovic was working in the country legally, having presented a work authorization card and passed FBI and Illinois State Police background checks.

There was no immediate response to a request seeking comment from ICE.

Bojovic, who was held at a detention center in Brazil, Indiana, according to ICE's online detainee locator, was released on bond on October 31, the Hanover Park Police Department said.

"Given that his bond was not contested and he remains authorized to work by the federal government, the Hanover Park Police Department determined that he may return to work," Deputy Chief Victor DiVito said in the statement.

DiVito said Bojovic would receive back pay for the time he was on leave during his detention.

DHS Assistant Secretary for Public Affairs Tricia McLaughlin told Reuters as of November 19, ICE and U.S. Customs and Border Protection officers had arrested more than 4,200 people in the Chicago area during Operation Midway Blitz.

Daily Gold (XAU/USD)

Daily Gold (XAU/USD)Spot Gold (XAUUSD) is grinding higher Tuesday, trading just above the short-term retracement zone between $4,133.95 and $4,192.36. That's the final line of defense before the 50-day moving average at $4,058.26 — and as long as that holds, the uptrend's still in play.

The two-day consolidation tells you what you need to know: traders are positioned, but nobody's pressing. They're waiting for the catalyst that breaks this week's high at $4,264.70. After that, it's a straight shot at the record at $4,381.44.

The setup is clean. Buyers have been stepping in on dips all year, and right now they're deciding whether to chase the breakout or wait for one more pullback. With the 50-day still rising, the bias is to buy weakness — but the real move likely comes from the data, not the chart.

At 12:27 GMT, XAUUSD is trading $4207.87, up $2.20 or +0.05%.

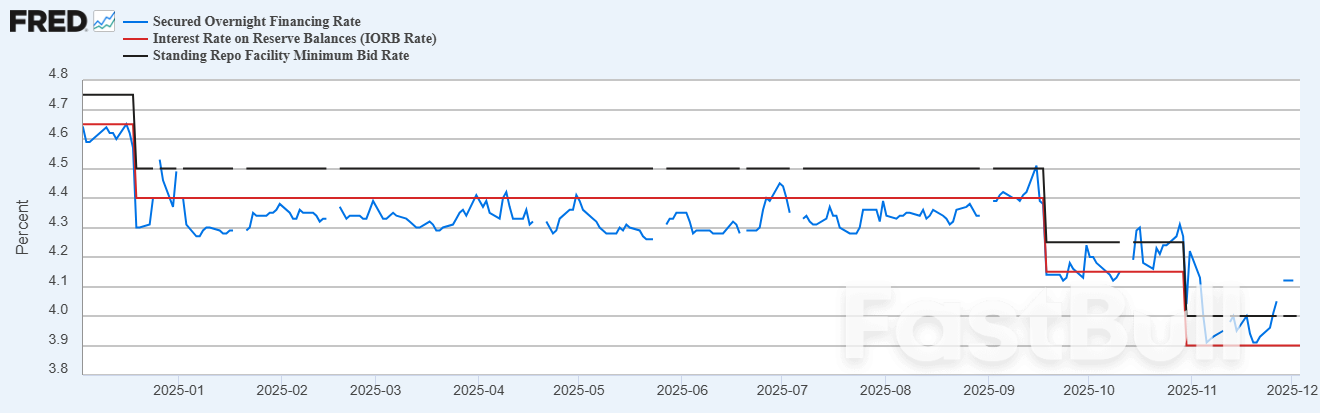

Markets are pricing an 87% chance of a December rate cut, up sharply from 30% just two weeks ago. That shift — driven by weaker jobs data and dovish comments from Fed Governor Christopher Waller — is doing the heavy lifting for gold right now.

Treasury yields are edging lower across the curve. The 10-year is down to 4.063%, the 2-year at 3.49%. Not a collapse, but enough to keep non-yielding assets like gold supported. Lower rates mean lower opportunity cost, and that's been the theme all year.

The question now is whether this week's data — ADP employment Wednesday, ISM Services later, and the delayed September PCE on Friday — confirms the Fed's dovish tilt or throws a wrench in it. If the numbers come in soft, gold could punch through resistance. If they surprise hot, the dip-buyers get their chance.

The dollar's on pace for its ninth consecutive daily loss, down 0.15% to 99.10 on the index. That's a nearly 9% drop for the year, and it's all about rate expectations. The more the Fed cuts, the less reason there is to hold dollars — especially when the euro's catching a bid on hopes of a Ukraine peace deal and the yen's firming on Bank of Japan rate hike talk.

Fed Chair uncertainty isn't helping. Trump's expected to announce his pick for Jerome Powell's replacement early next year, and the market's already pricing in a "shadow Fed chair" problem — two voices on policy when traders need one. That kind of noise usually weakens the dollar, and it's another tailwind for gold.

Gold's holding support, the Fed's dovish, and the dollar's weak. The setup favors the bulls, but the breakout isn't confirmed yet. This week's data will either push gold through $4,264.70 toward the record — or give dip-buyers one more entry before year-end. Either way, the 50-day moving average is the line that matters. As long as that holds, buyers have the upper hand.

Ethereum (ETH) is trading at around $3,065, with a 24-hour trading volume of $30 billion. The price has climbed 9% in the last day and 4% over the past week.

ETH is now sitting near a key level that could decide its short-term direction, as traders keep a close eye on $2,800.

$2,800 Support May Define the Next Trend

Crypto analyst CryptosRus said,

"$ETH is sitting right on $2,800, one of the biggest support zones on the chart." they added, "Hold it → room back to $3,300 and even $3,900. Lose it → volatility at $2,500 HVN, then a real shot at $2,300."

ETH has rebounded after recent weakness, but it remains close to this key zone. Price charts show a bullish candle on the daily close, though a clear breakout is still needed. Traders are watching the higher low trendline for confirmation of a push toward $3,700. For now, short-term setups on smaller timeframes are driving activity.

Data from Binance shows Ethereum's leverage ratio at an all-time high of 0.57, according to CryptoOnchain. This means many traders are using borrowed funds. At the same time, open interest has dropped to $6.6 billion, which suggests "a lot of froth already flushed out."

Notably, this creates a mixed setup. High leverage increases risk, while the drop in open interest shows that many weaker positions may have already been cleared. Traders are warning that the current build-up could lead to sudden price moves if the market reacts sharply near current levels.

CRYPTOWZRD shared that the $3,055 level is now an important intraday resistance. They explained that ETH recovered well but may be forming a double-top.

"A bearish pullback and then a bullish move again will offer a quality long setup, otherwise there may be a fake-out," they said.

The next lower support is around $2,880. If the asset holds there and finds buyers, traders may look for long entries.

On higher timeframes, ETH is forming a bullish wedge and inverse head-and-shoulders, based on recent analysis reported by CryptoPotato. These patterns are being tracked by traders expecting a breakout above $4,500.

Meanwhile, institutional buying is also active. BitMine, linked to Tom Lee, recently purchased over 30,000 ETH—worth close to $92 million. This shows growing interest from larger players, even as the market tests a critical zone.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up