Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

At least four ships carrying copper are trying to reach US ports before August to get ahead of planned import tariffs on the metal.

At least four ships carrying copper are trying to reach US ports before August to get ahead of planned import tariffs on the metal.

The shipments represent the final scramble by merchants to cash in on a lucrative arbitrage trade that has upended the global copper market since US President Donald Trump first floated the idea of copper tariffs. The urgency to secure imports increased in the past two weeks after Trump announced the levy would be 50% starting Aug. 1.

Bulk carrier Kiating left Australia’s Townsville port last Wednesday carrying 8,000 metric tons of refined cargo and is destined to reach Hawaii by July 30, according to shipping data provider Kpler. The firm can’t identify who owns the cargo, but it said two other recent US-bound shipments from the port contained copper from Glencore Plc’s Mount Isa Mines.

Port data show that the Kiating was originally scheduled to land in New Orleans, but changed its destination to Hawaii after Trump’s announcement — cutting its likely voyage time by almost 20 days. Even so, the cargo owner will be in a race against time to register the metal with the local customs office once the vessel arrives.

“It’s hard to say how efficient clearance will be in Hawaii, given that it’s such an atypical destination for this cargo,” said Ben Ayre, lead dry-bulk shipping analyst at Kpler.

In Latin America, three vessels brimming with Chilean copper are also rushing to get to US ports. Cargo ship Louise Auerbach is near Colombia’s Buenaventura port and en route for a July 28 arrival at Tampa, Florida, according to data compiled by Bloomberg and people with knowledge of the voyage. The BBC Norway is in Panama and the BBC Campana is anchored off northern Chile’s coast, according to the latest shipping data.

The vessels are among the last batch of copper cargoes whose owners are betting they can clear US customs just before the tariff bites. For reference, the difference between arriving ahead of the levy and having to pay it would be more than $70 million on a typical bulk carrier cargo of 15,000 tons. The voyage from northern Chile to southern US takes 10 to 15 days.

To boost the chances of landing before the tariffs, shippers can attempt to clear customs for the entire cargo at their first US port of call. They can also pay for preferential spots in the lineups, turning what can be days of waiting into just hours.

With copper prices surging in the US, traders including Glencore, Mercuria Energy Group, Trafigura Group, Hartree Partners LP and IXM SA have shipped huge volumes to US ports since Trump ordered the Commerce Secretary in February to consider tariffs as part of an probe into the impact of foreign copper on the US.

The tariff trade allowed those firms to capture profits that industry veterans say are the biggest they’ve ever seen. A 50% copper tariff is double what many analysts and traders expected, and prices in New York surged even more after Trump’s July 8 tariff announcement, creating even bigger potential profits for traders who can get vessels to America in time.

With copper trading at about $9,900 a ton on the London Metal Exchange, a 50% levy would mean US buyers need to pay a further $4,950 to customs authorities to import copper into the country. Nominally, traders stand to make nearly as much in profit if they can import the metal before the tariffs land in less than two weeks.

Traders are still awaiting key details about the tariffs, particularly whether there will be a grace period for cargoes that are already on the water — as there have been when similar levies were imposed on aluminum and steel.

President Donald Trump criticized Federal Reserve Chair Jerome Powell during a White House news conference on Tuesday, claiming Powell has kept interest rates too high and will be leaving his position in eight months.

"I think he’s done a bad job, but he’s going to be out pretty soon anyway. In eight months, he’ll be out," Trump said during a meeting with Philippine President Ferdinand Marcos Jr.

Trump referred to Powell as "too late" and suggested the Fed chair may be keeping rates elevated for political reasons. He pointed out that Europe has lowered rates multiple times while the U.S. has not, making it difficult for Americans to purchase homes.

"People aren’t able to buy a house because this guy is a numbskull. He keeps the rates too high and probably doing it for political reasons," Trump stated.

The president also criticized a Federal Reserve building project, claiming it has a $900 million cost overrun with a total price tag of $2.7 billion. Trump questioned the need for the building, suggesting it was "another Biden deal."

Trump argued that U.S. interest rates should be at 1% instead of the current level around 4%, claiming this difference costs the country over $1 trillion in interest payments.

Treasury Secretary Scott Bessent, who was present at the news conference, said he had called for the Federal Reserve to conduct "a big internal investigation" into what he described as "mission creep" at the central bank, particularly regarding its spending practices.

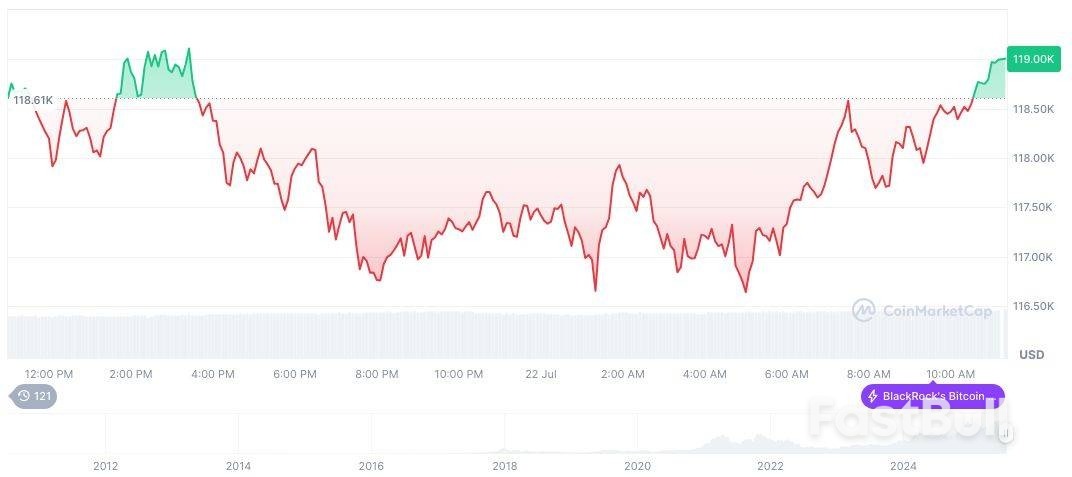

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 15:48 UTC on July 22, 2025.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 15:48 UTC on July 22, 2025. White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up