Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Many oil forecasts, notably from the IEA, wrongly predict a glut by relying on flawed models instead of physical data. Despite slowing China growth and OPEC shifts, global demand keeps rising, supporting prices.

Stephen Miran’s appointment to the Federal Reserve isn’t just another personnel move—it’s the placement of Trump’s Reset architect inside the very institution that will help carry out America’s most ambitious economic overhaul in generations.

If you’re still unfamiliar with what Trump’s Reset entails, I strongly recommend checking out Matt Smith’s comprehensive analysis. He’s done the heavy lifting of connecting dots that were only hinted at in Miran’s original white paper.

Without getting into the weeds, Miran, the mastermind behind what’s been dubbed the “Mar-a-Lago Accord,” outlined a comprehensive plan to flip the U.S. dollar’s reserve status from a burden into a bargaining chip. To turn America’s towering debt from an embarrassment into leverage. And to reorient the entire global economic structure in Washington’s favor.

And of course, what makes this especially relevant right now—particularly for anyone with gold exposure—is the timing.

The yellow metal has been on a relentless march higher throughout 2025, setting multiple all-time highs and blasting past $3,400 an ounce just last month. Now, with Miran’s appointment to the Fed, we’re seeing exactly why smart money has been quietly accumulating the yellow metal all year.

But anyone thinking Miran’s appointment is simply about giving Trump another dovish vote for rate cuts is missing the much bigger picture. Gold isn’t just rising because of anticipated rate cuts. It’s been rising because informed investors recognized what Trump’s Reset strategy would eventually require: the systematic weakening of dollar dominance and a potential gold revaluation.

Again, I urge you to check out Matt’s report if you’re unclear on the specifics—he’s laid out the relationships and implications more clearly than anyone I’ve seen attempt it.

The upshot is that Miran’s appointment is simply the latest confirmation that this plan is moving from theory into practice. (And once you see what that implies for both the dollar and gold, it’s easier to understand why $3,400 gold may be only the beginning.)

I don’t want to sound like a broken record, but I can’t stress this enough.

This isn’t just about securing another dovish vote for rate cuts—Trump could have picked any yes-man for that. It’s about placing the architect of America’s monetary reset directly inside the Federal Reserve.

You see, the Fed doesn’t set tariffs, negotiate trade deals, or sign defense pacts—but it does control the single most important lever in Trump’s Reset: the cost and flow of money.

From his position as Fed governor, Miran will have a permanent vote on the Federal Open Market Committee (FOMC), giving him direct influence over interest rates, money supply, and crucially, the Fed’s balance sheet operations. But more importantly, he’ll be positioned to coordinate monetary policy with the broader Reset strategy he designed.

Think about what this means in practical terms—and from Trump’s perspective. The Reset strategy involves coordinated dollar devaluation—but that requires the Fed to be on board. You can’t orchestrate a Plaza Accord (more on it below)-style currency adjustment if your central bank is fighting you every step of the way. With Miran inside the Fed, Trump gets someone who understands both the macroeconomic theory behind dollar devaluation and the practical mechanics of how to execute it through monetary policy.

Note: The U.S. dollar has already weakened more than 10% over the past six months. To put it in perspective, the last time the dollar fell this much early in the year was 1973—right after the U.S. finalized its break from gold and the fiat era fully took hold.

Miran’s appointment also signals something even more significant: the institutional capture of monetary policy. When Jerome Powell’s term expires in May 2026, Fed chairs are typically chosen from among existing governors. By installing Miran now, Trump is positioning his Reset architect to potentially lead the entire Federal Reserve system.

In short, it’s Trump making sure the Fed itself becomes a primary tool for carrying out his Reset. And there’s a very deliberate reason for that.

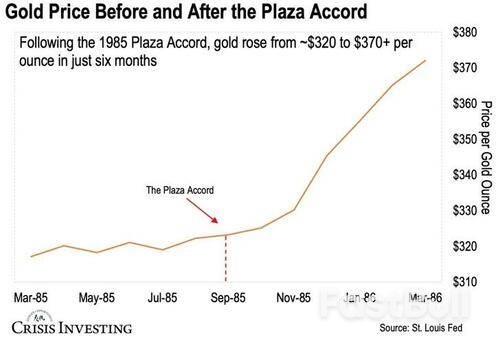

Now, I brought up the Plaza Accord above because it’s the closest historical precedent to what we’re calling Trump’s Monetary Reset (or the Mar-a-Lago Accord).

You’ve probably heard of it.

On September 22, 1985, finance ministers from the world’s largest economies gathered at New York’s Plaza Hotel to coordinate a devaluation of the unnaturally strong U.S. dollar.

Naturally, outside the U.S., no one wanted a weaker dollar—it would make their exports pricier for American buyers. But, just like today, Washington applied pressure with tariffs, import surcharges, quotas, and pointed accusations of “unfair trade.”

And guess what? It worked. West Germany and Japan—the economic powerhouses of the day—caved.

But here’s what made the Plaza Accord actually work: the Federal Reserve was fully on board. Fed Chairman Paul Volcker coordinated closely with Treasury Secretary James Baker to ensure monetary policy backed the dollar devaluation strategy. He cut interest rates from roughly 12% to 6% between late 1984 and late 1986, creating the conditions for the dollar to fall. Without that cooperation, the Plaza Accord probably would have been just another piece of paper.

This is exactly why Miran’s appointment is so crucial. Trump learned from Reagan’s playbook—to execute coordinated currency devaluation, you better make sure your central bank is pulling in the same direction. By installing the Reset architect inside the Fed, Trump ensures that monetary policy will align with, rather than undermine, his broader economic strategy.

And what happened to gold in the wake of the Plaza Accord?

It surged. Take a look at the chart below.

After the Plaza Accord in 1985, gold jumped from about $320 per ounce to over $370 between September 1985 and March 1986. That’s in just six months.

Adjusted for today’s prices, that would be like seeing gold leap to roughly $4,000 an ounce.

But here’s the thing… If Trump’s Reset unfolds the way Matt and I believe it will, it won’t just be a repeat of the Plaza Accord—it’ll be that on steroids.

In today’s globalized and overleveraged economy, the ripple effects could be enormous. I wouldn’t be surprised to see gold surge to $5,000–$8,000 per ounce as markets scramble to adapt.

Stephen Miran’s arrival at the Fed isn’t just a policy shift—it’s confirmation that Trump’s Reset strategy is already moving from blueprint to reality. The implications for the dollar, gold, and your personal wealth are enormous. We’ve been tracking the signs of this coming shift for months—the hidden gold run out of London, the quiet buildup of reserves, and now the placement of Trump’s Reset architect inside the Federal Reserve itself. If you’ve been wondering what all this means for your money—and how to prepare before the Reset accelerates—I strongly urge you to read our latest deep-dive: Get Ready for Trump’s Monetary Reset. Inside, you’ll see why central banks are scrambling for gold, how Trump’s team plans to “monetize America’s balance sheet,” and why we believe this could unleash the biggest wealth revaluation in half a century. Most importantly, you’ll learn the practical steps you can take right now to protect your savings—and position yourself to potentially profit. Click here to get the full story before the Reset leaves you behind.

Weekly CAC 40 Chart

Weekly CAC 40 Chart

President Donald Trump has moved to fire Federal Reserve Governor Lisa Cook after she refused his demand to resign over a claim by a top administration official that she lied on mortgage applications. The escalation sets the stage for a lawsuit that will help determine the extent of White House control over the US central bank.

Trump said in an Aug. 25 letter posted on Truth Social that he had “sufficient cause” to fire Cook, an acknowledgment by the president that he needs a valid reason to dismiss her under US law. Cook was accused of engaging in so-called mortgage occupancy fraud by falsely labeling a secondary home as her primary residence. No charges have been filed.

The move to dismiss Cook could give Trump a chance to name someone to the Feb board as he pressures officials to lower interest rates. Trump has repeatedly attacked Fed Chair Jerome Powell, who has also resisted the president’s demands to resign.

Cook’s high-profile defense attorney, Abbe Lowell, has pledged to file “a lawsuit challenging this illegal action.” Such a move would allow Cook to immediately ask for what’s known as a preliminary injunction, which would block her removal while the lawsuit moves forward.

Both sides would file briefs outlining their arguments, giving the Trump administration a chance to provide more details of its allegations against Cook. The filings could give Cook a chance to argue that her firing was unjustified and politically motivated.

The outcome could hinge on whether Cook can convince the judge that she — and the Fed — would suffer “irreparable harm” during the case if the status quo weren’t maintained. A decision on a preliminary injunction, which could be issued quickly, would be crucial because it may be months or longer before a judge rules on the actual merits of the case, including whether Cook was fired “for cause,” meaning for good reason.

It’s far from clear that the Trump administration’s mortgage allegations against Cook are enough to meet the “for cause” bar. There hasn’t yet been a formal investigation and she hasn’t been charged with anything, let alone convicted. That means Trump’s allegations are just that — allegations.

Cook could argue that unproven accusations are not enough to justify her termination. She could also argue that the allegations are irrelevant to her job, given that the alleged conduct took place a year before Cook’s appointment and had nothing to do with her duties as Fed governor.

Cook, appointed by President Joe Biden in 2022 to a term that was set to expire in 2038, has already said Trump doesn’t have cause to fire her.

“President Trump purported to fire me ‘for cause’ when no cause exists under the law, and he has no authority to do so,” Cook said in a statement released by her attorney. “I will not resign. I will continue to carry out my duties to help the American economy as I have been doing since 2022.”

Section 10 of the Federal Reserve Act, the 1913 law that governs the central bank, says members of the Fed’s Board of Governors can be “removed for cause,” although the statute doesn’t specify exactly what “cause” means.

Laws that do describe “for cause” generally define the term as encompassing three possibilities: inefficiency; neglect of duty; and malfeasance, meaning wrongdoing, in office. There’s no consensus on what those terms, which gained prominence in Congress more than a century ago, mean. A judge would have to decide whether Cook’s alleged mortgage fraud amounted to any of the three.

Clear legal precedents would be few and far between. The Supreme Court has never considered whether a president had adequate grounds to dismiss an official for cause.

Maybe not. Both sides could appeal an injunction ruling to a federal appeals court, which could be asked to expedite the case. A panel of three judges would issue a decision, possibly after holding a hearing.

If Cook’s request for an injunction were denied and the ruling were upheld on appeal, her firing would remain in effect. If the injunction were granted and backed by an appeals court, Cook could remain in office while the case moves forward.

The Supreme Court, where Trump has a 6-3 conservative majority, could have the final say. A decision by the nation’s highest court on an injunction in all likelihood would resolve the dispute long before any trial. Although the losing side could continue litigating the case, the chances of the justices effectively reversing themselves later on would be small.

The biggest hint came in May, when the justices cleared the way for Trump to oust officials at two other government agencies without having to give a justification. In doing so, the court majority said the decision didn’t mean the president wielded similar authority at the Fed, indicating that Trump can’t simply fire Fed officials without any grounds. The court called the central bank a “uniquely structured, quasi-private entity.”

At the time, Powell was in Trump’s cross-hairs. The ruling was interpreted as leaving open the possibility that Powell could be fired for cause. And Trump’s Supreme Court track record is likely to put him in a strong position should a case involving Powell — or Cook — land there.

The court’s conservative supermajority has repeatedly declined to second-guess Trump’s judgments, granting a barrage of requests to let policies of his that are under legal challenge take effect this year.

Federal Housing Finance Agency Director Bill Pulte, a staunch Trump ally, alleged on social media that Cook lied on loan applications for two properties — one in Michigan and one in Georgia — claiming she would use each property as her primary residence to secure more favorable loan terms. He said the applications were filed two weeks apart.

In his letter, Trump said it was “inconceivable” that Cook was not aware of requirements in two separate mortgage applications taken out in the same year requiring her to maintain each property as her primary residence.

“At minimum, the conduct at issue exhibits the sort of gross negligence in financial transactions that calls into question your experience and trustworthiness as a financial regulator,” Trump wrote.

The Trump administration has made similar claims against two other high-profile critics of the president, California Senator Adam Schiff and New York Attorney General Letitia James. Both have denied wrongdoing.

Investors wondering what President Donald Trump's move to fire Federal Reserve Governor Lisa Cook might mean for financial markets today can look back half a century for some insight. President Richard Nixon, aiming to clinch a second term in the White House, pressured then-Fed Chair Arthur Burns to loosen monetary policy before the 1972 election. Tape recordings of Oval Office discussions show Nixon, who went on to resign in 1974 for abuses tied to the Watergate scandal, used both direct and indirect actions to coerce Burns . More than 50 years later, Nomura currency strategists led by Craig Chan said Trump's decision to fire Cook, the first African-American woman to sit on the Fed, may "refocus" investors on how the market reacted to Nixon's attempt to steer the central bank, using the earlier move as a possible guidepost for what to expect now. In the current case, Trump cited unproven allegations of false statements Cook made when applying for a mortgage. Cook said the president "has no authority" to fire her. To be sure, Chan said history "may not be a perfect match" given other variables and how markets have changed since the era of fixed exchange rates, the gold standard and the Bretton Woods post-war monetary system. Still, the Nomura analyst noted historical parallels between Trump's attempt to fire Cook on Monday and Nixon's push for less-restrictive monetary policy in the early 1970s. Here's a look back at how markets fared back in the Nixon years, according to Chan: Currency The ICE U.S. Dollar Index (DXY) , which measures the U.S. greenback against a basket of foreign currencies, saw a massive drop after the U.S. left the gold standard and suffered massive balance of payments deficits under Nixon. The index first rose 0.5% from Nov. 6, 1972 — the day before the election — to a peak in January of the following year, which coincided with a high in stocks. But the dollar index then turned south, tumbling 18% to a July 1973 low. Stocks Similarly, a rise in stocks gave way to an eye-popping slide. The Dow Jones Industrial Average added more than 6% between Nov. 6, 1972 and its peak in mid-January of 1973, right around the time of Nixon's second inauguration. But within a year of hitting that high, the blue-chip average plunged as much as 19%. Within two years of that Jan. 1973 peak, the 30-stock average at one point plummeted as much as 44%. Treasurys As inflation accelerated, the yield on the U.S. 10-year Treasury note surged. In total, the 10-year yield rose more than 130 basis points between Nov. 6, 1972 and a high on Aug. 7, 1973. At one point, the yield touched a high of 7.58% — more than three percentage points above today's level around 4.3%. Nomura's outlook for today The stock market on Tuesday morning appeared to shake off much of the impact of the attempt to fire Cook. So far this year, the stock market has looked past Trump's pressure on the Fed, despite rising concerns over the central bank losing its independence and the effect that might have on inflation. However, the U.S. dollar took a hit Tuesday with the ICE U.S. Dollar Index down 0.3% vs. a basket of other currencies, bringing its decline for the year to nearly 10%. Gold futures were jumping on concern what a politicized Fed would mean for its inflation-fighting credentials. Chan and team, informed by the Nixon parallel, sees "risks to a weaker USD if the market fears a loss to Fed independence."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up