Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

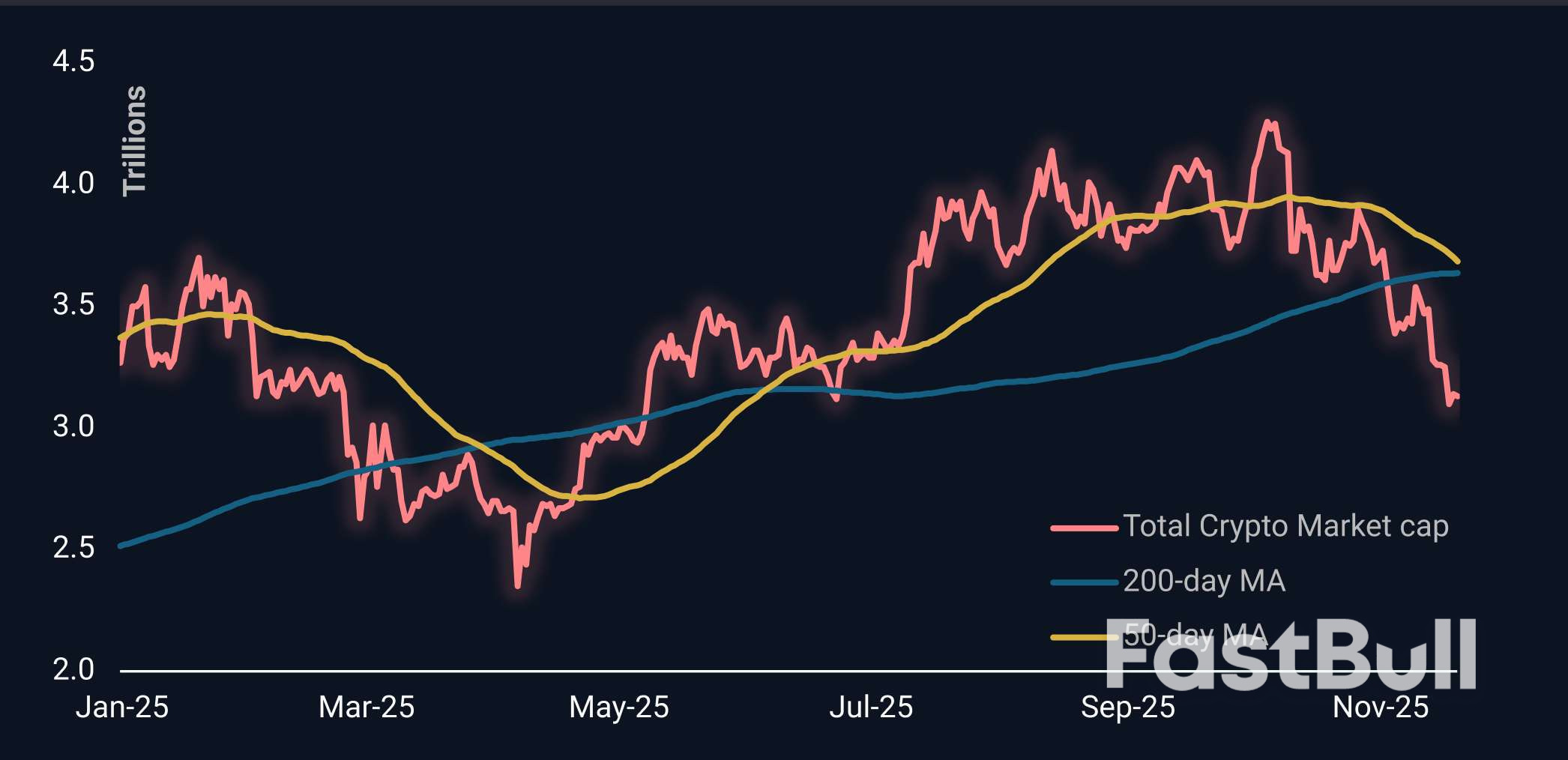

Crypto markets remain weak as Bitcoin stalls near $92K with worsening lower highs. Zcash outperforms but raises cycle-end concerns. ETF inflows into Solana and XRP continue, while bearish option positioning signals caution.

Odds of a December rate cut remained low following the release of delayed jobs data.

Markets were last pricing about a 35% chance of a quarter-point cut from the Federal Reserve next month, according to the CME FedWatch Tool. That is higher than the 30% likelihood priced in during the prior session, but remains weak. The tool used fed funds futures trading to calculate the odds.

The target rate is currently at 3.75% to 4.00%.

Those expectations held steady after the release of the September jobs data, the first nonfarm payrolls report investors have seen since the government shutdown. The report gave an uneven picture of the U.S. labor market. The U.S. economy added 119,000 jobs in September, a headline number that blew away expectations for 50,000 jobs added, according to economists polled by Dow Jones.

However, the unemployment rate showed unexpected weakness, rising to 4.4% from 4.3%. The new level is the highest level it's been since October 2021.

"All those numbers suggest an economy that's still hanging in there. Not a dramatic move one way or the other," Former Federal Reserve Vice Chairman Roger Ferguson told CNBC's "Squawk Box" on Thursday. "People should take note of the slight uptick in the unemployment rate, but labor force participation still looks pretty strong, average hourly earnings certainly looks strong, or strong enough. And so, I don't think this sort of tilts the cut decision much one way or the other."

To be sure, some investors are hopeful that weakness in the unemployment rate means a December rate cut remains on the table. The level is closely watched by Fed policymakers, more so than the headline number, and is additionally troubling given that a shrinking labor pool, given the rise in immigration crackdowns, theoretically would keep the job market tight.

"A December cut remains possible given continued labor market softness as expressed by the unemployment rate," wrote Kay Haigh, global co-head of fixed income and liquidity solutions at Goldman Sachs Asset Management. "Weak hard data and close-to-target inflation look set to drive policy going forward, despite recent hawkish noises."

"The setup is in place for Powell to continue his risk-management approach to the labor market before his term as Chair expires in May," Haigh continued.

Volodymyr Zelenskiy is scrambling to resist a potentially humiliating peace deal put forward by US officials just as the Ukrainian president faces growing domestic pressure to ditch his most trusted aide in the war against Russia.

Zelenskiy has received signals from the US that he should accept the deal drawn up in consultation with Moscow, a person familiar with the matter said, asking not to be identified because the matter is sensitive.

The White House didn't immediately respond to a request to comment.

Zelenskiy will hold talks in Kyiv on Thursday with US military officials led by Secretary of the Army Dan Driscoll. The delegation, which has met with Ukrainian Prime Minister Yuliia Svyrydenko and army chief Oleksandr Syrskyi, will examine ways to force Russia to end the fighting, according to people familiar with the matter.

The latest attempt by US President Donald Trump's administration to revive negotiations involves a 28-point plan that's modeled on the Gaza ceasefire. It outlines known Russian demands for concessions that Kyiv has repeatedly said are unacceptable and that have so far hindered any breakthrough in efforts to reach a ceasefire.

The proposal includes demands for Ukraine to cede territory in its eastern Donbas region to the Kremlin, the removal of sanctions from Russia, and a halt to war-crimes investigations, according to a person familiar with the matter.

Ukraine would also have to accept limits on the size of its army, the person said, asking not to be identified because the issue is sensitive. That would leave it vulnerable to any renewed offensive ordered by Russian President Vladimir Putin, who endorsed a previous peace accord with Kyiv over eastern Ukraine before starting the 2022 invasion.

European diplomats expressed skepticism about any deal, noting that Putin has a track record of appearing to accept overtures when under pressure. The Kremlin's trying to stop US sanctions targeting Russia's two largest oil companies, Rosneft PJSC and Lukoil PJSC, from coming into force on Friday, people familiar with the matter said, requesting anonymity to speak freely.

Zelenskiy's facing US pressure to make concessions to halt the war as he also prepares to meet with lawmakers from his party on Thursday to try to defuse public anger over a corruption scandal. Anti-graft investigators linked his former business partner to a scheme to embezzle as much as $100 million, a probe that has already forced the departure of two government ministers.

Some in his party want Zelenskiy to replace Chief of Staff Andriy Yermak, his right-hand man who plays a direct role in decisions on top-level appointments and critical elements of Ukraine's wartime strategy, according to a person familiar with the matter. The president will face a parliamentary crisis if he fails to oust Yermak, the person said, asking not to be identified discussing sensitive issues.

Yermak, who regularly accompanies Zelenskiy on high-stakes overseas trips, has amassed outsized influence in the administration. Zelenskiy pushed back against criticism last year, describing Yermak as a "powerful manager."

Ukraine's two independent anti-corruption agencies released details last week of their 15-month probe into alleged money-laundering in the country's energy sector. The scheme involved kickbacks from contractors building defenses to protect Ukraine's nuclear energy facilities from Russian air strikes, according to investigators.

The agencies are in possession of unreleased recordings of alleged conspirators discussing different corruption schemes and officials in Kyiv are on tenterhooks to see who else might be drawn into the investigation.

The controversy erupted as Ukrainians endure lengthy power outages following intense Russian missile and drone attacks targeting energy infrastructure in the approach to winter.

Zelenskiy in July sought to seize control over the anti-corruption agencies, before backing down in the face of Ukraine's largest street protests since the war began and condemnation from Kyiv's international allies.

The president told Bloomberg TV in a Nov. 13 interview that he fully supports the investigation. "The most important thing is sentences for those people who are guilty," he said. "The president of a country at war cannot have any friends."

The domestic political challenge is playing out as Ukrainian officials seek clarity on the plan to end the war promoted by Trump's special envoy Steve Witkoff and Kremlin envoy Kirill Dmitriev.

Ukraine's National Defense and Security Council Secretary Rustem Umerov met with Witkoff earlier this week in Miami and was briefed about the plan, which appeared beneficial to Russia, a person said, asking not to be identified because the matter isn't public.

Ukrainian and European officials don't yet know if Trump backs the proposals and what happens if Kyiv rejects them, according to people familiar with the matter. Ukraine relies on US intelligence support for air defense and on US weapons that are paid for mostly by the Europeans.

European Union foreign ministers voiced alarm at the proposals as they met for talks in Brussels on Thursday.

"For any plan to work, it needs to have Ukrainians and Europeans on board," the bloc's foreign-policy chief Kaja Kallas told reporters.

U.S. President Donald Trump said he will meet New York City Mayor-elect Zohran Mamdani at the White House on Friday in what would be the first meeting of the Republican leader with the democratic socialist who won this month's mayoral election.

Mamdani and Trump have been critical of each other, with Trump having backed Mamdani's opponent, Andrew Cuomo.

Mamdani, for his part, has been critical of the Trump administration's policies, including its crackdown on immigration and on protests against U.S. support for Israel during the Gaza war.

"We have agreed that this meeting will take place at the Oval Office on Friday, November 21st," Trump said on social media on Wednesday.

Mamdani told reporters earlier this week that his team had reached out to the White House to arrange a meeting.

"My team reached out to the White House to fulfill a commitment I made to New Yorkers over the course of this campaign," Mamdani said on Monday.

Mamdani's transition team did not immediately respond to a request for comment on Trump's post on Wednesday.

Trump has repeatedly turned the powers of the presidency on political rivals. During the New York City mayoral election campaign, Trump threatened to withhold billions of dollars in federal funding from the city if Mamdani won.

Mamdani made countering the 79-year-old Republican president's actions in the city - especially on immigration - a centerpiece of his successful campaign.

Mamdani will be sworn in as New York City mayor on January 1, 2026.

Ecuador just had a major vote which has gone some underreported in US mainstream media, given perhaps the current focus on the Venezuela crisis. The Latin American country held a referendum Sunday on allowing allowing the return of foreign military bases in the country.

This was ultimately seen as a vote on allowing an American military presence, which the US has long sought to reestablish. Ecuadoreans voted down the proposal in a significant blow to President Daniel Noboa, who has sought a change in the constitution. Since 2008, the constitution has banned foreign bases on Ecuadorean soil.

Image source, US Air National Guard: Ecuador's military receives a US C-130H Hercules aircraft in Latacunga.

Image source, US Air National Guard: Ecuador's military receives a US C-130H Hercules aircraft in Latacunga.One of Noboa's key rationales for seeking a reversal of the prior legislation was to have outside assistance in fighting soaring crime and drug-trafficking in the country and region.

The referendum was held 16 years after the United States was made to shut down a military site on Ecuador's Pacific coast.

The New York Times suggests that Ecuadoreans currently see the Trump administration pushing its military might around in the Caribbean while threatening countries like Venezuela, Colombia, and even more recently Mexico:

They soundly rejected a national referendum on Sunday that he had backed, aimed at authorizing a foreign miliary presence in Ecuador. With more than 98 percent of ballots counted, 61 percent opposed the measure.

The vote comes as the region has been roiled by the intensifying U.S. military campaign against boats the Trump administration claims are smuggling drugs.

The Ron Paul Institute also sees in this a grass roots movement among foreign peoples to reign in US foreign policy and militarism in their lands. Journalist and pundit Adam Dick writes the following:

There is not a lot of reason for hope for the US to start adhering soon to a noninterventionist foreign policy. Indeed, President Donald Trump has been moving the US in the opposite direction. He continued US participation in the wars of his predecessor. This includes the Ukraine and Israel wars, in regard to which Trump had promised, in the lead-up to becoming president, to bring peace very quickly. Further, Trump has begun a new war against Venezuela and is threatening to pursue a new "Global War for Christians," starting with threats of US military attacks in Nigeria. Meanwhile, Congress does nothing to stop or curtail the intervention.

There seems to be little hope of the US government choosing to move toward nonintervention abroad soon. Maybe some of the best hope for change in that direction comes from people in other countries saying "no more" to aiding the US government's interventionist pursuits.

On Sunday, a majority of voters in Ecuador voted in a national ballot measures election against allowing the US government to have military bases in the South American country. The "no" vote win occurred despite Ecuador President Daniel Noboa strongly campaigning for the ballot measure's approval.

So long as Americans fail to put an end to their government's interventions abroad, there is hope that people in Ecuador and elsewhere around the world can impose some restraint.

Also in the background has been Trump admin officials really pushing and reviving concept of influence in the world based on the 18th century Monroe Doctrine.

AFP/Getty Images

AFP/Getty ImagesThe historic Monroe Doctrine declared the Western Hemisphere off-limits to other countries, while vowing at the same time the US would stay out of European affairs. Of course, Washington is currently only interested in the former part of this and not so much the latter.

The fusion century is not yet wholly within China's grasp, but it will be if the United States doesn't make the right policy choices.

China already won the renewables race.

It's producing nearly a terawatt of new clean energy capacity every year — the equivalent of more than 300 large power plants worth of generation, according to The Economist. That pace has made it a new kind of energy superpower: one that manufactures, builds, and exports clean electricity on a planetary scale. And because that scale has driven prices so low, the rest of the world is now buying from Beijing. Even if the current US government is less supportive of renewables or decarbonization, global demand is undeniable: emerging markets are hungry for cheap renewables, with countries from Pakistan to Brazil rapidly importing Chinese solar and wind equipment to meet rising electricity needs.

There's no catching up to that. We're not going to out-subsidize, out-manufacture, or out-coordinate China on solar panels, inverters, or transmission wire. The truth is we didn't really try to compete until we had already lost—the United States innovated and invented but failed to build the environment needed to rapidly manufacture and scale its own technologies, ceding the market to China.

The question now is whether we're willing to win the next one.

China's dominance in renewables is a reminder that invention alone doesn't win global markets — scale does. And scale has two requirements: you have to be able to build what you invent, and you have to be able to connect what you build. China has solved both. It aligned its supply chain, manufacturing, permitting, and grid expansion into a single national project, which allowed it to deploy clean energy technologies at breathtaking speed. The United States, by contrast, has repeatedly invented world-changing technologies, only to watch other nations scale them first.

That is the risk in front of us with fusion. We can lead the science, pioneer the breakthroughs, and even set up first-of-a-kind facilities — but if we cannot build the components at volume and connect fusion power to the grid in large numbers, we will replay the solar century in real time.

The chokepoints that cost us leadership once are still with us: brittle supply chains, slow permitting systems, and an interconnection process that makes deployment slower than the technology itself. Winning the fusion century means attacking both barriers at once. It means building the supply chain for the machines we invent and modernizing the grid so those machines can be plugged in at speed. Coordinated scale wins — and this time, we have to be the ones who deliver it.

A Third Way report released this month captures the core of America's problem: we've made it nearly impossible to build anything.

More than 70 percent of developers say federal permitting is more onerous than state or local permitting, with National Environmental Policy Act (NEPA) reviews adding up to two years to project timelines. More than half say interconnection delays are now the single biggest barrier to clean-energy projects. Developers choose where to build not based on where the power is needed — but on where they can get permits fastest.

Those findings confirm what anyone trying to add megawatts to the grid already knows: our process is our policy, and our process is broken.

The report calls for shot-clocks, categorical exclusions, digital permitting portals, and lead agencies to coordinate reviews across federal and state lines. It's a sober, technocratic list—but if we don't act on it now, the United States won't just lose time. We'll lose the capacity to lead in energy, perhaps ever again.

Our electricity markets themselves are now showing their age. As Heatmap recently reported, regional operators like PJM are struggling to keep pace with surging load growth. The grid's "duty to serve" model, built for steady demand, is breaking down in an era of explosive, concentrated loads from AI and data centers. PJM has already warned it will have just enough generation to meet reliability requirements in 2026 and 2027, and billions in new costs are flowing directly to consumers. No one—utilities, producers, or tech developers—is happy with how the system works. America's electricity markets are failing at their most basic task: ensuring enough power can be provided where and when it's needed.

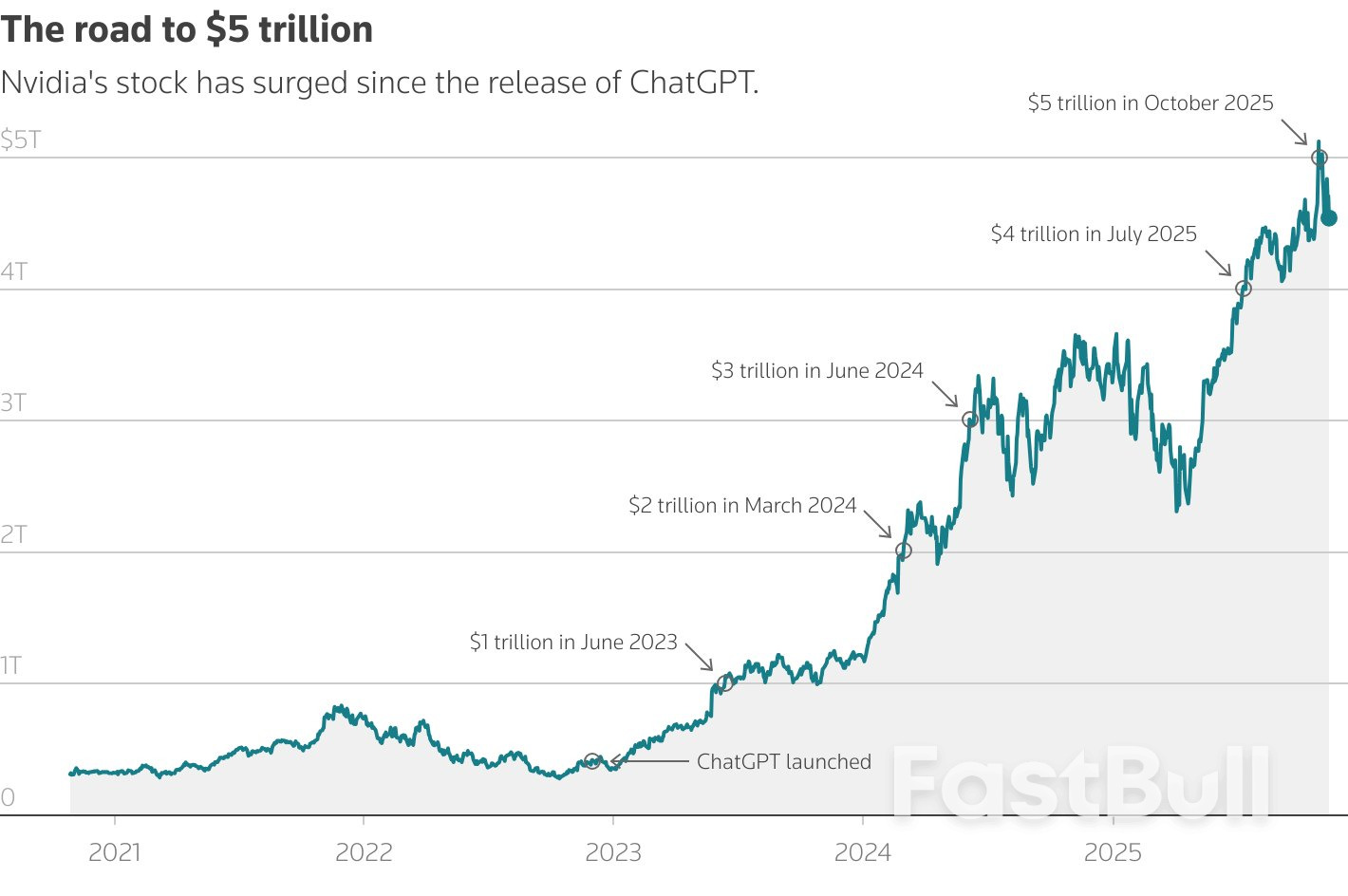

Look at what's happening in Nvidia's hometown: brand-new data centers are sitting empty because the local utility company can't connect them to the grid, according to Bloomberg. Across the country, AI demand alone could more than double US electricity use by 2035, and yet projects that could meet that demand are tangled in multi-year interconnection queues.

Texas understands that speed is key. Because of its competitive market and streamlined approvals, it can connect projects faster than any other state, sometimes in a matter of months rather than years. In doing so, Texas connected roughly 40 percent of all new US solar and storage capacity to the grid this year and has proven that faster processes are possible. But even this pace remains far too slow compared with China, which added 260 GW of renewables in just five months, according to The Economist. Texas offers a model worth studying as we consider how to move forward, but if America truly wants to compete, we'll need to go bigger and faster than even Texas has dared to go.

To their credit, some US regions are starting to act. The Southwest Power Pool just approved an $8.6 billion investment to build a 765-kV transmission "backbone" across 14 states — nearly 1,000 miles of high-voltage lines capable of carrying four times more power than existing lines, as Utility Dive reported. It's a recognition that our current grid is at capacity and that simply adding generation isn't enough without the wires to move it. Even so, SPP expects demand across its footprint to rise up to 136 percent , meaning this backbone is only the start of the buildout required to stay ahead.

China's clean-energy machine didn't happen by accident. It happened because every part of the system — finance, manufacturing, permitting, and export policy — moved in sync. The country aligned its industrial policy with its energy policy, and then pointed both at a single goal: dominate the supply chain.

We can dislike how it got there and still learn from the lesson. Speed, coordination, and national purpose matter.

And that's what America needs to bring to the next energy revolution — fusion. Not because it replaces renewables, but because it extends the frontier of clean, firm, dispatchable power that can run factories, data centers, and whole cities. Fusion is not a science experiment anymore. It's a buildout challenge.

If we want to win the fusion century, we have to clear the same barriers strangling the renewables boom:

That's how we reclaim America's edge: not by trying to win yesterday's race, but by setting the pace for tomorrow's.

China built the solar century. The next one — the fusion century — can still be ours. But only if we learn to build like a nation that wants to win again.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up